Razorpay

Earlier this year, the Razorpay CEO told Inc42 that RBI’s guidelines in each fintech vertical are better for the overall ecosystem. It seems like an unusual statement by a fintech founder when many of his counterparts are deriding regulators such as SEBI or the RBI for disrupting established startup models.

But Razorpay’s Mathur and co-founder Shashank Kumar don’t have a choice.

For over a decade, the fintech unicorn has operated in a tightly regulated payments business, where the RBI and NPCI are watching its every move. In some ways, Razorpay made its bed when it chose to enter the payments space.

India’s fintech startups are going through a challenging phase with the regulatory eye hovering over all operations, especially because of the maturity of some of these startups. Many of them have built an audience of tens and hundreds of millions over the past decade but, in the process, have arguably strayed from the guidelines set by the regulators.

Regulatory troubles have a real impact — take the case of ZestMoney, which had turned to small-ticket digital loans and BNPL for survival but had to shut down due to RBI’s changes to the risk weights in November 2023.

Others had to completely rewire themselves due to regulatory changes, as we noted in our deep dive into Instamojo’s pivot from payments. Besides this, we have seen the likes of Jupiter, Slice, PayU, and others suffer disruptions.

Throughout this, Razorpay has managed to survive and remain profitable — at least as of March 2024. The fintech company said that its PAT has grown 4.7x in FY24 to INR 34 Cr from INR 7 Cr in FY23.

The startup is looking at a big tax outlay for its redomiciling to India from the US, and several of RBI’s new rules for the payments industry came in after FY24, so the profit growth, while commendable, does come with some caveats.

Either way, one thing is clear, for Razorpay and other fintech giants, profitability involves walking the fintech tightrope set by the regulators. And that’s not always ideal, so can Razorpay balance itself for the long haul?

Razorpay’s Revenue Depth

The company claims to be processing transactions with a total payment volume (TPV) of $150 Bn.

As per industry watchers, this is among the highest in India’s payments gateway and payment aggregator market. “Only CCAvenue and PayU come close to this scale,” a rival fintech startup’s founder claimed.

lockquote>

To put this in context, digital payments transactions saw a 44% CAGR increase from 2,071 Cr in FY18 to 18,592 Cr in FY24 as per government data. The total value of these transactions have grown to INR 3,658 Lakh Cr in FY24.

