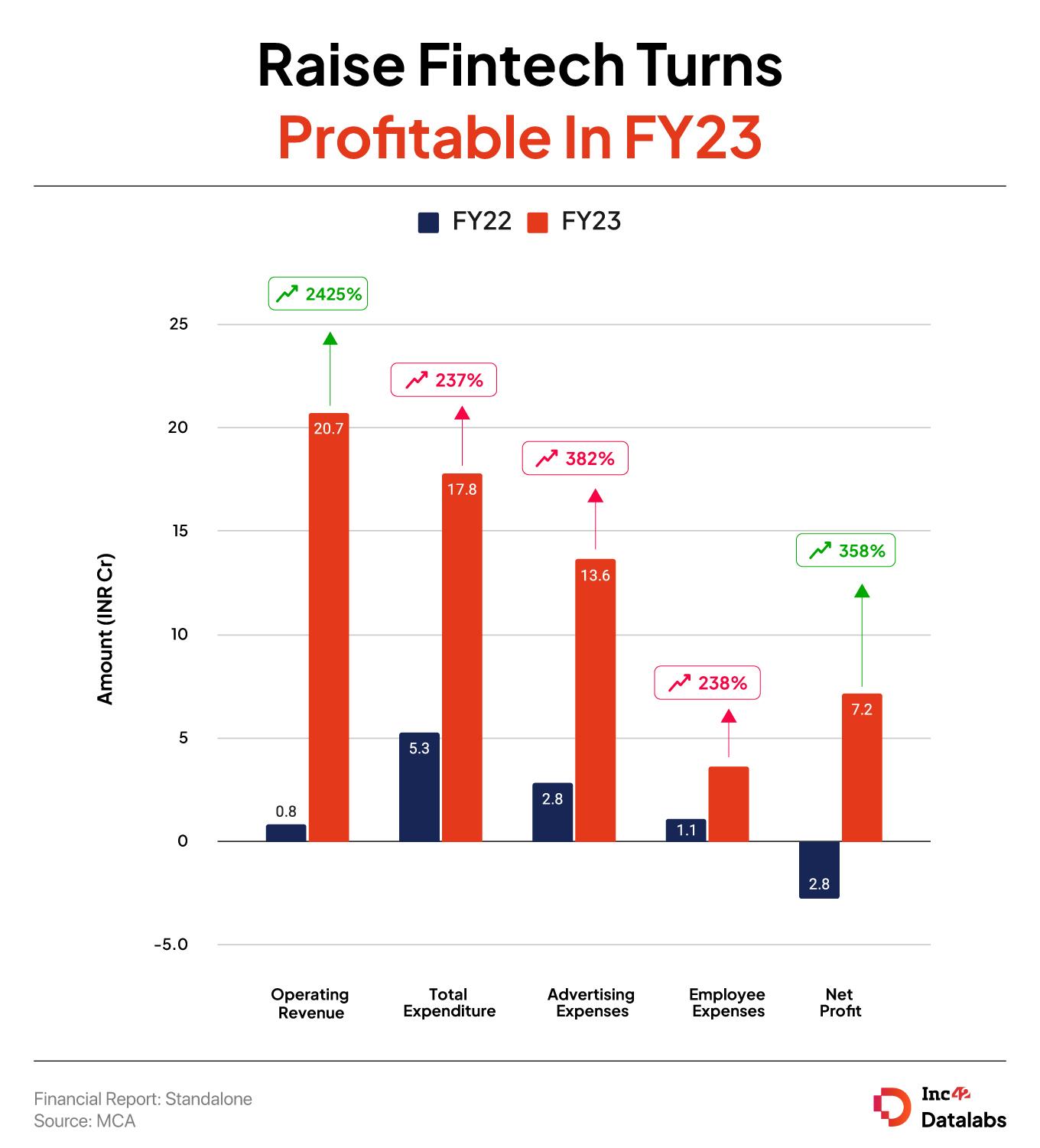

Raise Financial Services reported a net profit of INR 7.16 Cr in FY23 as against a net loss of INR 2.78 Cr in the previous fiscal year

Operating revenue zoomed 25X to INR 20.74 Cr in FY23 from INR 82.14 Lakh in FY22

Founded in 2021 by Pravin Jadhav, Raise offers multiple financial services in the stock broking space, primarily targeting users in Tier I, II Indian cities

Mumbai-based Raise Financial Services turned profitable in the financial year ended March 31, 2023. The fintech startup reported a net profit of INR 7.16 Cr in the financial year 2022-23 (FY23) as against a net loss of INR 2.78 Cr in the previous fiscal year.

The startup’s profitability can be attributed to strong business growth. Operating revenue zoomed 25X to INR 20.74 Cr in FY23 from INR 82.14 Lakh in FY22.

Including other income, the fintech startup’s total revenue stood at INR 26.53 Cr, a 10X jump from INR 2.5 Cr in FY22.

Founded by ex-Paytm Money CEO Pravin Jadhav and Alok Pandey in 2021, Raise offers multiple financial services in the stock broking space, primarily targeting users in Tier I, II Indian cities. Its portfolio of products consists of stock broking app Dhan, Option Trader app to facilitate options trading, Dhan Web platform, TradingView by Dhan and an API platform for traders called DhanHQ API.

Since its inception, the startup has also acquired brokerage company Moneylicious and edtech platform Upsurge. In 2022, the startup shared plans to invest up to $500K in early-stage startups in the investment tech and wealthtech space, mainly in India.

The startup raised an undisclosed amount of seed funding round in 2021 from Mirae Asset Venture Investment and a clutch of undisclosed investors.

Where Did Raise Spend?

In tandem with the rise in revenue, the startup’s total expenses also jumped over 3X to INR 17.80 Cr in FY23 from INR 5.28 Cr in the previous fiscal year.

Advertising Expenses: Marketing expenses accounted for the largest share of the startup’s expenses. It spent INR 13.64 Cr on marketing during the year under review as against INR 2.83 Cr in the fiscal prior.

Employee Expenses: Employee benefits surged 240% to INR 3.65 Cr in FY23 from INR 1.08 Cr in the previous fiscal year.

Raise competes with the likes of Zerodha, Groww, and Angel One in the country’s burgeoning investment tech market. As per an Inv42 report, the country’s investment tech industry will become a $74 Bn market opportunity by 2030 from $9.2 Bn in 2022.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)