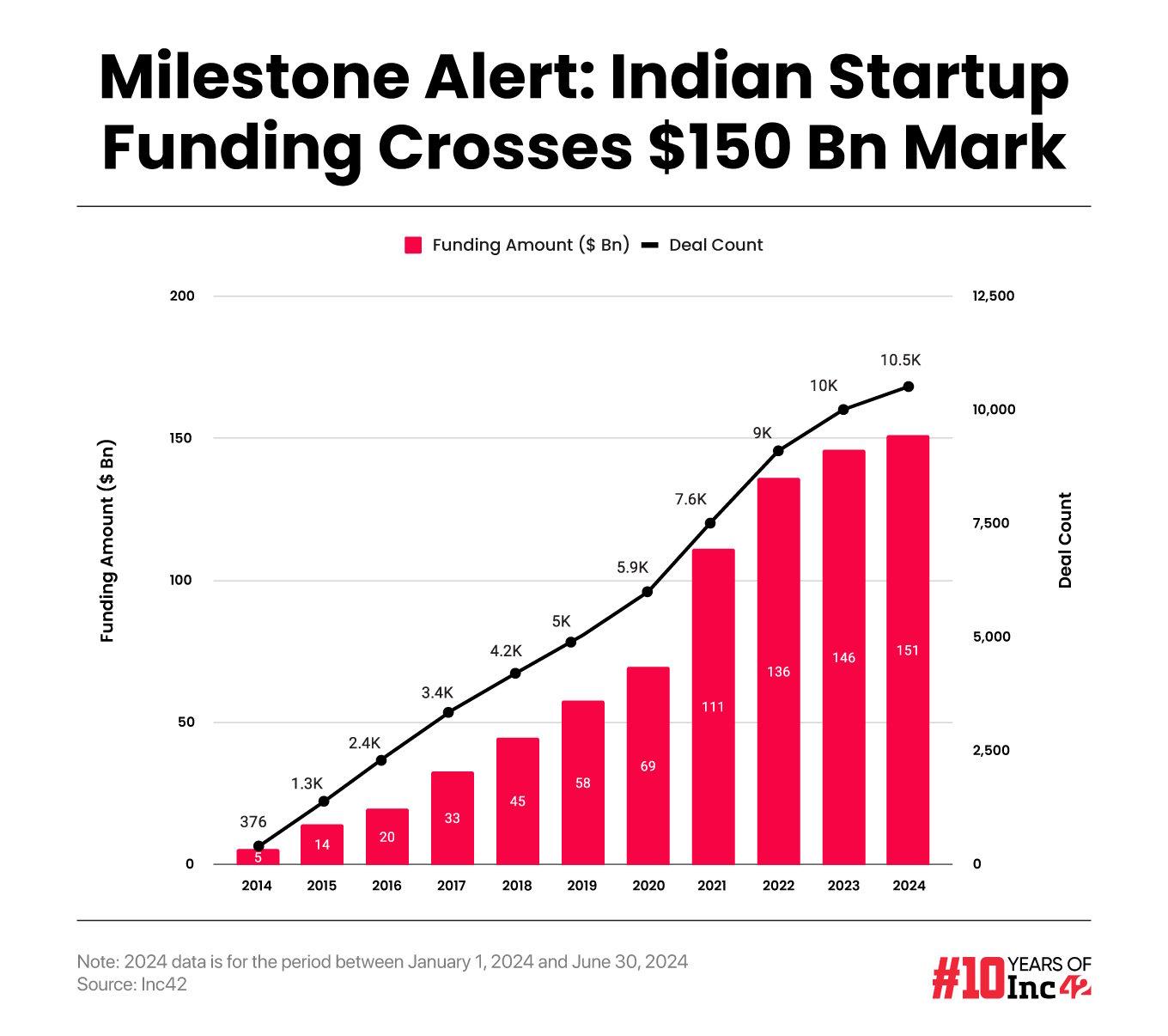

According to Inc42’s ‘Indian Tech Startup Funding Report H1 2024’, the funding in the world’s third-largest startup ecosystem stood at $151 Bn between 2014 and H1 2024

2021 was the best year for the startup ecosystem, with funding surging to $42 Bn. However, it plummeted to $10 Bn in 2023 amid the funding winter

Indian startups raised $5.3 Bn in the first half of 2024, and experts expect funding numbers to increase rapidly in the second half of the year

The cumulative funding raised by Indian startups crossed the $150 Bn mark in the first half (H1) of the calendar year 2024.

According to Inc42’s ‘Indian Tech Startup Funding Report, H1 2024’, the funding in the world’s third-largest startup ecosystem stood at $151 Bn between 2014 and H1 2024. Indian startups raised this funding across 10,500 deals.

In terms of funding trends over the years, 2021 was the game changer for the Indian startup ecosystem as investor interest shot up amid the Covid-19 pandemic. Indian startups raised a whopping $42 Bn in 2021, a jump of 281% from $11 Bn raised in 2020. The year 2021 also witnessed a record 1,700 deals.

But this momentum slowed down in the next year as the funding winter gripped the Indian startup ecosystem. Startup funding declined to $25 Bn in 2022. However, the worst was yet to come. The chill of the winter resulted in funding plummeting to $10 Bn in 2023, which was significantly lower than the pre-pandemic level.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/indian-tech-startup-funding-report-h1-2024/” target=”_blank” rel=”noopener”>DOWNLOAD FREE REPORT

Meanwhile, the year 2024 so far has shown signs of some improvement in the funding landscape. While the funding raised by the startups in January was the lowest in five years at $512 Mn, the funding amount has largely grown from there every month. Indian startups bagged $1.3 Bn in June, more than double the January funding amount.

Overall, Indian startups raised $5.3 Bn in the first half of 2024.

Investor interest is expected to improve further from hereon. Earlier this year, Bharat Innovation Fund’s partner Ashwin Raguraman said that while investors were sitting on a substantial amount of dry powder, fears about impending recession deterred them from deploying these funds.

lockquote>

Raguraman said he expected things to change in the second half of the year, with forces impeding capital deployment diminishing and clearing the way for a more vibrant investment landscape.

With Zepto raising $665 Mn towards the end of H1, there are signs that investors are loosening their purse strings. VCs like Glade Brook, Nexus, StepStone, Goodwater, Lachy Groom, Avenir Growth, Lightspeed, and Avra participated in the quick commerce startup’s funding round, which saw its valuation more than double to $3.6 Bn from $1.4 Bn earlier.

During the recently held Global IndiaAI Summit, Peak XV Partners managing director Rajan Anandan said that VC and PE firms are sitting on $20 Bn dry powder to deploy in the Indian startup ecosystem. He said that the growing artificial intelligence (AI) space is expected to see the highest interest from investors.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/indian-tech-startup-funding-report-h1-2024/” target=”_blank” rel=”noopener”>DOWNLOAD FREE REPORT

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)