Construction material procurement platform ArisInfra Solutions is among the Indian startups which have lined up to launch their initial public offerings (IPOs) this year.

The startup recently filed its draft red herring prospectus (DRHP) with markets regulator Securities and Exchange Board of India (SEBI) for an INR 600 Cr public issue.

Its IPO will comprise only a fresh issue of shares and no offer for sale (OFS) component. Shares of ArisInfra Solutions will be listed on the BSE and the NSE.

Founded in 2021 by Ronak Morbia and Bhavik Khara, ArisInfra uses AI and machine learning to simplify construction material procurement. It links property developers with vendors and also offers a smart financing platform for infrastructure and construction companies.

Backed by PharmEasy CEO Siddharth Shah and San Francisco-based Think Investments, the B2B ecommerce platform plans to utilise the proceeds from the IPO to repay outstanding borrowings, support working capital requirements, scale up investments in its subsidiary, among others.

ArisInfra clocked an operating revenue of INR 696.8 Cr in the financial year 2023-24 (FY24), down 6% from INR 746 Cr in the previous fiscal. Meanwhile, its consolidated net loss rose more than 12% year-on-year ( YoY) to INR 17.3 Cr in the fiscal ended March 2024.

However, it must be noted that the startup’s loss increased in FY24 primarily due to fair value loss on derivatives of INR 20.55 Cr. Excluding it, ArisInfra would have posted a net profit of INR 3.22 Cr during the year under review.

As the B2B ecommerce platform gears up for its IPO, let’s delve deeper into ArisInfra’s shareholding pattern and who’s at the helm of affairs at the company.

ArisInfra’s Biggest Shareholders

As per the draft papers, promoters and the promoter group together own more than 55% stake in the startup.

Aspire Family Trust is the largest shareholder with a 12.84% stake in the startup, followed by cofounder and chairman Ronak Morbia, who owns 11.78% in the B2B ecommerce platform.

Additionally, ace stock market investor Kedar Mankekar is the third largest investor in the company with a 10.27% stake, while US-based Think Investments and cofounder Bhavik Khara own 8.65% and 8.1% shareholding in the startup, respectively.

Other major investors include Priyanka Shah Family Trust (7.81% stake), Siddhant Partners (6.8%), Serenity Nest Trust (3.24%), among others.

