Mumbai (Maharashtra) [India], June17: Mumbai based Falcon Technoprojects India Ltd specialized in providing mechanical, electrical and plumbing services to clients across sectors such as petroleum refineries, housing estates, nuclear power, construction etc is planning to raise up to Rs. 13.69 crore from its SME public issue. The company has received approval to launch its public issue on NSE Emerge Platform of National Stock Exchange. The public issue open for subscription on June 19 and closes on June 21. The Proceeds of the public issue will be utilised to fund company’s expansion plans including meeting working capital requirements and general corporate purposes. Kfin Technologies Ltd is the lead manager of the issue.

Company to issue 14.88 lakh Equity shares of Rs. 10 face value at Rs. 92 per share; To list NSE EMERGE Platform of NSE

| Highlights:- – Fresh Public issue of Rs. 13.69 crore opens for subscription from June 19 to June 21 – Minimum lot size for application is 1200 shares; Minimum IPO application amount Rs. 1,10,400 – Funds raised through the issue will be used to meet the working capital requirements and general corporate purposes – For 10 months of FY23-24 company reported revenues of Rs. 10.36 crore and Net Profit of Rs. 87 lakh – Company’s client list includes – BARC, BPCL, Akashvani, NPCIl, MOIL, Air India, Tata Housing, Lodha, L&T, JSW, GVK, Shapoorji Pallonji, Reliance, HAL, Jio, Hubtown among others. – Kfin Technologies Ltd is the lead manager of the issue. |

The initial public offering of Rs. 13.69 crore comprises of a fresh issue of 14.88 lakh equity shares of face value Rs. 10 each at Rs. 92 per share. Out of the fresh issue of Rs. 13.69 crore, company plans to utilize Rs. 10.27 crore towards working capital requirements and Rs. 2.81 crore towards general corporate purpose. Minimum lot size for the application is 1200 shares which translates in to investment of Rs. 1,10,400 per application.

Retail investor quota for the IPO is kept at 50% of the net offer. Promoter holding pre issue stands at 84.20%.

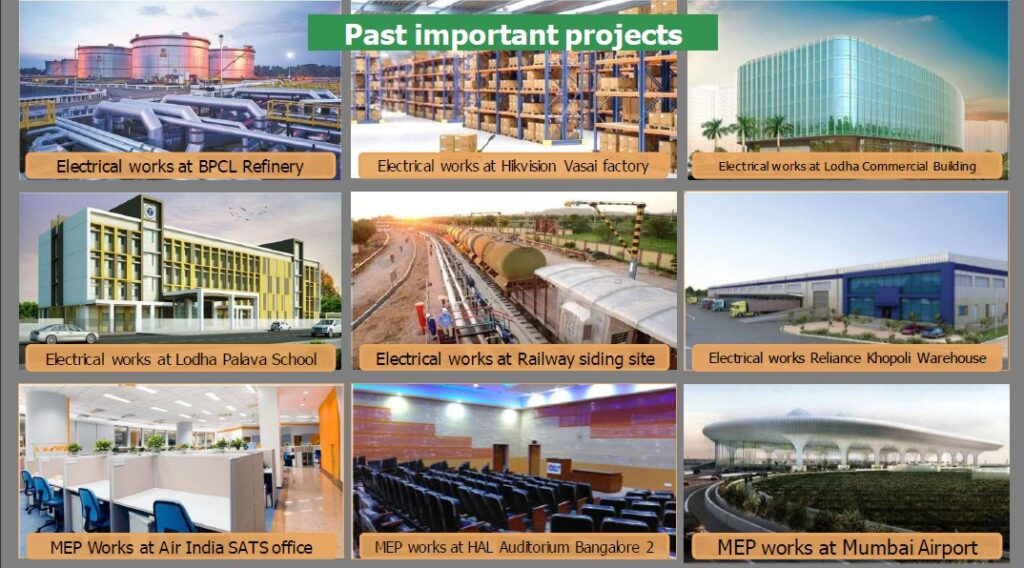

Established in 2014, Falcon Technoprojects India Limited provides mechanical, electrical and plumbing services to its clients across India and operates in various sectors such as petroleum refineries, housing estates, nuclear power, construction, etc. The company offers mechanical, electrical and plumbing (MEP) services. These services include the design, selection and installation of integrated mechanical, electrical and plumbing systems. This includes the installation of air conditioning, power and lighting systems, water supply and drainage, fire protection and fire extinguishing systems and telephones. Company’s client list includes – BARC, BPCL, Akashvani, NPCIl, MOIL, Air India, Tata Housing, Lodha, L&T, JSW, GVK, Shapoorji Pallonji, Reliance, HAL, Jio, Hubtown among others.

For 10 months of FY23-24 ended January 2024, company has reported net profit of Rs. 87 lakh and revenue of Rs. 10.37 crore as compared to profitability and revenue of Rs. 1.04 crore and Rs. 16.57 crore for 12 months of FY22-23.

As on January 2024, Net Worth of the company was reported at Rs. 8.98 crore, Reserves & Surplus at Rs. 5.11 crore and Asset base of Rs. 21.43 crore. As on 31st January 2024, ROE of the company was at 9.68%, ROCE at 11.54% and RONW at 9.68%. Shares of the company will be listed on NSE’s Emerge platform.

| IPO Highlights – Falcon Technoprojects India Ltd | |

| IPO Opens on | June 19, 2024 |

| IPO Closes on | June 21, 2024 |

| Issue Price | Rs. 92 Per Share |

| Issue Size | 14.88 lakh shares – up to Rs. 13.69 crore |

| Lot Size | 1200 Shares |

| Listing on | NSE Emerge Platform of National Stock Exchange |

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)