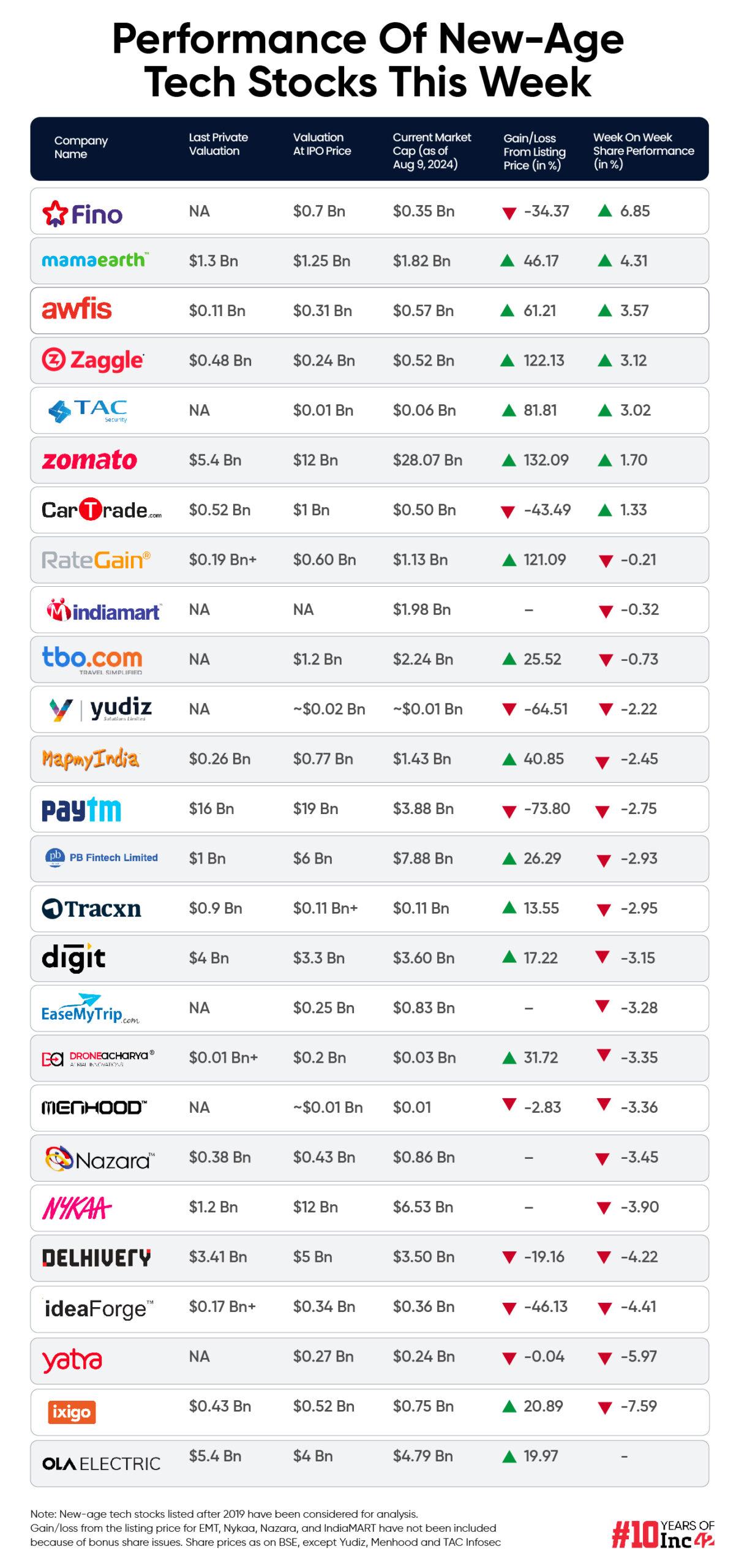

ixigo emerged as the biggest loser this week, plummeting 7.59% to end at INR 163.20. Paytm, Nazara, Go Digit, MapmyIndia were among the other prominent losers

Fino Payments Bank continued its rally this week as well to emerge as the biggest gainer, with its shares zooming 6.85%

Amid the turmoil in the global markets, Sensex and Nifty 50 ended in the red this week. Meanwhile, Ola Electric became the latest startup to list on the exchanges

New-age tech stocks suffered a heavy dent amid a crash in the broader market at the beginning of the week due to a rout in global equities markets. Eighteen of the 25 new-age tech stocks under Inc42’s coverage declined in a range of 0.21% to just under 8% this week.

Recently listed travel tech startup ixigo emerged as the biggest loser this week, plummeting 7.59% to end at INR 163.20. Paytm, Nazara Technologies, Go Digit, MapmyIndia were among the other prominent losers.