ArisInfra’s Top Guns

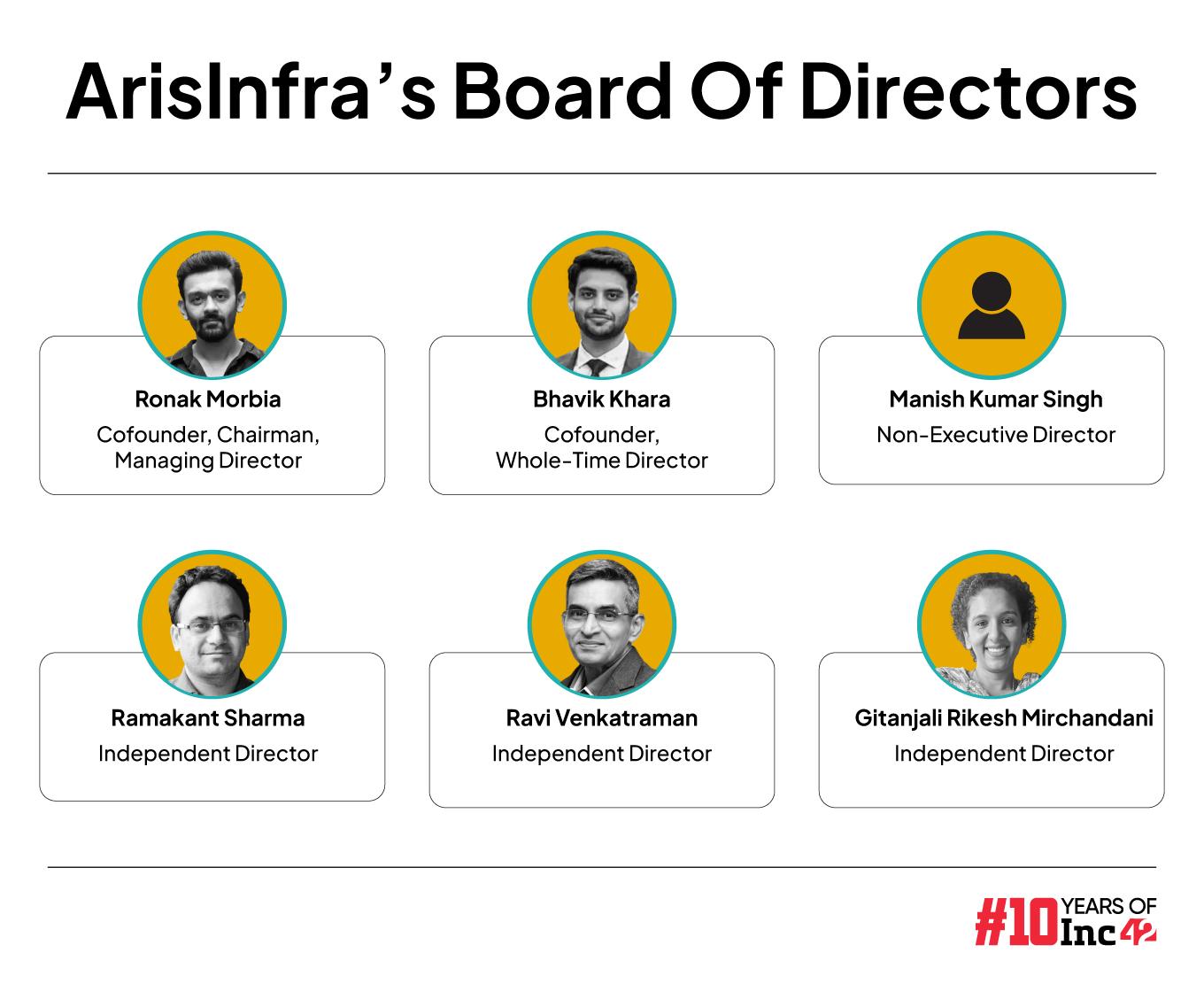

Board Of Directors

Ronak Kishor Morbia – Cofounder, Chairman & Managing Director

Morbia is responsible for shaping the technology and overall business strategy of the company. An alumni of Jai Hind College, Mumbai, he has over 13 years of experience in the construction materials industry.

Bhavik Jayesh Khara – Cofounder, Whole-Time Director

An alumnus of Rutgers Business School, Khara manages the company’s day-to-day operations, financial management and credit operations.

He previously worked with E&Y and has over six years of experience in the tax accounting and construction materials industry.

Manish Kumar Singh – Non-Executive Director

A nominee of investor Siddhant Partners on ArisInfra’s board, Singh was appointed as a non-executive director in May 2024. He has a bachelor’s degree in commerce from LN Tirhat College, Muzaffarpur, and over two decades of experience in the areas of finance and accounts.

He currently serves as a director on the board of VBuzz Teleservices Private Limited.

Ramakant Sharma – Independent Director

Sharma has been associated with the startup since May, 2024. He completed his B.Tech in materials and metallurgical engineering from IIT-Kanpur and post-graduate “programme in management” from Indian School of Business, Hyderabad.

He has over 17 years of experience and was previously associated with Myntra, Jungle Ventures, Livspace, among others.

Ravi Venkatraman, Independent Director

Venkatraman became ArisInfra’s independent director in May 2024. An alumnus of University of Madras, he is a qualified chartered accountant from the Institute of Chartered Accountants of India (ICAI).

With three decades of experience in the financial services space, Venkatraman currently serves as a director on the boards of Avanse Financial Services, Aditya Birla Arc, and Kotak Mahindra Prime.

Gitanjali Rikesh Mirchandani, Independent Director

The most recent addition to the company’s board, Mirchandani joined the startup’s board in July 2024. An alumnus of Mumbai’s SP Jain Institute of Management and Research, she previously worked with companies like Kotak Mahindra Bank and JM Financial.

As per the DRHP, Mirchandani has over 13 years of experience in the financial services industry.