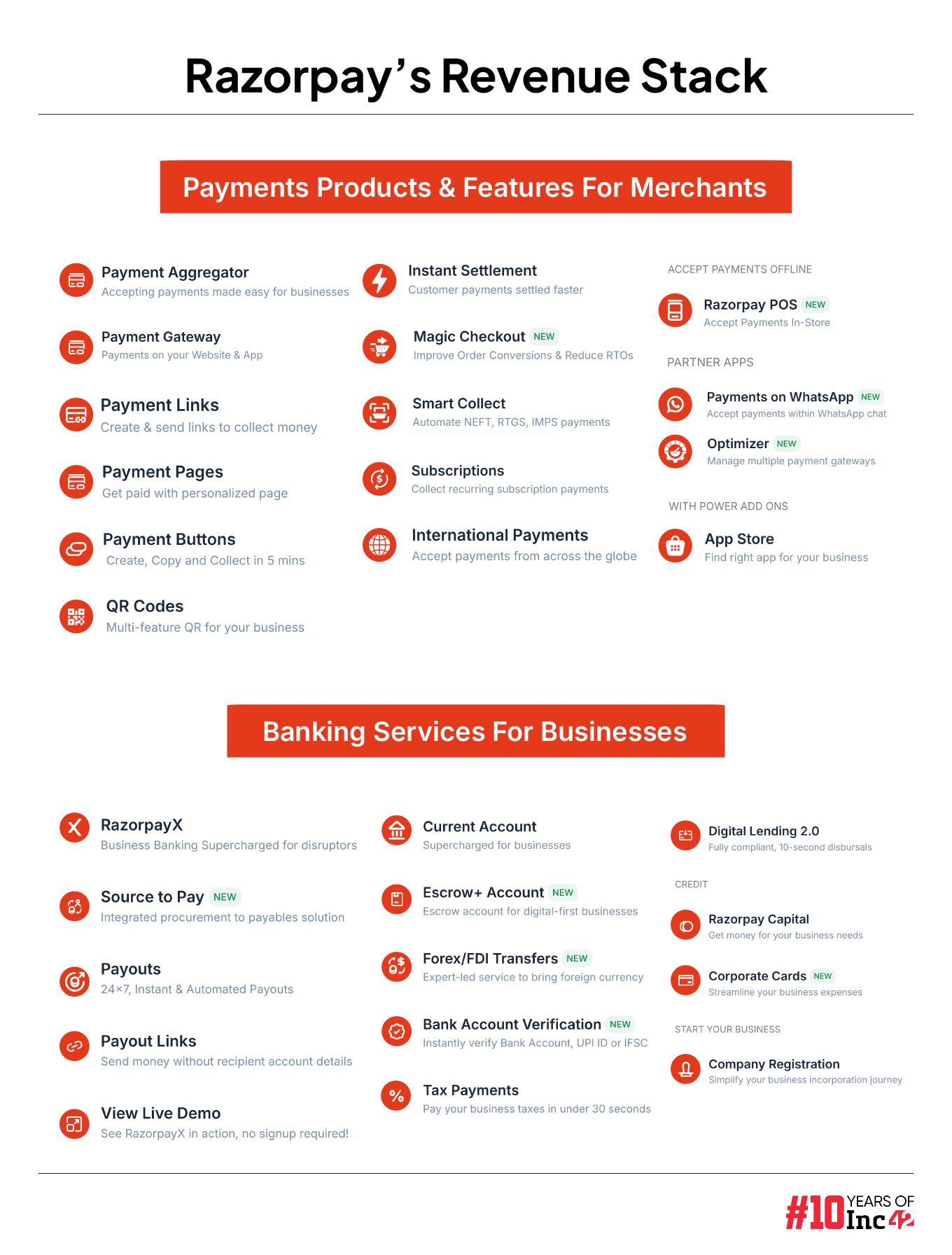

Today, Razorpay is a full-stack payments solution platform, but it built its reputation in the payments gateway space. In the early days of digital commerce, around 2015 and 2016, payment gateway were vital partners for marketplaces and online stores, but over the past eight years, there has been a rapid evolution.

The first phase of the evolution saw payment aggregators come into the picture, which collected payments from users and settled them en-masse with merchants and marketplaces, rather than processing each payment individually.

Razorpay entered the PA space with in-principle approval from the RBI, but in December 2022, the RBI banned companies from onboarding new users before getting full approval. This threw a spanner in Razorpay’s well-built machine.

In some ways, this could be seen as a blessing, because even the commerce ecosystem — particularly Razorpay’s D2C brand partners — was moving from online-first to omnichannel mode. Today, the payment aggregator (PA) business is the mainstay for Razorpay. Today, Razorpay claims to have 5 Mn businesses on board.

The company has built solutions for the wider ecosystem too, catering to problems such as tracking fraudulent ecommerce orders using customer insights, payroll disbursement, offline payments as well as cross-border payments.

However, any dissection of Razorpay’s business model has to start with the payment aggregator business.

Payment Aggregator Reality: Thin Margins, High Compliance

The payment aggregator model is an evolution of the payment gateway business. As the name suggests, a payment gateway is just a window through which an online transaction occurs.

A payment aggregator, on the other hand, collects payments from multiple users and then settles it en masse with the merchant or the marketplace involved in the transaction.

This key difference is also why the payment aggregator system has two layers — an online licence and an offline licence. In most cases, fintech startups want both licences so that they can cater to omnichannel operations.

Razorpay began setting up the PA business towards the end of 2021, and in July 2022, received an in-principle approval from the RBI for a PA licence. This was meant to be a major boost for Razorpay, but by December 2022, the RBI barred the startup along with the likes of Cashfree, Stripe, Paytm and PayU among others from signing up new users.

The central bank wanted these companies to get their full licence before going ahead with new user onboarding. It was only in December 2023 that Razorpay received the go-ahead along with others and since then the company has ramped up its merchant acquisition.

In Mathur’s own words, Razorpay was charged up since payments remained the core business, but while the RBI’s embargo was active, the company focussed on new products.

