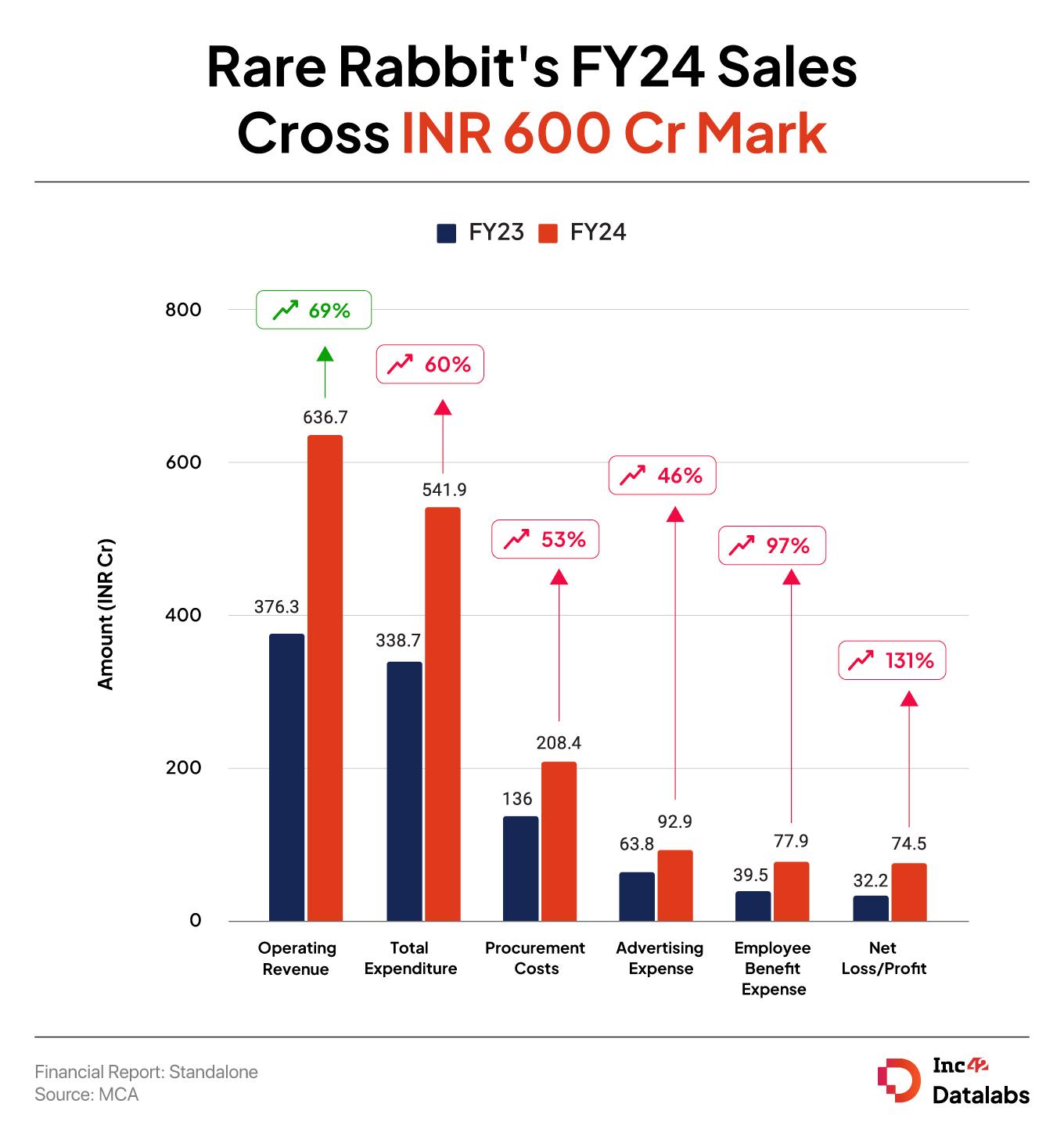

Rare Rabbit FY24: The startup’s parent, Radamani Textiles, posted a profit of INR 74.5 Cr in FY24, up 131% from INR 32.2 Cr in FY23

Including other income, the startup’s total revenue increased 1.5X to INR 641.8 Cr in FY24 from INR 381 Cr in the previous fiscal year

The House of Rare’s total expenditure rose 60% to INR 542 Cr from INR 339 Cr in the previous fiscal year.

Bengaluru-based fashion brand The House of Rare, which operates apparel brand Rare Rabbit, saw its net profit increase over 2X in the financial year ended March 31, 2024 on the back of rising sales. The startup’s parent, Radhamani Textiles, posted a profit of INR 74.5 Cr in FY24, up 131% from INR 32.2 Cr in the previous fiscal year.

Founded in 2015 by Manish Poddar and Akshika Poddar, The House of Rare operates three brands – Rare Rabbit, women’s brand Rareism, and everyday wear brand Articale. It earns revenue from sales of clothes, shoes, among others, via online and offline stores.

The House of Rare’s operating revenue zoomed 69% to INR 637 Cr during the year under review from INR 376 Cr in FY23.

Including other income, the startup’s total revenue increased 1.5X to INR 641.8 Cr in FY24 from INR 381 Cr in the previous fiscal. year.

Where Did Rare Rabbit Spend?

In line with the growing business, the startup’s expenses also increased. However, the rise in revenue was more than that in expenses. The House of Rare’s total expenditure rose 60% to INR 542 Cr from INR 339 Cr in the previous fiscal year.

Procurement Cost: Being an omnichannel clothing brand, the startup’s biggest expenditure was the cost of materials. It spent INR 208.4 Cr under the head in FY24, up 53% from INR 136 Cr in the previous year.

Advertisement Expenditure: The startup’s advertising expenditure stood at INR 93 Cr, up 46% from INR 64 Cr in FY23.

Employee Benefit Expenses: It spent INR 78 Cr on employee costs during the year under review, almost double of the INR 40 Cr it spent under the head in the previous fiscal year.

Earlier this year, the startup raised INR 150 Cr from A91 Partners, Nikhil Kamath’s investment firm Gruhas, Ravi Modi’s family trust (promoter of Manyavar) in its maiden funding round. The fundraise was likely a part of a bigger ongoing funding round of INR 500 Cr.

As per Inc42 estimates, the startup raised the funding at a pre-money valuation of INR 2,200 Cr (about $264 Mn).

The House of Rare competes against the likes of DaMenchs, The Souled Store, XYXX, among other apparel brands.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)