Hospitality giant OYO

According to sources, the OYO IPO is likely to be pushed back by six months to a year, especially as the company awaits the terms of the refinancing deal for the $660 Mn Term Loan B availed by founder and CEO Ritesh Agarwal to buy back shares from investors in 2019.

lockquote>

The IPO postponement is largely because of the material implications on OYO’s financials from this refinancing of this loan, which was already restructured in 2022.

OYO is said to be actively looking for a pre-IPO placement round cumulatively raising $200 Mn – $250 Mn from various fund offices, HNIs albeit at a much lower valuation than its last fundraise, when it commanded a valuation of close to $10 Bn. Top sources privy to the ongoing funding developments within the company said that the company has raked in $200 Mn from a clutch of investors and the announcement is likely to happen next week.

While Inc42 could not verify the deal structure, it is said to involve a secondary share sale as the company’s largest investor SoftBank looks to divest its stake as valuation drops.

OYO’s Turnaround Towards Profits

The refinancing of around $660 Mn (approx INR 5,300 Cr) of the pending Term Loan B amount will help the company save INR 124 Cr – INR 141 Cr per annum and will have material implications on the FY25 financial performance.

“The refinancing will reduce interest rate from 14% to 10%, lead to considerable annual savings and extend the repayment date to 2029. OYO’s operating costs improved to 14% of top line revenue in FY24, from 19% in FY23. Costs were cut across the board, which also led to layoffs,” as per our sources close to the company management.

lockquote>

This is in line with company’s claims of turning around the INR 1,000 Cr net loss in FY23 to INR 100 Cr net profit in FY24. OYO is said to have significantly cut down its employee costs by laying off nearly 600 employees even as lease related costs shot up.

CEO Agarwal further said that the company had logged eight consecutive quarters of profitability in FY23 and FY24, and had cash reserves of INR 1,000 Cr. While OYO is yet to file its audited financial statements for FY24, the company seems to have turned things around in a major way.

Yes, the debt restructuring is a challenge that is yet to be overcome, but from a business model and revenue perspective, the turnaround is evident and nothing short of a remarkable feat for OYO, where there have been questions for years about profitability.

So what really worked out for OYO in FY24?

Sharp Focus On Spiritual Tourism

In January 2024, Ritesh Agarwal was one of the few startup founders, officially invited for the Ram Mandir consecration ceremony in Ayodhya. The invitation came after OYO signed up more than 60 new properties and homestays in the temple town to cater to the influx of tourists.

This is not an isolated incident but a concerted push by OYO to cater to the millions of travellers who visit places of spiritual or religious importance.

Besides Ayodhya, OYO has targetted Katra (in Jammu & Kashmir) as well as holy sites in Uttarakhand and other spiritual hotspots in the past year. In January this year, OYO announced that it will add 400 properties in popular destinations for spiritual travel including locations such as Puri, Shirdi, Varanasi, Amritsar, Tirupati, Haridwar, and the Char Dham route by the end of this year.

The sharp focus on spiritual travel has shown big returns. “The pilgrim stays don’t need much of a facelift since pilgrims require basic facilities to stay for 3-5 days when they are on the move. Religious tourism has been a key driver of growth for OYO especially this year,” a hospitality sector analyst told us.

lockquote>

As further proof, the company claimed a staggering 350% increase in searches for Ayodhya on OYO over the past year.

Sports Tourism & Corporate Bookings Grow

Cricket is often called a religion in India and OYO seems to have cashed in on the holy sites for cricket fans around the country.

India hosted the ICC World Cup in 2023 and OYO increased its presence in the host cities with the addition of 400 hotels across the country strategically situated near the host stadia.

“In 2022, OYO did delist many hotels from the platform due to tiffs with hotel partners and since there was revision of contracts. However more hotels were onboarded in 2023 and 2024,” a source, who is privy to the company’s strategy, told Inc42.

lockquote>

Besides sports travel, corporate travel bookings have also shot up last year and this year leading to expansion in medium budget hotels. The company said earlier that it saw a 20% growth in the revenues in H1 2023 on the back of adding nearly 2,800 corporate clients in the same period.

Sources within the company stated that OYO has onboarded 15,000 corporate accounts and more than 10,000 travel agents, which has significantly improved the revenue mix for OYO, and allowed the company to rely on two separate growth engines.