Amid all these, seven new-age tech stocks gained in a range of over 1% to just under 7%. Fino Payments Bank continued its rally this week as well to emerge as the biggest gainer. The payments bank’s shares zoomed 6.85%.

The week began with a turmoil in the global markets. Most Asian markets slumped on Monday (August 5) due to rising tensions in the Middle East, weak US economic data spurring concerns on recession, tightening of monetary policy in Japan, among other reasons.

As a result, benchmark indices Sensex and Nifty50 slumped 2.74% and 2.68%, respectively, on Monday. The India volatility index (VIX) jumped 42% to 20 levels, which, as per analysts, indicates a fear among investors of an economic slowdown.

The sell-off on Monday wiped out over $2 Bn from the market capitalisation of new-age tech companies.

While the indices managed to recover some of the losses in the subsequent sessions, they still ended the week in the red. While Sensex declined 1.5% to end the week at 79,705.91, Nifty 50 slumped 1.4% to close at 24,367.50.

Vinod Nair, head of research at Geojit Financial Services, said that this recovery came after the Bank of Japan (BoJ) said that it would not raise interest rates during periods of financial instability.

“The Indian market experienced a marginal recovery from the uncertainties stemming from concerns about the unwinding of carry trades… While the carry trade issue appears to have eased for now, a gradual increase in interest rates by the BoJ could have some impact in the near future,” he said.

Meanwhile, Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services, said that the markets are likely to consolidate at higher levels due to mixed global cues and absence of any major domestic triggers.

“Over the past few days, Nifty has been volatile with some recovery seen in the last few days. India VIX descended from a level of around 20 to 15 during the week, showing easing cautiousness in the market and improvement in sentiments,” he said.

Analysts believe that new-age tech stocks will see stock-specific action in the coming week, with some of the companies slated to report their Q1 numbers.

