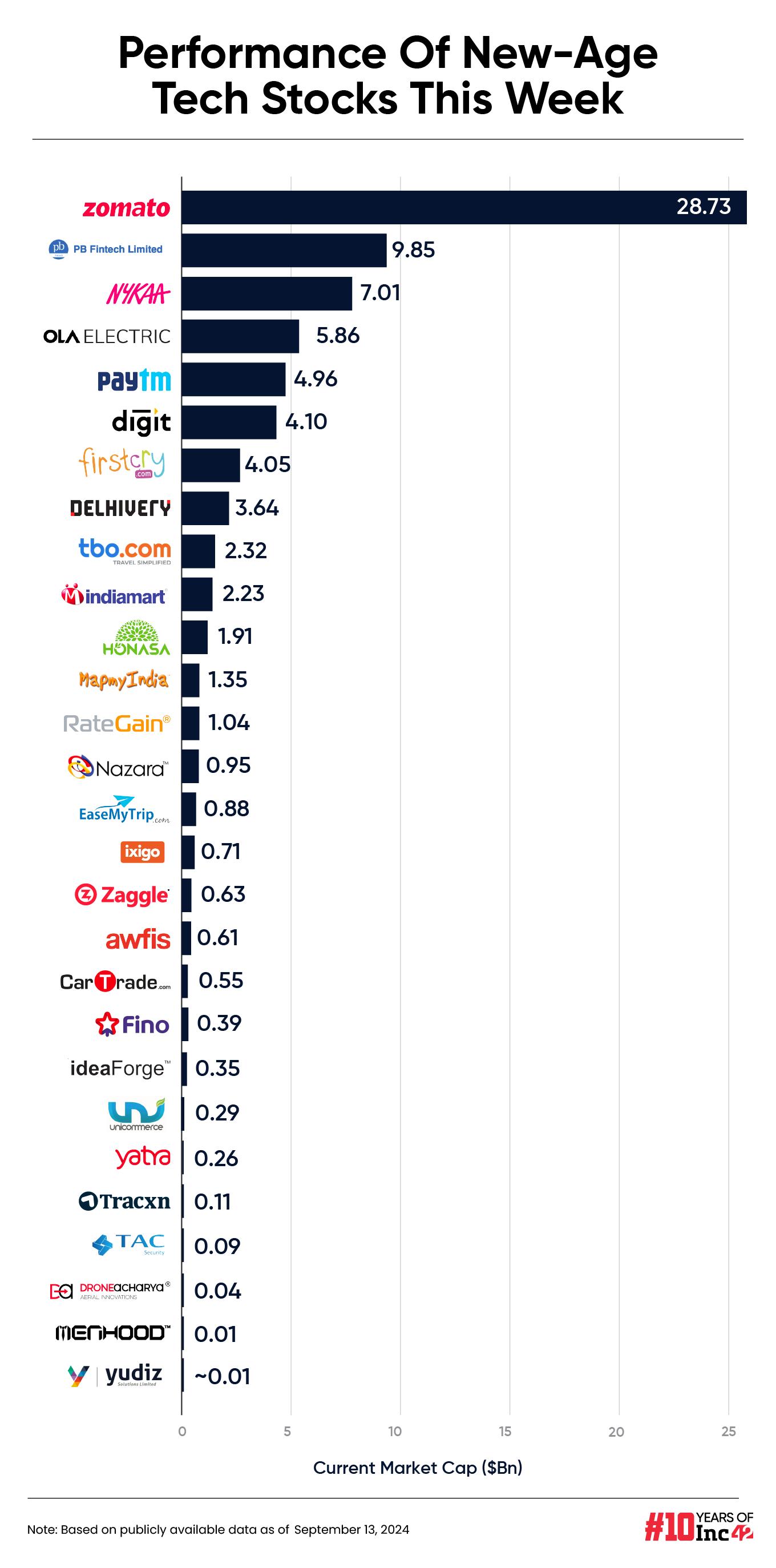

Indian new-age tech stocks witnessed a mixed week despite the bull run in the broader market, which resulted in benchmark indices soaring to fresh all-time highs.