Even though companies had to jump through hoops to get the PA licence, many in the industry believe this business is more hype than substance. Challenges include wafer thin margins for PAs and other revenue sharing agreements between partner banks, telecom companies and other entities using the payment aggregator.

lockquote>

For instance, a former BharatPe CXO claimed that fintech startups cannot fully rely on the PA business to earn profits, even though it will help in driving revenue growth. The key aspect here is the merchant discount rate or MDR, which is zero for most UPI transactions.

“UPI is the most dominant digital payments mode in India. However, the share of small ticket transactions is close to 80%, even though volumes have soared. This doesn’t help payment aggregators as they cannot charge MDR on any UPI transaction under INR 2000. For higher value transactions, the aggregators will have to share revenue with the banks in the form of transaction fees. This is usually a 50:50 split,” the executive added.

lockquote>

All PAs have to tie up with banks to set up escrow accounts and enable the PA system for merchants. Hence, payment aggregators have to pay banks for transactions, depending on the value of the transaction and the mode of payment. In this case, MDR is higher for netbanking transactions and credit cards as opposed to debit cards or UPI.

The GST Council on the other hand is reportedly considering levying 18% GST on below INR 2000 transactions via debit, credit cards on payment aggregators. There was no GST levied earlier from PAs for such transactions. This could further impact margins on the PA side.

Razorpay’s PG business saw a 24% YOY growth in FY24 at INR 2,068 Cr. The overall revenues rose by a modest 9% to INR 2,501 Cr in FY24 compared to INR 2,293 Cr in FY23.

The Payment Aggregator Rush

Any payment aggregator with Razorpay’s scale has to rope in mid-cap and large-cap enterprise clients besides SMEs or startups, according to Rohit Taneja, CEO and founder of Decentro, an API platform for lending, payments and banking. Incidentally, Decentro also received the PA licence from RBI earlier this year.

This healthy mix is critical for transaction volume and higher margins. “With large enterprise clients including corporates and startups, the payment aggregators generally move towards an annual or quarterly revenue share model depending on the transaction value and volume,” Taneja added.

To break this down, if an aggregator helped a large business process transactions worth INR 13,000 Cr in a quarter, the aggregator will charge 0.5% to 1% commission or roughly INR 65 Cr to INR 130 Cr.

Industry analysts say Razorpay, to an extent, has succeeded in roping in big clients for tapping this revenue source. According to sources close to the company, Razorpay has been able to secure the likes of Tata Consultancy Services (TCS), Meta, Airtel, Swiggy, Indian Oil among others as clients.

A former Razorpay employee working for the PA business unit said that this business does ensure growth in margins, however many enterprises are also cutting costs by building in-house payment aggregator systems which could be a future challenge.

lockquote>

This is immediately apparent when we see the array of players in the payment aggregator space, and many of these have received licences just this year.

Since December last year, the RBI has approved the PA applications or has given in-principle approval to Zoho, Juspay, Decentro, CRED, PayU, Enkash, Pine Labs, Amazon Pay, Innoviti, Groww, Worldline Global, Razorpay, CC Avenue, Cashfree, Tata Pay, Google Pay, Infibeam Avenues, Mswipe, among others.