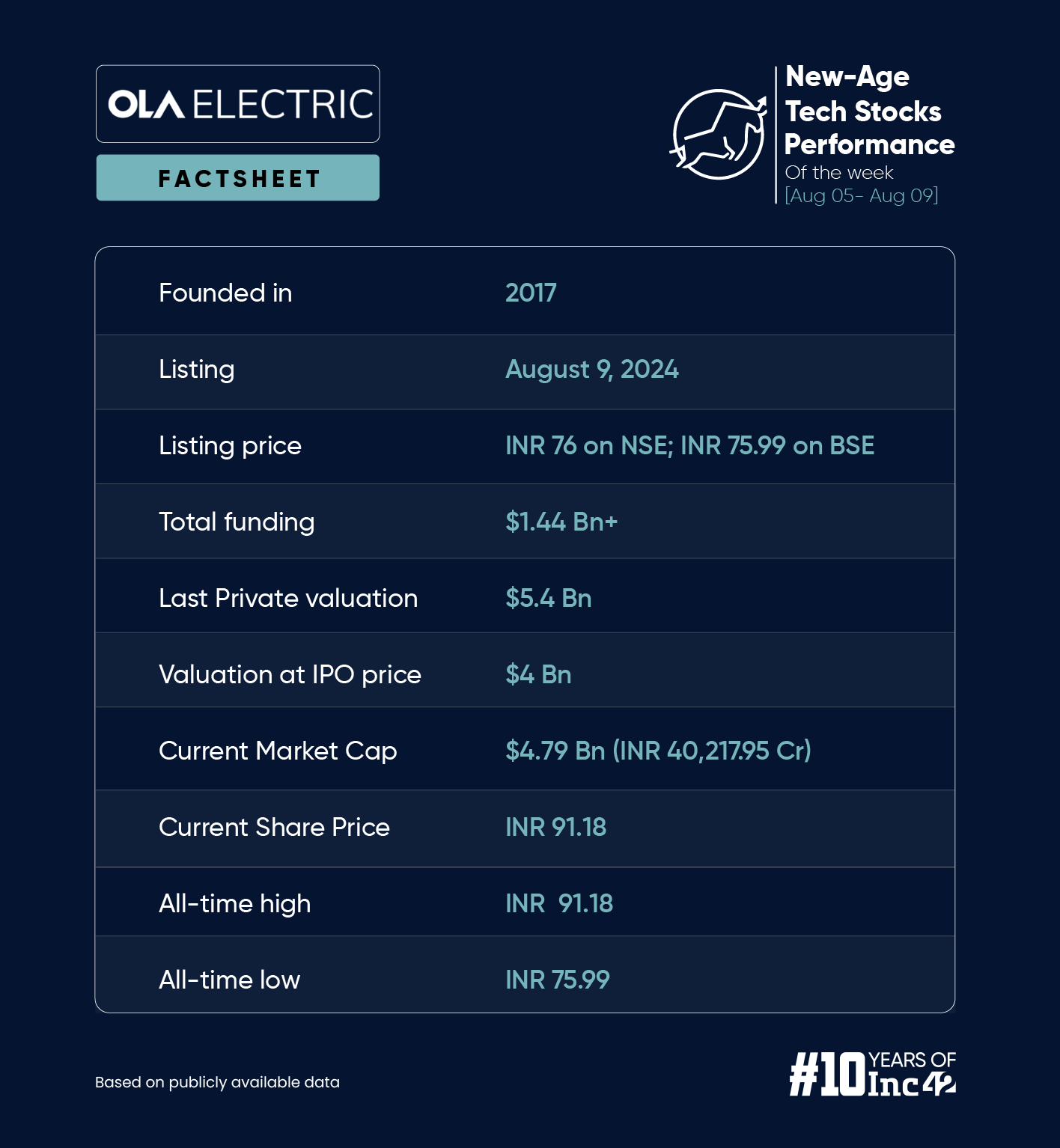

Amid the market turmoil, electric two-wheeler manufacturer Ola Electric became the first automobile manufacturer to get listed on Indian bourses in nearly two decades. Meanwhile, two other startups, FirstCry and Unicommerce, are set to list on the exchanges in the first half of next week.

Overall, the total market capitalisation of the 26 new-age tech stocks, including Ola Electric, under Inc42’s coverage stood at $72.05 Bn at the end of this week. In comparison, the market capitalisation of 25 new-age tech stocks stood at $67.91 Bn last week.

Now, let’s take a deeper look at the performance of new age tech stocks this week.

Ola Electric’s Tepid Debut

The shares of the EV maker listed on Friday (August 9) flat at INR 75.99 on the BSE against its IPO issue price of INR 76. However, the stock rose 20% during the day to close at INR 91.18 apiece.

It is pertinent to note that the company made its public market debut with a valuation of $4 Bn, 25% lower than its last private valuation of $5.4 Bn. After the jump in the share price on the first day, the startup’s market cap stood at about $4.79 Bn.

Commenting on the company’s listing, Geojit’s Nair said that the market debut defied grey market expectations of a 4-5% discount. “The positive performance can be attributed to its healthy long-term outlook, 38% market share in two-wheeler EVs, benefits from the PLI scheme, and advantages of vertical integration,” he added.

Meanwhile, Prashanth Tapse, senior VP of research at Mehta Equities, highlighted the short-term risks for the company.

“Post listing, the short-term view remains the same due to weak financials and risk of negative cash flows in future. The allotted investors should understand the risks, which could adversely impact its consolidated financial condition post listing. Considering all the factors, we advise only risk-taking investors to continue to hold with a minimum holding period of 2-3 years,” he said.

It is pertinent to note that Ola Electric continues to be a loss-making entity. In the financial year 2023-24 (FY24), its net loss widened 7.6% to INR 1,584.4 Cr from INR 1,472.1 Cr in the previous year. However, operating revenue jumped over 90% to INR 5,009.8 Cr during the year under review from INR 2,630.9 Cr in FY23.

As of now, all eyes will be on the company’s Q1 financial results, scheduled to be announced next week.