Fifteen of the 28 new age tech stocks under Inc42’s coverage gained in a range of 0.54% to just under 23% this week. Shares of fintech major Zaggle zoomed to a fresh all-time high of INR 446.40 this week. The stock emerged as the biggest gainer, zooming 22.64% during the week. Recently listed SaaS startup Unicommerce, gaming major Nazara Technologies, Paytm, PB Fintech, and FirstCry were among the other major gainers this week.

Besides Zaggle, the week saw shares of two startups, Mamaearth parent Honasa and foodtech major Zomato, hit fresh all time highs. Zomato gained 4.94% this week to end at INR 272.90, but Honasa slumped 7.20% to end the week at INR 493.45 to end as the biggest loser this week.

Besides the BPC major, the week saw shares of 13 startups fall in a range of 0.56% to over 7%. Last week’s top gainer TAC Infosec, Nykaa, Awfis and Fino Payments Bank were among the stocks which ended the week in the red.

Meanwhile, benchmark indices Nifty 50 and Sensex touched their all-time highs on Thursday (September 12). While Sensex gained 2.1% this week to end at 82,890.94, Nifty 50 jumped 2% to end at 25,356.50.

“Despite volatility, DIIs and FIIs flows remained positive as a strong monsoon, and an expectation of an uptick in demand during festive season drove investor sentiment….The market hit a new high as the rate-cut optimism globally (ECB & US Fed) has provided a positive impetus across the global markets,” Vinod Nair, head of research at Geojit Financial Services, said.

In the coming week, Nair believes that market trends will be shaped by the US Fed meeting next week, during which it is expected to announce a rate cut.

Amid the bull run, the IPO spring continues in the Indian equities market. Pantomath Capital Advisors said that IPO fundraising hit a 27-month high in August, with 10 companies cumulatively raising INR 17,047 Cr.

Moving forward, it expects domestic companies to raise over INR 1.50 Lakh Cr through IPOs in the next 12 months, signalling continued activity and strong investor interest ahead.

Banking on this, Ather Energy became the latest new-age tech startup to file its DRHP with SEBI for an IPO. According to the electric vehicle manufacturer’s DRHP, filed on September 9, its proposed IPO will be a combination of a fresh issue of equity shares worth INR 3,100 Cr and an offer-for-sale (OFS) of up to 2.2 Cr equity shares.

Now, let’s take a deeper look at the performance of the new-age tech stocks this week.

Overall, the total market capitalisation of 28 new-age tech stocks under Inc42’s coverage stood at around $82.93 Bn at the end of this week as against $79.38 Bn at the end of last week.

