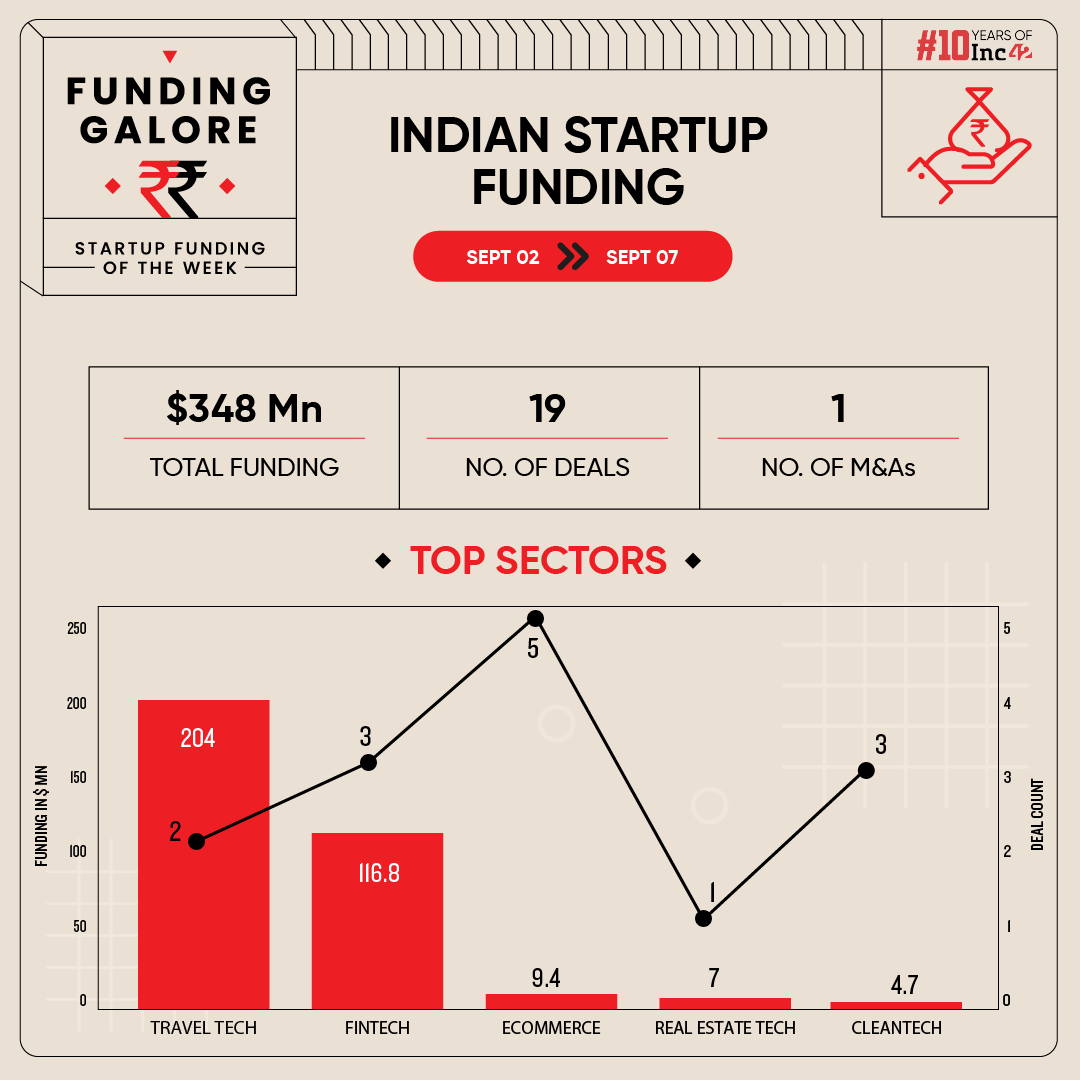

Between September 2 and 7, Indian startups collectively mopped up around $348 Mn in funding across 19 deals

Rapido’s fundraise, the traveltech sector became the funded sector with an investment of $204 Mn deals

Ather Energy is looking to file its DRHP with the SEBI next week for an INR 4,500 Cr IPO in a mix of a fresh issue and offer for sale (OFS)

The month of September started relatively in a high spirit as far as the startup funding is concerned. In the first week of the ongoing month, i.e., between September 2 and 7, Indian startups collectively managed to secure $348 Mn in funding across 19 deals, 25% lower than $466 Mn raised by 16 startups in the closing week of August.

The week further saw two mega deals with Drip Capital bagging $133 Mn, and Rapido finally announcing its massive $200 Mn funding from WestBridge Capital.

