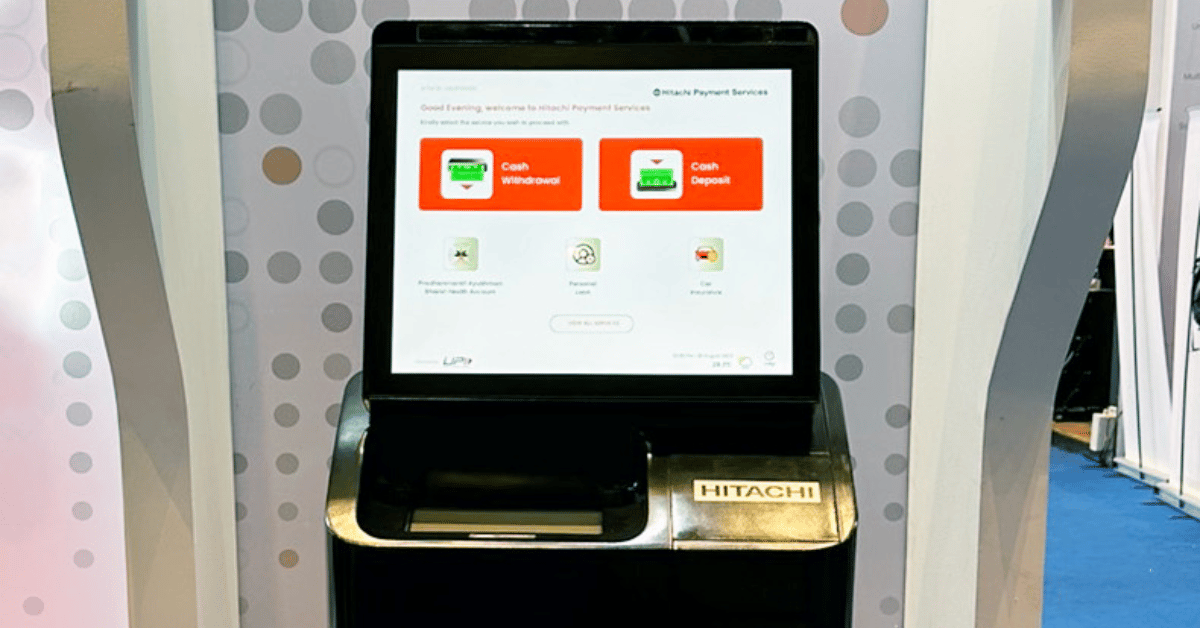

The new CRM also functions as a digital banking unit, offering services such as QR-based UPI cash withdrawal and deposits, account opening, credit card issuance, loans, insurance, among others

As per Hitachi Payment Services, the new CRM combines the “agility and flexibility” of the Android platform with the “benefits” of the traditional cash recycling machine

The launch comes a couple of months after Hitachi Payment Services received authorisation from the RBI to operate a PA in the country

Hitachi Payment Services, the fintech arm of the Japanese conglomerate, has launched India’s first Android-based cash recycling machine (CRM), which functions as a digital banking unit (DBU).

The new offering was showcased at the Global Fintech Festival (GFF) 2024 in Mumbai on Thursday (August 29). Earlier in the day, the National Payments Corporation of India (NPCI) said that banks and other entities showcased DBUs during the event. The payments body also launched UPI Interoperable Cash Deposit (UPI-ICD).

A DBU is basically an ATM with an open architecture that can host bank apps. A DBU offers services beyond deposits and withdrawals, including opening bank accounts, applying for credit cards, and more.

In a statement, Hitachi said that the new CRM will offer a comprehensive suite of features that can be tailored to various banking needs of clients.

The new offering allows banks to offer a range of banking and non-banking services as per their business needs and local market requirements, including QR-based UPI cash withdrawal, account opening, credit card issuance, personal and MSME loans, insurance, among others, the statement added.

As per Hitachi, the new CRM combines the “agility and flexibility” of the Android platform with the benefits of the traditional CRM. It also claimed that the new product offers enhanced customer security and enriched user interface.

“We are thrilled to launch India’s first Android-based cash recycling machine, which represents a significant shift in the way banking services would be delivered. Ushering in a new era of banking technology, it will play a pivotal role in digitalising banking services and expanding access to such services across India…,” said the managing director and CEO of Hitachi Payment Services’ cash business, Sumil Vikamsey.

Meanwhile, an NPCI spokesperson added, “… The Android-based cash recycling machine… can make it easier for banks to deliver convenient and secure digital services to their customers, even in remote areas. We believe that UPI-based cash withdrawal and deposit functionality… can further boost the adoption of banking services and contribute significantly to the growth of ATM channels in the country”.

The launch comes a couple of months after Hitachi Payment Services received authorisation from the Reserve Bank of India (RBI) to operate as a payment aggregator (PA) in the country.

Hitachi Payment Services is an end-to-end payments solutions provider that claims to have over 72,000 ATMs under management, including 27,500 CRMs. It also claims to cater to over 3 Mn merchant touch points and processes over 7 Mn digital transactions daily.

As per a report, the homegrown payment solutions market is projected to grow to a market size of $201 Bn by 2028.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)