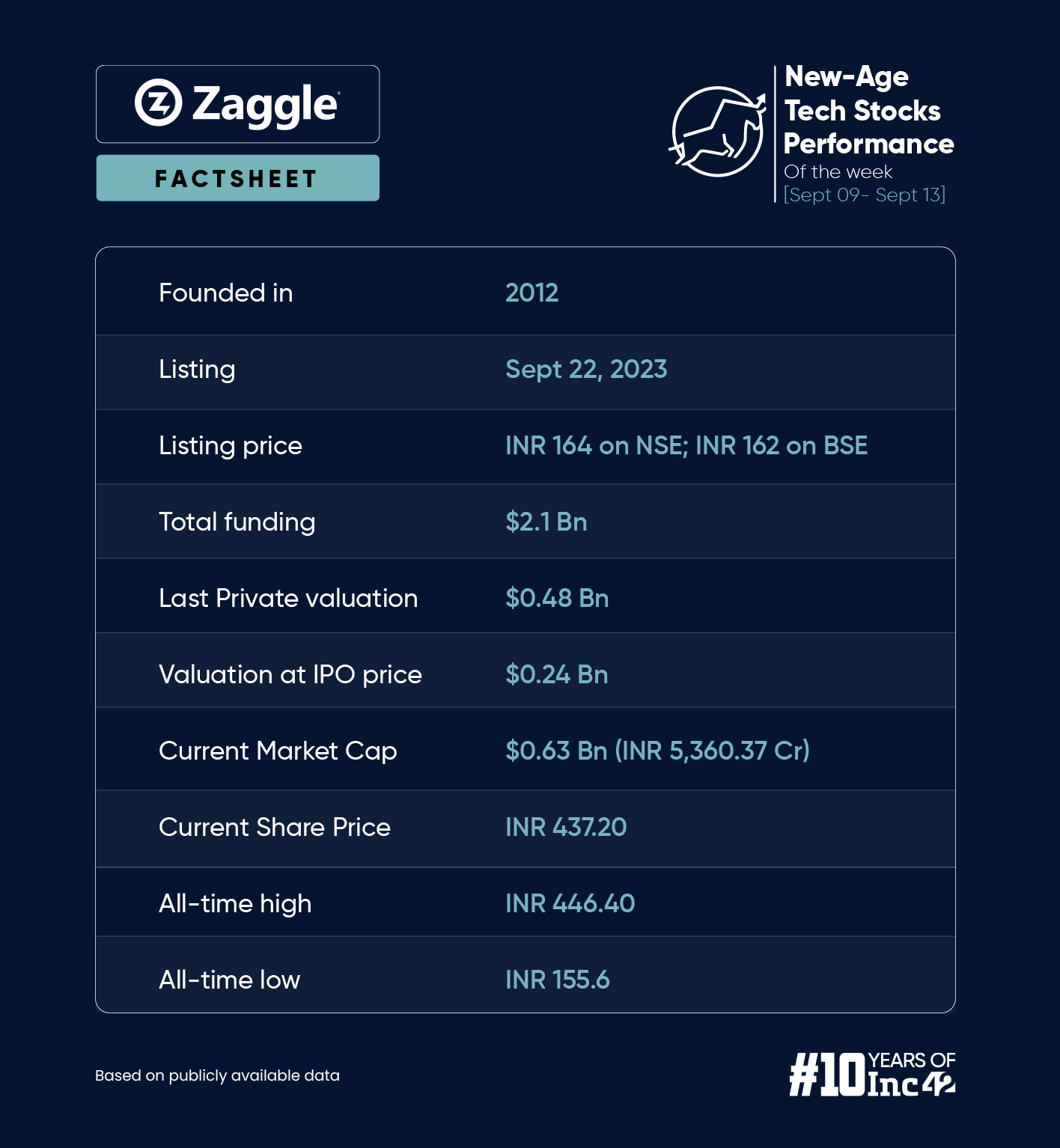

Zaggle Soars To New Heights

Almost a year after its listing, shares of fintech SaaS startup Zaggle Prepaid Ocean Services are seeing a renewed investor interest. The startup’s shares zoomed 22.64% this week to end the week at INR 437.20. Its market cap also zoomed past $630 Mn this week.

The startup’s shares have been on an upward momentum in September on the back of multiple new account wins. Zaggle announced bagging contracts from the likes of Blue Star, FCM Travel Solutions, HDFC ERGO, and Founderlink technologies this month so far.

For the uninitiated, Zaggle provides employee expense management platform, corporate employee rewards platform, among others, to enterprises.

In its annual report, Zaggle claimed to be India’s leading prepaid card issuer, with over 50 Mn cards distributed and more than 2.73 Mn users as of March 31, 2024. Further, it onboarded 620 new corporate clients, including marquee names such as Wipro, Bennett Coleman, and Emcure Pharmaceuticals, in FY24.

