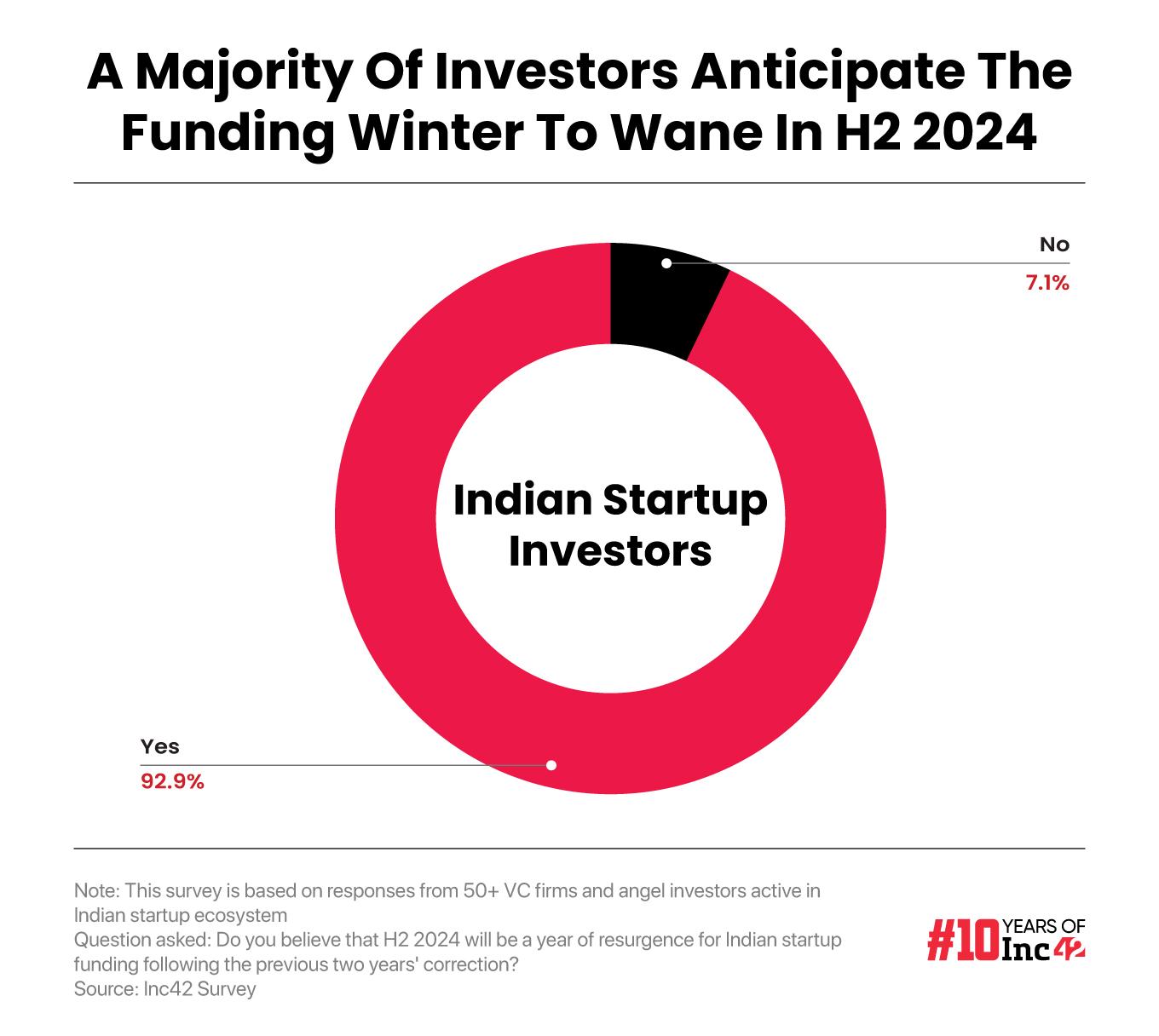

More than 90% of the startup investors surveyed by Inc42 anticipate 2024 to be a turnaround year for Indian startups

The VC ecosystem is believed to be sitting on a significant dry powder of more than $20 Bn

According to Inc42’s H1 2024 funding report, Indian startups lapped up $5.3 Bn in the first six months of 2024

Given the erratic nature of funding in the world’s third-largest startup ecosystem, a question has everyone perplexed — Will the funding winter’s impact on the Indian startup ecosystem subside anytime soon?

Well, the good news is that several startup investors expect the gloomy clouds of the long-standing funding winter to disappear soon.

According to an Inc42 survey — “India’s Top Startup Investor Ranking H1 2024 Survey” — about 93% of over 50 startup investors see 2024 as a turnaround year for Indian startups. Only a mere 7% feel that funding corrections will continue to fret Indian startup founders.

Surprisingly, the H1 2024 funding trend failed to capture investors’ optimism, which is otherwise visible from the findings of the survey. According to Inc42’s ‘Indian Tech Startup Funding Report, H1 2024’, Indian startups snagged $5.3 Bn in the first six months of 2024, enduring a 1.8% year-on-year (YoY) decline.

Speaking on the findings of the report, VC firm 3one4 Capital’s founding partner Pranav Pai opined that funding trends in the second half of the year are anticipated to pick up significantly due to the performance of the Indian public market.

“India’s economy is currently well-positioned to support the scaleups of homegrown businesses, as is evident from the increasing number of privately funded entities turning profitable and opting for IPOs. We will soon witness many more tech companies taking the IPO route. This trend is expected to positively influence investor interest in the private markets in India and help support the expected recovery,” Pai said.

While he believes that the outcomes of the Indian elections were aligned with investor anticipations, the impending US based elections are likely to give investment activities in the country a further push.

Moving on, the VC ecosystem is believed to be sitting on a significant capital as of now. Speaking during the Global IndiaAI Summit organised at Bharat Mandapam in New Delhi earlier this month, Peak XV Partners MD Rajan Anandan said that the VC firm alone was sitting on a dry powder of more than INR 16,000 Cr ($1.9 Bn). Besides, he believes that the entire Indian VC and PE ecosystem has over $20 Bn ready to be infused into Indian startups.

Echoing Anandan’s sentiment, 100X.VC’s cofounder Shashank Randev added that VCs are optimistic as companies in the Indian startup ecosystem are maturing.

“There is no funding winter now or in the near future. I am very optimistic on funds being deployed in great companies that are growing quarter on quarter,” Randev said.

lockquote>

Despite not-so-impactful funding numbers in H1 2024, investors have maintained their optimism for the later half of the year. However, it still remains to be seen how the second half of the year pans out for Indian startups waiting for investors to loosen their purse strings.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/indian-tech-startup-funding-report-h1-2024/” target=”_blank” rel=”noopener”>Download The Report

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)