Indian new-age tech stocks witnessed a mixed week, with major block deals pulling down some of them, despite the broader domestic market continuing its rally. Analysts believe that investors are currently following the ‘buy on dips’ strategy in the Indian equity markets.

Ten out of the 24 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.03% to almost 20% on the BSE.

TBO Tek emerged as the top gainer, with its shares surging 19.8% during the week after Goldman Sachs initiated coverage on it with a ‘buy’ rating and projected a meaningful upside. The shares touched an all-time high at INR 1,938.75 but ended the week at INR 1,903.2, only 3.5% lower than Goldman Sachs’ price target for the stock.

lockquote>

PB Fintech was the second-biggest winner this week, with its shares gaining 4.6% on the BSE. It was followed by Awfis, which gained 4.2%.

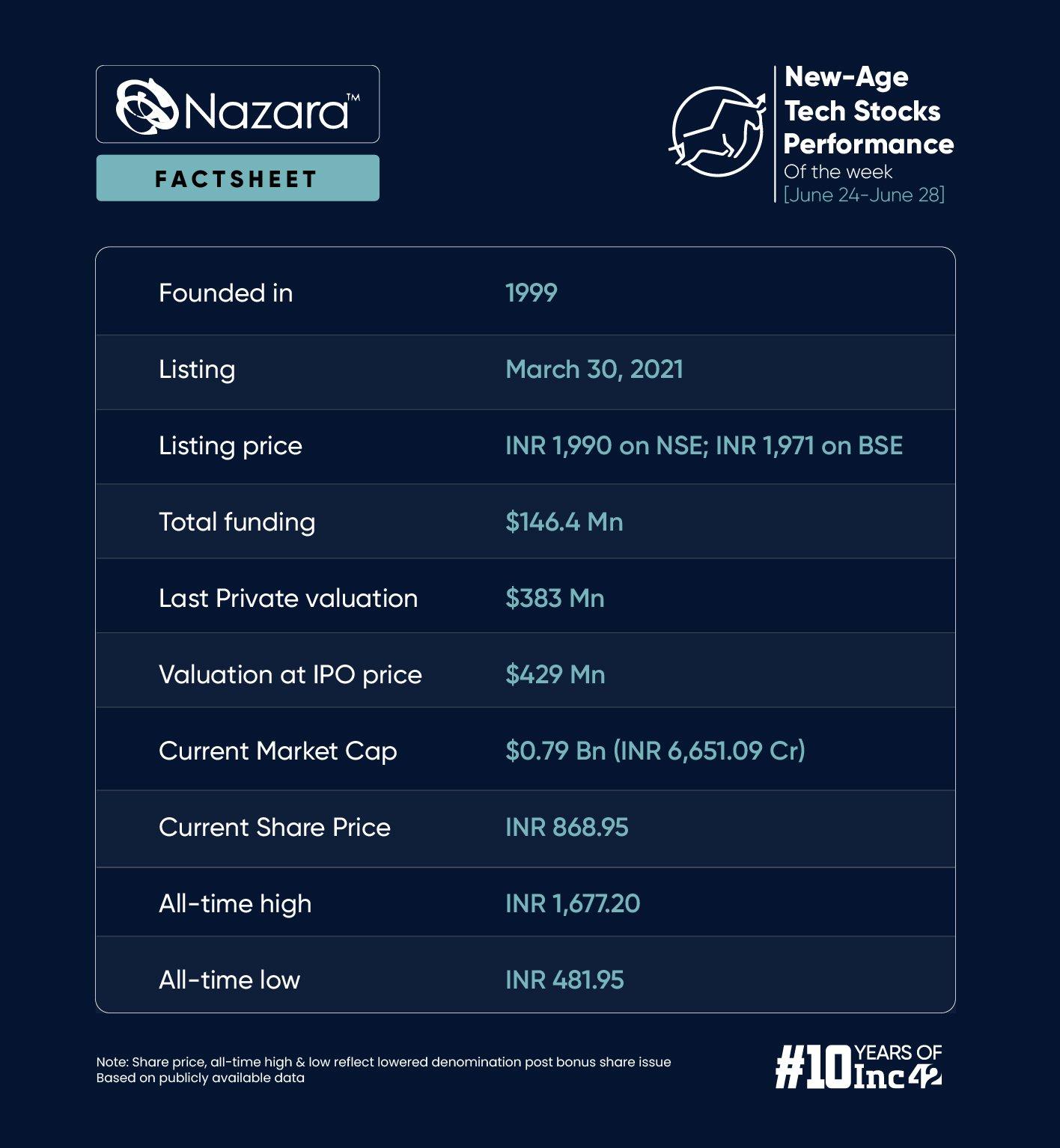

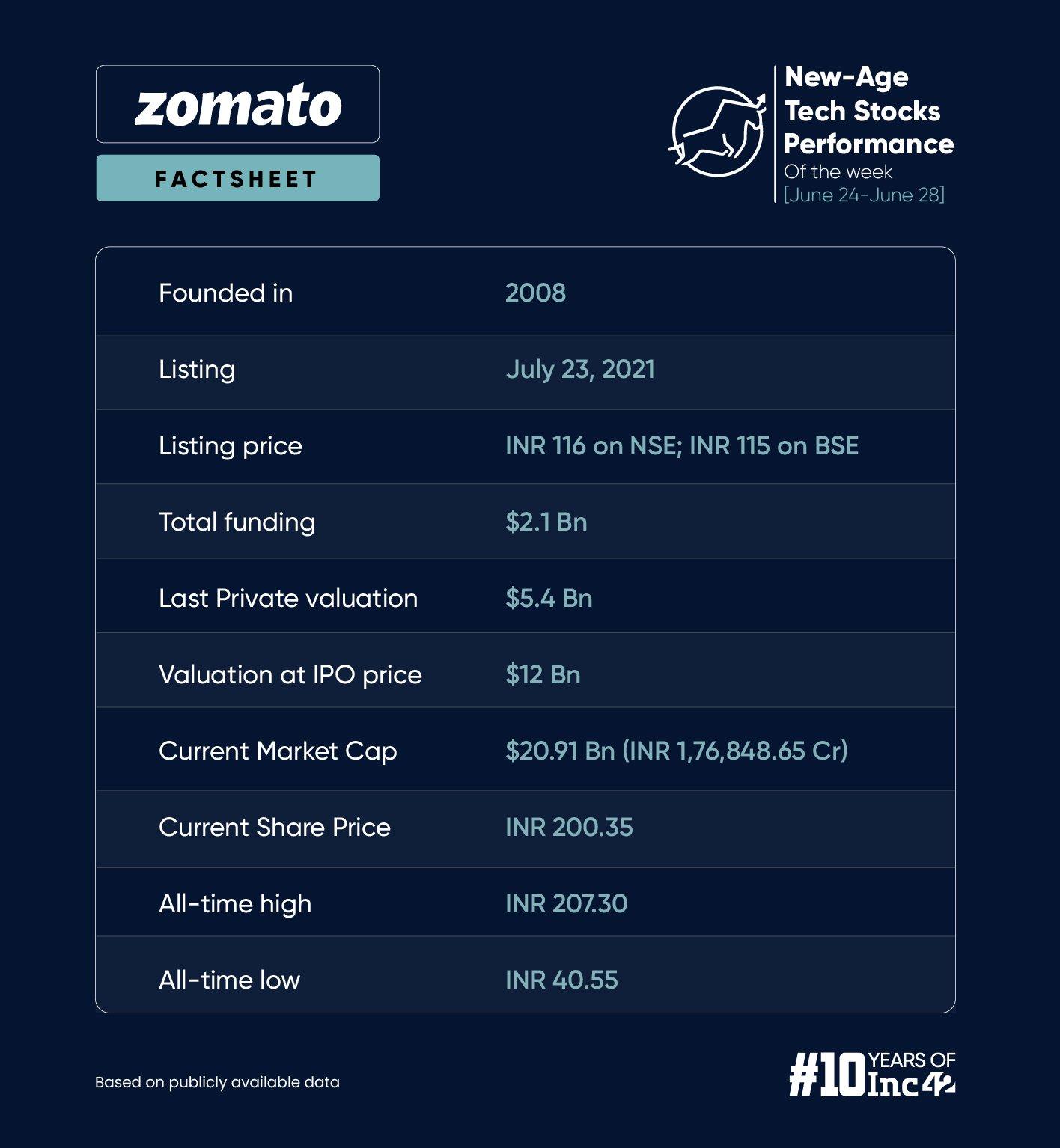

Zomato, Nykaa, IndiaMART, ideaForge, Go Digit, Delhivery, and Nazara were the other gainers this week.

On the other hand, TAC Infosec emerged as the biggest loser, as its shares nosedived 13.7%. It was followed by Fino Payments Bank, which fell 11.3%.

