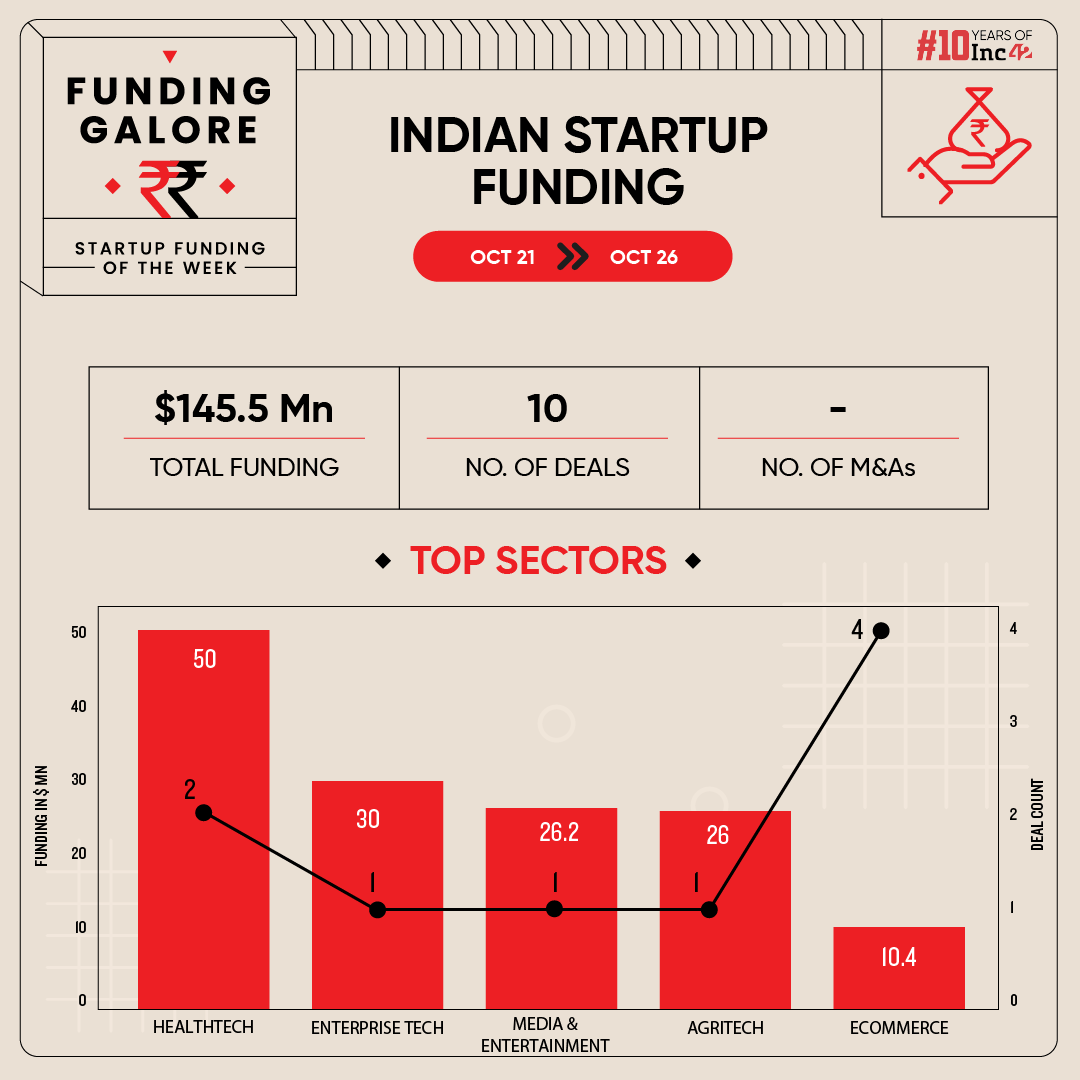

After a rise in funding activity across the Indian startup ecosystem, investor interest again went down again in the past week. Between October 21 and 26, startups cumulatively raised $145.5 Mn across 10 deals, a 70% decline from $478 Mn raised in the preceding week.

Moreover, the deal count also went down sharply this week by about 65% from last week’s 29 deals.

It is pertinent to note that investor interest in the startup ecosystem has been volatile since the past month or so. The volatility comes as a result of the dearth in the mega funding deals. The month of October has seen only one mega funding round materialise with Eruditus securing $150 Mn last week.

