Indian startups cumulatively raised $265.2 Mn via 16 deals, a 33% decline from the $395.63 Mn raised via 20 deals in the preceding week

The week saw a mega deal materialise with Bluestone raising $107.2 Mn in its pre-IPO round

Seed funding continued to move in a downward trajectory this week, with startups raising $1 Mn in the week, an 88 decline from last week’s $8.85 Mn funding

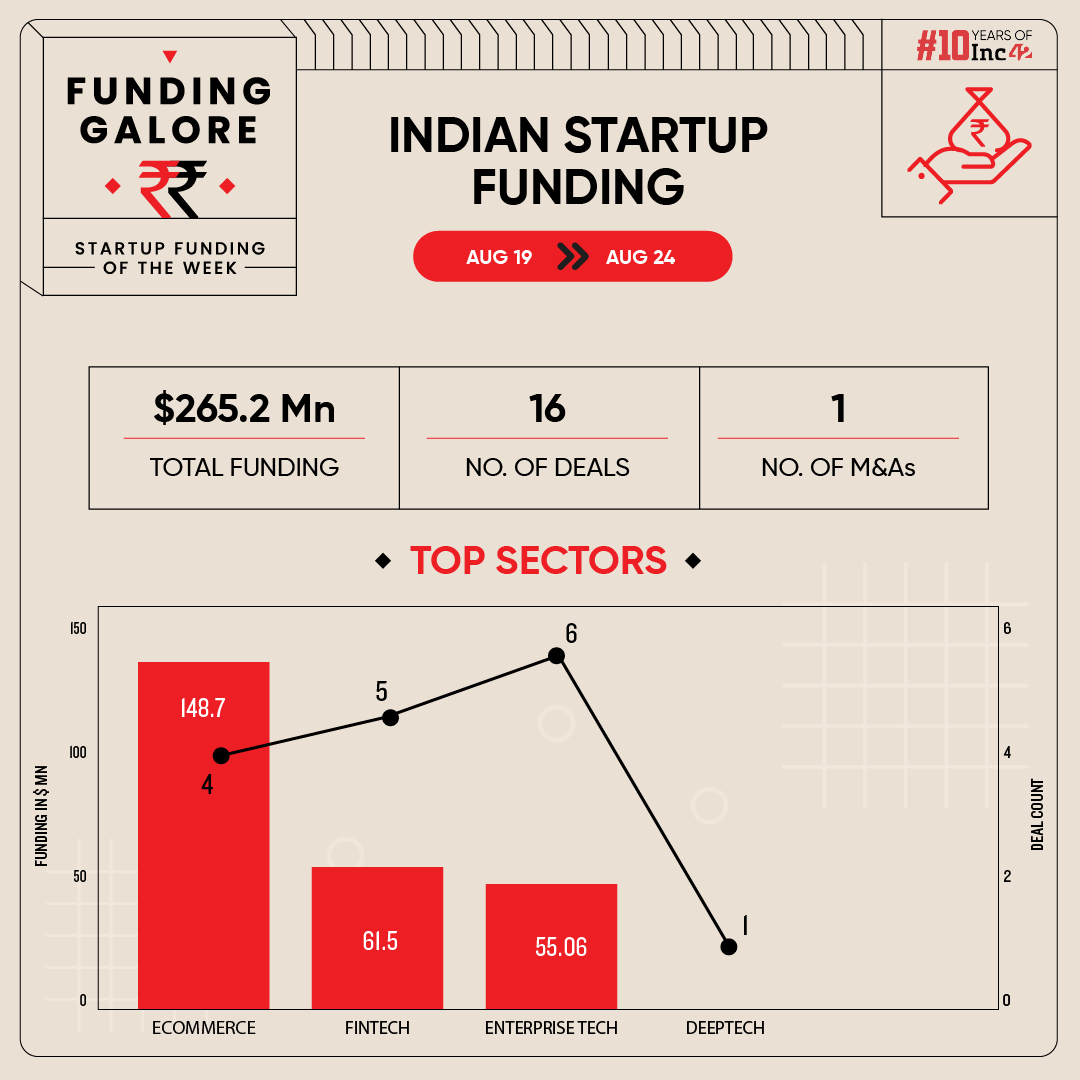

Funding momentum across the Indian startup ecosystem took a blow in the third week of the ongoing month after bucking an uptick trend in investment activity. Between August 19 and 24, startups raised $265.2 Mn across 16 deals, a 33% decline from the $395.63 Mn raised via 20 deals in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [ Aug 19-24 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 22 Aug 2024 | BlueStone | Ecommerce | D2C | B2C | $107.2 Mn | – | Peak XV Partners, Prosus, Steadview Capital, Think Investments, Pratithi Investments | – |

| 21 Aug 2024 | E2E Networks | Enterprise Tech | Horizontal SaaS | B2B | $50.1 Mn | – | – | – |

| 21 Aug 2024 | Livpure | Ecommerce | D2C | B2C | $27.8 Mn | – | M&G Investments, Ncubate Capital Partners | – |

| 21 Aug 2024 | Aye Finance | Fintech | Lendingtech | B2B | $25 Mn | – | Goldman Sachs (India) Finance | Goldman Sachs (India) Finance |

