After 12 years, the battle is finally won. Angel Tax is dead…

The life of an entrepreneur is defined by time and a constant battle against insuperable odds. Angel Tax best exemplified this statement as it was an albatross across the neck of all Indian entrepreneurs for 12 years.

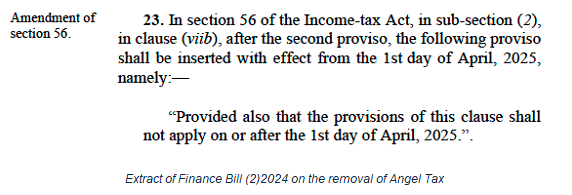

Introduced in 2012 by Shri Pranab Mukherjee under a series of measures titled “to prevent the generation and circulation of unaccounted funds”, Section 56(2)(viib) taxes the difference between issue price of unlisted shares and their fair market value as income in the hands of the company. Converting capital receipts to income and taxing it is a uniquely Indian innovation.

Over time, this section was used to harass startups who raised capital from investors. Such startups often do so at a premium and obtain a valuation report to justify the issue price. However, the tax department would compare the projections against the actual performance of the startup and tax the difference. Thus, an anti-abuse measure became a tax harvesting section.

These notices have resulted in companies shutting down due to the notices, being unable to raise funds from investors and even entrepreneurs leaving the country to startup overseas.

But at last, this tax has been removed.

lockquote>

The section will no longer be operational from April 1, 2024 (once the Finance Bill gets passed). This means that all startups who raise capital at a premium shall not be subject to this Angel tax from April 1, 2024 onwards (April 1, 2025 mentioned in the Finance Bill is for the relevant assessment year, not the year it goes live).

However, those who have raised capital in previous years may still receive a notice. The honourable Finance Minister must announce that startups in the past will not face Angel Tax notices and those who have gotten notices should see them withdrawn.

For years, this Angel tax section saw numerous changes, modifications, carveouts and exclusions. Those failed to create actual impact on the ground as the conditions were onerous, resulting in many startups giving up the exemptions. The extension of Angel tax to foreign investors in 2022 resulted in any investors choosing to pause on investing in India.

The fact that Angel tax was removed without any conditions is a huge boost for Startup India and investors.

After 12 years, the battle is finally won. Angel Tax is dead.

lockquote>

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)