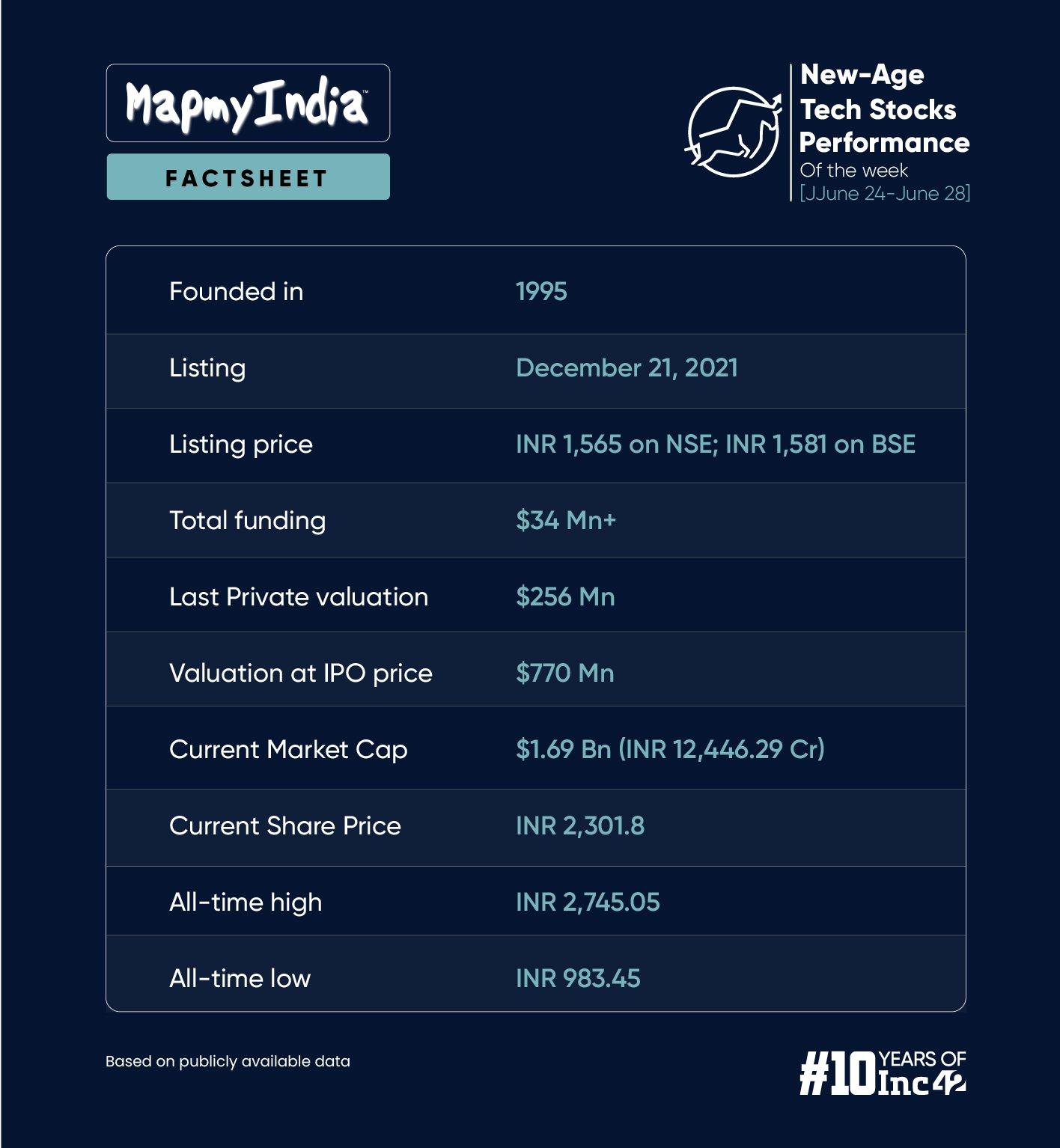

Yudiz, ixigo, CarTrade, MapmyIndia, Mamaearth, and RateGain were among the total of 14 new-age tech stocks that declined this week.

Among these, CarTrade saw some major block deals this week as some of its top investors – Highdell Investment, MacRitchie Investments, and JP Morgan’s CMDB II – offloaded shares worth over INR 535 Cr.

MapmyIndia shares also declined amid a block deal initiation announcement by the company’s promoter and founder.

In the broader market, benchmark indices Sensex and Nifty50 gained 2.4% and 2.2%, respectively. After touching fresh all-time highs on Friday (June 28), Sensex ended the week at 79,032.73 and Nifty 50 closed at 24,010.60.

Speaking about the market sentiment, V K Vijayakumar, chief investment strategist at Geojit Financial Services, said earlier this week that high valuations might prompt selling by foreign institutional investors (FIIs) and profit booking by domestic institutional investors (DIIs), but the exuberant retail investors are likely to buy every dip since the ‘buy on dip strategy’ has worked well in this bull market.