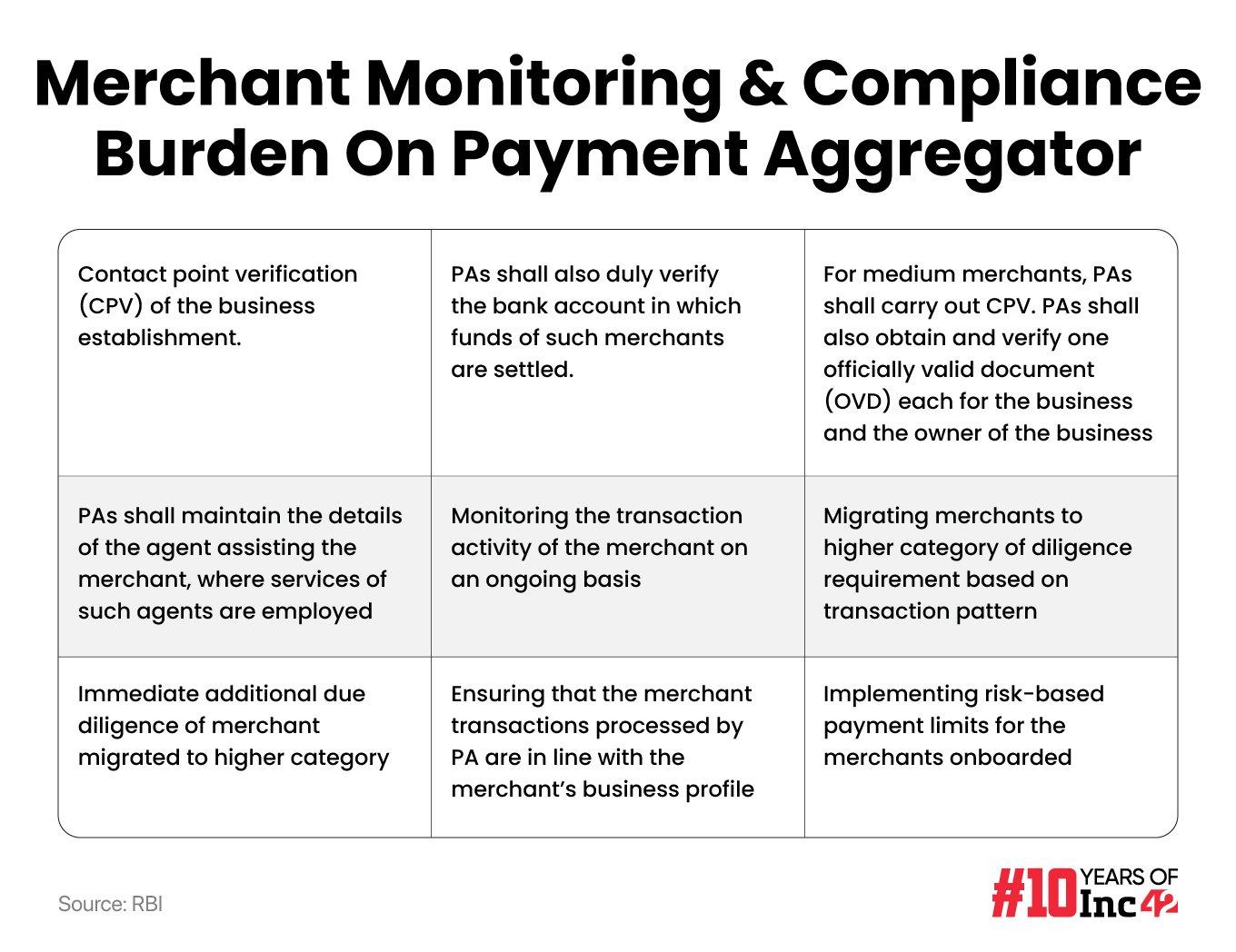

When we covered this PA rush in May this year, the primary challenge was around the high compliance bar for some of these players.

In earlier conversations with Inc42, industry insiders said that PAs in India will have to increase the strength of their in-house teams for customer verification purposes, since the RBI has called for physical verification of merchants and businesses empanelled. Some PAs could be compelled to empanel agencies and outsource the verification.

“This might be cheaper than hiring staff to conduct the verification in-house, but also opens up risks of inadequate checks by agencies that are dealing with large volumes. At the end of the day, the burden to ensure that the verification is done in the right manner still falls on the PA,” said another industry insider and cofounder of a digital KYC solutions company that works with a number of such payments companies.

lockquote>

Combined with the thin margins and high competitive intensity, even those companies operating at Razorpay’s scale do not have clarity on how a PA licence contributes to profitability.

Razorpay’s PoS Battle

The PA licence is not just for online transactions. Even offline digital payments through point of sale devices, some QR code devices among others are governed by the RBI’s licensing rules for payment aggregators.

In the offline space, Razorpay is counting on its PoS business — built on the Ezetap acquisition from August 2022 — but there’s more than stiff competition from the likes of Paytm, PhonePe, Google Pay, Pine Labs, BharatPe, Amazon Pay and banks.

In December 2023, Razorpay claimed that it saw a 60% growth in its POS business in FY23, and the company expects this to contribute 20%-30% of the revenue in the next couple of years.

