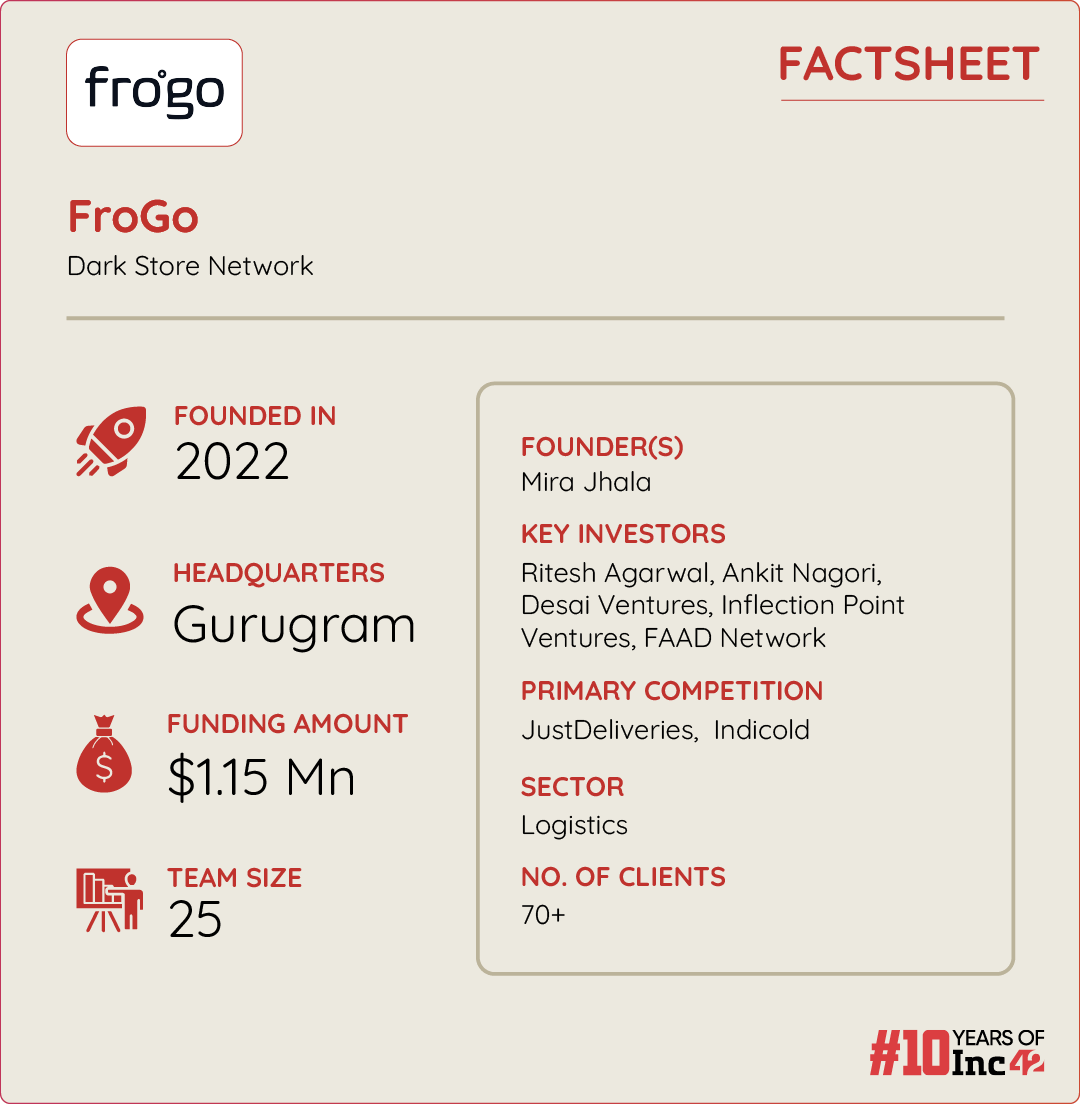

Founded in March 2022, provides tailored fulfilment infrastructure for ice cream and frozen food brands, allowing them to start online operations in a few days

The core of FroGo’s operations is its 50 dark stores across North India that not only hold the inventory but also process orders and handle deliveries, allowing brands to serve customers swiftly

Currently, FroGo operates on a revenue-sharing model with 70+ FMGC and D2C brands. By the end of FY25, it aims to work with around 150 brands, expanding beyond just frozen foods to include a broader range of food products

Driven by an ever-expanding fleet of new brands, the Indian frozen food industry has undergone a complete metamorphosis in recent years. However, the expansion of this segment, fuelled by a range of factors, including the pandemic, a surge in global culinary trends, and increased urbanisation, has not been easy.

