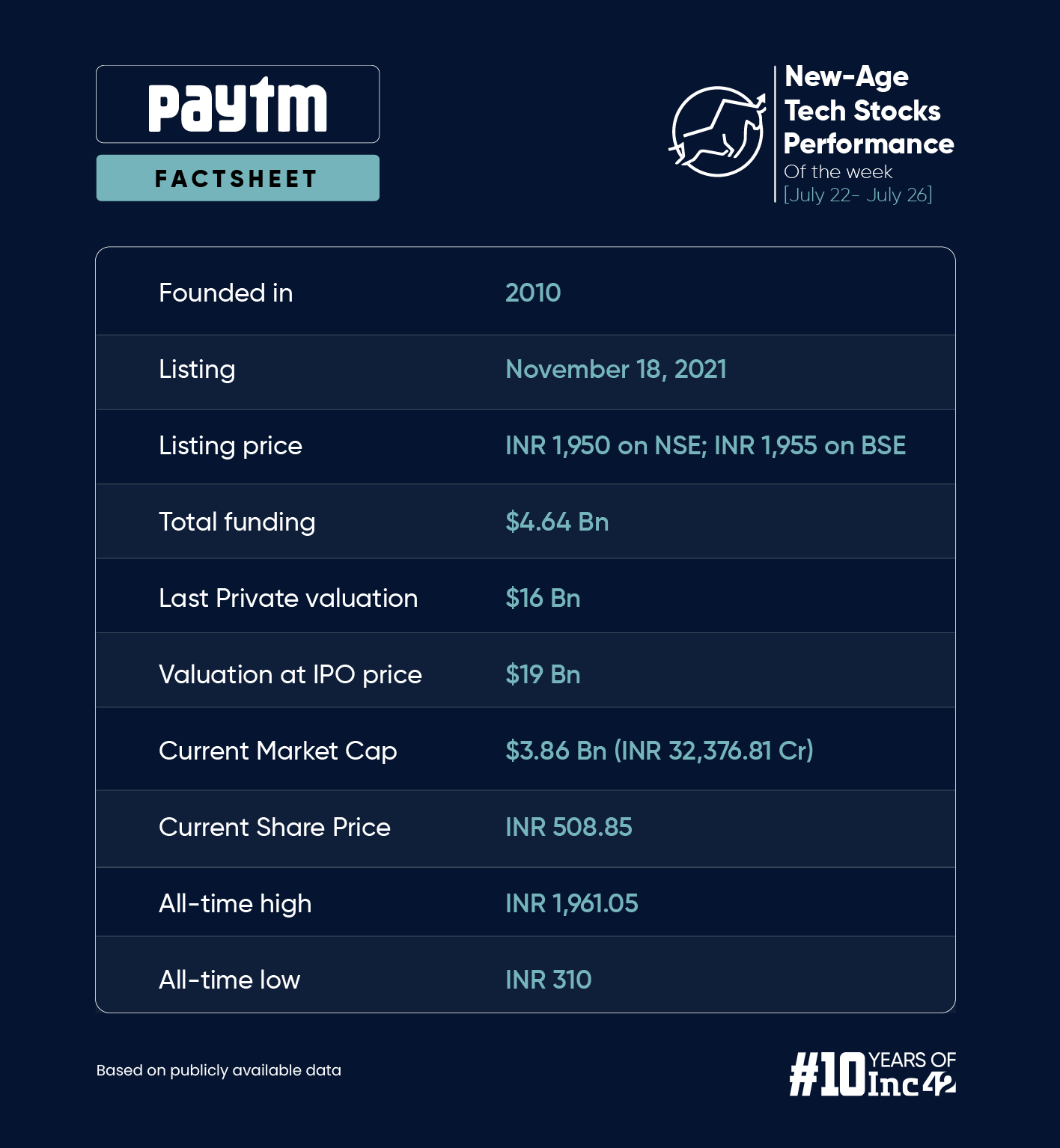

Shares of Paytm breached the INR 500 mark after a long time and the stock emerged as the biggest gainer this week with a 10.93% jump

Traveltech startups EaseMyTrip, Yatra, and ixigo gained this week after the finance minister announced a slew of initiatives in her budget speech to boost tourism

