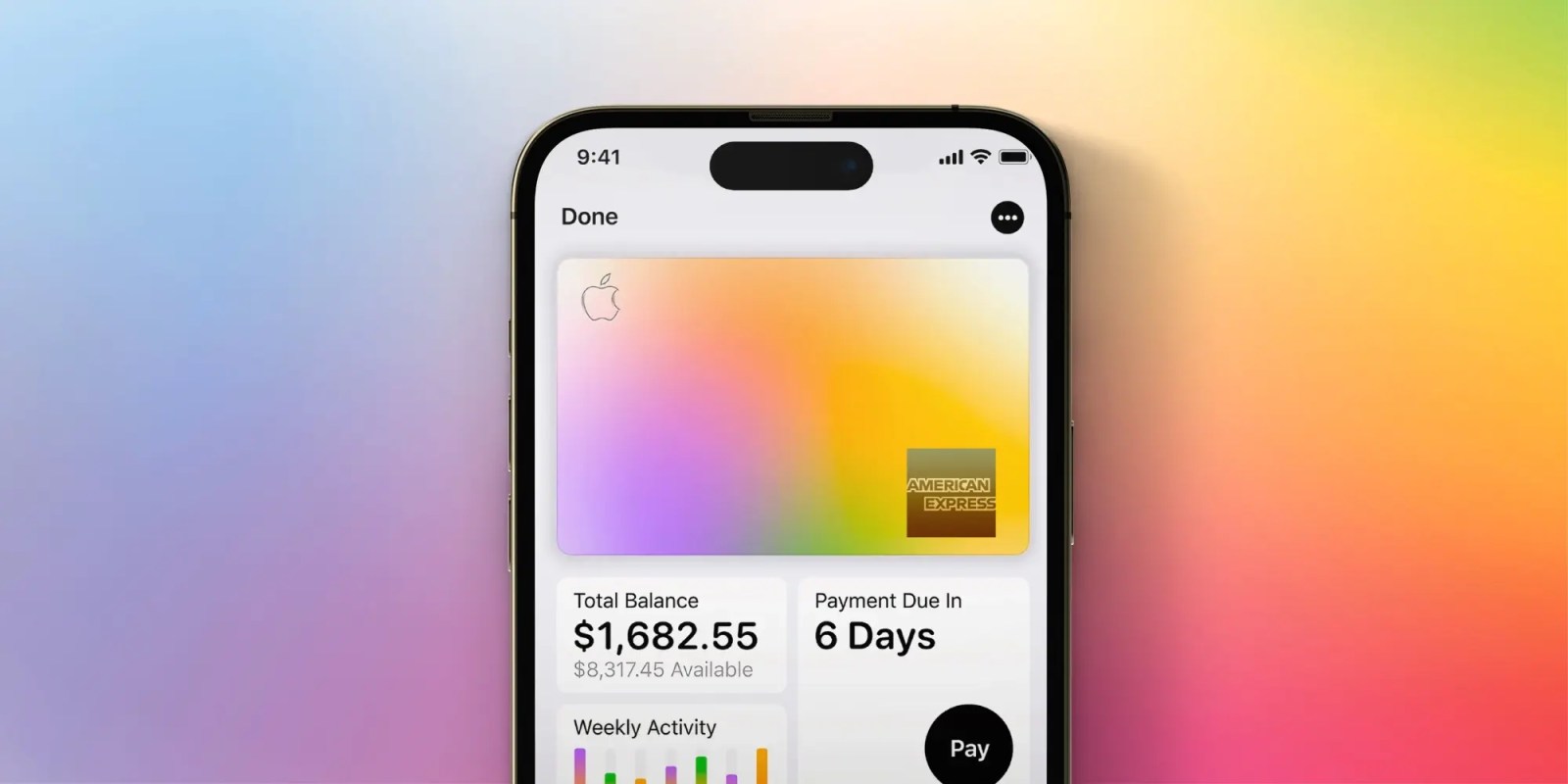

Apple Card recently passed its five year anniversary, and I’ve recently been thinking about whats next for the credit card. With Apple Card not being super profitable, combined with the fact that Apple wants to position itself as more of a services company, I think it could make a lot of sense for Apple to start offering a higher end credit card.

Apple Card today

Currently, Apple Card is a simple, no annual fee credit card focused on providing 2% cash back whenever you use Apple Pay. It also has an elevated 3% category for Apple and other partner merchants, incentivizing users to spend more money at Apple. It’s not bad, but also it’s not a super exciting credit card.

Apple Card in its current form also cost Goldman Sachs (the issuing bank) over a billion dollars, and Goldman Sachs is set to exit its Apple Card partnership in the next 3-6 months. With those two things on the table, I think it might be quite interesting to see an annual fee version of the Apple Card, more focused on travel…

The competition

There are a number of banks in the general-purpose travel credit card space, such as Chase, American Express, Citi, and Capital One. When I say general-purpose, I just mean that the cards aren’t in direct partnership with one airline or hotel. However, most of these setups require multiple cards if you want to maximize value. I think Apple could simplify things, and make general-purpose travel credit cards more appealing to a wider audience.

For example, a popular setup is the Chase Trifecta, composed of the Chase Freedom Unlimited, Chase Freedom Flex, and Chase Sapphire Preferred. The first two cards are no annual fee, and the third is $95, and the three cards all earn in the same points ecosystem, allowing you to pool all of them together, and transfer them out to one of Chase’s travel partners – such as Southwest Airlines, World of Hyatt, or one of the many others.

The Chase Freedom Unlimited’s primary purpose is to earn 1.5x points on all purchases, the Freedom Flex comes in with 5x points on certain rotating categories (gas stations, grocery stores, etc), and the Sapphire Preferred comes in with 3x on dining, and 2x on travel. Sapphire Preferred also has a bunch of travel insurances, making it the go-to card for putting anything travel related on.

‘Apple Card Pro’ earnings

I think Apple could make a really good single credit card focused on travel, although it wouldn’t be easy. Apple would need to establish partnerships with a bunch of hotel and airlines to make the Apple point ecosystem worth using, which banks like Wells Fargo and Capital One have struggled with. Neither of those banks have partnerships with domestic US airlines.

With Apple’s travel credit card, I think the structure of earning 1x points with the physical card and 2x points at Apple Pay should stick around. It’d allow the card to still serve as a good catch-all. They can also keep around 3x on Apple, although they should drop all of the other partnerships. Instead, they should focus on rewarding users with 3x points for any dining or travel.

The card would probably target around a $299 annual fee, similar to the Amex Gold card. Apple could help users justify the card with one major perk: lounge access.

Travel benefits

Apple could establish a partnership with Priority Pass, and allow Apple Card “Pro” customers to access 1600+ airport lounges worldwide. It’d be one of the more affordable credit cards to offer this benefit, so it’d likely have a limitation on visits, perhaps 12 a year – which would still be more than enough for most people. And the great thing is, if users don’t take full advantage of those visits, Apple (and the issuing bank) gets to profit from the annual fee paid.

It’d also be pretty neat to see Apple work on a unified travel portal to search for point redemptions across all of their varying partners, similar to point.me. One of the annoyances of transferring points is that you have to search each partner individually to find the best value, and I think Apple could make that process easier.

Would a travel focused card get you to sign up for Apple Card, or would you rather see Apple take a different approach? Let us know in the comments.

FTC: We use income earning auto affiliate links. More.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)