Fund managers and key personnel managing venture capital funds could soon be taking notes from YouTube tutorials and mugging up rules and regulations related to operating alternative investment funds (AIFs) as SEBI’s May 2025 deadline for certification draws near.

In May this year, the regulator said it would need existing funds, new funds and schemes to get certification for at least one key personnel in the investments team. The certification criterion is applicable for registration of alternative investment funds, and launch of schemes by existing AIFs after May 10, 2024.

The rules have been a few years in the making, but this year, SEBI has made it clear that all AIFs in India have to go through the clearly established certification process.

In addition to passing the National Institute of Securities Market (NISM) Series-XIX-C: Alternative Investment Fund Managers Certification Examination, fund managers need to have a professional qualification in finance, economics, capital markets or banking from a university or an institution recognised by the central or state government or a foreign university, or a CFA charter from the CFA Institute.

The requirement for a certification was approved by the SEBI board in March 2023 to facilitate skill-based approvals of AIFs and to bring in a measure of objectivity in the registration process.

What’s SEBI Thinking?

Over the past year, the markets regulator has been inundated with registration requests of new funds and schemes of existing funds over the past year. Plus, the rush to register new funds is unlikely to subside in the near future as startups and private companies will remain a very attractive asset class.

And when combined with the spree of startups going for public listings, the tide of new funds is unlikely to ebb for the next few quarters. This has naturally made it more challenging for SEBI to ratify and approve applications for AIFs.

There’s also the matter of many founders quitting startups and launching new funds in 2023 and 2024. Many of these funds are awaiting registration, and several of them have warehoused deals in the meantime as they wait for SEBI’s nod.

As per sources in the Indian VC industry at the peak of the rush in 2022 and 2023, some 1,300 applications were waiting for SEBI’s clearance, and only about 300 have managed to get registered, with other bids either expired or rejected.

Amid this glut, the regulator is also looking to clamp down on inexperienced fund managers joining the hype and failing to operate within the guidelines set for AIFs.

