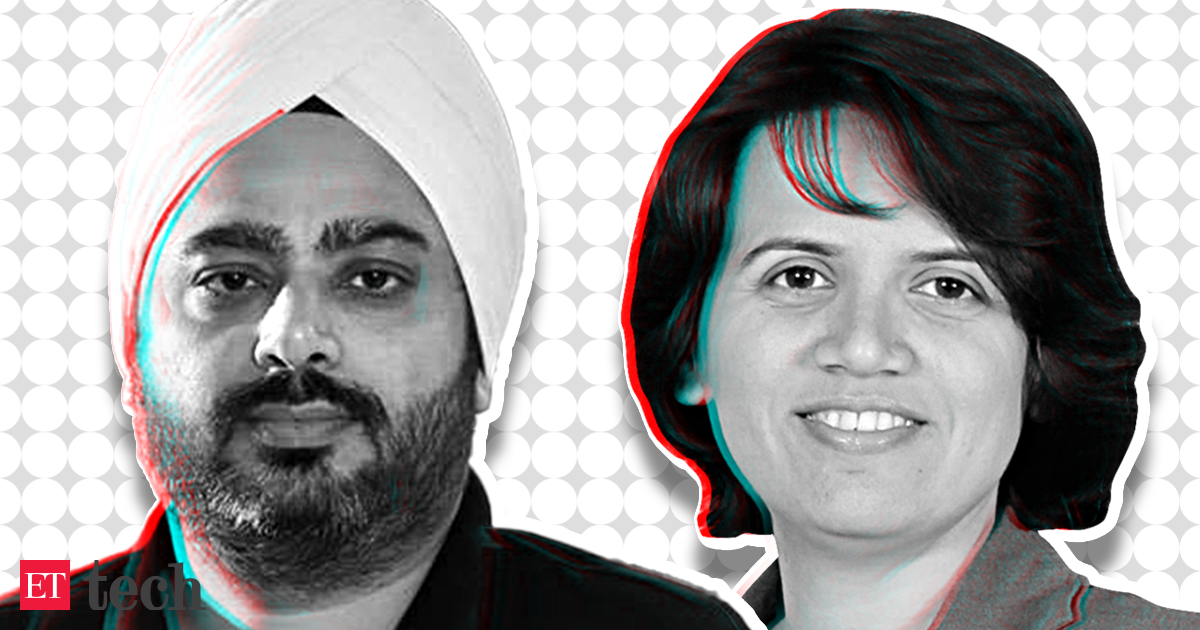

“Our partnership with ref=”dofollow” data-ga-onclick=”Inarticle articleshow link click#Tech#href” href=”https://economictimes.indiatimes.com/topic/piramal-finance” target=”_blank”>Piramal Finance marks a significant step towards addressing the credit needs of millions of Indians. By combining Piramal Finance’s expertise in financial services with MobiKwik’s digital platform, we are confident of creating a seamless experience for our users,” MobiKwik cofounder and MD Bipin Preet Singh MobiKwik said.

Under the partnership, MobiKwik app users pan India will have access to with the ref=”dofollow” data-ga-onclick=”Inarticle articleshow link click#Tech#href” target=”_blank” href=”https://economictimes.indiatimes.com/wealth/borrow”>loan amount for ref=”dofollow” data-ga-onclick=”Inarticle articleshow link click#Tech#href” href=”https://economictimes.indiatimes.com/topic/zip-emi” target=”_blank”>ZIP EMI ranging from Rs 50,000 to 2 lakh.

ZIP EMI is a personal loan service provided by MobiKwik.

Eligibility criteria for these loans are income exceeding Rs 25,000 and between the ages of 23 and 55 with payment tenure ranging between 6 months to 24 months.

Discover the stories of your interest

Before Piramal Finance, MobiKwik had eight partnerships in place to offer personal loans.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)