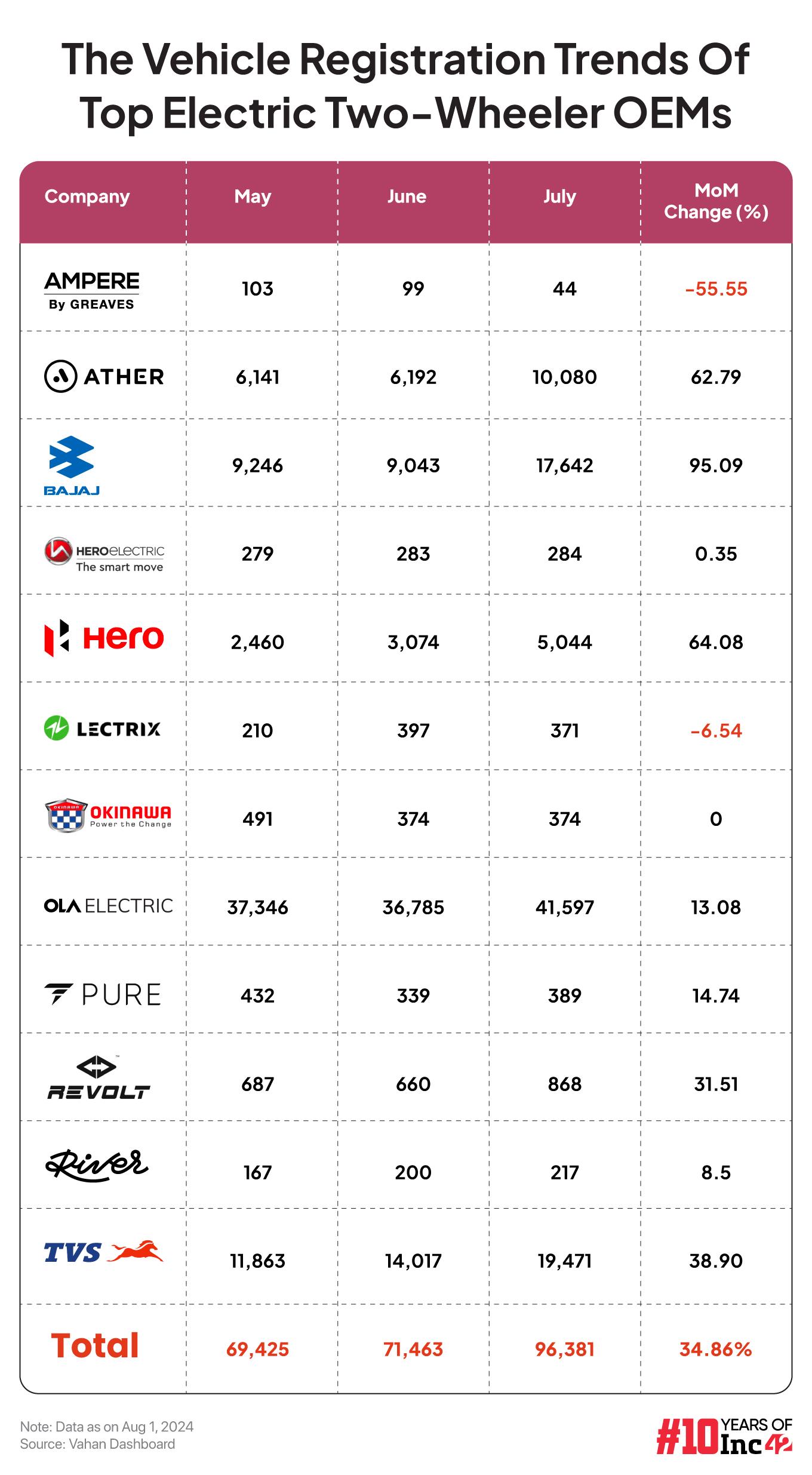

IPO-bound Ola Electric’s registrations rose 13% MoM to 41,597 units , with the startup accounting for 40% of the two-wheeler EV registrations in July

Ather Energy saw a massive 63% MoM jump in vehicle registrations, while TVS Motor also witnessed a 39% MoM rise

The likes of Pure EV, River, electric motorcycle makers Revolt, Oben Electric, and Ultraviolette also saw growth in registration volumes

Total electric two-wheeler monthly registrations crossed the 1 Lakh units mark in July, with IPO-bound Ola Electric alone claiming almost a 40% market share.

As per Vahan data as on August 1, two-wheeler EV registrations grew 34% month-on-month (MoM) to 1.07 Lakh units in July. The last time EV registrations surpassed the 1 Lakh units mark was in March this year, the last month of the Centre’s subsidy scheme FAME-II.

Ola Electric saw registrations of 41,597 units of its escooters last month, a rise of more than 13% from 36,785 units in June. When compared on a year-on-year (YoY) basis, the leading escooter manufacturer’s vehicle sales more than doubled from 19,406 units in July last year.

The Bhavish Aggrwal-led startup revealed in its IPO papers that it currently earns a majority of the revenue from the sale of its S1 Pro escooters. Its other EV two-wheeler variants include Ola S1, S1 Air, S1 X, and S1 X+.

While Ola Electric continues to lead the electric two-wheeler market in the country, it is important to note that some of its competitors are witnessing sustained growth – some of them even more than Ola.

For instance, Hero MotoCorp-backed Ather Energy, which is also preparing for its IPO, saw a massive 63% MoM jump in vehicle registrations to 10,080 units in July. On a YoY basis, this was almost a 51% jump.

lockquote>

Legacy two-wheeler player TVS Motor’s EV registrations also witnessed a 39% MoM rise to 19,471 units in July. It continued to hold the second position in terms of sales after Ola. TVS Motor’s registrations stood at 10,398 units in July last year.

On the other hand, Hero MotoCorp saw its two-wheeler EV registrations surge 64% to 5,044 units in July from 3,074 in June. This was also a 500% YoY growth.

Legacy automotive player Bajaj Auto’s EV registrations almost doubled to 17,642 in July this year from 9,043 units in the month before. On a YoY basis, its registrations zoomed 300%.

lockquote>

While the tapering down of government subsidies initially caused a slowdown in electric two-wheeler adoption over the past few months, the pace of growth has started picking up again.

The likes of Pure EV, River, electric motorcycle makers Revolt, Oben Electric, and Ultraviolette have also started witnessing growth in registration volumes.

However, Okinawa, Hero Electric, and Ampere continued to witness degrowth or zero growth in July, even as the EV market improved. These escooters makers are the most impacted EV players from the government’s tightened regulations for EV subsidy schemes.

Inc42 recently reported on the possibility of at least three to five EV OEMs shutting down, affecting 1K dealerships and more than 5K jobs in the coming months, as the impact of tightened regulations around product localisation wreaked havoc on many of these players.

Meanwhile, the Indian government is yet to announce FAME-III, which the Indian EV ecosystem is eagerly waiting for. However the Centre last month announced the extension of the electric mobility promotion scheme (EMPS) 2024 till September.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)