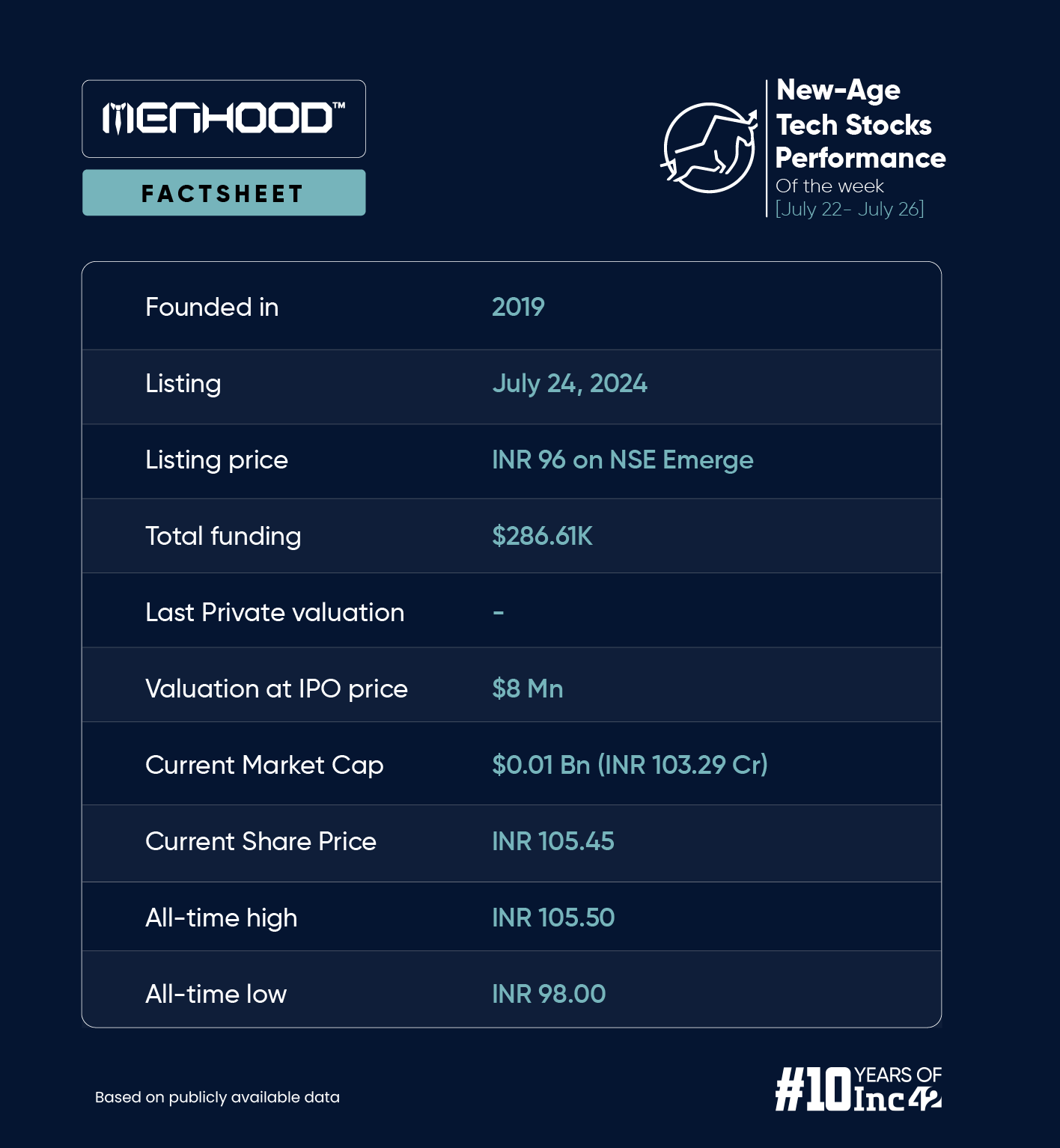

Jaipur-based D2C men’s grooming brand Menhood made its public market debut on the NSE Emerge this week

In a week in which finance minister Nirmala Sitharaman presented the first Union Budget of Modi government 3.0, new-age tech stocks rallied in line with the broader market and stock-specific developments.

Twenty one out of the 24 stocks under Inc42’s coverage ended the week with gains in the range of 0.26% to almost 11%. Shares of Paytm breached the INR 500 mark after a long time and the stock emerged as the biggest gainer this week with a 10.93% jump. Nykaa, Zomato and Mamaearth also rose this week.

Traveltech startups EaseMyTrip, Yatra, and ixigo gained this week after the finance minister announced a slew of initiatives in her budget speech to boost tourism.

