Online travel aggregator ixigo shares sank by 6.4% to INR 149.30 apiece on the BSE intraday trading session on the BSE today

The company’s market capitalisation currently stands at INR 5,938.44 Cr ($675.6 Mn)

To note, of the last five trading sessions, the company has ended three sessions in red

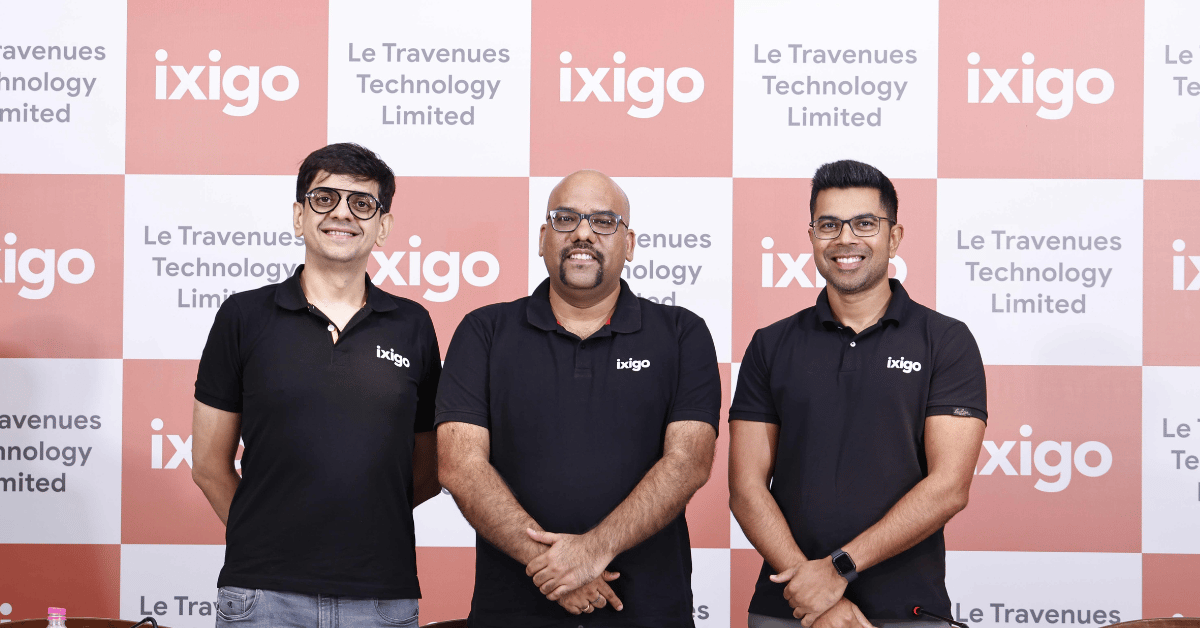

Online travel aggregator Ixigo

As of 01:57 PM, the stock was last down 4.5% at INR 152.35 per share on the BSE, compared to its previous close of INR 159.45 apiece.

The company’s market capitalisation currently stands at INR 5,938.44 Cr ($675.6 Mn).

To note, of the last five trading sessions, the company has ended three sessions in red.

Only a few days ago, ixigo received a GST demand order of INR 89.8 Lakh from the Haryana GST authorities, pertaining to the historical business of the company involving the “export of services alleged as intermediary services”, as per its filing.

On the financial front, the company’s consolidated net profit slumped 49% to INR 15.54 Cr in Q3 FY25 from INR 30.65 Cr in the year-ago quarter, while its revenue from operations zoomed 42% to INR 241.76 Cr during the quarter under review from INR 170.55 Cr in Q3 FY24.

Meanwhile, shares of the company plunged hours ahead of its third quarter earnings, marking its all-time low of INR 118.75 apiece on the BSE on January 28.

Following its results, the online travel aggregator allotted 10.58 Lakh equity shares to eligible employees under various employee stock option plan (ESOP) schemes. Post the allotment, the total paid-up share capital of ixigo, which stood at INR 38.97 Cr.

The company hit the exchanges on June 18, 2024, where it opened at INR 135 apiece, up 45.16% from the issue price of INR 93, on the BSE. Also, shares opened at INR 138.10 per share, a 48.5% increase from the issue price, on the NSE.

The stock has lost almost 5% year-to-date (YTD), as of its last close.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)