Indian startups cumulatively raised $200 Mn via 25 deals, a 45% increase from last week’s $138.04 Mn raised through 15 deals

The week’s largest funding round saw fintech unicorn slice bag $30 Mn debt from Neo Asset Management’s Credit Opportunities Fund

Seed funding grew 17% this week to $9.78 Mn from last week’s $8.33 Mn this week

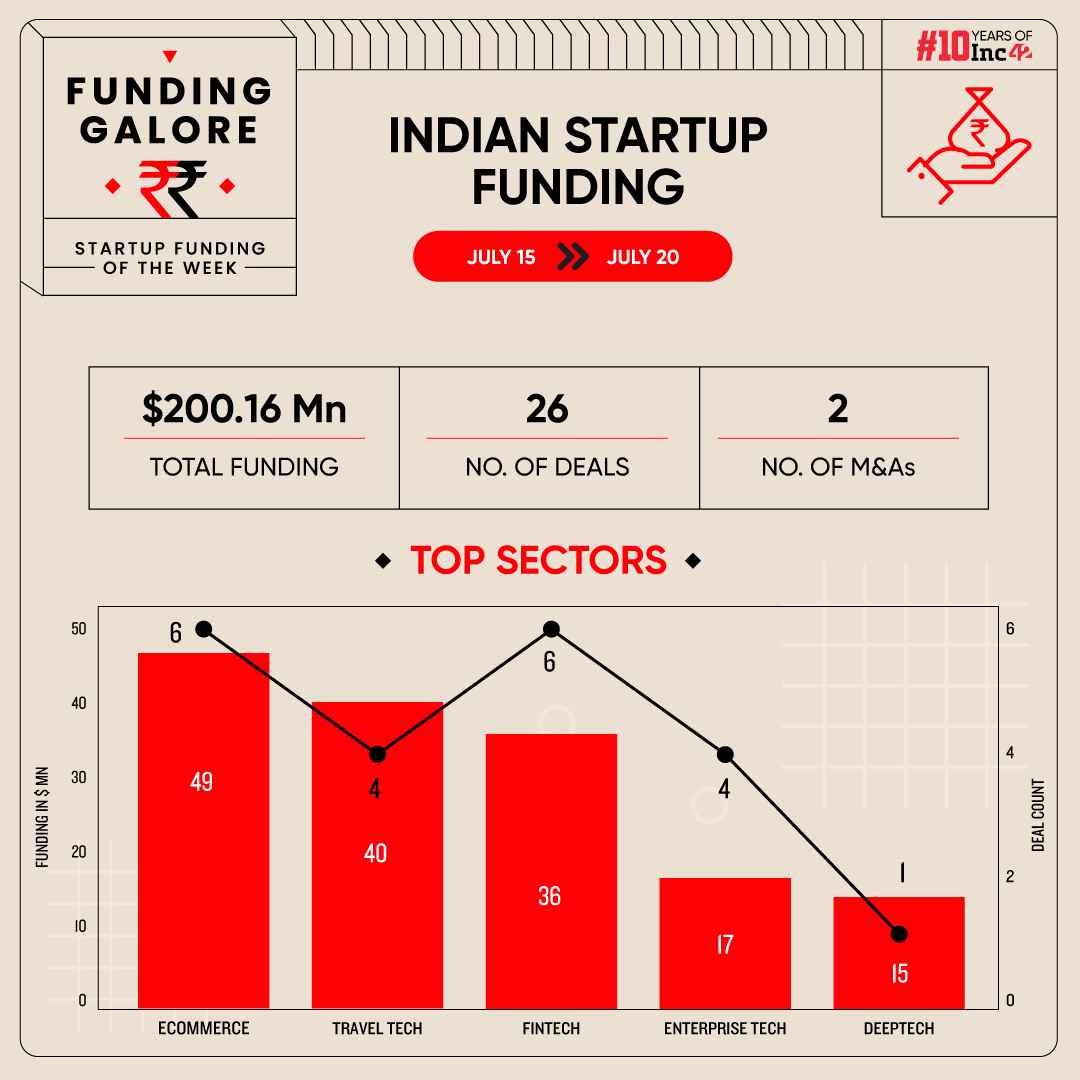

Funding momentum across India’s startup ecosystem has seen a slight revival three weeks after a slump in investment activity. Between July 15 and 20, startups cumulatively raised $200.16 Mn across 25 deals, a 45% jump from $138.04 Mn raised last week via 15 deals.

