The Apple Savings APY falls again after a December drop, reaching a new all-time low of 3.75% APY.

The title=”Apple Savings” href=”https://appleinsider.com/inside/apple-savings” data-kpt=”1″ data-reader-unique-id=”2″>Apple Savings APY falls again after a December drop, reaching a new all-time low of 3.75% APY.

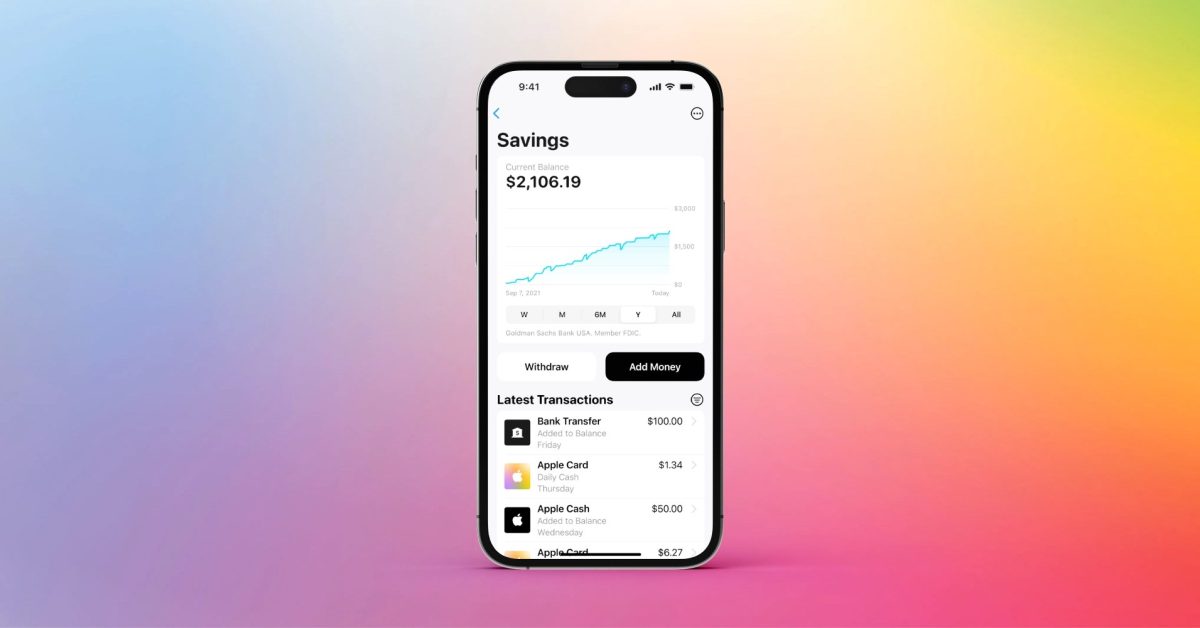

Apple launched a high-yield savings account attached to the Apple Card in April 2023 at 4.15% APY. It climbed up to 4.5% by January 2024 and saw its first rate cut in April to 4.4%, then a second cut to 4.25% in September, another to 4.10% in October, and then a drop to 3.90% in December.

Apple has begun notifying Apple Savings users of another APY dip late Tuesday night. The 3.90% rate was an all-time low for the high-yield savings account, but it has reached a new low of 3.75%.

When Apple launched Apple Savings in 2023, interest rates were high. The Federal Reserve lowered rates by a half a percent in September, then another quarter percent was cut in November — impacting the entire market.

Those rates held from January to March thanks to a pause in decreases by the Federal Reserve. However, uncertainty due to economic challenges and inflation could see rates drop again soon.

Watch the Latest from AppleInsider TV

Apple’s competitors are lowering interest rates too, so Apple Savings remains competitive, but not the best option. The market ranges between 3.70% and 4.41% interest rates on high-yield accounts.

Apple Savings users don’t need to take any action. The 3.75% interest rate is already in effect.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)