On Friday, Vijayakumar said, “The market momentum has the potential to take the Sensex to 80,000 levels. The healthy trend in the recent rally is that it is driven by fundamentally strong large caps. However, corrections can happen any time since the market is in the overbought zone and DIIs are booking profits.”

lockquote>

“The elevated valuations in the market continue to be a concern but the market is not yet in bubble valuation territory,” he added.

Meanwhile, the trend of FIIs selling their holdings has also started seeing some reversals.

Siddhartha Khemka, senior group VP, head of research at broking and distribution at Motilal Oswal, expects the positive momentum that the market saw this week to continue at a steady pace with stock-specific action.

lockquote>

“However, the release of economic data points next week would keep a little volatility in the market,” Khemka added.

Overall, the 24 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $58.42 Bn.

Now, let’s take a deeper look at the performance of the new-age tech stocks in the market.

MapmyIndia Promoter To Pare Stake

Shares of MapmyIndia, which ended last week at a historical highest close of INR 2,532.7, fell 9.12% this week after its promoter and founder Rakesh Verma announced selling 5 Lakh shares of the geotech company in a block deal.

The company said that Verma was selling a part of his stake for philanthropy. However, the shares declined in two consecutive sessions mid-week. The stock ended Friday’s session 2.6% higher at INR 2,301.8 on the BSE.

It is also pertinent to note that brokerage JM Financial started its coverage on MapmyIndia with a ‘buy’ rating and a price target (PT) of INR 2,900, which implies an upside of almost 26% to the stock’s last close.

The brokerage said that its constructive view on the stock is based on a few top-down rationales, including location intelligence as a service (LaaS) becoming ubiquitous across industries and the company’s well-established moats to not only ride the rising adoption trend but also gain market share.

lockquote>

Speaking on MapmyIndia’s performance, Jigar S Patel, senior manager of technical research analyst at Anand Rathi, said that the stock’s support is at INR 2,200.

“Investors can use ‘buy on dips’ strategy for the next week,” said Patel, adding that the trading range is expected to remain between INR 2,200 and INR 2,450 in the near term.

Nazara’s Business Expansion Continue

After a slightly slow start to the week, shares of Nazara jumped almost 7% during Friday’s trading session, ending the week at INR 868.95 on the BSE.

The rally took place after Nazara’s esports subsidiary NODWIN Gaming announced increasing its existing 13.51% stake in Germany-based Freaks 4U Gaming GmbH to 100% in tranches through a share swap valued at INR 271 Cr.

Besides, earlier this week, Nazara’s publishing arm, Nazara Publishing, also entered into a publishing partnership with nCore to publish ‘Made in India’ mobile game FAU-G Domination. The pre-registration of the game will open on Google Play and the App Store later this year.

Overall, the gains for the week were marginal.

It is pertinent to note that after witnessing a sharp slump from the beginning of the year till May, shares of Nazara have witnessed a significant rally over the last one month and have jumped over 41% so far since May 27, after the company published its FY24 earnings.

Anand Rathi’s Patel said that the upside for the stock is seen till INR 935-INR 940, while the support is at INR 800 zone.

lockquote>

Brokerages More Bullish On Zomato After Swiggy’s 2023 Performance Update

After Prosus published IPO-bound Swiggy’s 2023 operating performance, multiple Indian and international brokerages turned more bullish on Zomato’s market share and performance in food delivery.

For instance, Goldman Sachs said that Zomato now likely holds a 56-57% market share in the food delivery market.

It is to be noted Zomato’s biggest competitor in the food delivery market, Swiggy saw a 26% year-on-year (YoY) increase in gross order value (GOV) in 2023. Its core food-delivery business GOV grew by “double digits”, as per Prosus’ disclosure.

“At a 31% FY24-27 GOV CAGR, Zomato is the fastest growing food delivery company within our global coverage and also one with the highest margin profile,” Goldman Sachs said.

Meanwhile, JM Financial also said in a research note that while Swiggy confidentially filed its pre-DRHP with the SEBI earlier this year, a successful public listing of the company largely hinges on the management’s ability to arrest market share losses in both food delivery and quick commerce businesses. Besides, they will also have to demonstrate a clear path to adjusted EBITDA break-even at a consolidated level for the company.

Emkay, CLSA, and Kotak Institutional Equities also reiterated their ‘buy’ rating on Zomato, with most of them highlighting that the company’s growth is faster than Swiggy’s.

Following the brokerages’ bullish stance, shares of Zomato ended above INR 202 level on Tuesday (June 25) for the first time. However, the stock ended the week at INR 200.35, gaining 3.22% overall during the week.

Anand Rathi’s Patel said INR 205 is a crucial resistance level for the stock. A further upside is possible only above this level, he said, adding that the support is at INR 90.

lockquote>

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)