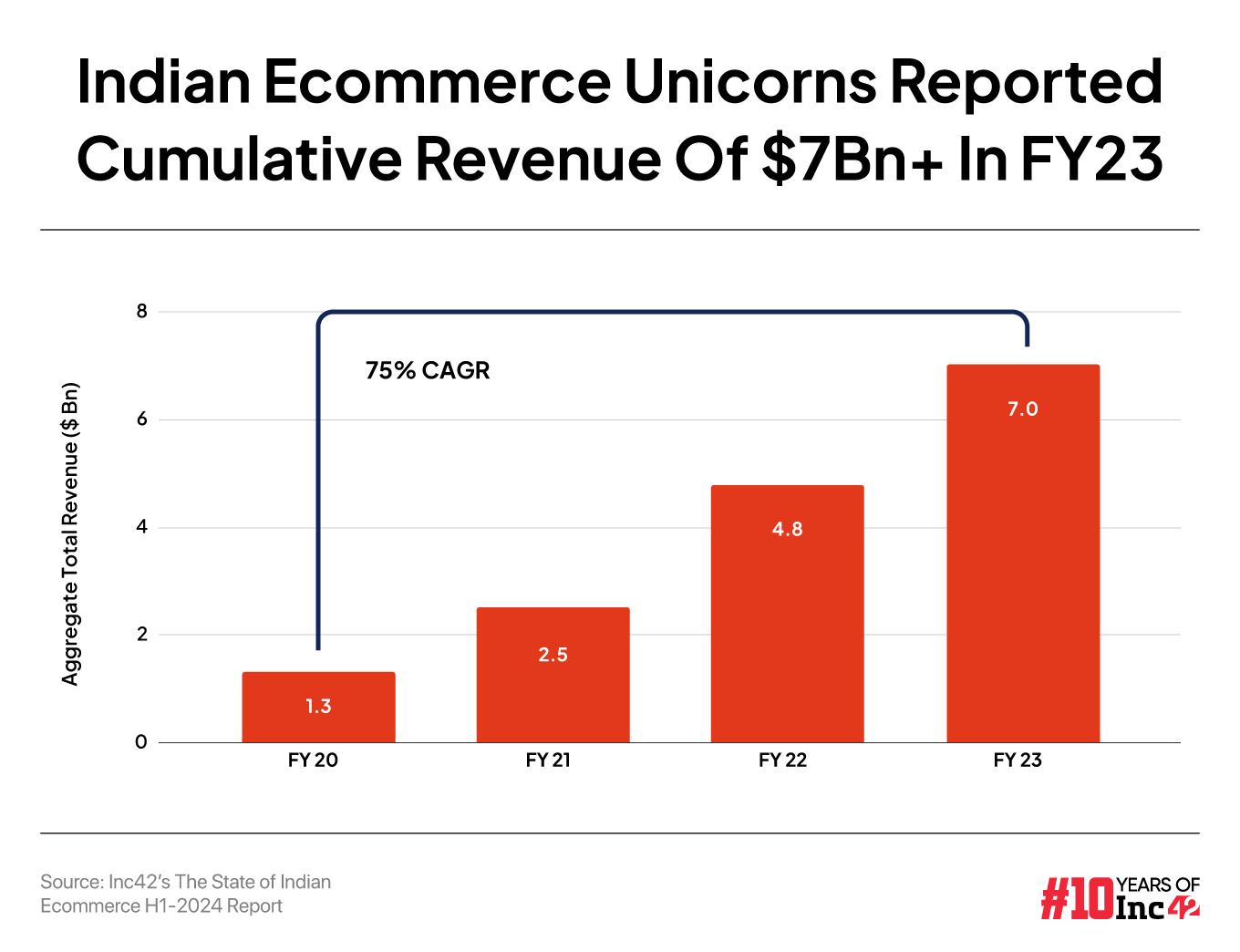

Indian ecommerce unicorns recorded over $7 Bn in aggregate revenue in the financial year 2022- 23 (FY23)