Funding Galore: Indian Startup Funding Of The Week [ Sept 2– Sept 7 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 5 Sep 2024 | Rapido | Travel Tech | Transport Tech | B2C | $200 Mn | Series E | WestBridge Capital, Nexus Venture Partners, Think Investments, Invus Opportunities | WestBridge Capital |

| 5 Sep 2024 | Drip Capital | Fintech | Lending Tech | B2B | $113 Mn | – | GMO Payment Gateway, Sumitomo Mitsui Banking Corporation, International Financing Corporation IFC, East West Bank | – |

| 4 Sep 2024 | JUSTO Realfintech | Real Estate Tech | Real Estate Services | B2B | $7 Mn | – | Arbour Investments | Arbour Investments |

| 2 Sep 2024 | Nutrabay | Ecommerce | D2C | B2C | $5 Mn | pre-Series A | RPSG Capital Ventures, Kotak Alternate Asset Managers | RPSG Capital Ventures |

| 4 Sep 2024 | The Hosteller | Travel Tech | Accommodation | B2C | $4 Mn | – | V Cube Ventures SA, LV Angel Fund, Unit E Consulting LLP | V Cube Ventures SA |

| 5 Sep 2024 | RecommerceX | Cleantech | Waste Management | B2B-B2C | $3.6 Mn | Seed | Accel, Kae Capital | Accel, Kae Capital |

| 2 Sep 2024 | Global Care | Healthtech | Healthcare Services | B2C | $3 Mn | Series A | 35North India Discovery Fund – II | 35North India Discovery Fund – II |

| 3 Sep 2024 | BigEndian Semiconductor | Deeptech | IoT & Hardware | B2B | $3 Mn | Seed | Vertex Ventures SEA & India | Vertex Ventures SEA & India |

| 3 Sep 2024 | Theater | Ecommerce | D2C | B2C | $3 Mn | pre-Series A | Prath Ventures | Prath Ventures |

| 4 Sep 2024 | Invest4Edu | Fintech | Investment Tech | B2C | $3 Mn | Seed | – | – |

| 4 Sep 2024 | Boson Whitewater | Cleantech | Water Tech | B2B | $1.1 Mn | – | Rainmatter | Rainmatter |

| 4 Sep 2024 | TruNativ | Ecommerce | D2C | B2C | $1.1 Mn | – | Rainmatter | Rainmatter |

| 4 Sept 2024 | Valyx | Fintech | Payments | B2B | $800K | Seed | Huddle Ventures, Waveform Ventures, Bharat Founders Fund, Propell Fund | Huddle Ventures, Waveform Ventures |

| 4 Sept 2024 | Slikk | Ecommerce | B2C Ecommerce | B2C | $300K | Seed | Better Capital, Untitiledxyz Ventures | Better Capital |

| 3 Sep 2024 | BiUP Technologies | Enterpristech | Horizontal SaaS | B2B | – | – | CarDekho | CarDekho |

| 4 Sep 2024 | 0xPPL | Media & Entertainment | Social Media & Chat | B2C | – | – | Peak XV Partners, AllianceDAO, Anagram, Balaji Srinivasan, Sandeep Nailwal, Anatoly Yakovenko, Raj Gokal | Peak XV Partners, AllianceDAO, Anagram |

| 3 Sep 2024 | Plan B | Ecommerce | D2C | B2C | – | Seed | JIIF, Ah! Ventures | |

| 3 Sept 2024 | ReCircle | Cleantech | Waste Management | B2B-B2C | – | Seed | Venture Catalysts, Mumbai Angels | |

| 6 Sept 2024 | Mechanic Pro | Consumer Services | Hyperlocal Services | B2C | – | Seed | Naveen Kumar Telkani & Family | |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Bike taxi startup and now a cab aggregator Rapido entered the unicorn club with $200 Mn from WestBridge Capital.

- Fuelled by Rapido’s fundraise, the traveltech sector became the funded sector with an investment of $204 Mn deals

- In terms of number of deals, the ecommerce sector bagged the most with five deals, raking $9.4 Mn

- The seed funding soared to $10.7Mn this week across eight deals, an over 200% higher than $3.05 Mn reported last week.

Other Major Developments Of The Week

- Alternative credit provider Blacksoil Capital and impact investment lender Caspian Debt have got unanimous approval from their boards of directors to merge via a share swap agreement.

- Ather Energy is looking to file its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) next week for an INR 4,500 Cr IPO in a mix of a fresh issue and offer for sale (OFS).

- Mumbai-based venture debt firm VentureSoul Partners has marked the first close of its INR 600 Cr maiden fund, raising INR 146.5 Cr ($17.4 Mn).

- Mumbai-based lendingtech startup SarvaGram is reportedly in discussions to raise a fresh funding of around $50 Mn from both new and existing investors.

- OfBusiness has begun preparations for an initial public offering (IPO) of up to $1 Bn and is close to finalising the bankers for its public listing in the second half of 2025.

- LetsVenture has launched LV Debt, a marketplace designed to educate founders and offer debt financing tailored to the specific requirements of startups.

- Money View is looking to raise INR 250 Cr (around $29.8 Mn) from unidentified investors through private placement of non-convertible debentures (NCDs).

- Hindustan Composites said it has signed a share purchase agreement to acquire a stake in IPO-bound foodtech major Swiggy for INR 5.175 Cr.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)