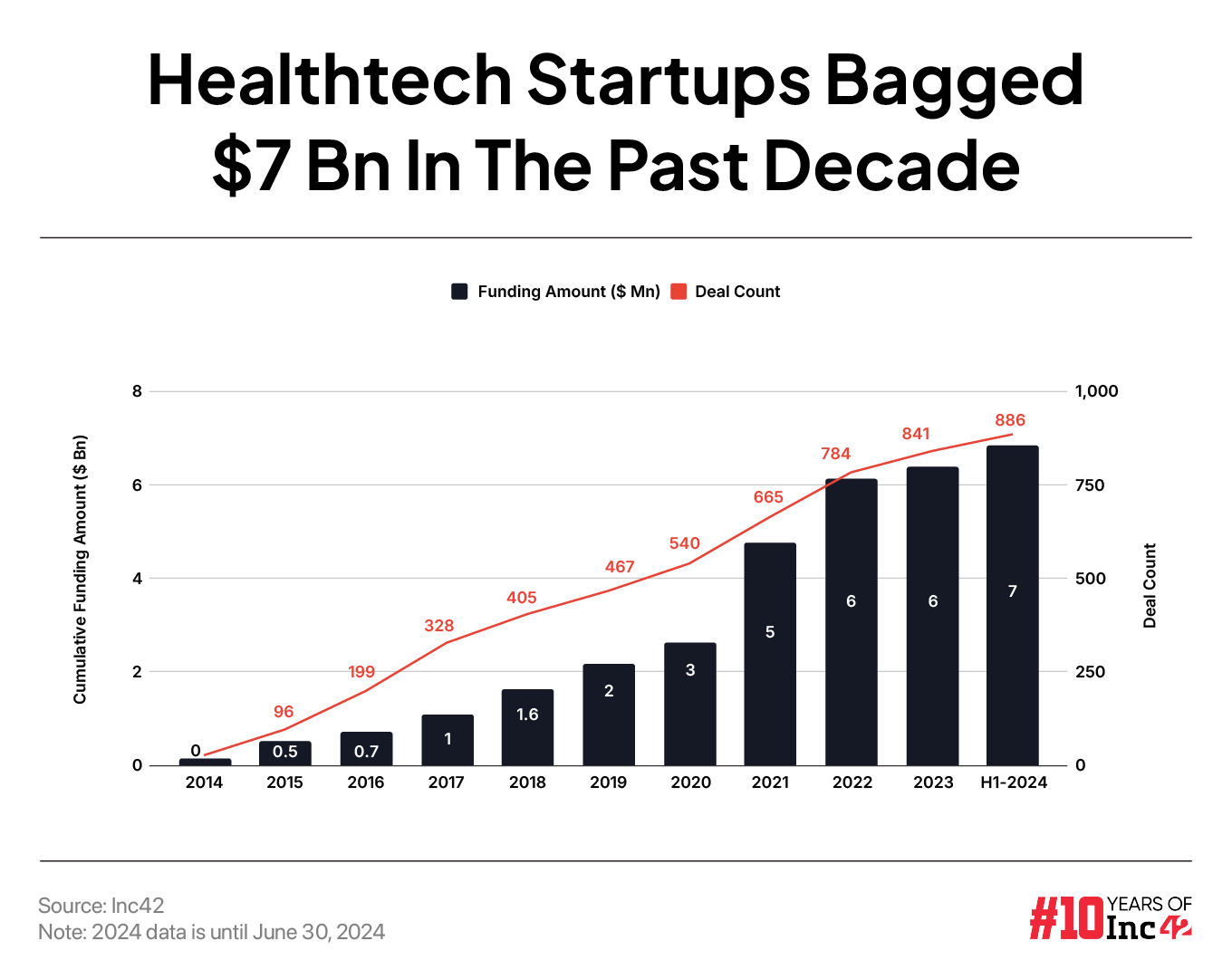

According to Inc42’s ‘The State Of Indian Startup Ecosystem Report’, healthtech startups raised a little over $7 Bn between 2014 and H1 2024 in 886 deals.

Cumulative funding raised by Indian startups during this period crossed the $150 Bn mark. While ecommerce emerged as the most funded sector with $34 Bn, fintech took the second spot with $29 Bn

Investors estimate healthtech funding to gain momentum in the coming quarters as they continue to bet big on new innovations to solve specific Indian healthcare issues

It has been four years since the pandemic swept the world and locked billions inside their homes. Despite the mayhem, the period turned out to be the driving force for the adoption of the internet and the allied digital ecosystem.

