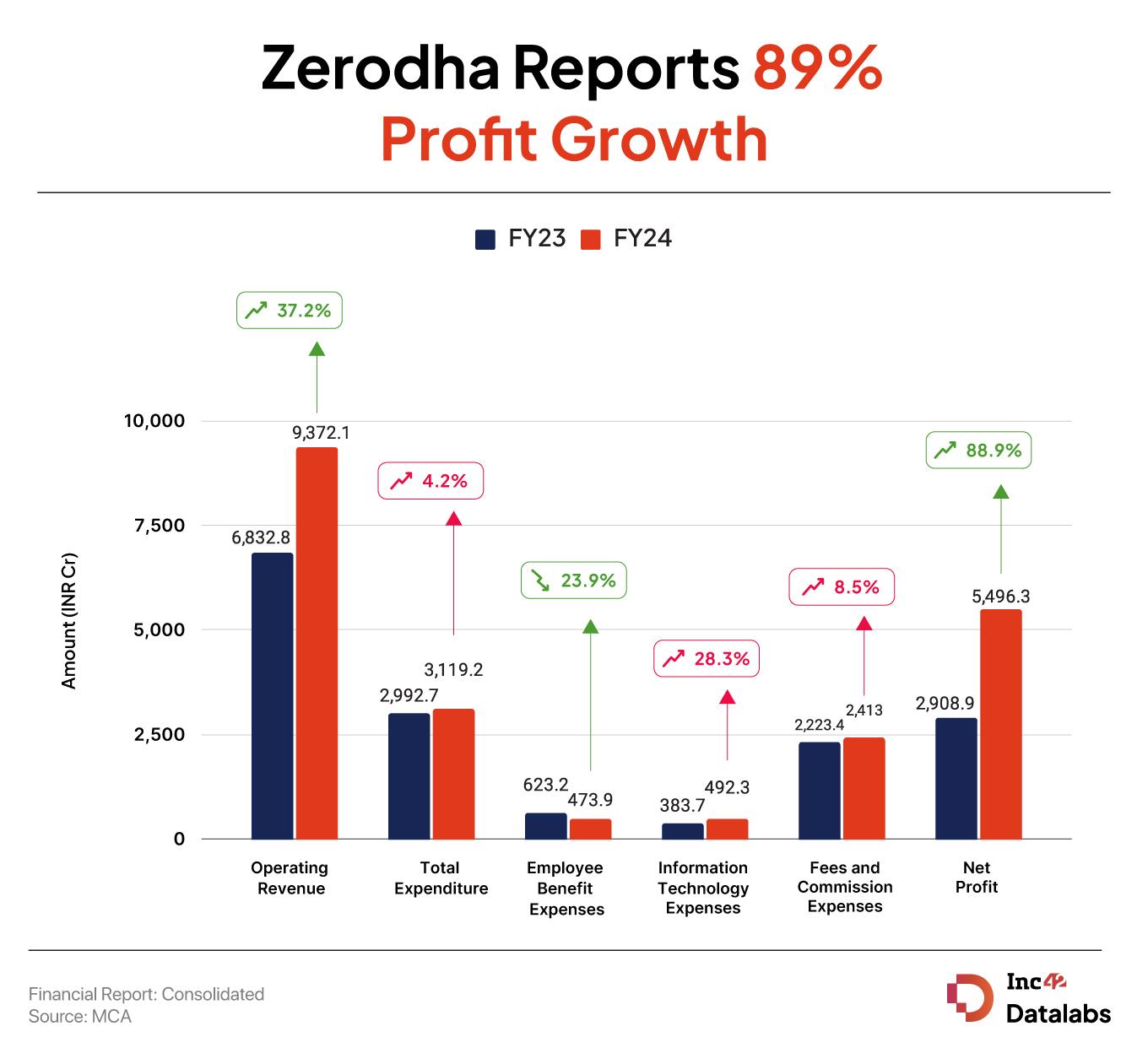

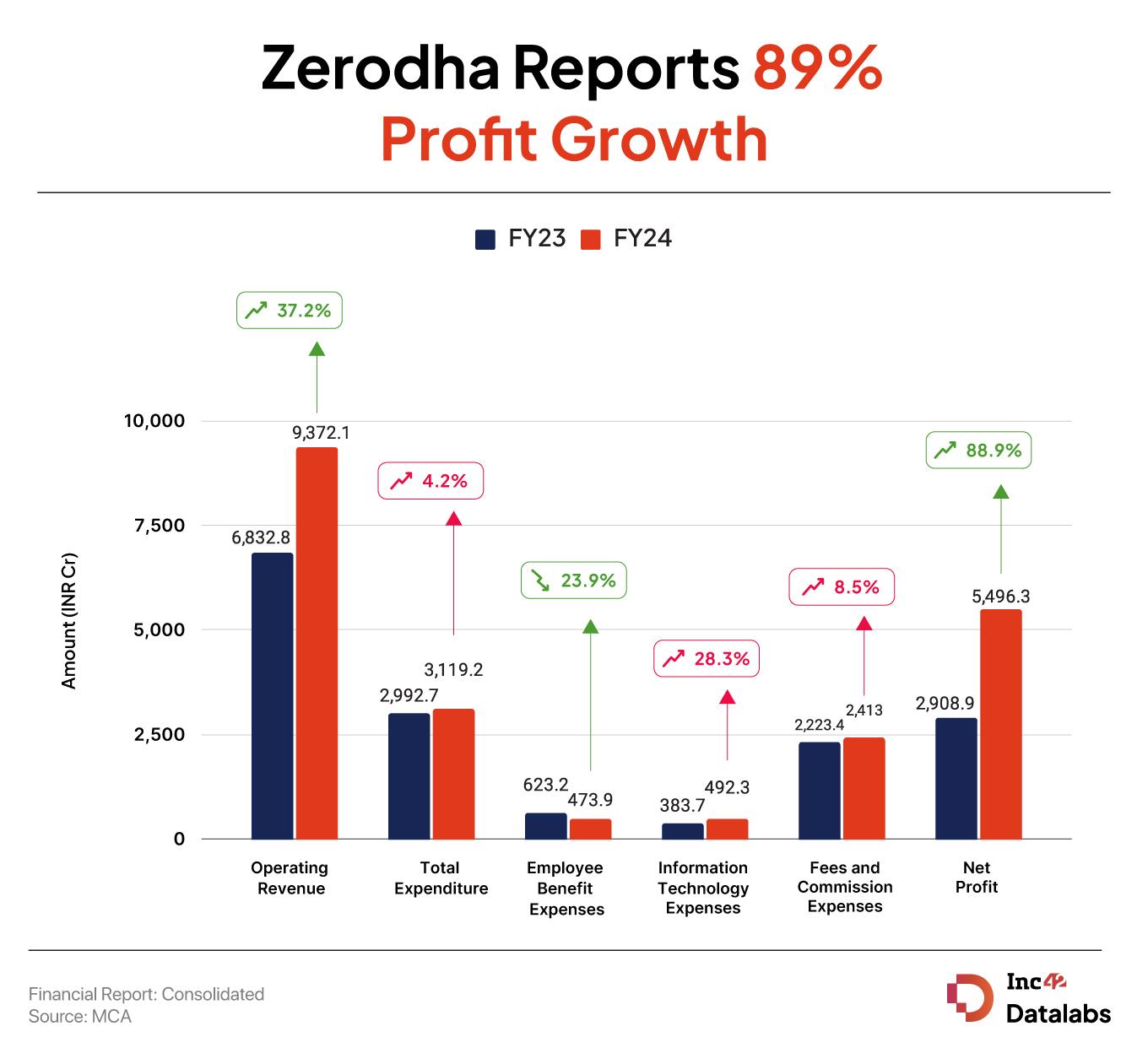

Zerodha’s revenue jumped 37% to INR 9,372.1 Cr in FY24 from INR 6,832.8 Cr in the previous year

Profit crossed the INR 5,000 Cr mark, surging 88.95% to INR 5,496.3 Cr from INR 2,908.9 Cr in FY23

Meanwhile, the company’s total expenses rose a mere 4.23% to INR 3,119.2 Cr in FY24 from INR 2,992.7 Cr in the previous year

Stock broking major Zerodha’s consolidated revenue jumped 37.16% to INR 9,372.1 Cr in the financial year ending March 2024 (FY24) from INR 6,832.8 Cr in the previous fiscal.

Including other income of INR 622.3 Cr, the startup’s total income rose to INR 9,994.5 Cr during the year under review.

Founded in 2010 by the brother duo of Nithin and Nikhil Kamayth, Zerodha

Zerodha managed to control its expenses relative to the rise in its top line, which resulted in improvement in margins. Consequently, its net profit surged 88.95% to INR 5,496.3 Cr during the year under review from INR 2,908.9 Cr in FY23.

Earlier this year, while announcing the financial results in a blog post, Zerodha cofounder and CEO Nithin Kamath announced that its total assets under management surged to INR 5.66 Lakh Cr.

However, Kamath also said that he expects the startup’s revenue and profit to plateau after the various changes proposed by the Securities and Exchange Board of India (SEBI) come into effect.

The markets regulator has taken a number of steps in recent times to improve transparency and protect the interests of retail investors, especially in the overheated future and options (F&O) segment.

