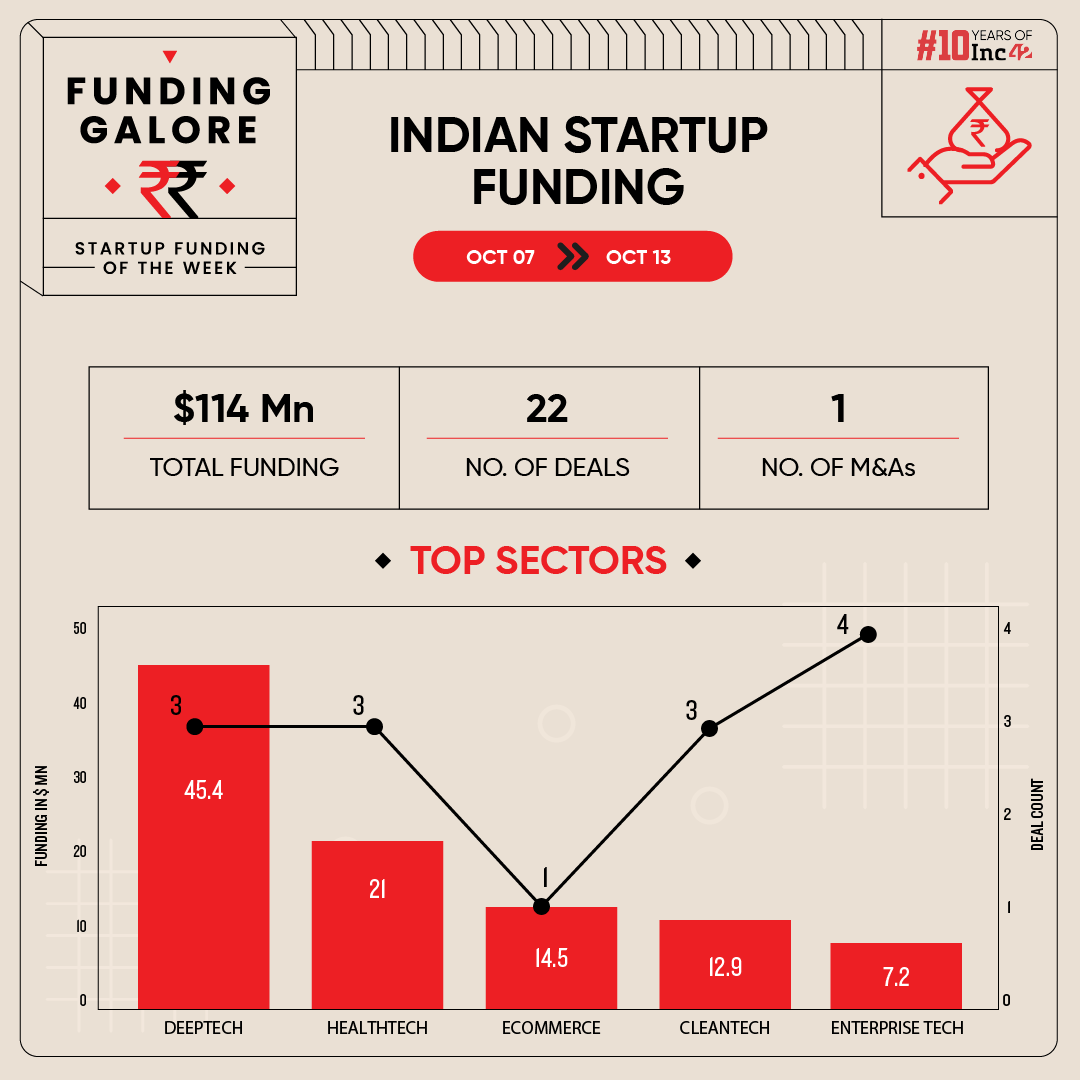

Indian startups cumulatively raised $114 Mn across 22 deals, a 32% increase from $86.4 Mn raised across 16 deals last week

Deeptech emerged as the investor favourite sector this week on the back of Haber’s $38 Mn fundraise

Seed funding picked up this week to $17.8 Mn from $1.9 Mn last week

After a significant drop in funding trends leading into the month of October, investor sentiment picked up slightly in the second week of the month. Indian startups raised $114 Mn via 22 deals during October 7-12, up 32% from $86.4 Mn raised last week across 16 deals.

This was the second week when no mega funding rounds materialised. This came after a quarter filled with heightened funding interest. In the third quarter of calendar year 2024, Indian startup funding doubled year-on-year to $3.4 Bn from $1.7 Bn in the same period last year. Late-stage investments surged 115% to surpass the $2.1 Bn mark in the September quarter this year from $984 Mn in Q3 2023.