Zaggle’s net profit stood at INR 44 Cr in FY24 as against INR 23 Cr in the previous fiscal year. Operating revenue grew 40% year-on-year to INR 775.6 Cr in FY24.

The startup is aiming to increase its revenue by 45-55% in the ongoing fiscal year. Zaggle’s managing director and CEO Avinash Ramesh Godkhindi said in its annual report, that the increase is expected to come from the startup’s strategy to scale up its products – Zoyer and Save and Propel, and enhance cross-selling efforts.

“We are diligently working on our US expansion by precisely identifying our Ideal Customer Profile (ICP) and our Product Market Fit (PMF) to ensure targeted success,” Godkhindi said.

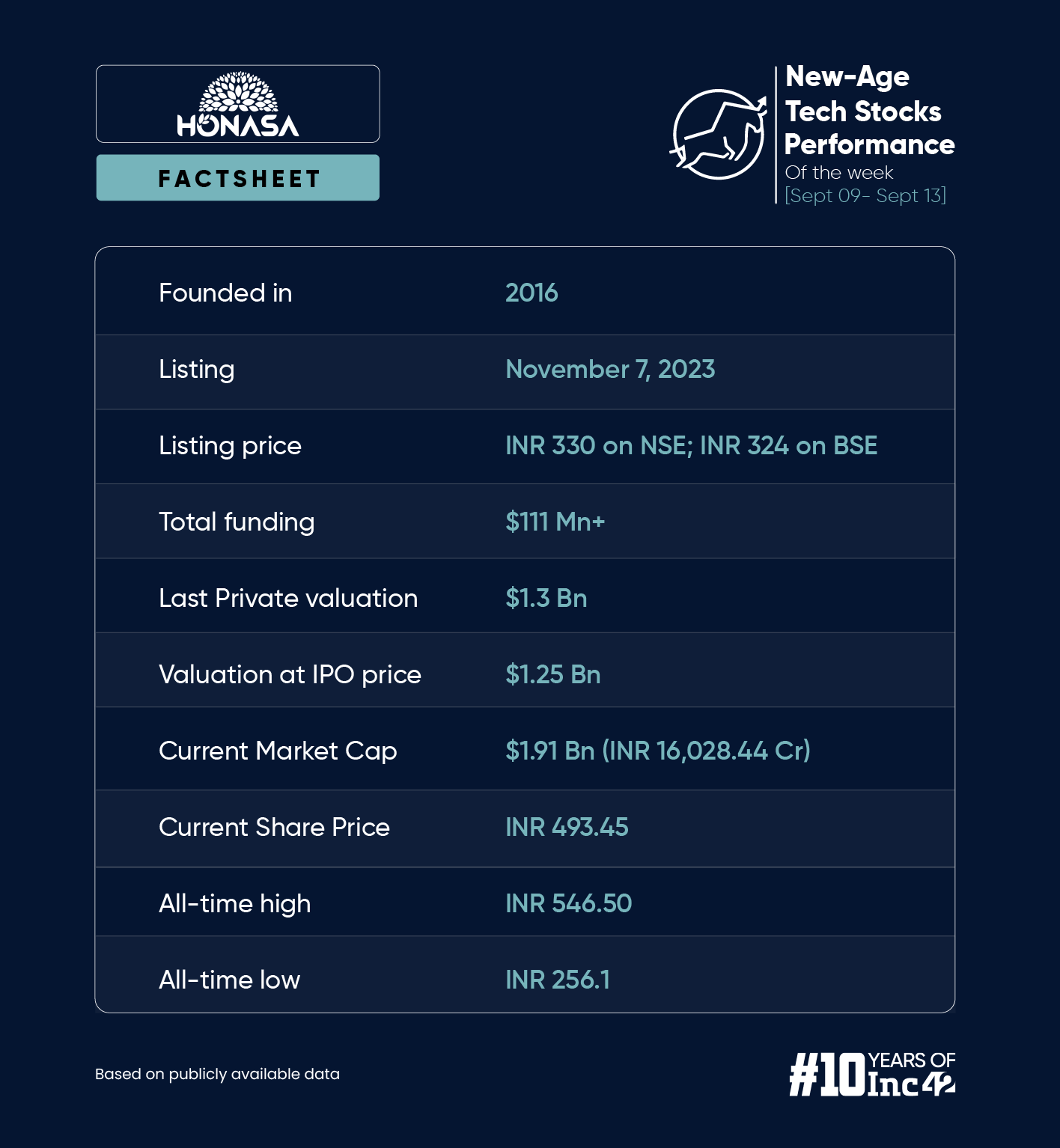

Bulk Deals Derail Honasa’s Momentum

The upward momentum seen in Honasa’s shares since the announcement of its Q1 results came to a halt this week. The stock declined 7.2% to end the week at INR 493.45. However, it started the week on a strong note, touching an all-time high of INR 546.5 during intraday trading on September 10. The jump also led to its market cap breaching the $2 Bn mark.

The upswing came after HSBC reaffirmed its “buy” rating for Honasa and raised its price target to INR 570 from INR 550 earlier.

The brokerage said that Honasa is expected to achieve over 20% structural growth in the coming years, driven by ongoing margin improvements. It also said that the startup’s house of brands strategy will increase its market share across various high-growth personal care sectors.

Amid this bull run, a host of the startup’s investors offloaded shares on September 12. Peak XV Partners, Fireside Ventures, Stellaris Venture Partners, among others, cumulatively sold shares worth INR 1,601.68 Cr via bulk deals. The shares were lapped up by Morgan Stanley and ICICI Prudential Life Insurance Company.

Following the bulk deals, the startup’s shares plunged nearly 6% on September 12 itself.

Meanwhile, ICICI Prudential’s stake in Honasa increased to 5.48% following the acquisition of fresh shares.