The ecommerce unicorns’ cumulative total expenditure stood at $7.9 Bn in FY23

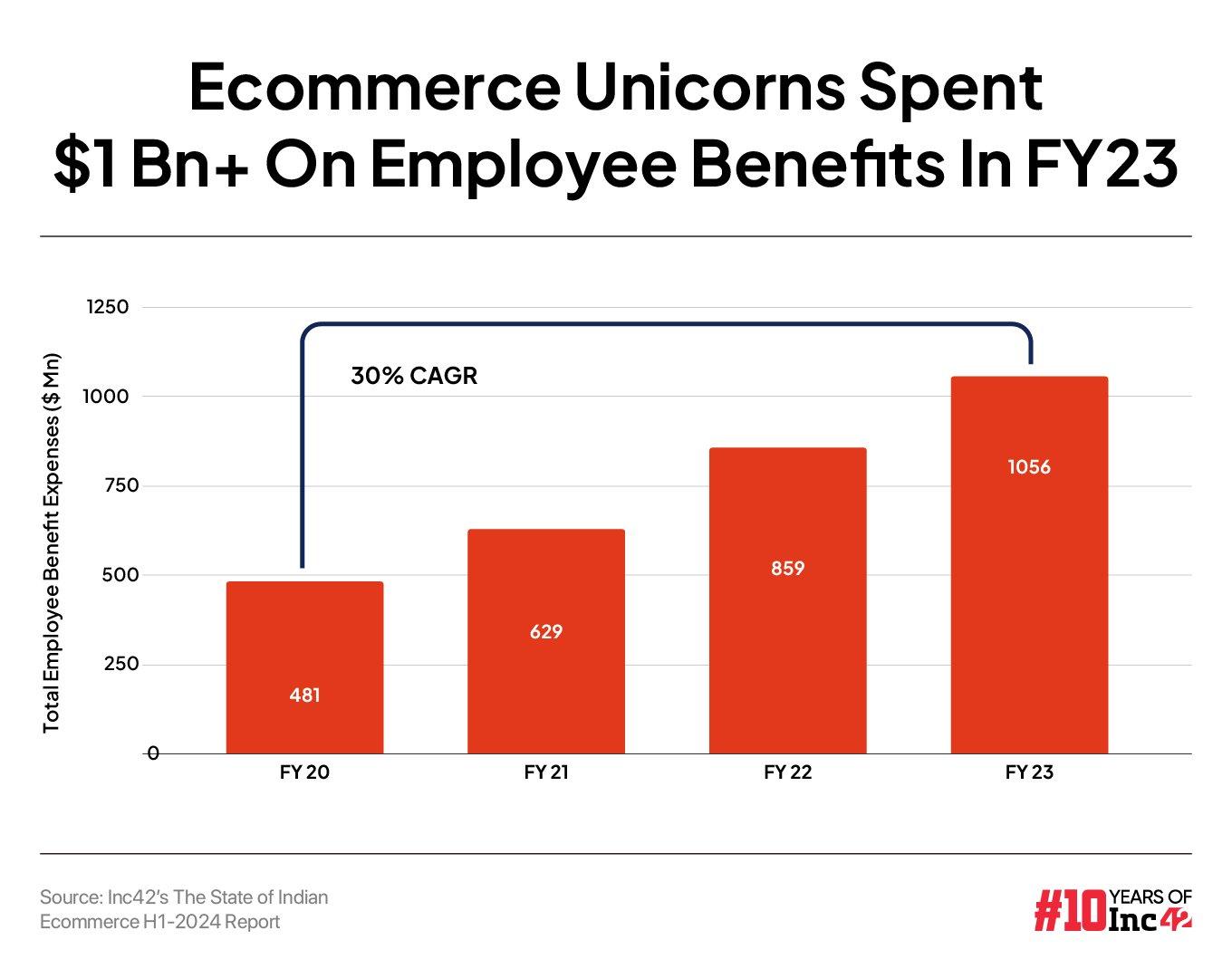

They spent over $1 Bn on employee costs in FY23, translating into a 30% CAGR increase from $481 Mn in FY20

The ecommerce sector has been at the forefront of the burgeoning Indian startup ecosystem. Pegged at $123 Bn currently, the ecommerce sector is expected to grow at a CAGR of 19% and become a $400 Bn opportunity by 2030.