Tapping First-Generation Hoteliers

In 2023, OYO launched the inaugural cohort of its accelerator programme under which the company partnered with the first-generation hoteliers. The company is today running 1,000 hotels under the project. In March, 2024 OYO tied up with JP Morgan to offer a credit facility for these entrepreneurs.

Besides helping these hotels scale up and grow, OYO earns extra commissions from these hotel partners and it also helps them avail credit facilities which also comes with a revenue component.

“One of the reasons why OYO has been successful in tying up with first generation hotel owners is that the operations are running far more smoothly than the legacy hotels. There are less conflicts of interests and better revenue sharing percentages in this tie-up and each entrepreneur is running 2-3 hotels under the programme,” a source added.

Restructured Inventory, Focus On Branded Hotels

OYO’s brand is built around its proposition for the budget traveller. But in FY23, the company shed a lot of its inventory of rooms to focus on profitability. As per our sources who are privy to the internal business and revenue strategy of OYO, the company delisted thousands of hotels in FY23 following conflicts of interest and tussles with hotel partners.

“The first shift was to restructure its hotel inventory in India. It stopped chasing growth in terms of the number of hotels. The culled its low-performing and low-customer experience hotels. A large part of this clean-up played out in FY23 where its hotel count decreased from 12,000 to 8,000,” the source mentioned above added.

lockquote>

Despite a massive drop in the number of hotels, OYO’s gross booking value or top line revenue increased substantially to INR 3.9 Lakh per hotel in FY23 from INR 2.19 Lakh per hotel in FY22.

“There was increased focus on customer reviews and hotels were accorded Super OYO tag based on customer ratings. This also led to an increase in the footfalls for Super OYO hotels. This is akin to the Superhost tag on Airbnb,” the source added.

lockquote>

Following this, the company increased the number of hotel partners in FY24, but the updated GBV numbers for FY24 are not available yet. Those in the know told us that the premium category drives revenue growth, but this space was largely captured by legacy hotels. OYO zeroed in on some properties to onboard them and improve visibility and also launched new brands.

According to a Hotelivate report, the branded and organised hotel sector in India closed 2023 with decade-high numbers for occupancy of 66.1%, average daily rate of INR 6,869 and revenue per available room (or RevPAR) of INR 4,537, which is nearly double of FY23.

