Premji Invest joined the wealthtech startup’s cap table with a capital infusion of $20 Mn (about INR 168.8 Cr) in what seems to be its Series B funding round

Existing investors Elevation Capital, Matrix Partners, and Accel Partners also participated in the funding round

Founded in 2021, Dezerv claims to have managed assets worth over INR 6,000 Cr since its inception

Wealthtech startup Dezerv has raised $32 Mn (about INR 265 Cr) in a funding round led by Premji Invest, its regulatory filings with the Ministry of Corporate Affairs (MCA) revealed.

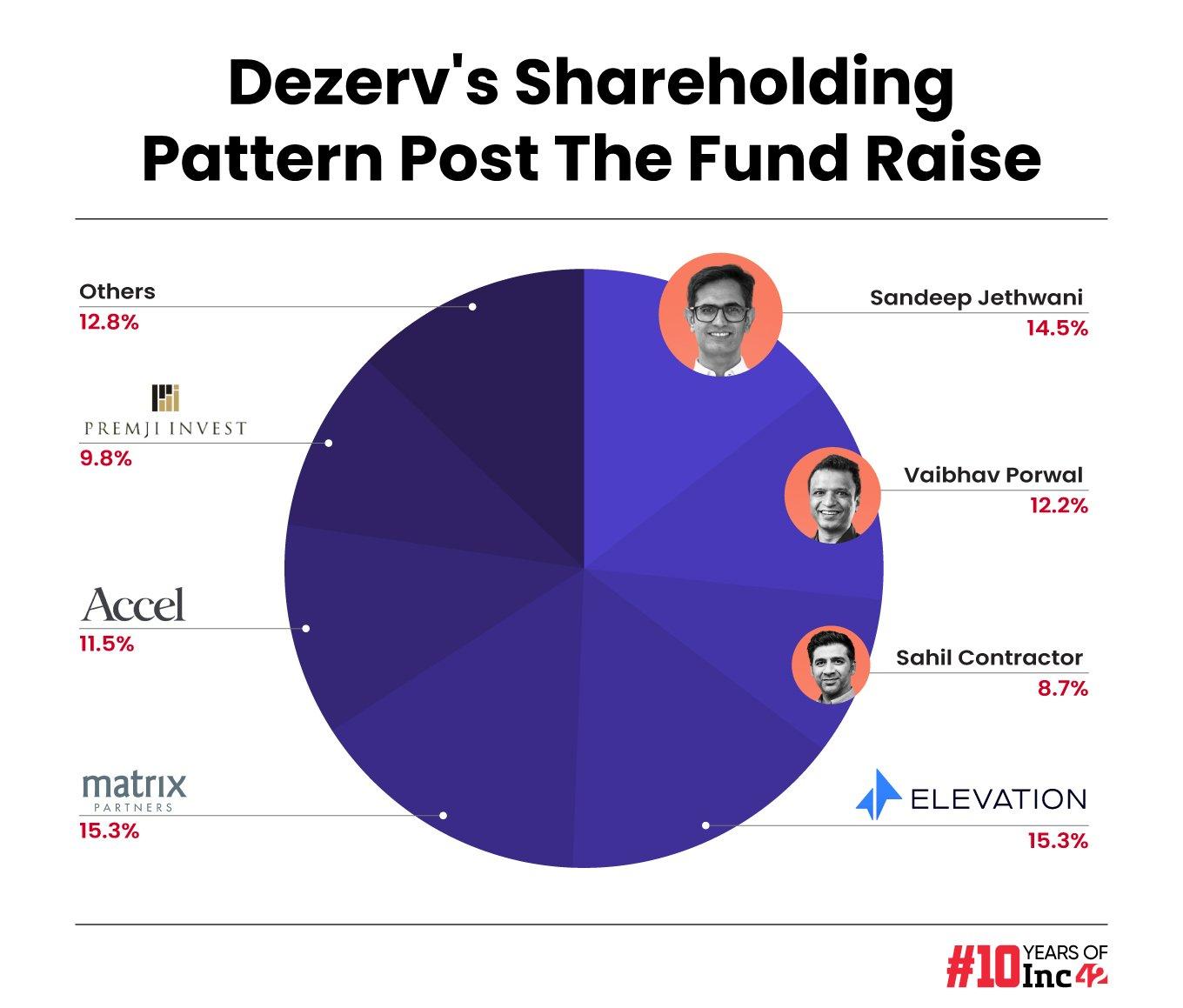

Premji Invest joined the startup’s cap table with a capital infusion of $20 Mn (about INR 168.8 Cr) in what seems to be its Series B funding round. Post the funding round, Premji Invests holds about 9.8% stake in the startup.

As per Inc42 estimates, the startup’s post-money valuation stands at around $205 Mn.

The fresh round of investment saw Premji Invest join the startup’s cap table with a capital infusion of $20 Mn (INR 168.8 Cr) for an exchange of around 9.8% stake in the company, the regulatory filing revealed.

Existing investors Elevation Capital, Matrix Partners, and Accel Partners also participated in the funding round, as per the filings. While Elevation Capital and Matrix Partners infused $4 Mn each, Accel Partners invested $3.1 Mn.

A detailed questionnaire sent to Dezerv about the funding round didn’t elicit any response till the time of publishing this story

Following the funding round, the stakes of the startup’s cofounder saw a decline. While Sandeep Jethwani’s stake declined 2.66 percentage point to 14.48%, Vaibhav Porwal saw a 2.23 percentage point decrease in his shareholding to 12.19%. The startup’s third cofounder, Sahil Contractor, holds 8.65% stake after the fundraise as against 10.24% stake earlier.

Here’s a detailed breakdown of the shareholding pattern:

Founded in 2021, Dezerv began as an invite-only platform for wealth management. Later, it opened the access to everyone.

The startup claims to have managed assets worth over INR 6,000 Cr since its inception.

Including the latest funding, Dezerv has raised a total capital of $50 Mn till date. It counts the likes of Whiteboard Capital, Blume Founders Fund, CRED founder Kunal Shah, Acko founder Varun Dua, Meesho founder Vidit Aatrey, and OfBusiness founder Ashish Mohapatra among its investors.

Dezerv incurred a loss of INR 50.8 Cr in the financial year 2022-23 (FY23) on an operating revenue of INR 1,013 Cr.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)