As a result, investors have been bullish on the country’s ecommerce sector for over a decade, betting big on the startups in the space. Ecommerce startups raised over $34 Bn funding between 2014 and the first half of 2024 via 1,833 deals, as per Inc42’s ‘The State of Indian Ecommerce H1 2024’ report.

This period saw 25 ecommerce startups, including Flipkart, boAt, Meesho, and Snapdeal, turn unicorns. These unicorns are cumulatively valued at over $89 Bn today.

Besides, the Indian ecommerce sector also has 18 soonicorns, including Drools, Country Delight, BlueStone, among others. The combined valuation of these startups exceeds $6 Bn.

Overall, there are over 5.1K ecommerce startups in India, of which over 940 are funded. These startups are looking to expand their businesses on the back of the growing number of Indians flocking to digital channels for their shopping needs.

With the number of online shoppers in the country expected to cross the 500 Mn mark by 2030, these startups see enough potential to shore up their revenues. However, what will be the cost of this additional revenue and will these startups be able to create profitable business models? We don’t have the exact answer to this question, but the past trends give some indications about the future.

Ecommerce Unicorns Earned $7 Bn At An Expense Of $7.9 Bn

Indian ecommerce unicorns recorded over $7 Bn in aggregate revenue in the financial year 2022- 23 (FY23). This translated to a CAGR of 75% from the $1.3 Bn revenue they earned in FY20, a year before onset of the COVID-19 pandemic.

It needs to be highlighted that the pandemic turned out to be a boon for the ecommerce sector as amid the stay-at-home mandates across the world, millions of new users took to online shopping.

Besides the convenience of getting orders delivered at doorstep, the option to choose from 1,000+ brands with a single click and the discounts offered by ecommerce platforms led to a surge in the number of customers. All of these resulted in the increase in revenues of ecommerce players.

For instance, India’s most valued startup, Flipkart saw its operating revenue jump by 46% year-on-year (YoY) to $1.9 Bn in FY23, whereas B2B ecommerce unicorn OfBusiness’ operating revenue zoomed 80% to $1.4 Bn during the year.

However, the expenses of these startups also jumped in line with the rise in their revenues. The ecommerce unicorns’ cumulative total expenditure stood at $7.9 Bn in FY23.

Advertising Expenses, Employee Costs Jump

The rise in the expenditure was largely led by increase in advertising and employee costs of these unicorns.

Employee Benefit Expenses: As the demand for their services increased, the ecommerce unicorns went on an aggressive hiring spree. They spent over $1 Bn on employee costs in FY23, translating into a 30% CAGR increase from $481 Mn in FY20.

For the uninitiated, employee benefit expenses include employee salaries, ESOP expenses, PF contribution, gratuity, among others. In FY23, Flipkart’s employee expenses rose 18% to $553 Mn from $467 Mn in FY22.