The government announced support plans for comprehensive development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor to boost the spiritual tourism sector. The finance minister allocated INR 2,479.62 Cr for the tourism sector for FY25, up 46% from the revised allocation of INR 1,692.10 Cr in FY24.

Shares of geotech company MapMyIndia also soared over 5% this week as Sitharaman announced plans to digitise land records in urban India with GIS mapping.

Only three new-age tech stocks ended in the red this week – Awfis, TAC Infosec, and Yudiz, declining in a range of 0.8% to about 3%.

Meanwhile, the broader market continued its upward momentum this week. Sensex gained 0.9% to end at 81,332.72, while Nifty 50 rose 1.2% this week to end at 24,834.85.

Commenting on the market performance this week, Geojit Financial Services’ head of research Vinod Nair said that the budget was both populist and prudent, and failed to spark any significant excitement in the market.

“The market has now recovered its losses from budget day, driven by positive US GDP data and expectations of improved global demand. Moving forward, the direction of the domestic market will likely be influenced by the progress of the earnings season,” he said.

Meanwhile, Prashanth Tapse, senior VP of research at Mehta Equities, said that Indian markets outperformed the global peers this week on the back of a strong buying support across the board. He attributed this resilience to the strong growth of the Indian economy and better-than-expected earnings reports of blue chip and mid-cap companies.

Amid the startup IPO rush, Jaipur-based D2C men’s grooming brand Menhood made iCts public market debut on the NSE Emerge this week and became the latest stock under Inc42’s coverage.

Overall, the total market capitalisation of the 25 new-age tech stocks under Inc42’s coverage stood at $63.27 Bn at the end of this week. The valuation of 24 new-age stocks stood at $60.99 Bn last week.

Now, let’s take a deeper look at the performance of some of the listed new-age tech stocks this week.

Paytm Gets Long-Pending Approval

Shares of Paytm surged nearly 11% this week to cross the INR 500 mark after the company received the long-pending approval from the government to invest INR 50 Cr in its payments arm, Paytm Payment Services.

The stock surged 10% on Friday (July 26) after it was reported that the Vijay Shekhar Sharma-led company has secured the investment approval, which would allow it to apply for an online payment aggregator (PA) licence.

It is pertinent to note that Paytm reported an underwhelming financial performance in the first quarter of the fiscal year 2024-25 (Q1 FY25), with its net loss widening 134% year-on-year to INR 840.1 Cr.

Paytm was in the news this week for a number of other reasons:

- Brokerage firms Emkay Global, JM Financial, and Motilal Oswal retained their “reduce”, “sell”, and “neutral” ratings on the stock, respectively, following the declaration of Q1 results.

- Paytm joined hands with Axis Bank to offer point of sale solutions and card payment machines to its merchant network on July 23.

- Paytm received a fine of INR 250 for failure to pay stamp duties pertaining to the allotment of ESOP granted by the company. Moreover, an additional penalty of INR 370 has been imposed for similar non-compliance.

Commenting on the stock’s performance, Amol Athawale, VP of technical research at Kotak Securities, said, “We maintain a neutral stance on Paytm, viewing the recent movement as a potential pullback or technical rebound. We anticipate short-term bullish trends to persist. It is difficult to predict in the long term as there’s been too much volatility in the stock.”