Funding Galore: Indian Startup Funding Of The Week [ Oct 21 – Oct 26 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 23 Oct 2024 | Even Healthcare | Healthtech | – | B2C | $30 Mn | Series A | Khosla Ventures, Founders Fund, 8VC, Lachy Groom | Khosla Ventures |

| 22 Oct 2024 | Neysa | Enterprise Tech | Horizontal SaaS | B2B | $30 Mn | Series A | NTTVC, Z47, Nexus Venture Partners | NTTVC, Z47, Nexus Venture Partners |

| 21 Oct 2024 | Nazara* | Media & Entertainment | Gaming | B2C | $26.2 Mn | – | SBI Mutual Fund | – |

| 21 Oct 2024 | Stellapps | Agritech | FaaS,Market Linkage | B2B-B2C | $26 Mn | Series C | Blume Ventures, Omnivore, Bill & Melinda Gates Foundation, IDH Farmfit Fund, 500 Startups, Blue Ashva Capital, Miledeep Capital, US International Development Finance Corporation | – |

| 25 Oct 2024 | Healthify | Healthtech | Fitness & Wellness | B2C | $20 Mn | pre-Series D | Khosla Ventures, LeapFrog Investments, Claypond Capital | Khosla Ventures, LeapFrog Investments |

| 22 Oct 2024 | Zouk | Ecommerce | D2C | B2C | $10 Mn | Series B | Aavishkaar Capital, Stellaris Venture Partners, Titan Capital, Sharrp Ventures, JJ Family Office | Aavishkaar Capital |

| 21 Oct 2024 | Advance Mobility | Logistics | Supply Chain | B2B | $3 Mn | – | Growthcap Ventures, India Accelerator, Finvolve | – |

| 23 Oct 2024 | WishNew Wellness | Ecommerce | D2C | B2C | $250K | – | Gyanesh Sharma, Abhijeet Rana, Ashish Singh | – |

| 24 Oct 2024 | NG Earsafe | Ecommerce | D2C | B2C | $126K | Seed | Inflection Point Ventures | Inflection Point Ventures |

| 25 Sep 2024 | Automoto** | Ecommerce | D2C | B2C | – | pre-Seed | Venture Bridge | Venture Bridge |

| Source: Inc42 *Part of a larger round **Included this week as it was skipped earlier. Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Healthttech startup Even Healthcare bagged the biggest cheque of the week, raising $30 Mn in its Series A round led by Khosla Ventures, along with Founders Fund, 8VC and Lachy Groom.

- On the back of Even Healthcare’s fundraise, healthtech emerged as the investor favourite startup sector this week. Besides, Healthify (formerly Healthifyme) also raised $20 Mn in its pre-Series D funding round.

- Ecommerce sector saw the highest number of rounds materialise this week as it witnessed a fresh capital infusion of $10.4 Mn across 4 deals.

- Khosla Ventures emerged as the most active investor this week, backing Even Healthcare and Healthify.

- Seed funding plunged this week to $126K as compared to $26.5 Mn raised by startups at this level.

Mergers & Acquisitions This Week

- FirstCry’s rollup brand GlobalBees has invested INR 4.5 Cr in its subsidiary Dynamic IT Solution to acquire more stake in the company. Dynamic IT Solution builds sports & fitness accessories and other sports and fitness products under the brand name Strauss.

- While announcing its financial results for Q2 FY25, Zomato said that it has received its board’s nod to acquire an 8% stake in innovative kitchen appliances maker Byondnxt.

- Online travel aggregator announced the acquisition of 51% stake in train food delivery platform Zoop Web Services Pvt Ltd for INR 12.54 Cr this week.

Fund Launches This Week

- Venture capital firm Avaana Capital marked the final close of its early stage fund at $135 Mn. Via the fund, it plans to back 20-25 startups in the cleantech space.

- Snapdeal founders Kunal Bahl and Rohit Bansal led Titan Capital marked the final close of its new fund, Titan Capital Winners Fund, at $40 Mn.

- About three months after its announcement, the union cabinet has approved a spacetech VC fund with a corpus of INR 1,000 Cr under the Indian National Space Promotion and Authorisation Centre (IN-SPACe).

- US-based venture capital firm General Catalyst launched its new fund, Fund XII, this week. The VC has raised $8 Bn fresh capital to back startups across the globe operating in sectors like artificial intelligence, defence and intelligence, climate and energy, industrials, healthcare and fintech.

Updates On Indian Startup IPOs

Other Developments Of The Week

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)