Funding Galore: Indian Startup Funding This Week [Oct 7-12]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 10 Oct 2024 | Haber | Deeptech | Robotics Process Automation (RPA) | B2B | $38 Mn | – | Accel India, Beenext Capital, Creaegis | – |

| 9 Oct 2024 | Spry Therapeutics | Healthtech | Healthcare SaaS | B2B | $15 Mn | – | Flourish Ventures, Together Fund, Fidelity’s Eight Road Ventures, F Prime Capital | Flourish Ventures |

| 10 Oct 2024 | Millenium Babycares | Ecommerce | D2C | B2C | $14.5 Mn | – | Pantamoth Capital | Pantamoth Capital |

| 9 Oct 2024 | Urja Mobility | Cleantech | Electric Vehicle | B2B | $12 Mn | pre-Series A | Mufin Green Finance Limited, Hindon Mercantile Limited | Mufin Green Finance Limited, Hindon Mercantile Limited |

| 7 Oct 2024 | XDLINK | Deeptech | Spacetech | B2B | $7 Mn | Seed | Ashish Kacholia, E2MC, Mana Ventures | Ashish Kacholia |

| 9 Oct 2024 | BioPrime | Agritech | Farm Inputs | B2B | $6 Mn | Series A | Edaphon, Omnivore, Inflexor | Edaphon |

| 8 Oct 2024 | Dezy | Healthtech | Telemedicine | B2C | $6 Mn | – | Alpha Wave, Chiratae Ventures, Peak XV | – |

| 9 Oct 2024 | Swara Fincare | Fintech | Lendingtech | B2B | $2.3 Mn | Series A | Unitus Capital, Piper Serica, Dev Verma, Mukund Madhav, Sumit Ranjan | Unitus Capital |

| 9 Oct 2024 | Figr | Enterprisetech | Horizontal SaaS | B2B | $2.2 Mn | Seed | Kalaari Capital, Antler, Golden Sparrow | Kalaari Capital |

| 9 Oct 2024 | LearnTube | Edtech | Skill Development | B2C | $2 Mn | Seed | Blitzscaling Ventures, Goodwater Capital, Bisk Ventures, ACT | – |

| 7 Oct 2024 | Framer AI | Enterprisetech | Horizontal SaaS | B2B | $2 Mn | Seed | Lumikai | Lumikai |

| 7 Oct 2024 | Nayan Tech | Enterprisetech | Horizontal SaaS | B2B | $2 Mn | pre-Series A | BEENEXT, We Founder Circle, Venture Catalysts, LetsVenture, FAAD Capital | BEENEXT |

| 9 Oct 2024 | ZenStatement | Fintech | Fintech SaaS | B2B | $1.6 Mn | Seed | 3One4 Capital, Boldcap VC, Dynamis Ventures, Atrium Angels | 3One4 Capital, Boldcap VC |

| 10 Oct 2024 | Datazip | Enterprisetech | Horizontal SaaS | B2B | $1 Mn | Seed | Equirus InnovateX Fund | Equirus InnovateX Fund |

| 4 Oct 2024 | Holiday Tribe | Travel Tech | Travel Planning & Activities | B2C | $642K | Seed | Powerhouse Ventures, GSF, Dinesh Agarwal, Dinesh Gulati, Murugavel Janakiraman, Gaurav Kapur | Powerhouse Ventures, GSF |

| 10 Oct 2024 | Onlygood.ai | Cleantech | Climate Tech | B2B | $475K | Seed | IITMIC, Goel Group, DICV | – |

| 9 Oct 2024 | iRasus Technologies | Cleantech | Electric Vehicle | B2B | $475K | Seed | IAN Group, DFAN | IAN Group |

| 10 Oct 2024 | flutrr | Media & Entertainment | Social Media & Chat | B2C | $446K | – | Zee Media Corporation | Zee Media Corporation |

| 10 Oct 2024 | Social Hardware | Deeptech | Robotics Process Automation (RPA) | B2B | $381K | Seed | Inflection Point Ventures, Ivyleague Ventures, Soonicorn Ventures | Inflection Point Ventures |

| 9 Oct 2024 | Deftouch | Media & Entertainment | Gaming | B2C | – | – | KRAFTON, T-accelerate Capital, Lumikai, Visceral Capital, Play Venture | KRAFTON, T-accelerate Capital, Lumikai |

| 8 Oct 2024 | Jivi AI | Healthtech | Personal Health Management | B2C | – | – | Andrew Ng | Andrew Ng |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Artificial intelligence (AI)-based robotics startup Haber bagged the biggest cheque this week, securing $38 Mn (INR 317 Cr) by issuing Series C CCPS to venture capitalist (VC) firms Accel India, Beenext Capital, and Creaegis.

- On the back of Haber’s funding round, deeptech toppled enterprise tech to emerge as the investor favourite sector this week. Deeptech startups raised $45.4 Mn across three deals this week.

- However, enterprise tech saw the most number of deals materialise this week. Startups in the sector raised $7.2 Mn across four deals this week. Trailing it were deeptech and cleantech, with both the sectors seeing a similar number of three deals.

- Beenext and Lumikai emerged as the most active investors this week, backing two startups apiece. While Beenext invested in Haber and Nayan Tech, Lumikai backed Framer AI and Deftouch.

- Seed funding picked up this week to $17.8 Mn from $1.9 Mn last week.

Fund Launches This Week

Updates On Indian Startup IPOs

Other Developments Of The Week

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)