The ongoing Q1 FY25 earnings season resulted in a mixed week for the listed startups under Inc42’s coverage, with stock-specific action seen in the new-age tech stocks.

Eleven of the 25 new-age tech stocks under Inc42’s coverage gained in a range of over 3% to 17%. Zomato emerged as the top gainer this week, buoyed by its strong Q1 show. Nazara Technologies, Nykaa, and Delhivery were also among the gainers this week.

Meanwhile, 14 listed saw a decline in their share prices, falling in a range of under 0.1% to 11.27%. IndiaMART InterMESH, MapmyIndia, ixigo, and Go Digit were among the losers this week..

ideaForge emerged as the biggest loser this week, with its shares plunging 11.27% to INR 735.40 over its weak Q1 numbers. The drone startup’s profit after tax (PAT) declined almost 94% to INR 1.2 Cr from INR 18.9 Cr in the year-ago quarter.

Meanwhile, the broader market plummeted in the later part of the week after moving up earlier during the week. While Sensex ended the week 0.43% lower at 80,981.95, Nifty 50 declined 0.47% this week to end at 24,717.70.

Commenting on the market trend, Geojit Financial Services’ head of research Vinod Nair said that the market is displaying signs of fatigue at higher levels as most “positive factors have already been priced in”. Adding to this is the global economic slowdown due to escalating trade tensions, conflicts in the Middle East, and persistently high inflation.

“Going forward, the chances of further consolidation seem elevated due to premium valuations, weak Q1 results, and ongoing global market consolidation,” he said.

Echoing his sentiment, Mehta equities’ senior VP (Research) Prashanth Tapse said that investors in domestic markets felt the impact of the global market situation and resorted to profit booking as recession fears re-emerged.

“Despite the slump, our resilient economy and strong fundamentals, along with healthy corporate earnings, would keep the downside limited. Technically speaking, the 25,000 mark for Nifty has now become a psychological hurdle and confirmation of strength can be seen only above that level,” he said.

In the coming week, all eyes will be on the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC), which will meet from August 6-8, Nair said.

Amid all these, the startup IPO boom continues. Three startups – Ola Electric, Unicommerce and FirstCry – are set to list on the exchanges in the coming weeks.

Ola Electric’s IPO opened on August 2 and received 35% subscription on the first day of bidding on Friday. The EV maker has set a price band of INR 72-76 per equity share for the public issue. At the upper end of the price band, it would raise INR 6,145.6 Cr.

In its IPO note, wealth management and investment advisory Devan Choksey gave Ola Electric’s public offering a “subscribe” rating. It believes that Ola Electric’s continued focus on fostering research and development will help it extend its market share in the two-wheeler EV category. It is pertinent to note that Ola Electric is already the market leader in the segment.

“The company prioritises R&D and plans to continue launching next-generation EVs. The company’s strategic initiatives include the development of the Ola Gigafactory and a focus on backward integration to enhance supply chain control and cost efficiency. Overall, the growth plans and cost efficiency initiatives justify the valuation,” it said.

FirstCry and Unicommerce’s public offerings are set to open on August 6 and close on August 8. While FirstCry is set to raise INR 4,193 Cr at the upper end of its price band of INR 440-465, Unicommerce’s IPO will see its shareholders sell shares worth INR 276.57 Cr.

Overall, the total market capitalisation of the 25 new-age tech stocks under Inc42’s coverage stood at $67.91 Bn at the end of this week as against $63.27 Bn last week.

With that said, here’s a deeper look at the performance of the top three gainers this week.