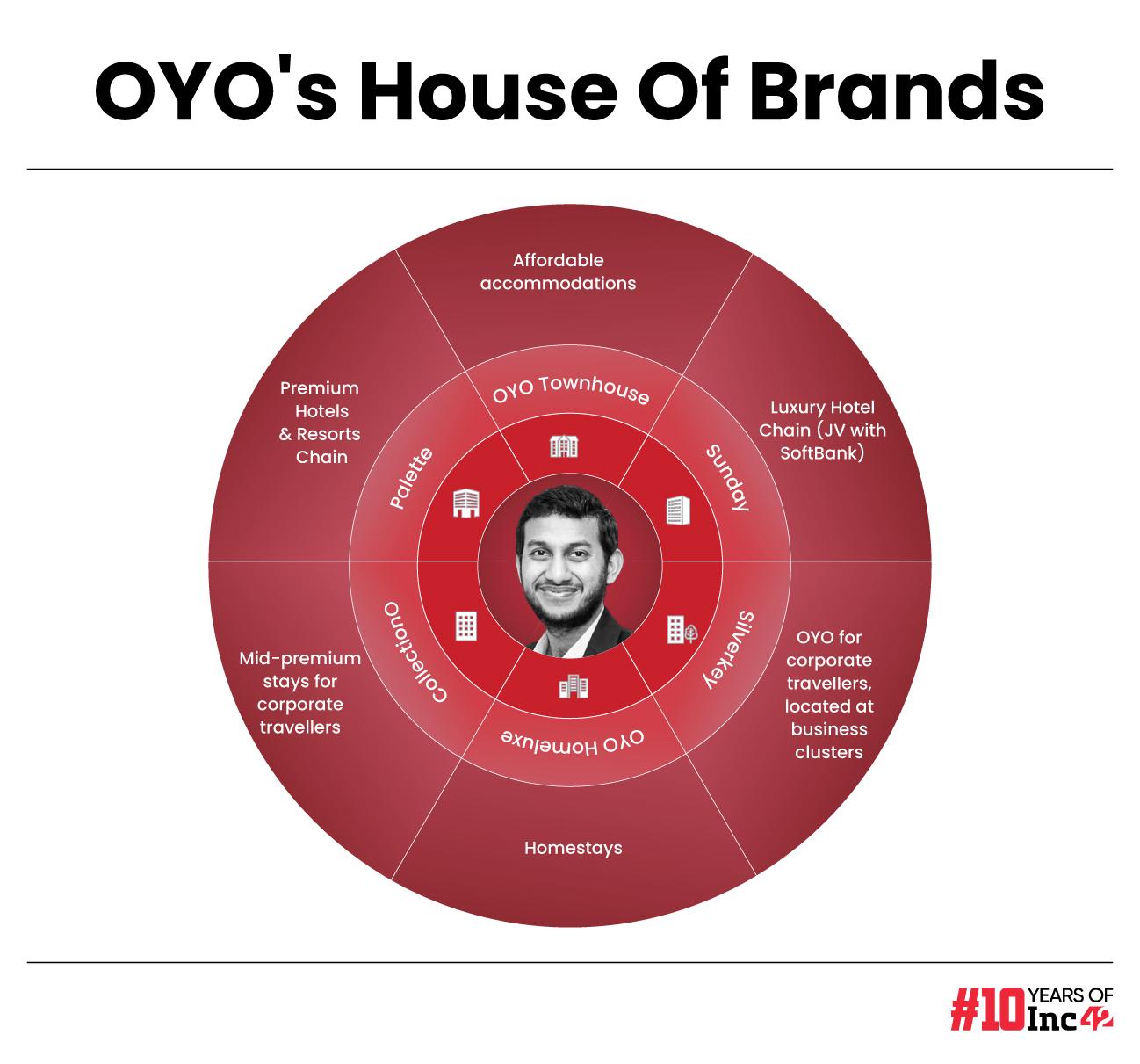

For instance, in April 2024, OYO launched a joint venture with lead investor SoftBank under the luxury hotel chain brand ‘Sunday’. These properties have been launched in Jaipur, Vadodara and Chandigarh, with more cities lined up.

Improving Take Rates With Revenue Sharing Strategy

Several years ago, OYO onboarded thousands of hotels with a minimum guarantee for revenue, but at the time its focus was on expansion.

Now, the focus is on revenue, which means the company has turned to a revenue-sharing strategy with the onus now on hotels to improve the infrastructure, even as OYO will give them a broader access to the consumer base, marketing tools and technology.

It charges partner hotels 30% on average in commission these days, with the revenue sharing varying according to hotel’s frequency of bookings and how much value it is offering the platform.

While the earlier minimum guarantees posed challenges such as cash burn and reckless spending on low quality hotels, the new revenue sharing model allows the company to target more premium hotel chains for partnerships.

Sharpening Focus On Overseas Markets

The final piece of the puzzle seems to be OYO’s focus outside India.