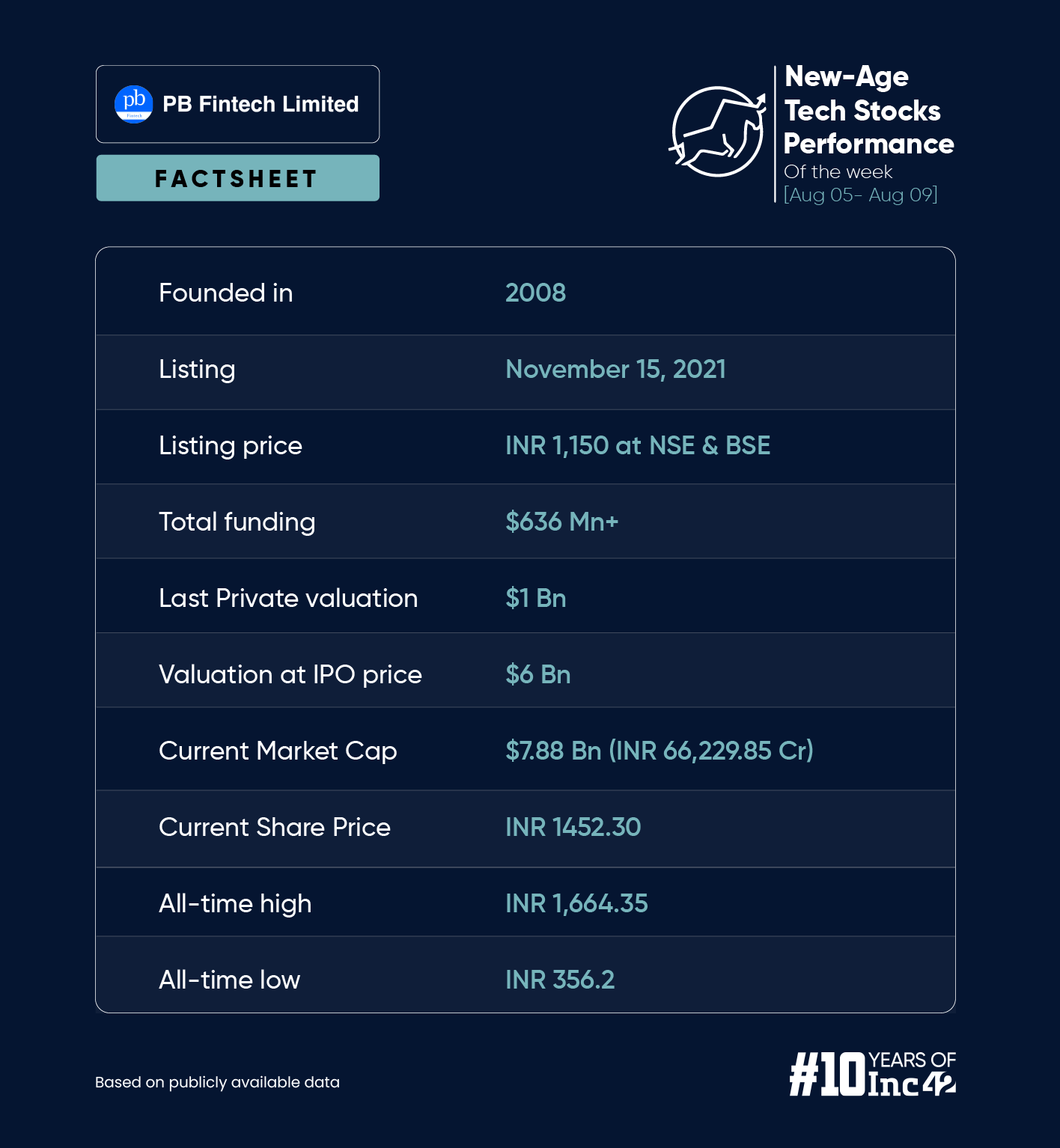

PB Fintech Touches All-Time High But Loses Steam

PB Fintech, the parent of Policybazaar, reported a net profit of INR 59.98 Cr in Q1 FY25 this week as against a loss of INR 11.9 Cr in the year-ago quarter. While its core online business, which includes Policybazaar and Paisabazaar, grew 29% year-on-year (YoY) to INR 665 Cr, the new initiatives arm saw its revenue jump 131% YoY to INR 346 Cr.

A day after it reported its results, shares of PB Fintech touched an all-time high of INR 1,664.35 on Wednesday (August 7). However, the stock declined in the subsequent sessions to end 2.93% lower week-on-week at INR 1,452.30.

The decline can be majorly attributed to the bearish view of brokerages on the stock. Kotak Institutional Equities downgraded its rating on the stock from ‘add’ to ‘reduce’ post the financial disclosure, saying that the price leaves little room for business vagaries.

Brokerage Nuvama increased its revenue estimates for PB Fintech but lowered margin expectations.