| 23 Aug 2024 | axio | Fintech | Lendingtech | B2B-B2C | $20 Mn | – | Amazon Smbhav Venture Fund | Amazon Smbhav Venture Fund |

| 17 Aug 2024 | FlexiLoans* | Fintech | Lendingtech | B2C | $9 Mn | Debt | JM Financials | JM Financials |

| 21 Aug 2024 | uppercase | Ecommerce | D2C | B2C | $9 Mn | Series B | Accel, Sixth Sense Ventures, Akash Bhansali | Accel |

| 21 Aug 2024 | Zoff | Ecommerce | D2C | B2C | $4.7 Mn | – | JM Financial Private Equity | JM Financial Private Equity |

| 21 Aug 2024 | TransBnk | Fintech | Fintech SaaS | B2B | $4 Mn | Series A | 8i Ventures, Accion Venture Lab, GMO Venture Partners, Ratio Ventures, Force Ventures | 8i Ventures, Accion Venture Lab |

| 23 Aug 2024 | LoanKuber | Fintech | Lendingtech | B2B | $3.5 Mn | Pre-Series B | Inflection Point Ventures, TRTL VC, Auxano, LetsVenture, Mavuca Capital, Ruchi Deepak, Prashant Tandon, Pankaj Vermani | Inflection Point Ventures, TRTL VC |

| 23 Aug 2024 | Fabrication Bazar | Enterprise Tech | Enterprise Services | B2B | $3 Mn | Pre-Series A | Physis Capital, ICMG, Inflection Point Ventures | Physis Capital |

| 22 Aug 2024 | LLUMO AI | Enterprise Tech | Horizontal SaaS | B2B | $1 Mn | Seed | SenseAI Ventures, India Quotient, AumVC, Venture Catalyst, IIM Indore Alumni Angel Fund | SenseAI Ventures |

| 22 Aug 2024 | Dopplr | Enterprise Tech | Vertical SaaS | B2B | $750K | – | Cornerstone Ventures, BAT VC | Cornerstone Ventures |

| 22 Aug 2024 | Favcy | Enterprise Tech | Enterprise Services | B2B | $214K | – | – | – |

| 21 Aug 2024 | NxtQube | Deeptech | Drone Tech | B2B | – | Seed | Venture Catalysts, Pontaq VC, Ananta Bizcon LLP, Rushikesh Bhandari | Venture Catalysts |

| 21 Aug 2024 | Humanize | Enterprise Tech | Horizontal SaaS | B2B | – | – | NLB Services | NLB Services |

| Source: Inc42 *Included this week as it was skipped in last week’s edition Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- The week saw lone mega fundraise with omnichannel jewellery startup Bluestone bagging $107.2 Mn (INR 900 Cr) in its pre-IPO round from Peak XV Partners, Prosus, Steadview Capital, Think Investments and Pratithi Investments.

- Buoyed by Bluestone’s funding round, ecommerce emerged as a sectoral leader this week. as startups raised $148.7 Mn via 4 deals in the week.

- Fintech sector trailed behind ecommerce at a sectoral level, with startups in the sector securing $61.5 Mn via 5 deals. Notable deals in the sector included Aye Finance’s $25 Mn loan from Goldman Sachs (India) and axio’s $20 Mn fundraise from Amazon Smbhav Venture Fund.

- Enterprise tech sector hogged the limelight with the maximum number of deals this week with startups raising $55.06 Mn via six deals.

- JM Financial Private Equity, Inflection Point Ventures and Venture Catalysts emerged as the most active investors this week, backing two startups each.

- However, seed funding continued to move in a downward trajectory this week with LLUMO AI bagging $1 Mn cheque.

Startup Fund Launches Of This Week

- Gujarat-based micro venture capital firm Volt VC launched its early-stage focused maiden fund with a target corpus of INR 45 Cr. With this, it will focus on pre-seed investments in consumer-focused businesses across sectors like D2C, B2C and B2B2C models.

- Edtech unicorn PhysicsWallah has floated ‘PW School of Startups’, INR 100 Cr fund to back more than 100 startups. As per the company, the PW SOS will provide a platform for entrepreneurs to access cost effective ideation programmes, practical training, mentorship and capital raising opportunities.

- Ex-Venture Highway lead investor Aviral Bhatnagar launched a new venture capital fund called AJVC, which will focus on pre-seed investments. AJVC’s first fund received SEBI approval last week.

Other Developments Of The Week

- Flipkart backer Chiratae Ventures announced the third cohort of its flagship seed investment programme Chiratae Sonic. The initiative targets early-stage startups looking to raise up to $2 Mn in funding.

- Titan Capital Winners Fund, backed by Snapdeal cofounders Kunal Bahl and Rohit Bansal, has raised a target corpus of INR 200 Cr to invest in follow-on rounds of breakout startups from its seed portfolio. Bahl and Bansal will anchor the fund as its largest investors.

- IPO-bound meat delivery startup Zappfresh acquired Mumbai-based meat and seafood delivery brand Bonsaro in an all-cash deal. The acquisition sees Zappfresh take over Bonsaro’s entire operations and business, including all the assets, to expand its presence in the western pocket.

- VC firm Ankur Capital’s fund III, which aims to raise a target corpus of INR 1,200 Cr, has received commitments from two existing limited partners (LPs).

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)