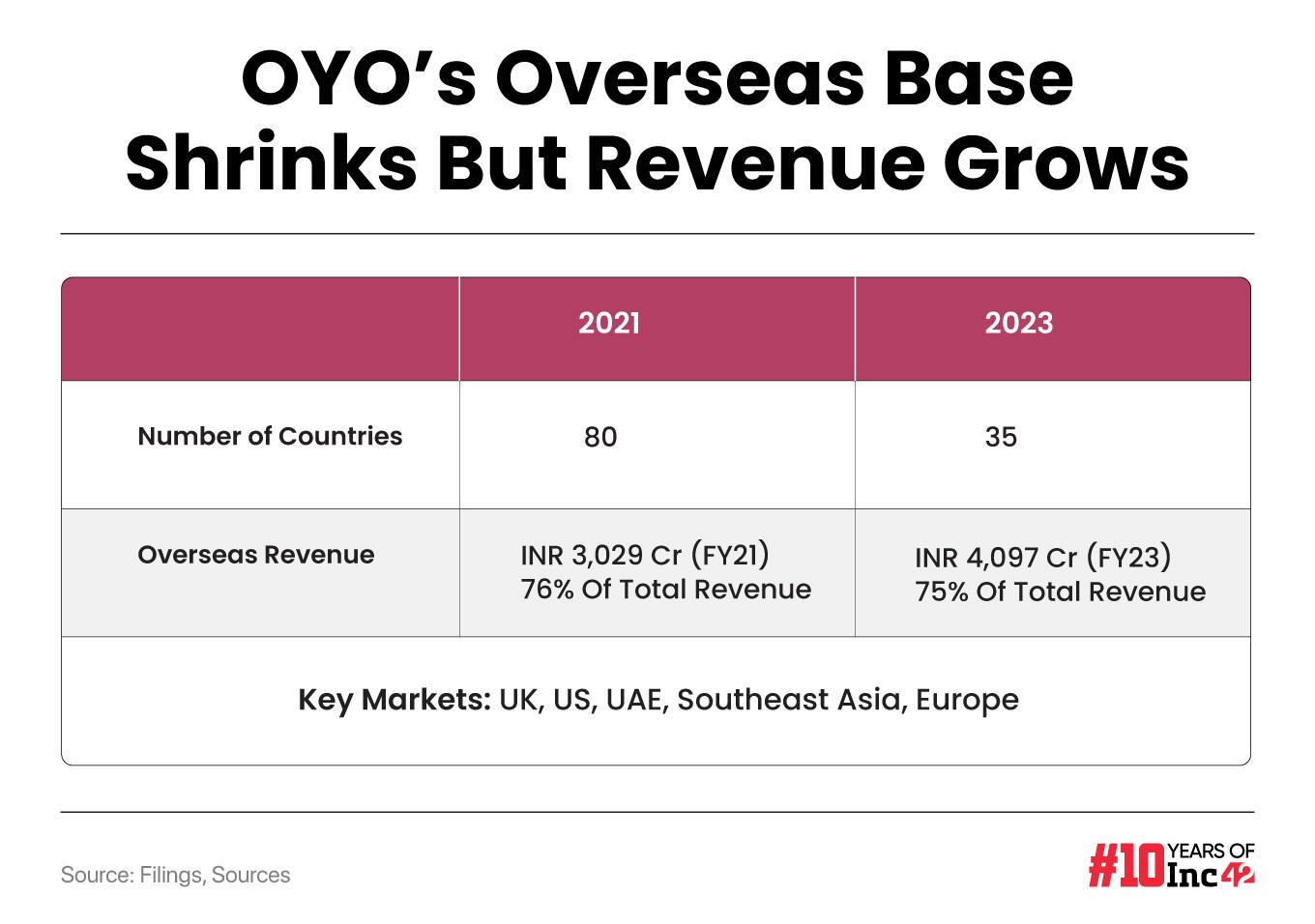

Sources close to OYO claim the company has scaled down overseas from 80 geographies to 35 today. This also means a bigger focus on the markets that are bringing in revenue and where the company does not have to go up against big competition. “OYO set up nearly 400 rooms in major Chinese cities. However it has driven its focus away from China to the UK and few cities in the US now,” sources further added.

OYO faces stiff competition in Europe and many large cities in the US in the vacation homes segment from the likes of Booking.com and Airbnb, but this is less of a problem in Nordic countries, Southeast Asia as well as parts of the UK and US which regulate platforms like Airbnb. These markets have come to the fore for OYO in the past two years.

lockquote>

Further, there has been a 21% increase in the overseas travel from India compared to 2019 with a greater uptick in the first quarter of 2024, according to the MasterCard Economics Institute’s latest report on the back of larger demand from middle class families.

“Surprisingly, markets such as the US and UK also grew, perhaps due to the strong South Asian and Indian diaspora in the hotelier business in these countries and the value hunting by customers due to the tepid economy,” sources privy to OYO’s business growth told us.

lockquote>

Can OYO Refinance In Time?

While the sharper focus on the unit economics, business model and strategy have seemingly delivered the results from a financials perspective, the next big challenge for OYO will be to show that its past indebtedness will not be a major long-term problem.

Profitability is the biggest demand by public markets investors, and many new-age tech companies such as OYO which wanted to list in 2021 spent the last two years figuring out the answer. It seems OYO is ready now, but the final hurdle will be the terms of the refinancing.

The timing cannot be better for OYO with the IPOs of TBO Tek and ixigo this year showing that investors have a lot of appetite for new-age stocks, but almost all of these companies came to the IPO table with a consistent record of profitability.

Now, OYO has to prove that its turnaround in the past year was not a flash in the pan and that profitability can be sustained for the foreseeable future.

[Edited By Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)