SEBI’s new rules for the F&O segment, including a mandate for one weekly index expiry per exchange and increase in contract sizes, came into effect last month. Days after the regulator released the new framework, Nithin Kamath said he expected the trades on Zerodha to decline by 30%.

Last month, SEBI also released a consultation suggesting changes to the listing framework of small and medium enterprises (SME).

Where Did Zerodha Spend?

Zerodha’s total expenses rose a mere 4.23% to INR 3,119.2 Cr in FY24 from INR 2,992.7 Cr in the previous year. Here’s a detailed breakdown of its expenditure categories:

Employee Benefit Expenses: Zerodha reported a sharp decline in employee benefit expenses, which fell by 23.96% to INR 473.9 Cr in FY24 from INR 623.2 Cr in FY23.

The startup has about 1,200 employees currently.

Information Technology (IT) Expenses: Expenses under the head jumped 28.30% to INR 492.3 Cr from INR 383.7 Cr in FY23.

Fees & Commission Expenses: Expenses under the fees and commissions category increased 8.53% to INR 2,413 Cr in FY24 from INR 2,223.4 Cr in FY23.

This category included various subcomponents:

- Commission & Other Advisory Fees: This segment saw a slight decline, with expenses falling to INR 342.3 Cr from INR 356.3 Cr in FY23.

- Exchange & Depository Charges: These charges rose 6.43% to INR 1,570.5 Cr in FY24 from INR 1,475.6 Cr in FY23.

- Technology Fees & Related Expenses: This subcategory saw a considerable rise of 28.30%, growing to INR 492.3 Cr from INR 383.7 Cr in FY23.