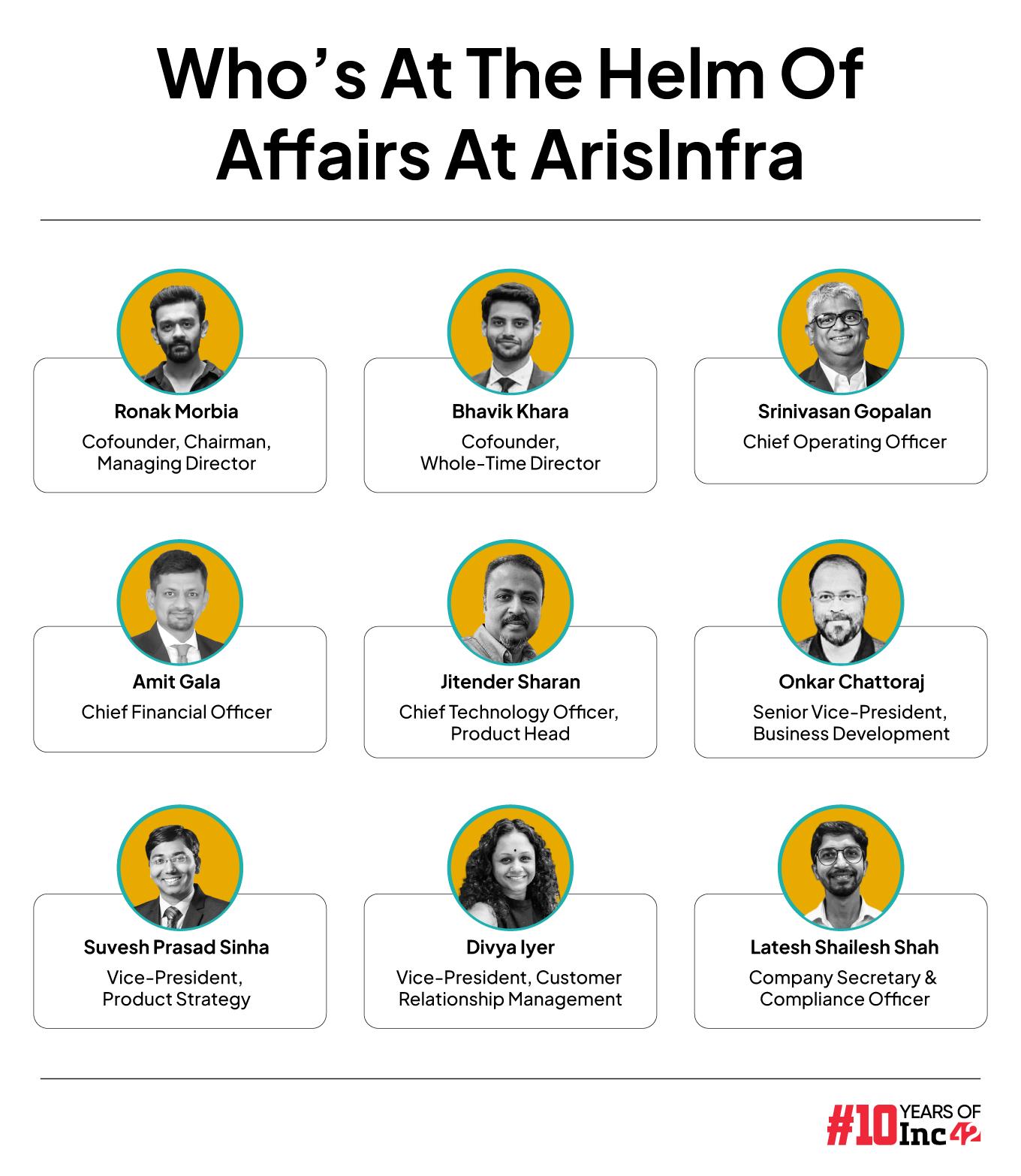

Key Managerial Personnel

Srinivasan Gopalan – Chief Executive Officer

Appointed as ArisInfra’s CEO in June 2024, Gopalan is an alumnus of the Mumbai University and is a qualified chartered accountant.

With more than 13 years of management experience under his belt, Gopalan spearheads business development and oversees ArisInfra’s business relationships with stakeholders.

Previously, he worked with real estate company Wadhwa Group and chemical procurement platform ROW2 Technologies.

Amit Manhar Gala – Chief Financial Officer

An alumnus of Mumbai University as well, Gala holds a bachelor’s degree in commerce and is a qualified CA. He joined ArisInfra in July 2024 and since then oversees financial management, fundraising and strategic planning at the company.

Before joining the IPO-bound startup, he was associated with Paytm, Neblio Technologies, Mogli Labs and ICICI Securities in various capacities.

Latesh Shailesh Shah – Company Secretary and Compliance Officer

Shah took over as the company secretary and compliance officer of the B2B marketplace in July 2024. He has a bachelor’s degree in law and commerce from Mumbai University and more than 14 years of experience under his belt. She was previously associated with Better World Technology Private Limited.

He is also an associate and fellow member of the institute of company secretaries of India (ICSI).

Senior Managerial Personnel

Jitender Sharan – Chief Technology Officer & Product Head

Since joining the company in early-2022, Sharan has been instrumental in scaling up the startup’s tech stack and helming the development of new products.

An alumni of IIT-Kanpur, Sharan has more than two decades of experience under his belt and previously worked with companies such as InMobi, WM Global Technology Services, Poynt Co., among others.

Onkar Chattoraj – Senior Vice-President (Business Development)

As per the DRHP, Chattoraj oversees the team of sales personnel, and provides strategic direction and mentorship to the company. He joined ArisInfra in 2022 and previously worked with companies such as Nuvoco Vistas Corp, Masters Builders Solutions India, and Associated Cement Companies.

An alumnus of Tilkamanjhi Bhagalpur University and Mumbai’s SP Jain Institute of Management and Research, Chattoraj has over 18 years of experience in sales and marketing.

Suvesh Prasad Sinha – Vice-President (Product Strategy)

Sinha joined ArisInfra in 2022. He oversees product development and “plays an important role in aligning company goals with actionable plans”.

An alumnus of IIT Kharagpur, he also holds an MBA from University of Delhi. He has eight years of management experience under his belt and previously worked with companies like Dr. Reddy’s Laboratories, Poncho Hospitality and Nurture Ag Tech.

Divya B Iyer – Vice-President (Customer Relationship Management)

Iyer has a bachelor’s degree in arts from Mumbai University and more than 12 years of experience. She was previously associated with real estate companies such as Wadhwa Group and Lodha Group.

As per the DRHP, she focusses on optimising collections processes at the IPO-bound startup. Iyer joined ArisInfra in 2022.

It is pertinent to note that 10 new-age tech companies, including Ola Electric, Go Digit, FirstCry, and Unicommerce, have made their public market debuts in 2024 so far. Besides, the likes of Swiggy, MobiKwik, Ecom Express, among others, are awaiting SEBI nod to go public.

On Tuesday (August 28), D2C meat delivery startup Zappfresh became the latest to file a DRHP.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)