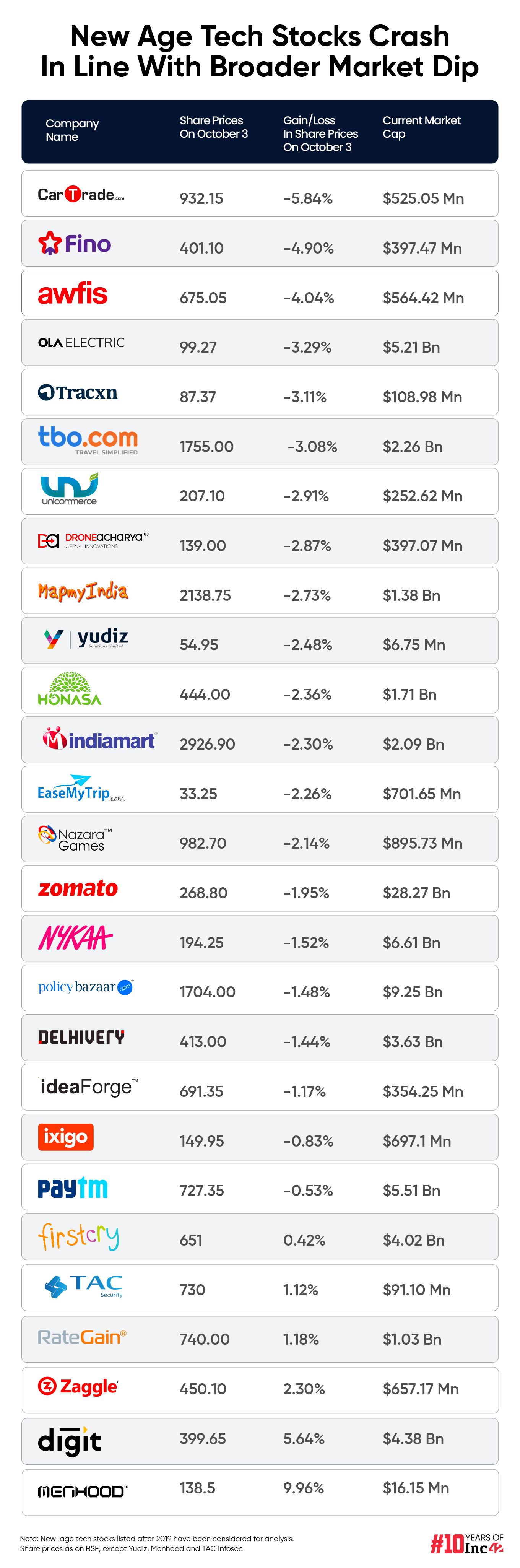

Twenty two out of the 28 new-age tech stocks under Inc42’s coverage ended in the red today, falling in a range of 0.53% to a little under 6%.

Leading the pack of losers was car marketplace CarTrade, with its shares falling 5.84%. EaseMyTrip, TBO Tek, Zomato and Paytm were the other major stock which ended in the red

Menhood emerged as the biggest gainer among the six startups whose stocks ended in the green today, with the D2C grooming brand’s shares surging 9.96%

Shares of new-age tech stocks plummeted on Thursday (October 3) as the broader equity market crashed due to rising tensions in the Middle East.

Sensex plunged 2.10% to end today’s trading session at 82,497.10, while Nifty 50 also fell 2.12% to end the day at 25,250.10.

In line with the decline in benchmark indices, 22 out of the 28 new-age tech stocks under Inc42’s coverage ended in the red today, falling in a range of 0.53% to a little under 6%.

Leading the pack of losers was car marketplace CarTrade, with its shares falling 5.84% to INR 932.15.

It is pertinent to note that new-age tech stocks witnessed a similar decline last week. Nineteen of the 28 stocks under Inc42’s coverage fell in a range of 0.2% to over 16% in the past week.

Last week’s biggest loser, EaseMyTrip continued its downward journey this week. Shares of the online travel aggregator fell 2.26% to end today’s session at INR 33.25. With this, the travel tech startup is approaching its 52-week low of INR 32.83.

Last week’s top gainer TBO Tek’s shares also plummeted 3.08% to close today’s session at INR 1,755.

Zomato, Paytm, Ola Electric, Nazara Technologies, PB Fintech, and Delhivery were among the other major new-age tech stocks which ended in the red today.

Meanwhile, Menhood emerged as the biggest gainer among the six startups whose stocks ended in the green today. The D2C men’s grooming brand’s shares zoomed 9.96% to close at INR 138.50. Other gainers of the day were Go Digit, RateGain, Zaggle, TAC Infosec and FirstCry.

The total market capitalisation of the 28 new-age tech stocks under Inc42’s coverage stood at $87.61 Bn at the end of today’s trading.

Commenting on the broader market crash, Hrishikesh Yedve, AVP of technical and derivatives research at Asit C. Mehta Investment Interrmediates, said that bearish sentiment took over the Indian market in line with the global dip.

“The domestic benchmark indices opened with a gap-down, in line with global cues. Nifty started the day on a negative note and remained under pressure throughout, ultimately closing negatively at 25,250. Technically, on the daily chart, the index formed a large red candle, signalling further weakness. Moreover, the index has broken its key support base and trend line support at 25,350, indicating fresh weakness,” he said.

The downward spiral of the market today was triggered by the surge in oil prices due to the escalating tensions in the Middle East.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)