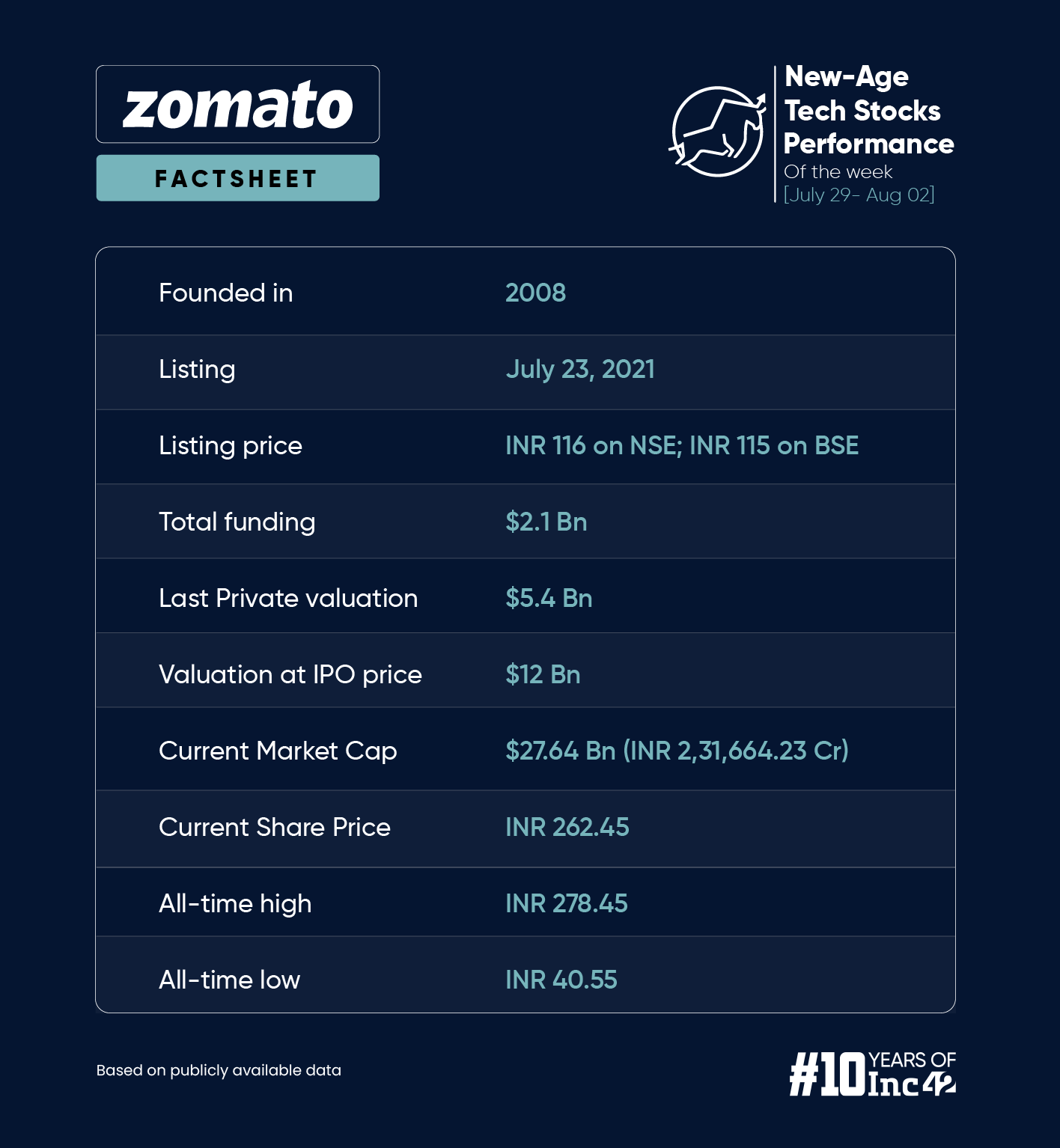

Zomato Continues Its Winning Streak

Zomato continued its run on the profit lane in the first quarter of FY25. The company’s profit zoomed 45% on a sequential basis to INR 253 Cr in the quarter, while operating revenue jumped more than 18% to INR 4,206 Cr in Q1 FY25.

Consequently, shares of the foodtech major touched a 52-week high of INR 278.45 in early trading hours on August 2. Its market cap also inched closer to the $30 Bn mark. The startup’s shares shed some gains as the day progressed but gained 16.88% during the week to end at INR 262.45 apiece.

Brokerage firm Bernstein gave the company’s shares an “outperform” rating and revised its price target to INR 275 from INR 230 earlier.

The brokerage said that Zomato is on track to display sustained growth in food delivery, poised for a strong quick commerce performance with Blinkit and a higher uptick in monthly transacting users.

“We see Zomato as a core internet holding, and our top pick in India Internet,” the brokerage said.

Meanwhile, JM Financial also increased its price target on the stock to INR 260 from INR 230 earlier. “Zomato continues to be one of our preferred picks in the listed Internet space as we believe it is well positioned to benefit from robust industry tailwinds for the hyperlocal delivery businesses,” it said.

Bernstein expects Blinkit to grow over 40% year-on-year (YoY). It anticipates Blinkit’s valuation to grow 7X by FY26, primarily due to its aggressive store expansion to reach 1000 stores by FY25 an 2000 stores by 2026.

Meanwhile, Zomato also announced the launch of a new app, District (by Zomato), to scale up its going-out business.