From online grocery deliveries to edtech, the pandemic era put several sectors into the high-growth trajectory. It was also the time during which quick commerce prospered and the edtech ecosystem had its dream run.

Not to mention, the pandemic exposed major cracks in the country’s healthcare system. However, many saw an opportunity to fix this with technology. As a result, the country saw a significant revamp in India’s healthtech space.

Such was the optimism that the homegrown healthtech space was being projected to become a $21 Bn market opportunity by 2025, growing from a mere $6.8 Bn in 2020.

Unfortunately, the market appears to have fallen way short of the forecast. While the Indian healthtech space has seen over 11,620 startups emerge since 2014, investors haven’t been too keen on this space.

According to Inc42’s ‘The State Of Indian Startup Ecosystem Report‘, healthtech startups raised a little over $7 Bn between 2014 and H1 2024 in 886 deals.

In comparison, the cumulative funding raised by Indian startups during this period crossed the $150 Bn mark across 10,500 deals. While ecommerce emerged as the most funded sector with $34 Bn raised across 1,835 deals, fintech took the second spot with $29 Bn in 1,570 deals.

Now back to the funding woes of the Indian healthtech paradigm, on a sub-sectoral level, online pharmacy startups led the charts with $1.7 Bn in total funding. Following its lead were fitness and wellness, as well as telemedicine sub-sectors, which cumulatively raised $1.2 Bn in funding in 202 and 186 deals, respectively.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/the-state-of-indian-startup-ecosystem-report-2024/” target=”_blank” rel=”noopener”>Access Free Report

As per the Inc42 data, healthtech has been investors’ second least favourite sector after logistics. Substantiating this fact is the total number of unicorns in the sector. Notably, the Indian healthtech space fosters a mere eight unicorns, including Tata 1mg, Innovaccer, Pharmeasy, and Pristyn Care. Also, not a single Indian healthtech unicorn has been minted since 2022, when Tata 1mg secured funds at a valuation north of $1 Bn.

On the contrary, while tracing the Indian healthtech funding trends, we observed that investments in the space saw a steep jump during the pandemic. Healthtech funding surged 4.8X from $456 Mn in 2020 to $2.19 Bn in 2021. It is also imperative to mention that the Indian healthtech sector netted a mere $3 Bn in funding between 2014 and 2020.

Post the pandemic boom, funding numbers dipped by 19% CAGR every year between 2022-H1 2024. Such was the impact of the capital drought that many startups have had to shut shop.

Most recently, insurtech startup Kenko Health shut down after five years, despite raising $13.7 Mn. Startups like DayTwo, Nintee, and ConnectedH, too, have called it quits in recent times. More interestingly, PharmEasy, one of the biggest names in the space, had to cut its valuation by 90% to secure $216.2 Mn in a rights issue earlier in April this year.

Industry experts see several reasons for this funding turmoil. First, India is a trust-based society when it comes to healthcare, which raises the bar for tech startups and their innovations. Additionally, the market is already dominated by larger, more established players, making it tough for new entrants to survive. Adding insult to injury is the fact that the healthtech business is highly capital-intensive and doesn’t always guarantee significant returns.

Funding Revival For Healthtech On The Cards?

Despite investors’ cautious stance, the recent uptick in funding numbers has brought some optimism to the sector. For context, cumulative funding secured by healthtech startups jumped 2.8X to $460 Mn in the first half (H1) of 2024 from $120 Mn raised in H1 2023.

This uptick came primarily due to PharmEasy’s downround. With this, funding secured at the late stage jumped to $296 Mn from $44 Mn in H1 2023. Besides, there was also a 35% year-on-year (YoY) uptick in healthtech growth stage funding in the first half of 2024, which stood at $138 Mn.

As per Bharat Founders Fund’s partner Maanav Sagar, the emergence of healthtech startups with scalable businesses, as well as the improving infrastructure, will drive the change.

“Also, with the government’s initiatives like the National Health Stack (Ayushman Bharat), there’s potential for a similar ecosystem shift to what we witnessed with UPI in the fintech sector. As these initiatives unfold, we can expect a more supportive environment for healthtech startups, which could lead to increased funding and growth opportunities in the near future,” he said.

All in all, investors estimate healthtech funding to gain momentum in the coming quarters, as they continue to bet big on new innovations to solve specific Indian healthcare issues.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/the-state-of-indian-startup-ecosystem-report-2024/” target=”_blank” rel=”noopener”>Access Free Report

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)