GIC spearheaded the round with a total investment of INR 354.4 Cr while RTP Capital and Sofina poured INR 74.9 Cr and INR 25.9 Cr, respectively

The fintech major raised the capital at a valuation of 3.5 Bn, down nearly 45% from $6.4 Bn at which it was last pegged in 2022

CRED is said to have taken the hefty valuation cut as it is exploring a potential initial public offering (IPO) in the next two years

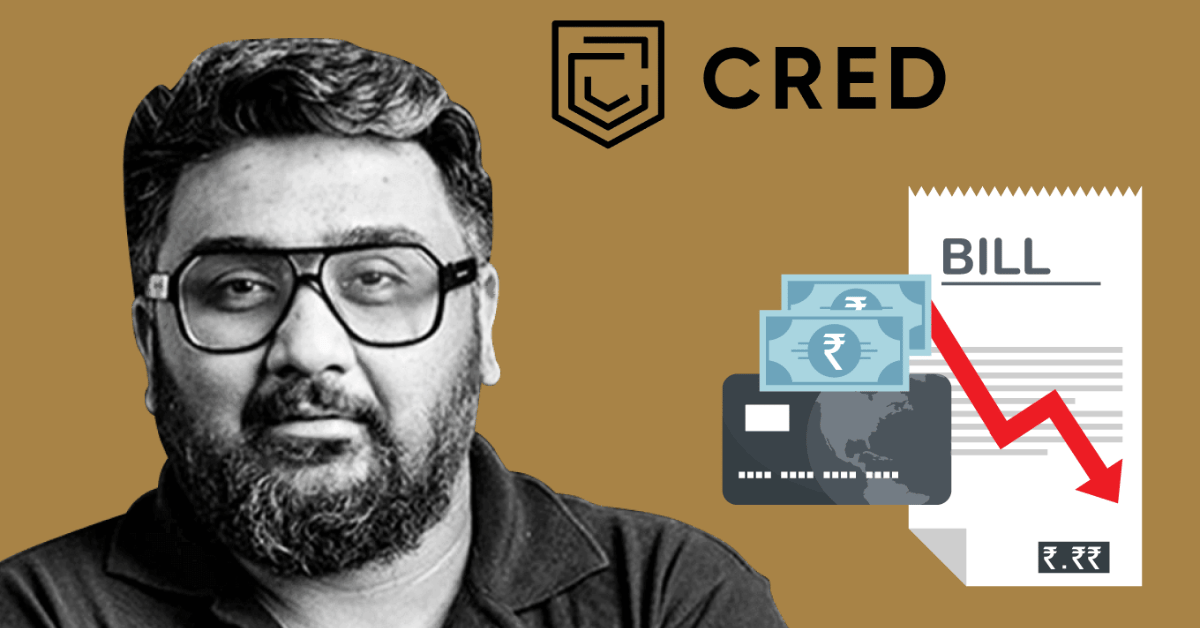

Kunal Shah-led fintech unicorn Cred

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)