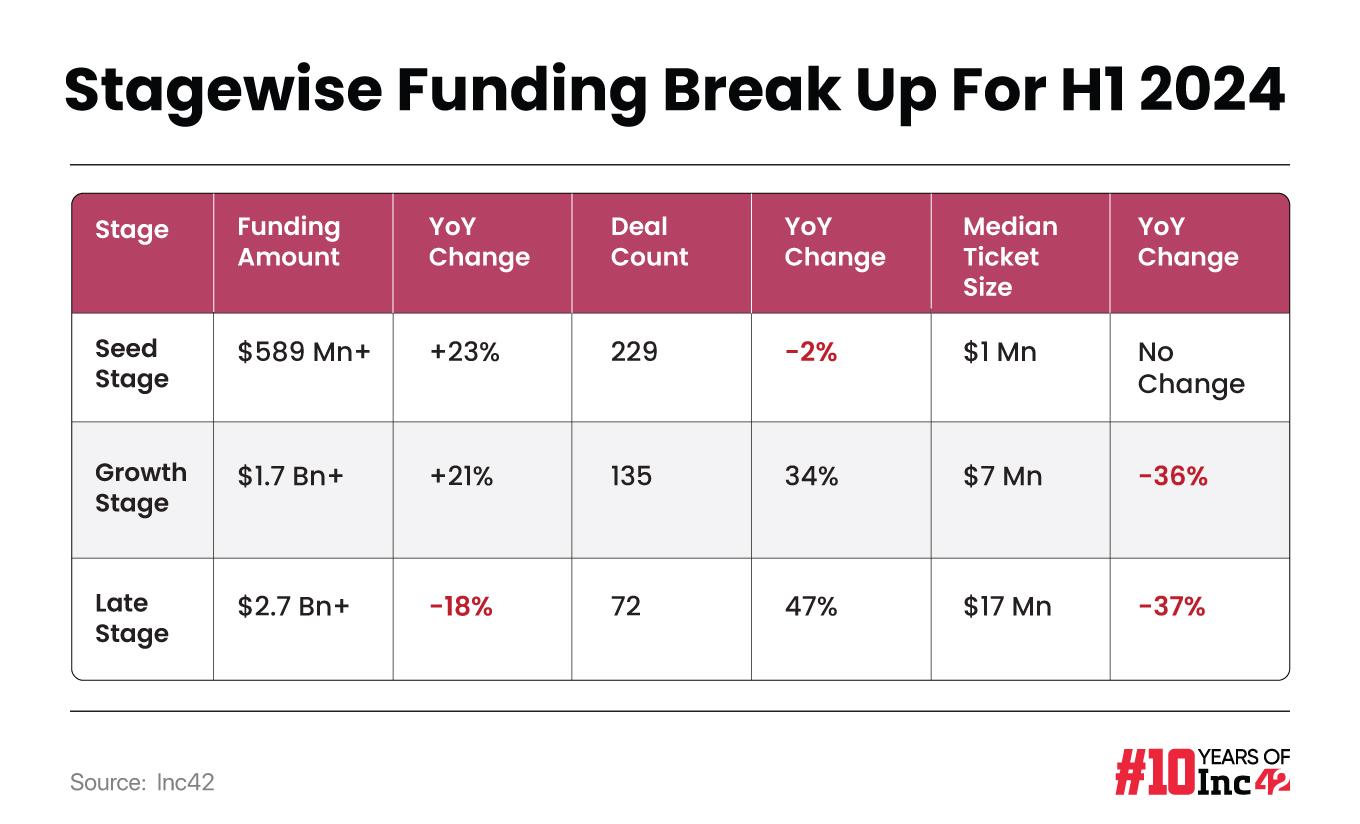

During the first half of FY24, Indian startup ecosystem witnessed funding of $2.7 Bn in late stage funding, a decline of 18% from $3.3 Bn raised in the year-ago period

The ecosystem witnessed 50% YoY decline in mega funding deals in H1 2024

Of the $5.3 Bn raised in H1 2024, $1.7 Bn went into growth stage and $589 Mn was raised at seed stage

While the startup funding trend remained subdued in the first half (H1) of 2024, investor interest varied significantly across segments. As per Inc42’s ‘Indian Tech Startup Funding Report, H1 2024’, seed and growth stage startups drove the funding trends in the first half of the year, while late-stage startup funding took a back seat.

Late-stage startups managed to raise $2.7 Bn in H1 2014, a decline of 18% from $3.3 Bn raised in the year-ago period.

lockquote>

The primary reason for this drop can be attributed to a big decline in the number of mega deals. The world’s third-largest startup ecosystem only saw seven deals of $100 Mn or above during the period under review. This was half of the 14 mega deals witnessed in H1 2023.

For context, in the first half of 2024, the Indian startup ecosystem attracted a capital inflow of $5.3 Bn across 504 funding deals. Although the total funding amount decreased by 2% compared to H1 2023, the number of deals increased by 7%.

Zepto’s $665 Mn fundraise, PharmEasy’s $216 Mn rights issue, iBus’ $200 Mn fundraise, IPO-bound Avanse Financial’s $120 Mn cheque, Atlan’s $105 Mn Series C round, Pocket FM’s $103 Mn raise, and ShadowFax’s $100 Mn funding round were the mega deals which took place in H1 2024.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/indian-tech-startup-funding-report-h1-2024/” target=”_blank” rel=”noopener”>Download The Report

Besides the mega deals, late-stage startup Perfios attained the unicorn tag with its $80 Mn fundraise from new investor Teachers’ Venture Growth (TVG), the late stage investment arm of Canadian pension fund Ontario Teachers’ Pension Plan.

Despite the decline in funding raised by late stage startups, the number of funding deals shot up by 50% to 72 in the first half of 2024 from 48 in H1 2023. The decline in funding amount was largely a result of the fall in the median ticket size, which stood at $17 Mn in H1 2024 compared to $30 Mn in the year-ago period.

Meanwhile, seed-stage funding zoomed 23% to $589 Mn in H1 2024 from $479 Mn a year ago. Similarly, growth-stage startups raised $1.7 Bn during the period under review, an increase of 21% from $1.4 Mn in H1 2023. The number of deals stood at 229 for growth stage and 135 for late stage in the first six months of 2024.

However, with startup funding expected to pick up in the second half of the year, late-stage deals are likely to get a boost. Quick commerce startup Zepto is said to be eyeing raising another $400 Mn, while hospitality major OYO is also in talks for a big funding round.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/indian-tech-startup-funding-report-h1-2024/” target=”_blank” rel=”noopener”>Download The Report

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)