Funding Galore: Indian Startup Funding Of The Week [ July 15- July 20]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 19 Jul 2024 | slice | Fintech | Lendingtech | B2C | $30 Mn | Debt | Neo Asset Management | Neo Asset Management |

| 15 Jul 2024 | BluSmart | Travel Tech | Transport Tech | B2C | $24 Mn | – | responsAbility Investments AG, Sumant Sinha, MS Dhoni Family Office | – |

| 18 Jul 2024 | Lenskart | Ecommerce | D2C | B2C | $19.1 Mn | – | Peyush Bansal, Neha Bansal, Amit Chaudhary, Sumeet Kapahi | – |

| 18 Jul 2024 | Newme | Ecommerce | D2C | B2C | $18 Mn | Series A | Accel, Fireside Ventures, AUM Ventures | Accel |

| 19 Jul 2024 | Aero | Deeptech | Dronetech | B2B | $15 Mn | Series B | 360 ONE Asset, StartupXseed Ventures, Navam Capital | 360 ONE Asset |

| 15 Jul 2024 | UptimeAI | Enterprise Tech | Horizontal SaaS | B2B | $14 Mn | Series A | WestBridge Capital, Emergent Ventures, Aditya Birla Ventures | WestBridge Capital |

| 16 Jul 2024 | Namma Yatri | Travel Tech | Transport Tech | B2C | $11 Mn | pre-Series A | Blume Ventures, Antler, Google | Blume Ventures, Antler |

| 17 Jul 2024 | Corvi LED | Ecommerce | D2C | B2C | $8 Mn | Series B | Enam Investments | Enam Investments |

| 18 Jul 2024 | byteXL | Edtech | Skill Development | B2C | $5.9 Mn | Series A | Kalaari Capital, Michael and Susan Dell Foundation | Kalaari Capital |

| 18 Jul 2024 | Fresh Bus | Travel Tech | Transport Tech | B2C | $5.3 Mn | Series A | – | – |

| 17 Jul 2024 | Boon | Cleantech | Water Tech | B2B | $5 Mn | Series A | Spanish Roca Group Ventures | Spanish Roca Group Ventures |

| 17 Jul 2024 | OmniCard | Fintech | Payments | B2B | $3 Mn | pre Series A | Ankurit Capital, Taisys, VLS finance group family office | Ankurit Capital |

| 17 Jul 2024 | Ninecamp Ventures | Ecommerce | D2C | B2C | $2 Mn | Seed | Mohit Gupta, Gaurav Gupta, Ghazal Alagh, Varun Alagh, Vikram Chopra, Ruchit Agarwal, Mehul Agrawal, Gajendra Jangid, Dharmil Sheth | – |

| 19 Jul 2024 | Fibr | Enterprise Tech | Horizontal SaaS | B2B | $1.8 Mn | Seed | Accel, 2AM VC, Kunal Shah, Sunil Kumar | Accel |

| 16 Jul 2024 | Icanheal | Fintech | Lendingtech | B2C | $1.8 Mn | Seed | IvyCap Ventures | IvyCap Ventures |

| 15 Jul 2024 | SkinInspired | Ecommerce | D2C | B2C | $1.5 Mn | Seed | Unilever Ventures, Arjun Vaidya | Unilever Ventures |

| 17 Jul 2024 | Multipl | Fintech | Investment Tech | B2C | $1.5 Mn | – | Blume Ventures, MIXI Global Investments | – |

| 18 Jul 2024 | Lifetime Health | Healthtech | Home Healthcare | B2C | $1.5 Mn | Seed | The Garage Syndicate | The Garage Syndicate |

| 19 Jul 2024 | class=”in-cell-link” href=”http://pintel.ai/” target=”_blank” rel=”noopener”>Pintel.ai | Enterprise Tech | Horizontal SaaS | B2B | $1 Mn | Seed | IvyCap Ventures | IvyCap Ventures |

| 18 Jul 2024 | Honestly | Enterprise Tech | Vertical SaaS | B2B | $382K | pre-Seed | Better Capital, QED Innovations | Better Capital |

| 16 Jul 2024 | FRENDY | Consumer Services | Hyperlocal Delivery | B2C | $238K | – | UC Inclusive Credit | UC Inclusive Credit |

| 18 Jul 2024 | MyPickup | Travel Tech | Transport Tech | B2C | $179K | Seed | Inflection Point Ventures | Inflection Point Ventures |

| 15 Jul 2024 | Validus Fintech | Fintech | Fintech SaaS | B2B | – | Seed | AUM Ventures | – |

| 17 Jul 2024 | Getepay | Fintech | Payments | B2B | – | – | Virender Sehwag | Virender Sehwag |

| 19 Jul 2024 | Abhay HealthTech | Ecommerce | D2C | B2C | – | – | Vindu Dara Singh | Vindu Dara Singh |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

|

|||||||

Key Startup Funding Highlights Of The Week

- The week’s biggest fundraise was fintech unicorn slice’s $30 Mn debt funding from Neo Asset Management’s Credit Opportunities Fund. Hefty deals also materialised for major startups like BluSmart, Lenskart and Newme this week.

