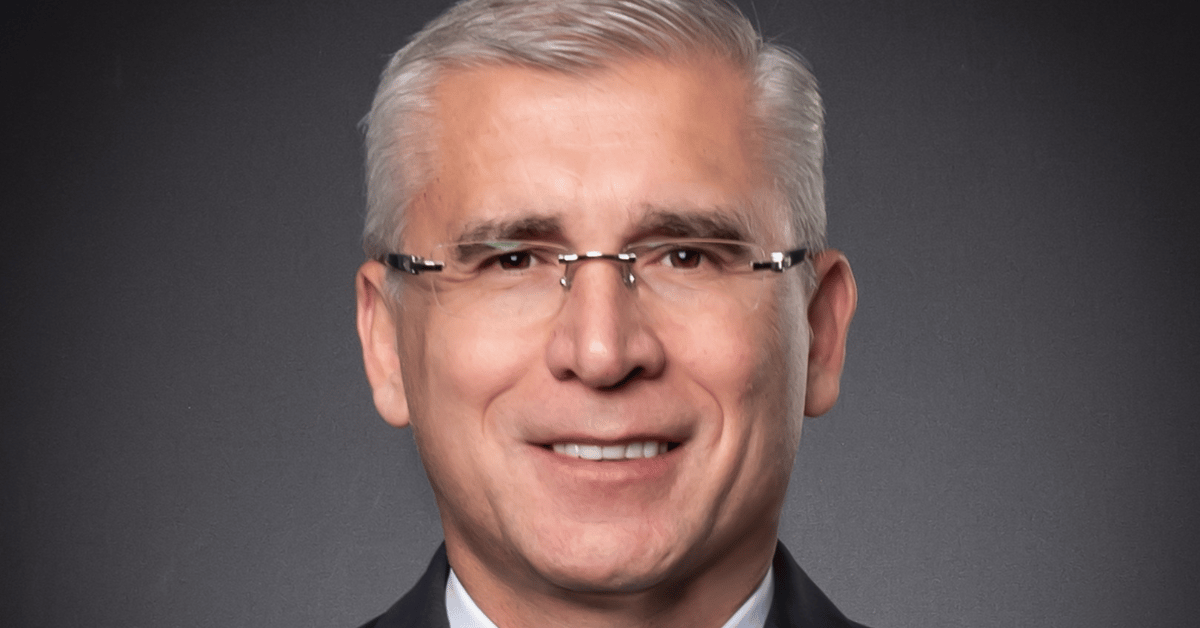

The IPO-bound startup has appointed manufacturing industry veteran Vadim Yakubov as the CEO of its US subsidiary Unimacts

In a statement, the startup said that its US subsidiary contributes 20-25% to its global revenues

Prior to joining the Zetwerk subsidiary, Yakubov has held top leadership positions at global private and Fortune 500 companies

IPO-bound B2B marketplace Zetwerk

In a statement, the startup said that its US subsidiary contributes 20-25% to its global revenues. It further added that, since initiating operations in the US in 2019, its team supporting operations in the country now stands at 350.

Recently, Unimacts expanded its operations in the country with the establishment of three factories and six operations centres across the US.

Unimacts, which is an abbreviation of Universal Industrial Manufacturing Services company, provides tooling, castings, forgings, fabrications and machine shop services to Industrial Original Equipment Manufacturers in North America, Western Europe, Japan and Australia.

The company sources its products and services from “high quality sources in low cost countries”.

“The US market is crucial to our global growth strategy. With Vadim at the helm of Unimacts, we’re well-positioned to capitalize on this opportunity. His experience and strategic vision align perfectly with ZETWERK’s goal of becoming a global manufacturing powerhouse,” Zetwerk’s cofounder and COO Srinath Ramakkrushnan said on the new appointment.

Prior to joining the Zetwerk subsidiary, Yakubov helmed designing and manufacturing solutions provider Acument. He also has held top leadership positions at global private and Fortune 500 companies such as Precision Castparts (PCC), Novares Group and Ford during his near three decade career.

Zetwerk has brought him onboard amid its bid to become a listed new age tech company within this year. On January 15, it was reported that it has shortlisted Axis Capital, Goldman Sachs Group, Jefferies Financial Group, JM Financial, JPMorgan Chase & Co and Kotak Mahindra Bank as bankers for its upcoming initial public offering (IPO). Reports ascertain that the company is likely to raise $500 Mn via the IPO which will value the Bengaluru-based startup at $5 Bn.

In its latest private funding round in December, the B2B marketplace startup raised $70 Mn at a valuation of $3.1 Bn. The startup plans to utilise the fresh proceeds will fuel its expansion in areas such as renewables, consumer electronics, and aerospace.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)