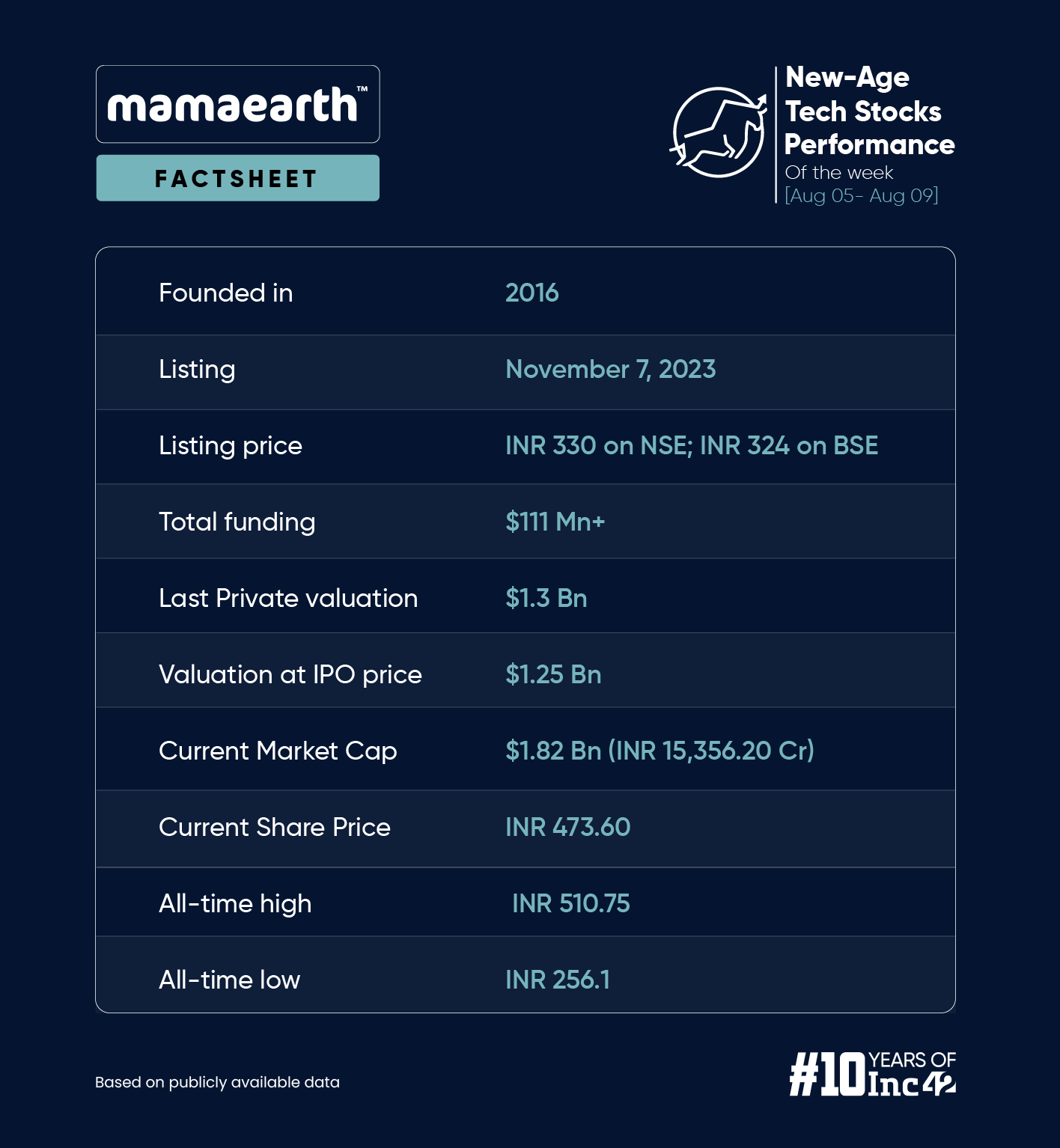

Mamaearth Posts Robust Q1 Numbers

Honasa Consumer Ltd, the parent company of D2C brand Mamaearth, reported a 62.9% increase in profit after tax (PAT) to INR 40.2 Cr in Q1 FY25 from INR 24.7 Cr in the same quarter last year.

Honasa continued to reap the benefits of its ‘house of brands’ strategy this quarter. It currently operates six brands – Mamaearth, Auqalogica, The Derma Co, Dr Sheth’s, BBlunt, and the recently-launched colour cosmetics brand Staze. The company noted that its product business increased 20.3%, driven by a volume growth of 25.2% in Q1 FY25.

It is pertinent to mention that brokerages have been bullish on Honasa’s house of brands approach in the past. Earlier in July, Emkay gave the company a price target of INR 525 by June 2025.

“Our ground checks suggest faster scale up of new brands like The Derma Co and Aqualogica. We foresee a distribution shift in the top-50 towns aiding the Mamaearth brand, where repeats are ensuring. We expect enhanced profitability in hero SKUs, where Honasa is likely to reduce trade margin, given healthy repeats,” it said.

The company’s chairman and CEO Varun Alagh said that Honasa has captured a strong market share in the face wash category online while steadily gaining ground offline, “driven by its house of brands strategy and innovation capabilities”.

However, the company said it has discontinued its ayurvedic beauty products brand Ayuga. It cited the failure to establish a product-market fit (PMF) as the reason behind it.

Shares of Honasa ended this week 4.31% higher, despite falling 4.6% on Friday to INR 473.35 ahead of the earnings announcement.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)