- Propelled by Lenskart’s $19.1 Mn funding round and Newme’s $18 Mn round, the ecommerce sector continued to be the major traction to investors this week. Startups in the space cumulatively raised $48.6 Mn via six deals this week.

- BluSmart’s $24 Mn funding round and Namma Yatri’s $11 Mn round made the travel tech sector the second favourite sector for investors this week. Startups in this sector raised $40.48 Mn via four deals this week.

- For the second consecutive week, seed funding grew 17% to $9.78 Mn from last week’s $8.33 Mn.

Startup Acquisitions This Week

- Talent management and influencer marketing firm Collective Artists Network has acquired AI-based platform galleri5 to expand its creator and content ecosystem. The acquisition will allow the firm to expand its tech-based integrated solutions ranging from talent management, creator tech, influencer marketing and consultancy.

- Listed gaming major Nazara has fully acquired Paper Boat Apps Pvt Ltd after picking up 48.42% from its promoters Anupam and Anshu Dhanuk for INR 300 Cr. It will allow the company access to PBA’s healthy cash flows that can be reinvested for organic as well as inorganic growth.

Fund Launches This Week

- Real estate investment management firm Altern Capital launched its maiden CAT-II Alternative Investment Fund, named Jiraaf Au India Real Estate Fund – I, with a target corpus of INR 250 Cr. It will have an additional greenshoe option of INR 100 Cr, the company said.

- Launching a new venture capital firm called PROMAFT Partners, ex-investment head of Alibaba Group India, Raghav Bahl, and former partner at 9Unicorns (now 100Unicorns), Soham Avlani, floated an INR 1,000 Cr maiden fund. The fund will be sector agnostic and plans to invest in 10-12 startups.

- Yali Capital launched an early stage fund worth INR 810 Cr to back startups operating in the deeptech sector. The fund will focus areas, including chip design, robotics, genomics, smart manufacturing, aerospace and AI, among others, in the deeptech space.

Other Major Developments Of The Week

- Unicorn India Ventures has announced a partial exit from neo diagnostics startup Sascan Meditech. The exit from Sascan has generated 6X returns for the fund as UIV continues to hold a substantial stake in the company.

- Singapore’s sovereign wealth fund Temasek plans to invest $10 Bn in India over the next three years. The sovereign wealth fund pumped in a record $3 Bn in the country in FY24 and plans to increase its headcount in India from 20 currently.

- Excitel cofounder Vivek Raina, along with other startup founders and executives, launched an incubator to foster startups in Jammu & Kashmir called “Launchpad Kashmir”. The incubator will take in incubate 24 early stage startups based out of the union territory by March 2025.

- Listed lendingtech startup Moneyboxx is looking to raise $32.4 Mn through a mix of preferential issue and warrants. It will deploy the fresh funds to fuel its growth plans and expand its reach in rural India.

- AdTech unicorn InMobi is looking to get listed in the Indian public markets at a $10 Bn valuation. For this, it is planning to relocate its headquarters from Singapore to India in the coming months.

- Beer Bira 91 maker B9 Beverages is eyeing to make its public markets debut by 2026. It has tapped investment banking firm Morgan Stanley for its pre-IPO process.

- Urban Company raised $50 Mn this week from Bengaluru-based VC firm Dharana Capital via a secondary share sale. The secondary stake sale, which saw the startup’s employees as well as other stakeholders participate, allowed Snapdeal cofounders Rohit Bansal and Kunal Bahl’s venture capital (VC) firm Titan Capital to exit the company with INR 111 Cr, 195X of their INR 57 Lakh investment in 2015.

- Kalpavriksh Fund exited D2C beauty and health brand The Ayurveda Experience (TAE) with over 6X return. It first invested in the D2C startup in 2019 in its Series A fundraise when it was a part of Centrum Group.

- Deeptech-focused venture studio IndusDC has set aside INR 100 Cr for FY25 and FY26 to identify and help co-build tech startups across industrial and energy sectors. It plans to build five startups in the next two years and more than 50 new companies globally over the next decade.

- The Central government is working on setting up an INR 750 Cr Category-II AIF named ‘Agri Fund For Startups and Rural Enterprises’ to help startups operating in the agriculture and allied sectors.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)