A former Razorpay exec believes it will be an uphill climb for the company since the advantage continues to be with UPI platforms like PhonePe, Google Pay, Paytm, CRED and others. “These companies have been sitting on mammoth data of the users, merchants due to the UPI transactions volumes and were probably the earliest entrants in this ecosystem. So the challenge will be up against such players especially when it comes to small merchants, businesses,” the executive said.

lockquote>

In addition, PAs are also expected to ensure merchant transactions are in line with their business profile — this means continuous monitoring to identify red flags, if any. Payment aggregators are also mandated to have risk-based payment limits for merchants.

Razorpay’s revenue expectations from the PoS and offline payments business have to be tempered with this compliance burden.

The Cross-Border Opportunity

One trump card could be the cross-border payments business, where Razorpay competes with Cashfree, CCAvenue, PayU, Instamojo among others.

Razorpay received a cross-border payments licence from RBI in June 2023. “After reaching a TPV scale like Razorpay has, cross-border payments or international payments seem to be the natural avenue for diversifying business streams,” Decentro’s Taneja said.

lockquote>

Once again, this is a tightly regulated space where companies have to comply with ever-changing Foreign Exchange Management Act (FEMA) guidelines, the Liberalised Remittance Scheme (LRS) and Payments and Settlements Systems, 2007, in addition to any RBI guidelines.

Industry analysts say payment aggregators have simplified cross-border payments to a large extent compared to traditional banks by offering easy integration solutions through APIs without the need for extensive paperwork.

Furthermore, startups also charge lower transaction fees (1%-4%) and currency conversion fees while processing payments faster. “This space is gaining traction and because of the higher transaction values, it does offer better margins to PAs. Also as ecommerce builds up and more D2C brands cater to users outside India, this vertical shows a lot of promise for growth,” a senior fintech executive added.

lockquote>

Taneja highlighted that challenges in cross-border payments involve complex processes for onboarding merchants, especially large enterprise clients.

But Razorpay is swerving and catering to the masses. For instance, in June this year, Razorpay announced the MoneySaver Export Account for freelancers and independent professionals. It’s the first Indian PA to support international payments for freelancers, enabling international bank transfers and eliminating the need for additional paperwork.

There are positives for fintech companies operating outside India. A fintech analyst who was formerly associated with PhiCommerce said that Southeast Asia is becoming a new territory for expansion.

“There are hot markets like Indonesia, Malaysia, Thailand and even the Middle East, where businesses are drastically going for cashless payments. We have seen Indian PAs like Razorpay providing tech infrastructure to the payment companies there. They might not be able to process transactions directly without necessary approvals which again will be cumbersome. However, acquisition of local companies and consolidation is happening,” the analyst added.

lockquote>

Will Acquisitions Be Razorpay’s Trump Cards?