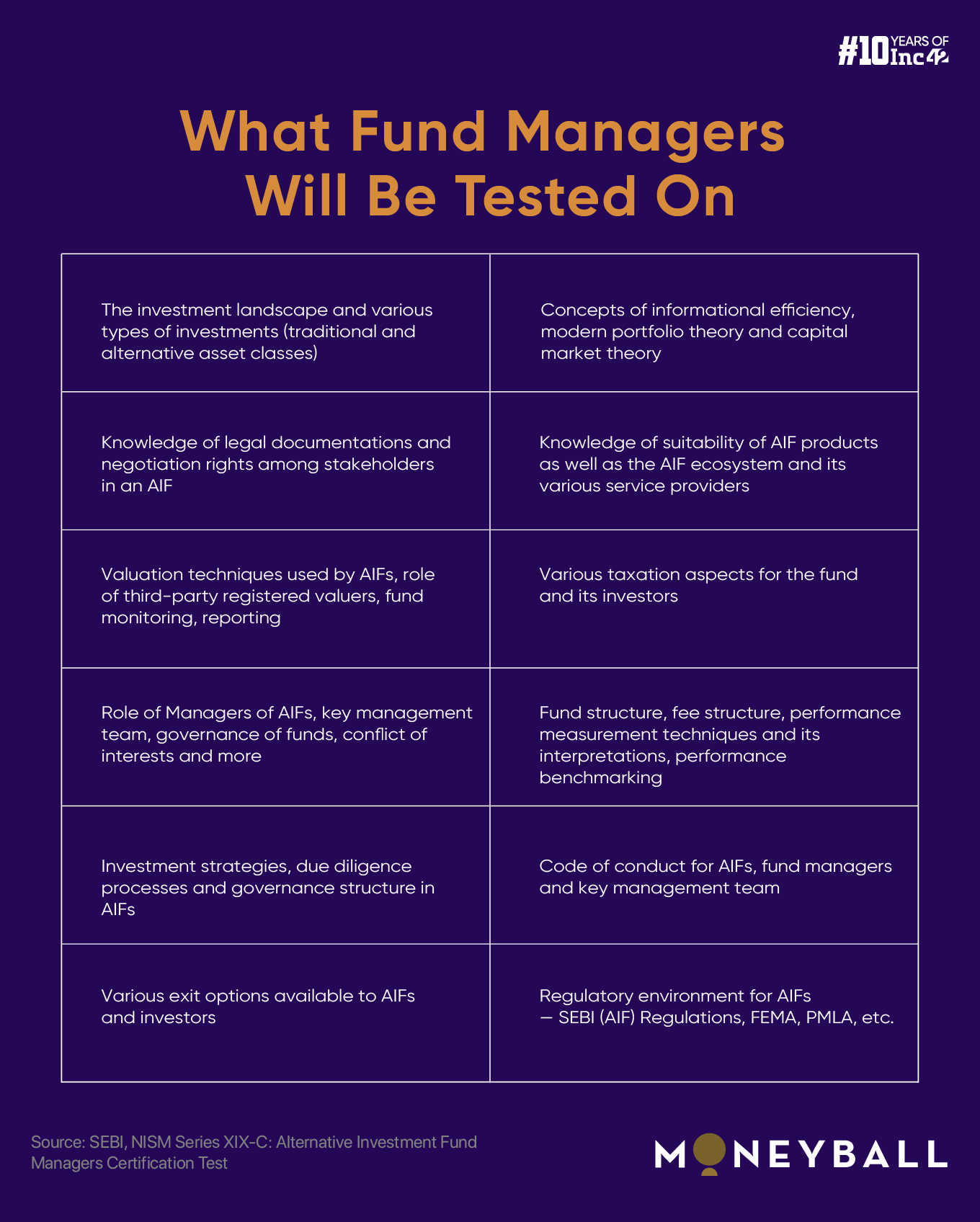

Here’s what SEBI mandates for fund managers: at least one personnel has to take the National Institute of Securities Market (NISM) Series-XIX-C: Alternative Investment Fund Managers Certification Examination, which will test the candidates on the extensive rules and regulations pertaining to the AIF ecosystem.

Plus, candidates will also have to demonstrate their knowledge of fund structures, valuation techniques, exit strategies and more. Here’s a snapshot of what the NISM would test candidates on:

Now, let’s go deeper into the problem and what exactly SEBI is looking to clean up.

How Limited Partners Pushed SEBI

The rush for new funds was at its peak in 2021, when a number of new AIFs joined the market or launched new investment funds, and sprayed capital at the height of the zero interest rate regime in 2021 and 2022.

In 2024, this wanton infusion of funds is biting many VCs, with allegations of poor due diligence and weak fund performance.

Many limited partners have alerted SEBI about mismanagement of funds invested in funds, while the exit of key general partners and fund managers from many prominent funds has also become a problem for these limited partners.

It’s easy to ignore limited partners as a powerless class in the VC equation, until one considers that even some state-backed vehicles such as SIDBI have invested in funds.

For instance, in early 2023, the GoMechanic controversy broke out where one of the four cofounders of the startup publicly admitted to have misreported revenue and inflated sales.

Sources say this was a major breaking point for the regulators as SIDBI had backed multiple funds that cut large cheques for GoMechanic. The company was valued at close to $600 Mn at the time, and counted investors such as Orios Venture Partners, Chiratae Ventures and others that had SIDBI as a limited partner.

The subsequent value erosion for GoMechanic’s investors was a major concern for SIDBI at the time, and many general partners were questioned about why due diligence did not unearth the discrepancies that the GoMechanic founder admitted to.

Similarly, BYJU’S is an example where India’s reputation as a destination for foreign investments has been tarnished by the drastic value erosion of the once-heralded edtech giant.

Partner Exodus Hurts LP Sentiments

Besides these issues, in 2024, many LPs find themselves in a situation where they invested in a particular fund due to the partner operating the fund, but exits and departures have left LPs wondering whether they even know who is managing their money.

Inc42 has covered this issue of partners quitting funds extensively over the past two years, which has further destabilised the LP-VC relationship.

One could even say that the more prolific investment activity by family offices in the past year is an indication that HNIs want to wrest control of their investments rather than investing in funds. That of course doesn’t mean that VC funds are less relevant today, but there were quite a lot of glaring issues which were overlooked at the peak of the funding and investment activity.

As public markets crashed and new models of business emerged during the pandemic in 2020 and 2021, many HNIs reduced their portfolio’s exposure to public markets, and moved towards startups as an asset class.

Many of these HNIs and even large institutions backed venture capital giants, leading to record-breaking capital raised by VC funds in India. Venture capital funds worth more than $6.2 Bn were launched in India in 2021 alone, which grew to a staggering $18.3 Bn in 2022.

In the case of many funds, they suffered from a funding problem, just as some of the startups in their portfolio. Just imagine the place many funds found themselves soon after Covid broke out in 2020.

Suddenly everyone wanted to invest in startup-focussed funds with rampant oversubscription of schemes and new funds. And these funds had to find a destination, which often meant hype-led investments.