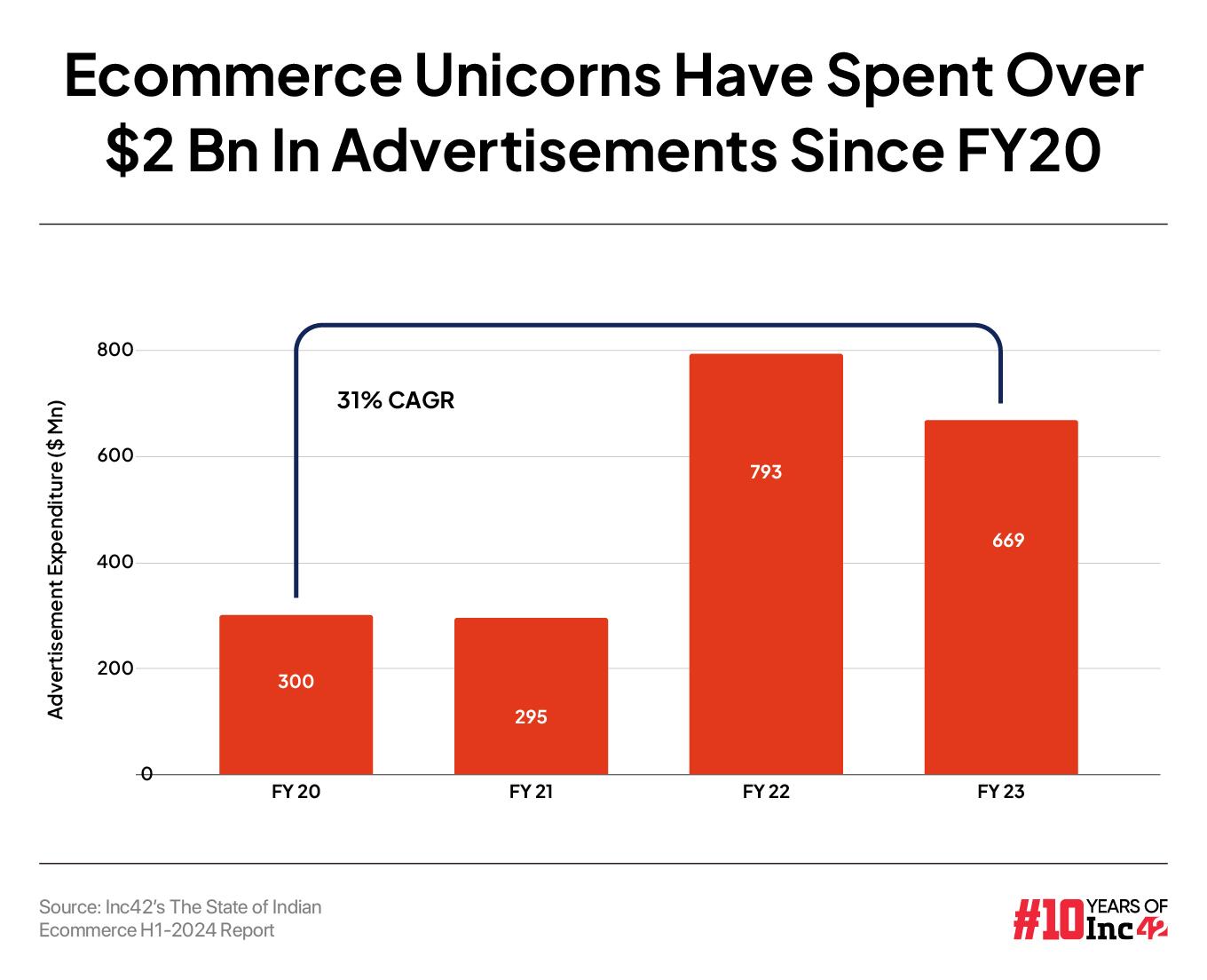

Advertising Expenses: Ecommerce startups have to spend a hefty amount of capital to showcase their products and offer to customers and compete against their competitors.

As per the Inc42 report, the country’s ecommerce unicorns collectively spent $669 Mn in FY23 on advertisements. Walmart-owned Flipkart spent the highest amount on advertising at $301 Mn in FY23, an increase of 24% from $243 Mn in FY22.

Signs Of Profitability?

Despite the rise in expenses, the ecommerce unicorns managed to cut down their losses in FY23.

The onset of funding winter in 2022 forced startups across sectors, including ecommerce, to cut down their expenses as it became difficult to get funds for loss-making entities. Sustainable and profitable business models became the talk of the town as startups felt the chills of the funding winter.

As a result, startups resorted to cost-cutting measures like reducing advertising and marketing spends, laying off employees, and enforcing salary cuts to reduce their losses or turn profitable. This was reflected in the bottom lines of the ecommerce unicorns for FY23. Their cumulative net loss declined 23% to $994 Mn in FY23 from $1.2 Bn in FY22.

Flipkart saw its loss drop 10% to $493 Mn from $545 Mn in FY22. SoftBank-backed Meesho also managed to halve its loss to $209 Mn in FY23 from $406 Mn in the previous fiscal year.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)