Topping the list of challenges for companies in this line of work are the substantial capital investments needed to establish and maintain freezing facilities, storage infrastructure, and distribution networks.

Moreover, despite improvements in the cold chain infrastructure, significant gaps remain, posing ongoing challenges in ensuring the consistent quality and safety of frozen products throughout the supply chain.

Amid this, Mira Jhala, a third-time entrepreneur, is hell-bent on solving the cold storage supply chain challenges for frozen foods with her B2B supply chain startup, FroGo.

Founded in March 2022, FroGo provides tailored fulfilment infrastructure for ice cream and frozen food brands, allowing them to start online operations in a few days.

Notably, Jhala comes with a ton of experience in the food industry. Before moving back to India in 2009, she worked in the US for several years. Her previous startup in the food services space was acquired by Curefit, and she wanted her next venture to remain within the food industry but address an underserved market.

“Over the years, I have observed the growth of the frozen food sector, noticing a significant increase in exposure from 2009 to the present. I have also identified gaps throughout the entire supply chain. The rapid growth of this category is evident, with the domestic retail market valued at INR 50,000 Cr and expanding at a 17% CAGR. The strong demand and growth potential in this sector make it an attractive opportunity for addressing the current market needs,” Jhala said.

Where Does FroGo Fit Into The Supply Chain Equation?

Speaking with Inc42, Jhala shared that her goal with FroGo is to streamline how food brands connect with consumers by leveraging its network of dark stores, which also forms the core of FroGo’s operations. These dark stores hold the inventory, process orders, and handle deliveries, allowing brands to serve customers swiftly.

Currently, Frogo operates over 50 dark stores in Delhi, Noida, Faridabad, Chandigarh, Panchkula, and Mohali.

Per Jhala, the company is rapidly expanding its reach by adding two new dark stores each week to keep pace with the growing demand. Further, the startup simplifies how food brands deliver their products to consumers through a network of dark stores and third-party warehouses.

It also enjoys its partnerships with three external warehouse companies to manage the storage of products for various brands. FroGo also takes care of logistics, ensuring that products are efficiently moved from these warehouses to its dark stores.

Jhala told Inc42 that while the market includes quick commerce players offering 10-minute delivery and large platforms like Amazon with 1 to 3-day delivery, FroGo occupies a unique niche between these two extremes.

“We focus on providing 30 to 90-minute deliveries, offering a middle ground where brands can maintain control over their demand while achieving fast delivery times,” the founder said.

Besides fast delivery, brands that partner with FroGo can showcase their full product catalogue and manage demand themselves, rather than depending on the platforms where they may have limited SKUs. Hence, this provides a parallel channel to both quick commerce and traditional ecommerce, catering to specific needs without overlapping with existing solutions.

The Road Ahead For Frogo

Currently, FroGo operates on a revenue-sharing model with the brands that use its dark store network. The startup claims to be working with 70+ FMGC and D2C brands. However, the founder denied to share FY24 numbers.

By the end of FY25, FroGo aims to work with around 150 brands, expanding beyond just frozen foods to include a broader range of food products.

“Customer acquisition has not been a challenge for us. As a B2B company, our clients are food brands, and we already work with over 70 of them. Word spreads quickly in our industry, and we even have a waiting list of 22 brands eager to onboard,” Jhala said.

In addition, FroGo’s annual gross merchandise value (GMV) stands at approximately INR 18 Cr. As it is expanding its dark store network, it is targeting a 5X increase in GMV in FY25.

The startup is also focussed on adding two dark stores every week in North India and has plans to expand into southern cities like Bangalore, Hyderabad, and Chennai soon.

“This expansion will impact our expenses, but we have structured our business model to ensure that we achieve contribution margin positivity in each city within six months. This approach allows us to grow quickly but sustainably,” Jhala added.

According to a market study, the India Supply Chain Management (SCM) market, valued at $3.42 Bn in 2023, is set to grow at a CAGR of 11.1%, reaching $6.43 Bn by 2030.

On a different note, FroGo’s competitors like JustDeliveries and Indicold have recently grabbed a lot of investor interest.

In March, JustDeliveries secured $1 Mn in a funding round led by NABVENTURES Fund, with participation from FAAD Network, Anay Ventures, Caret Capital and the Mahansaria family office.

With the capital, the cold chain solutions startup plans to deepen its logistics networks across key cities, including Bangalore, Mumbai, Pune, and NCR, and launch operations in Hyderabad. Similarly, supply chain startup Indicold received raised funds from Fundalogical Ventures and Everstone Group to expand its footprint.

With this kind of investor interest and growth in the segment, the entry of more players is inevitable. For now, to secure its market position from existing players and new entrants, FroGo may have to be on its toes until it becomes a go-to name in the industry.

[Edited By Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)