This is of course a gist of the past couple of years, and market dynamics are far more nuanced than this simplified summary. But consider the fate of some of the companies that raised massive capital in 2021.

Unicorns such as BYJU’S, Pharmeasy, Dealshare and others that raised huge rounds in 2021 are now struggling for various reasons. Others such as Unacademy are facing the reality of the market after burning the capital raised in 2021.

LPs had great expectations from their startup portfolio, but many blew up and others are mired in untenable situations.

Not all funds launched in 2022-23 had the pedigree to invest in the right manner. Many portfolios have crumbled in the funding winter since 2022; layoffs have decimated the most promising models and growth funding was hit hardest. Even if startups survive the course of the funding winter, they are under-capitalised and have half-baked models in many cases that cannot be scaled up without further funds,

In steps SEBI then, making it a bit more challenging for fund managers and funds, in the hope that this could relieve the VC ecosystem of some of its froth.

How does this change things for VC funds and fund managers?

VCs Scramble To Pass SEBI’s Test

Fund managers that we spoke to are of the belief that SEBI-mandated certification is long overdue, though some have pointed out glaring gaps even with these changes.

“SEBI brought in the certification criterion, as there was too much noise in the market. This is just like SEBI asking public market investment advisors (IAs) to get registered. It cracked down on many unauthorised IAs last year, and now AIFs are being brought on par with this requirement,” Anup Jain, an early-stage investor and former Orios VP managing partner, told Inc42.

With the May 2025 deadline just nine months away, funds are scrambling to train partners, principals and other investment analysts. Sources indicate that several funds are running training programmes for these roles who form their investment teams. Consultants are shopping their services to AIFs to help their personnel get the right training and certification.

One Delhi-based early-stage investor claimed that analysts are passing the NISM test, while Chief Information Officers are failing. It’s funny to think that fund managers have to think about questions and marks decades after their last exam in college.

“The test is not easy as far as we have been told. Even though it is a multiple choice question (MCQ) format, there is negative marking (-25%) for wrong answers, and the passing score for the examination is 60 marks,” the Bengaluru-based partner added.

lockquote>

Since SEBI has mandated that at least one personnel on the investment team needs the certificate, many funds are wondering whether they can get by with having one such certified professional and not changing much else. “There is a possibility that the system may be gained. A fund can put in a figurehead and put them on all investment teams. But the final decision making will continue to rest with partners as it does right now,” the partner quoted above added.

What this means is that one person can be appointed by the AIF across its multiple funds and schemes as a token certified investment team member. This does not completely eliminate the problem of low-skilled or inexperienced fund managers.

Multiple investors in Bengaluru and Delhi claimed that individuals with NISM certification for AIFs have sensed the opportunity and are applying for open positions at VC funds. These individuals do not have the track record to run funds, but may become appointees in investment teams just to clear SEBI’s bar.

Given this loophole, many insist that SEBI needs to be more stringent.

Will SEBI Raise The Bar Further?

Another Delhi-based partner at a prominent VC fund told Inc42 the problem in the past two years is that LPs often engaged with partners who had the skill set to be a fund manager, but did not have high enough equity in the fund.

Consequently, when partners quit the firm due to internal issues, LPs are left holding a bag of loss-making investments. Now, while SEBI is ensuring that only those who have the skills and the knowledge are able to manage LP money, it is not addressing questions of responsibility and accountability.

“SEBI’s certification mandate does not completely eliminate the problem of only skilled and approved people running funds. The regulator needs to mandate that at least one partner, ideally the one with the highest equity in the partnership, needs to be certified by NISM,” the partner mentioned above added.

lockquote>

So on the one hand, SEBI has increased the skill barrier to entry to the VC ecosystem, but this is just the first step. Most investors we spoke to believe that SEBI needs to raise the bar further when it comes to new fund managers, as startups have become a significant asset class.

Finally, there is a risk that high compliance and certification requirements might exacerbate the elitism that is seen in the VC game. With more and more individuals joining the investor pool every year, there was talk about a democratisation moment in India’s venture capital space. SEBI may want to clamp down on bad managers, but stopping the flow of new fund managers can be detrimental to the startup ecosystem in the medium and long term.

This is arguably why SEBI’s certification rules for AIF fund managers are currently not that stringent, and why AIFs and venture capital funds do have some leeway. Even if this may just be for the time being.

The post title=”Indian VCs Face The Test, Literally!” href=”https://inc42.com/features/vc-fund-managers-partners-sebi-aif-certification-exam/”>Indian VCs Face The Test, Literally! appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)