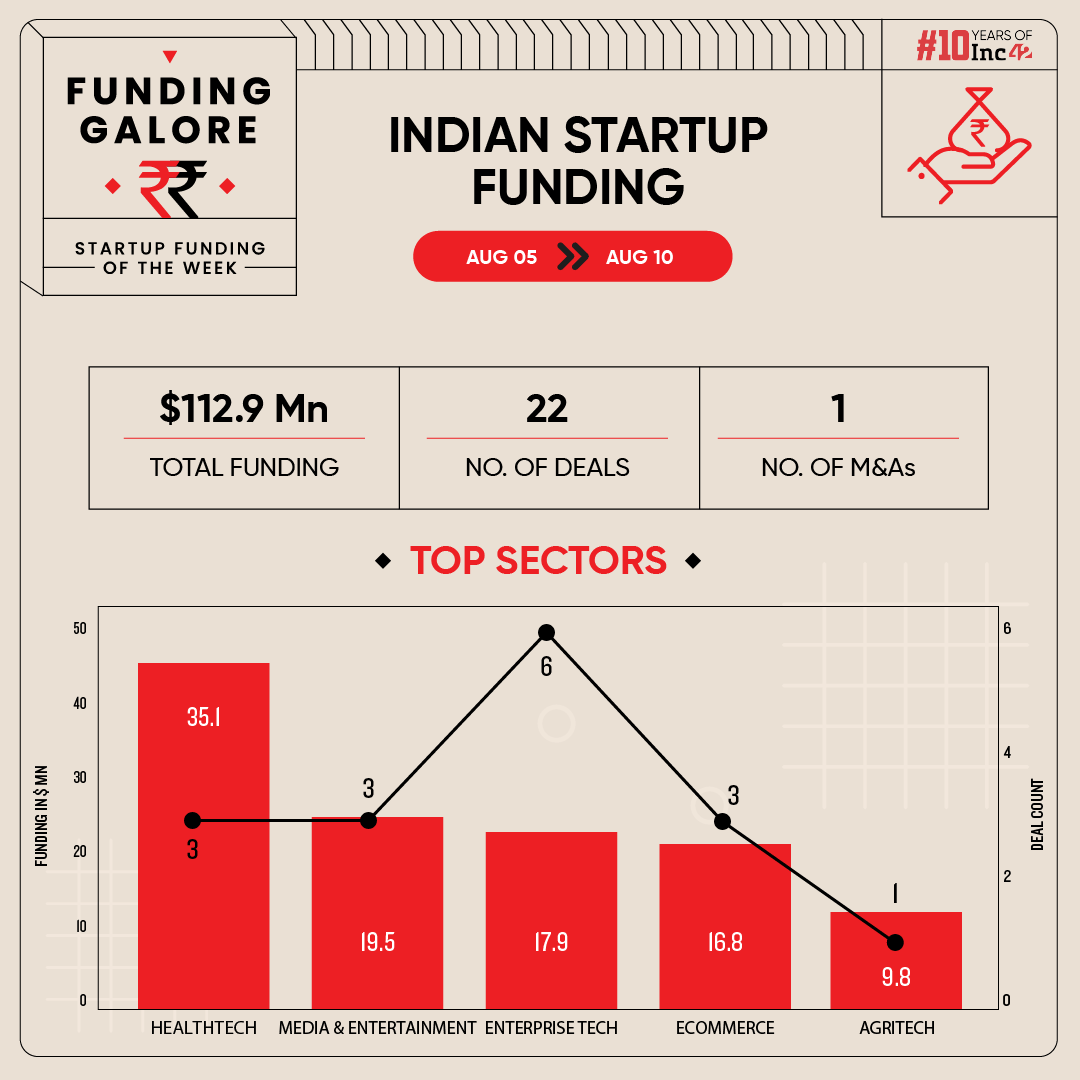

Indian startups cumulatively raised $112.9 Mn via 22 deals, down almost 50% from last week’s $222.2 Mn secured through 25 deals

While Ola Electric made its public market debut this week, FirstCry and Unicommerce are set to get listed in the first half of the coming week

Omnivore VC and CRED’s founder Kunal Shah emerged as the most active investors this week, backing two startups each

Amid mounting global geopolitical tensions, funding momentum in the Indian startup ecosystem took a significant hit. Between August 5 and 10, startups cumulatively raised $112.9 Mn via 22 deals, down almost 50% from $222.2 Mn secured through 25 deals in the preceding week.

While startups failed to see traction with investors at a broader level, Ola Electric made its public market debut this week. Besides, FirstCry and Unicommerce are also set to get listed in the first half of next week.

Funding Galore: Indian Startup Funding Of The Week [Aug 5 – Aug 10]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 7 Aug 2024 | Visit Health | Healthtech | Telemedicine | B2B | $29.8 Mn | – | – | – |

| 3 Aug 2024 | Sharechat* | Media & Entertainment | Social Media & Chat | B2C | $16 Mn | Debt | EDBI | EDBI |

| 5 Aug 2024 | Agrizy | Agritech | Market Linkage | B2B-B2C | $9.8 Mn | Series A | Accion, Omnivore, Capria Ventures, Thai Wah Ventures, Ankur Capital | Accion, Omnivore, Capria Ventures |

| 8 Aug 2024 | Scimplify | Enterprise Tech | Enterprise Services | B2B | $9.5 Mn | Series A | Omnivore, Bertelsmann India Investments, 3one4 Capital, Beenext | Omnivore, Bertelsmann India Investments |

| 5 Aug 2024 | Country Delight | Ecommerce | D2C | B2C | $8.3 Mn | Debt | Alteria Capital | Alteria Capital |

