S1 X escooter models (both 3 kWh and 4 kWh) successfully met the stringent minimum localisation criteria of 50%, as mandated by the Ministry of Heavy Industries, said the EV startup

With the PLI now in place, Ola Electric believes it will be able to further improve its bottom line

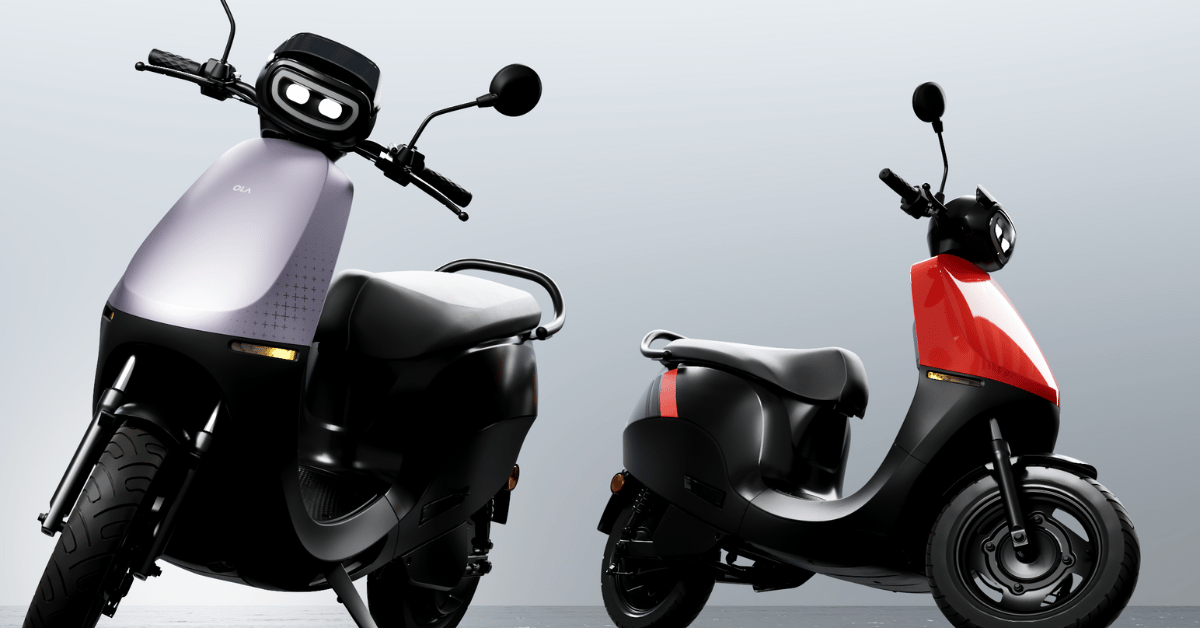

Recently, Ola Electric also unveiled its electric motorcycle portfolio, ‘The Roadster Series’

Recently listed electric two-wheeler startup Ola Electric’s S1 X escooter model (both 3 kWh and 4 kWh) has received domestic value addition (DVA) certification needed to be eligible for the Production Linked Incentive (PLI) scheme for automobile and auto components.

The startup said in a statement on Tuesday (August 20) that the escooters successfully met the stringent minimum localisation criteria of 50%, as mandated by the Ministry of Heavy Industries.

Ola Electric

Earlier, in January this year, the two-wheeler EV major received the same certificate for S1 Air. Later on, in March this year, its S1 Pro model also received the DVA certification under the PLI scheme. As per the startup’s data, Ola S1 Pro accounts for the largest portion of its revenue.

Meanwhile, following S1 X’s DVA certification, an Ola Electric spokesperson said, “S1 X 3 kWh and S1 X 4 kWh together contribute to almost half of our revenues, and with the PLI now in place, we will be able to further improve our bottom line.”

“Receiving the PLI certification for the premium and mass-market products affirms our vertically integrated manufacturing strength, marking a significant achievement in advancing India’s EV vision,” the spokesperson added.

The certification was given by the Automotive Research Association of India (ARAI). Under the PLI scheme, Ola Electric is eligible for incentives for up to five consecutive financial years, commencing from fiscal 2024. The incentive would range between 13%-18% of the determined sales value of the products.

It is pertinent to note that Ola Electric went public as a loss-making entity. Its consolidated net loss widened 30% to INR 347 Cr in the June quarter (Q1) of FY25 from INR 267 Cr in the year-ago period. Operating revenue increased 32% YoY to INR 1,644 Cr in the quarter.

In FY24, Ola Electric’s net loss stood at INR 1,584.4 Cr on an operating revenue of INR 5,009.8 Cr.

Even though the startup made a flat market debut on August 9 and got listed on the BSE at INR 75.99 apiece, its shares have almost doubled since then. The shares ended today’s trading session at INR 137.72 on the BSE.

Last week, Ola Electric also unveiled its electric motorcycle portfolio, ‘The Roadster Series’.

While the shares are rallying, analysts remain skeptical about the stock. For instance, Saji John, senior research analyst at Geojit Financial Services, recently said, “Investors should be cautious, especially given the company’s ongoing losses and the high volatility in its stock price. For new investors, it may be wise to wait for a more stable entry point or consider the stock as a long-term play with a high risk-reward ratio.”

However, HSBC Global initiated coverage on the stock with a ‘buy’ rating and a price target of INR 140, which currently implies an upside of 1.6%.

Though the brokerage admitted that there are many concerns about the company, it said there is a positive risk-reward ratio.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)