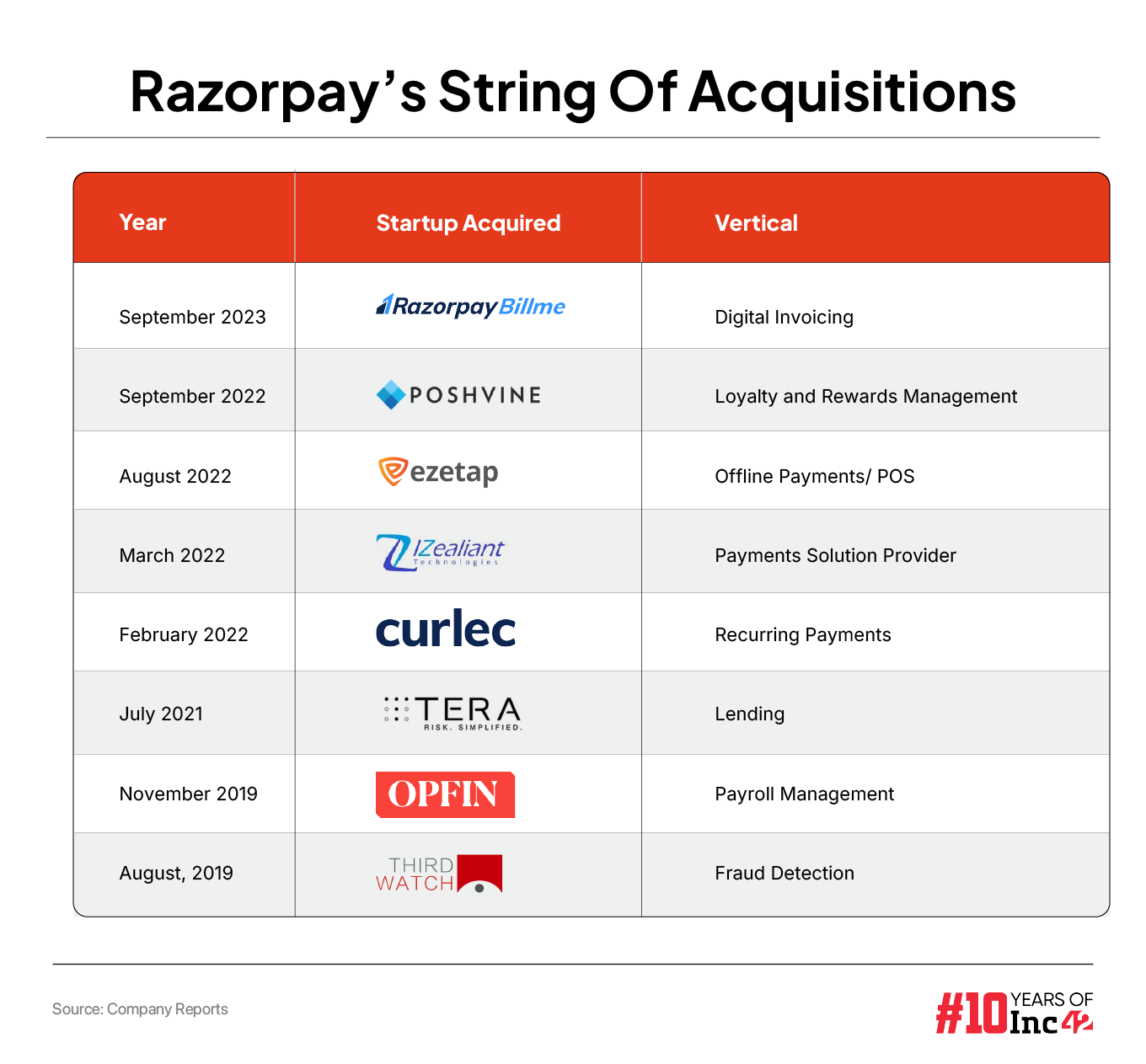

Razorpay forayed into international markets in February 2022 by completing its first overseas acquisition in the form of Curlec, a Malaysian recurring payments startup.

Industry watchers said that building a payment infrastructure model for many businesses in overseas markets will be a one-time revenue generation exercise, however, acquisitions will help them get into the core of the payments industry in these geographies. Working with local players in overseas geographies also involves strict adherence to local regulations and tie-ups with banks.

“Malaysia is an important strategic market for us as we see plenty of similarities with the Indian payments market. Our extensive experience in navigating the diverse and dynamic landscape of the Indian market empowers us to continually leverage that expertise, tackling various challenges and resolving payment issues on a global scale. I believe that we can help play a pivotal role in driving the adoption of DuitNow, similar to how we helped scale UPI in India,” Rahul Kothari, chief business officer for Razorpay, said in an earlier statement.

lockquote>

Razorpay’s product suite and value-added services can be largely attributed to the string of acquisitions since 2019.

Razorpay has forayed into niche verticals like HR services, payroll management, fraud detection, security, invoicing, cash rewards, and loyalty management, among others, through these acquisitions. In a bid to diversify its overseas revenue base, Razorpay will also need to identify which of these products will work in international markets. This will be critical to add to the profitability momentum in FY25.

This might be a challenging task for any growth-stage startups, but Razorpay’s revenue scale is an advantage. Nevertheless, there’s a difference between scale in fintech and other sectors. Even temporary setbacks due to regulations can have a damaging impact. And Razorpay runs this risk across geographies.

Can Razorpay balance its push for revenue across borders and verticals with the regulatory reality for fintech?

[Edited By Nikhil Subramaniam]

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)