| 7 Aug 2024 | kindlife | Ecommerce | D2C | B2C | $8 Mn | Series A | TK Fund, MIXI Global Investments, Kalaari Capital | TK Fund, MIXI Global Investments |

| 7 Aug 2024 | BlueBinaries | Enterprise Tech | Enterprise Services | B2B | $7.1 Mn | – | Anicut Capital | Anicut Capital |

| 6 Aug 2024 | Punch | Fintech | Investment Tech | B2C | $7 Mn | Seed | Stellaris Venture Partners, Susquehanna Asia VC, Prime Venture Partners, Innoven Capital, Kunal Shah, Vatsal Singhal, Nitish Mittersain | Stellaris Venture Partners, Susquehanna Asia VC, Prime Venture Partners, Innoven Capital |

| 6 Aug 2024 | EtherealX | Deeptech | Spacetech | B2B | $5 Mn | Seed | YourNest, BIG Global Investments JSC, BlueHill Capital, Campus Fund, Golden Sparrow Ventures | YourNest |

| 7 Aug 2024 | SigTuple | Healthtech | MedTech | B2B | $4 Mn | Series C | Sidbi Venture Capital, Endiya Partners | Sidbi Venture Capital |

| 6 Aug 2024 | Juleo | Media & Entertainment | Social Media & Chat | B2C | $2.5 Mn | – | Ramakant Sharma, Kunal Shah, Ruchi Deepak, Leo Puri, Harsh Jain, Lalit Keshre | – |

| 5 Aug 2024 | Neuron Energy | Cleantech | Electric Vehicle | B2B | $2.3 Mn | Series A | Chona Family Office, Capri Global Family Office | – |

| 6 Aug 2024 | Burma Burma Restaurant and Tea Room | Consumer Services | – | B2C | $2 Mn | – | Negen Capital | – |

| 6 Aug 2024 | Latambarcem Brewers | Alcoholic Beverage | Alcoholic Beverage | B2C | $1.5 Mn | pre-Series A | LBB Investor SPV, Dhruv Agarwala, Sheba Venture Holding | LBB Investor SPV |

| 7 Aug 2024 | Karma Primary Healthcare | Healthtech | Telemedicine | B2C | $1.3 Mn | Series A | UBS Optimus Foundation, 1Crowd | UBS Optimus Foundation |

| 8 Aug 2024 | Oneiric11 Gaming | Media & Entertainment | Gaming | B2C | $1 Mn | pre-Series A | NG Family Trust, TAC Holdings | NG Family Trust, TAC Holdings |

| 6 Aug 2024 | Cellivate Technologies | Enterprise Tech | Enterprise Services | B2B | $1 Mn | Seed | Antler, Venture Catalysts, Hatcher+, We Founder Circle | Antler |

| 5 Aug 2024 | CURRYiT | Ecommerce | D2C | B2C | $536K | – | RK Family Trust, Tangent Advisors, Freeflow Ventures, Ramesh Damani, Ajaya Jain | – |

| 9 Aug 2024 | NuvoRetail | Enterprise Tech | Enterprise Services | B2B | $350K | – | – | – |

| 6 Aug 2024 | Ippopay | Fintech | Payments | B2C | – | – | Mithun Sacheti, Siddhartha Sacheti | – |

| 8 Aug 2024 | Weavings Manpower Solutions | Enterprise Tech | Enterprise Services | B2B | – | – | Gruhas | Gruhas |

| 8 Aug 2024 | FlexiBees | Enterprise Tech | Horizontal SaaS | B2B-B2C | – | pre-Series A | Inflection Point Ventures, Shan M S, Reema Mahajan | Inflection Point Ventures |

| Source: Inc42 *Included this week as it was skipped last week Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Fuelled by this week’s largest funding round of Visit Health, healthtech emerged to dominate sectoral funding trends. Three healthtech startups cumulatively bagged $35.1 Mn in the week.

- Enterprise tech continued to reign as the investor favourite this week, with startups bagging the maximum number of cheques this week. Enterprise tech startups bagged $17.9 Mn via six deals in the week.

- Delhi based venture capital fund Omnivore VC and CRED’s founder Kunal Shah emerged as the most active investors this week, backing two startups each.

- Seed funding continued its upward streak this week, with startup’s at this stage raising $13 Mn, 2.5X from the previous week’s $5.1 Mn.

Other Developments Of The Week

- Instawork bought Bengaluru-based hiring platform Able Jobs for an undisclosed deal to scale up its global job market with new tools and offerings

- India Inflection Opportunity Fund manager Pantomath Capital Management launched its second AIF, Bharat Value Fund (BVF), this week. It will invest in companies with an intent to make an exit via an initial public offering within three years with an average ticket size of INR 75 Cr.

- VC firm Sauc.vc marked the final close of its third fund at INR 365 Cr (nearly $43.6 Mn). 95% of its capital was raised from domestic investors, and include top consumer focused family offices, fund of funds, corporates and HNIs.

- Continuing with its expansion spree, listed gaming major Nazara has got the letter of intent to acquire bankrupt Smaaash Entertainment this week, and will also be acquiring UK-based IP gaming studio Fusebox Games for INR 228 Cr ($27.2 Mn) in an all-cash deal.

- SoftBank said that it was sitting on a gross gain of $285 Mn from its investment (via Vision Fund I) in listed logistics unicorn Delhivery at the end of June 2024.

- Dalmia Group Holdings’ chairman Gaurav Dalmia has joined Fashion Entrepreneur Fund as investor and promoter.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)