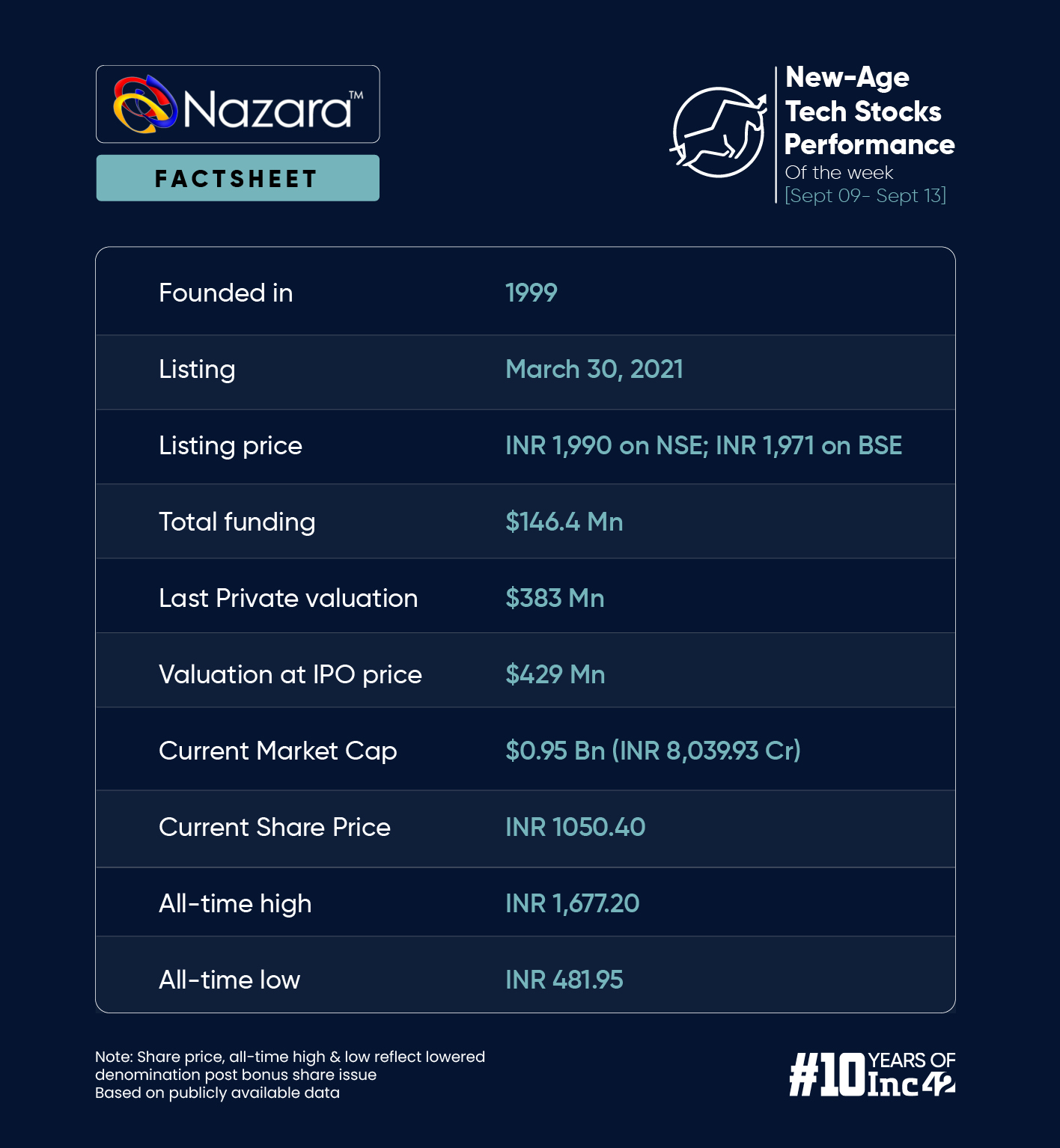

Markets Respond Positively To Nazara’s Acquisition Spree

Gaming major Nazara continued its expansion spree this week and investors reacted positively to it. The shares of the company ended the week 14.05% higher at INR 1,050.40. With this, its market cap rose to over $950 Mn this week.

Here’re the major events related to the startup from this week:

- Nazara disclosed its plans to acquire a 15.86% stake in gaming community platform GetStan Technologies Pte. Ltd (STAN) for INR 18.4 Cr (around $2.2 Mn). The purchase will be made through its wholly owned subsidiary Nazara Dubai FZ via a secondary transaction.

- The startup will be making its biggest bet in the form of purchase of a 47.7% stake in online poker platform Pokerbaazi’s parent Moonshine Technology for INR 831.5 Cr through a secondary transaction.

- Nazara’s board is scheduled to decide on approving raising of fresh funds by issuance of equity shares on a preferential basis on September 18.

With the two new acquisitions, Nazara added on to its expansion spree from FY24. In the prior fiscal, it acquired 100% stake in Paper Boat and NextWave. Its subsidiary Sportskeeda acquired Pro Football Network, SoapCentral and Deltia’s Gaming.

Its gaming subsidiary NODWIN acquired Freaks4U Gaming, Branded Pte. Ltd, Comic Con India, PublishME, and Ninja Gaming to expand globally.

In its annual report, Nazara reiterated its focus on acquisitions to shore up its revenue. It said it will expand its portfolio of core gaming IPs and reinvest generated cash to acquire new IPs and grow satellite businesses.

Besides, it is also focusing on esports and adtech entities and expects these ventures to expand into areas like physical play, toys, and AR/VR/XR in the future.

“With substantial cash reserves and a strong M&A pipeline, we are well positioned to seize further growth opportunities and enhance our trajectory through strategi M&As over next couple of years, driving the future of gaming worldwide from our strong foundation in India,” Nazara’s joint MD and CEO Nitish Mittersain said.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)