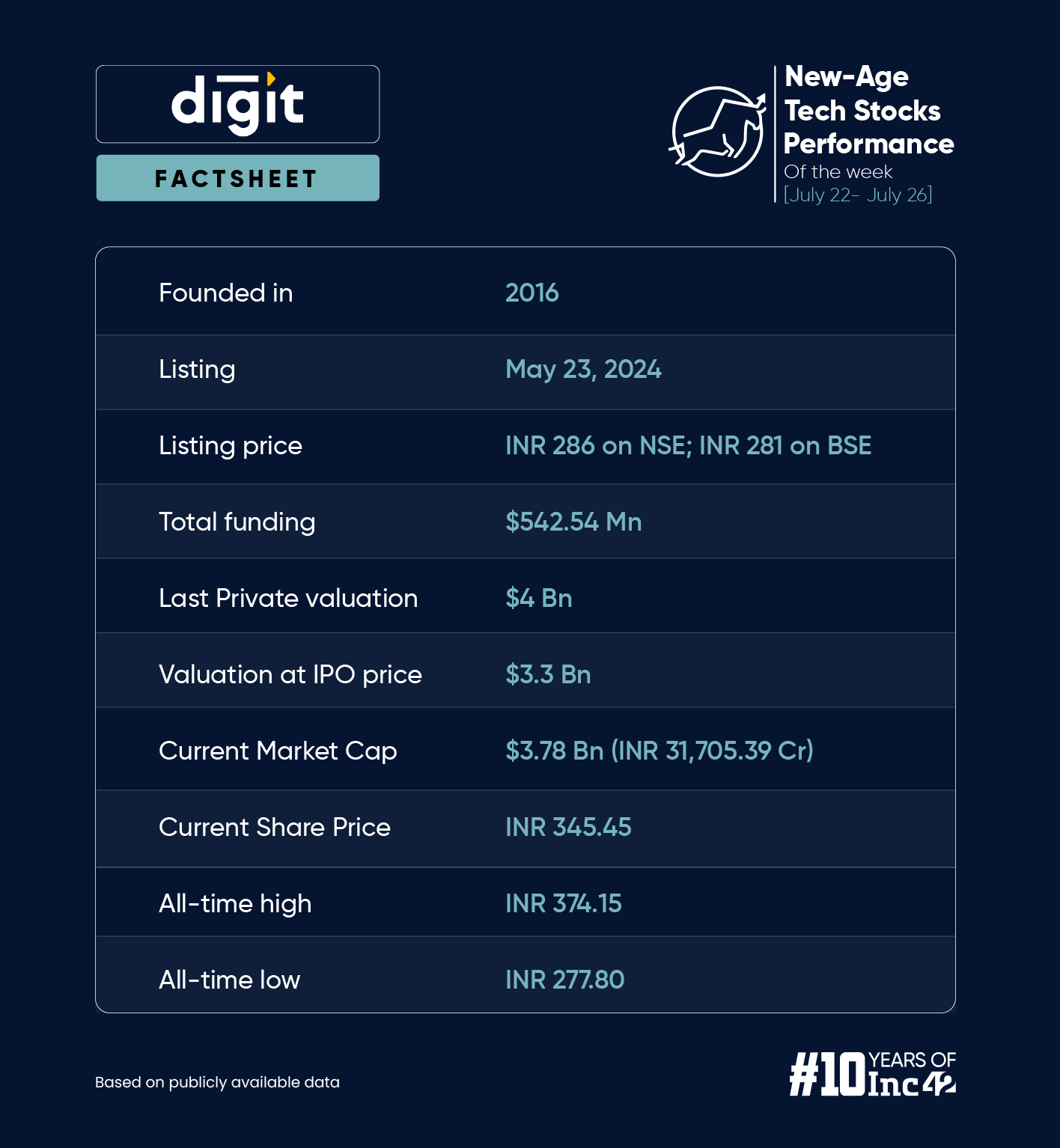

Go Digit Posts Robust Q1 Numbers

Insurtech unicorn Go Digit this week reported a 74% increase in its profit after tax (PAT) to INR 101 Cr in Q1 FY25 from INR 58 Cr in the year-ago quarter. Its net earned premium also rose to INR 1,824 Cr during the period under review from INR 1,475 Cr in the year-ago quarter.

Following the disclosure of Q1 numbers on June 25, the stock rallied over 8% to touch INR 362.25 apiece during the intraday trading session on the BSE on June 26. Overall, Go Digit rose 0.26% this week to end at INR 345.45.

Athawale said that Go Digit’s immediate resistance level is INR 370 and support for the stock is seen at INR 335. He added that the stock would see a strong rally if it breaches INR 375 mark, while it can come down to INR 310-315 on the lower level.

Menhood Makes A Strong Debut

D2C brand Menhood parent Macobs Technologies became the third new-age entity to list on NSE Emerge this week, after TAC Infosec and Trust Fintech.

Menhood’s IPO was oversubscribed 157.5X, with investors bidding for 40.89 Cr shares as against 25.95 Lakh shares on offer.

The D2C brand got listed at INR 96 apiece, a 28% premium to its issue price of INR 75. Since its listing on Wednesday, the startup’s share prices have spiked 9.84% to end the week at INR 105.45.

It filed its draft red herring prospectus (DRHP) in January 2024. Its IPO comprised a fresh issue of 25,95,200 equity shares of INR 10 each.

Founded in 2019 by Dushyant Gandotra, Menhood offers a wide range of products in the male grooming and lifestyle segment, such as trimmers, intimate perfumes, intimate wash and moisturisers.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)