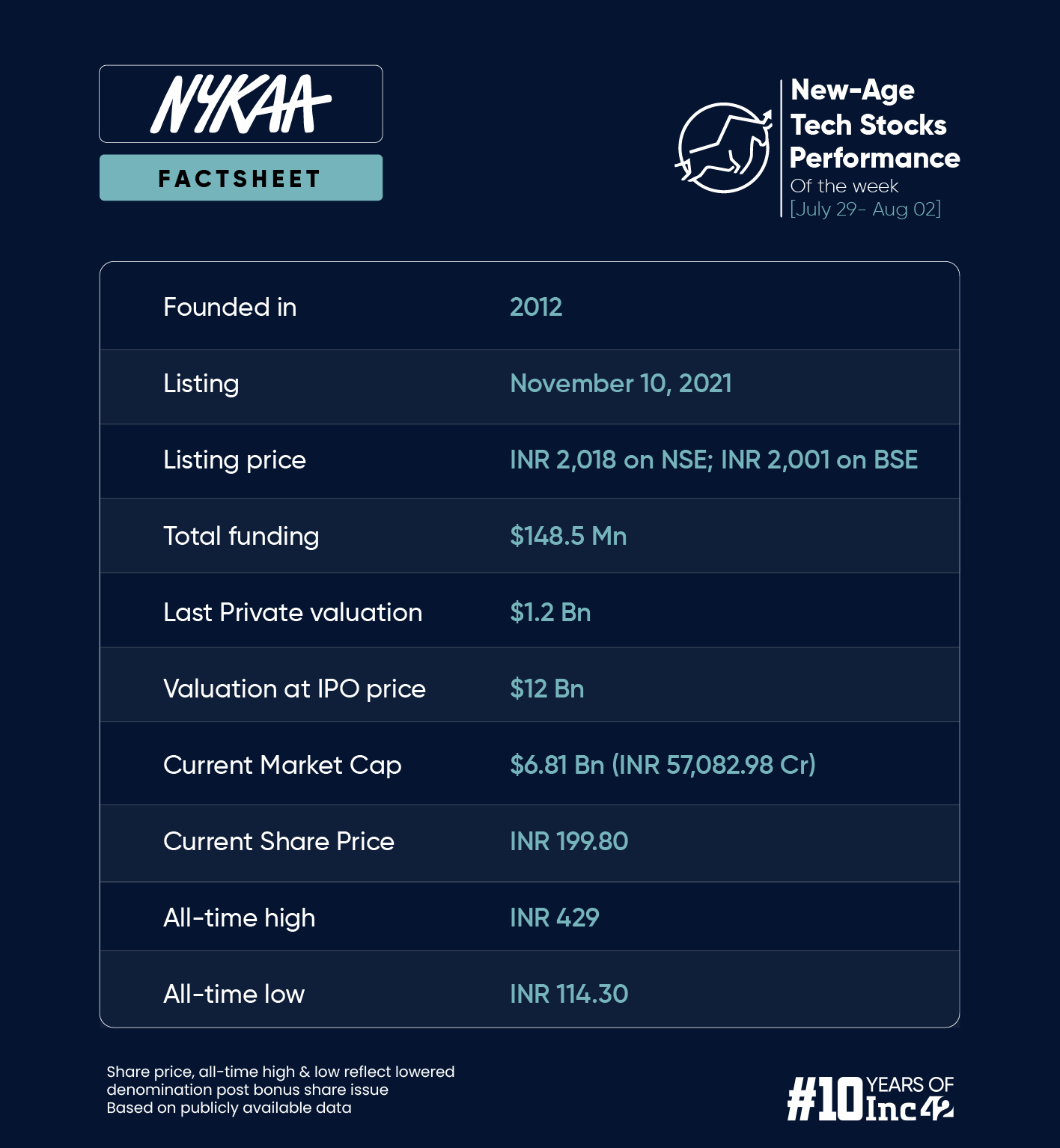

Nykaa Rallies To A 52-Week High

Shares of the beauty ecommerce major Nykaa jumped as much as 10.4% to touch a 52-week high at INR 202 during the intraday trading on July 30 (Tuesday). However, the stock gave up some of the gains to end below the 200 mark. Despite this, the stock rose 9.33% this week.

On Tuesday, the shares saw a multifold increase in their average trading volumes. A total of 53.2 Mn shares changed hands cumulatively on the BSE and the NSE, a 14-fold rise from the stock’s average weekly volume of 3.8 Mn shares.

While Nykaa is yet to declare its Q1 financial numbers, the startup expects a strong revenue growth of around 22-23% YoY.

“Our beauty vertical’s revenue growth for the quarter is expected to be around 22-23% YoY, similar to the consolidated entity’s revenue growth. GMV growth is expected to be higher, in the high twenties YoY, in line with long-term BPC (Beauty & Personal Care) industry growth trajectory,” the startup said in July.

On its investor day in June, Nykaa said that it is aiming to achieve a mid-single-digit EBITDA margin by FY27 and then increase it to 10%. It also expects its BPC business to grow at a CAGR of mid-to-late 20% till FY28.

Post this disclosure, JM Financial raised its price target on Nykaa to INR 230 from INR 220 earlier. ICICI Securities also upgraded the stock to ‘add’ from ‘hold’ and raised the target to INR 195 from INR 175 earlier.

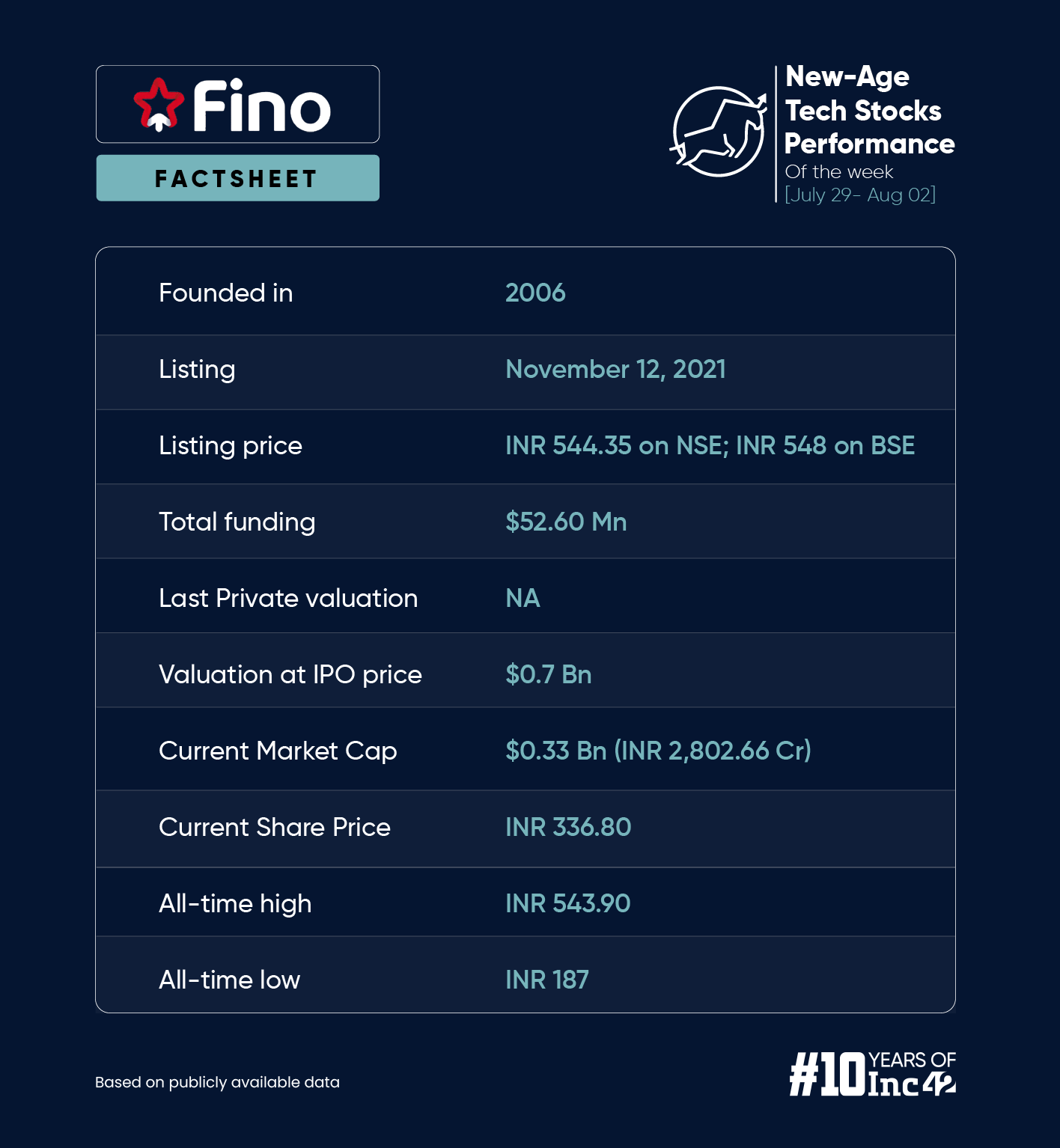

Fino Payments Bank Gains On Uptick In Q1 Numbers

The Rishi Gupta-led payments bank emerged as the second biggest gainer this week as markets reacted positively to its Q1 performance. Fino’s shares ended the week 12.24% higher at INR 336.80.

The payments bank posted a PAT of INR 24.27 Cr in Q1, up 29.7% from INR 18.7 Cr in the year-ago quarter. Revenue from operations grew 25.4% YoY to INR 436.86 Cr in Q1.

In the quarter, Fino said that over 68,000 new digital accounts were opened on its platform which facilitated 57 Cr UPI transactions. Besides, the payments bank also saw its merchant network rise 25% YoY to 18.1 Lakh.

Moving forward, the company is looking to enhance its focus on digital payment services. “Our new vertical ‘digital payment services’ is growing on a profitable basis and giving the necessary impetus to our TAM (transaction, acquisition and monetisation) strategy,” CEO and MD Gupta said.

The current account savings account (CASA) segment contributed INR 93.6 Cr to Fino’s net income in Q1 FY25.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)