Inflation Spike Puts Pressure on Reserve Bank Interest Rates

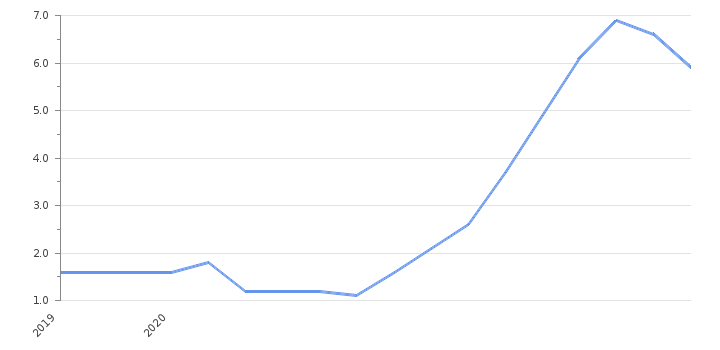

Australia’s economy faced an unexpected setback this month as the Australian inflation rate climbed to a 16-month high, dampening optimism for early Reserve Bank interest rate cuts. The latest data has alarmed policymakers and economists, signaling that the battle against rising prices is far from over.

According to newly released economic figures, the inflation rate in Australia accelerated faster than anticipated, driven by soaring fuel prices, housing costs, and a sharp uptick in essential goods and services. The unexpected increase has disrupted financial markets and led analysts to predict that the Reserve Bank of Australia (RBA) may maintain its restrictive stance on interest rates for longer than previously forecast.

Key Drivers Behind the Inflation Spike

The spike in the Australian inflation rate has been primarily attributed to global oil price volatility, higher energy bills, and sustained demand in the housing and rental sectors. Food prices also rose steadily, reflecting both supply chain disruptions and extreme weather conditions affecting agricultural production.

Economic experts have noted that while core inflation—excluding volatile items such as fuel and food—has remained stable, the broader consumer price index (CPI) continues to climb.

“Inflation remains sticky,” said one Sydney-based economist. “The latest figures suggest that the RBA’s job is not yet done, and any discussion of early rate cuts is now off the table.”

Reserve Bank’s Reaction and Policy Outlook

The Reserve Bank interest rates have remained unchanged at 4.35% since the last monetary policy meeting, but the latest data may prompt the RBA to reconsider its future course.

Governor Michele Bullock previously hinted at the possibility of a pause in rate hikes if inflation continued to cool. However, with the inflation rate in Australia now reversing course, the central bank is expected to remain cautious.

“The RBA will not risk easing too soon,” said a senior market strategist. “They will likely wait for several consecutive months of inflation moderation before considering any cuts.”

The RBA’s next meeting is expected to draw significant attention from both investors and households, as the direction of Reserve Bank interest rates directly affects mortgage repayments, savings returns, and overall consumer spending.

Impact on Households and Businesses

The latest rise in the Australian inflation rate is set to have a ripple effect across the economy. Households already facing higher living costs will continue to struggle with elevated grocery and fuel prices, while mortgage holders may see relief delayed as rate cuts remain out of reach.

Small and medium-sized businesses, particularly in retail and hospitality, could also feel the squeeze. Many are already contending with declining consumer confidence and rising operational costs, which limit their ability to absorb price increases.

“This inflation report is a reality check,” said an economic analyst. “It shows that Australia’s cost-of-living crisis is far from over, even as wages have shown modest growth.”

Global Context and Economic Comparison

Australia’s inflation trend mirrors similar patterns seen in other advanced economies, where progress in controlling price rises has proven uneven. The U.S. Federal Reserve and the European Central Bank have also adopted cautious approaches, wary of reigniting inflation by cutting rates too quickly.

Despite these challenges, economists believe that Australia’s long-term inflation trajectory remains manageable. The RBA’s consistent policy stance and the nation’s strong employment figures offer some reassurance that inflation will gradually return to target in the medium term.

Financial Market Reaction

Following the release of the inflation report, the Australian dollar strengthened slightly against the U.S. dollar, as traders recalibrated expectations for the timing of rate cuts. Meanwhile, bond yields rose, reflecting growing concerns about persistent inflationary pressures.

Stock markets, particularly in the banking and real estate sectors, saw minor volatility as investors digested the news. Analysts noted that sectors sensitive to Reserve Bank interest rates—such as property and construction—may face further headwinds if borrowing costs remain high.

Looking Ahead

The coming months will be critical for Australia’s economic outlook. Policymakers will closely monitor inflation data, wage growth, and household spending trends to determine whether current monetary settings are sufficient.

For now, economists agree that the Reserve Bank of Australia is unlikely to deliver any rate relief until at least mid-2026, barring a sharp slowdown in inflation or economic growth.

“The RBA will stay patient,” said one economist. “It’s a delicate balancing act between curbing inflation and avoiding unnecessary pressure on households.”

Conclusion

The surprise increase in the Australian inflation rate has effectively delayed hopes for interest rate cuts, reaffirming the Reserve Bank’s cautious approach. With inflation pressures persisting across key sectors, Australians may need to brace for an extended period of high borrowing costs and elevated living expenses.For continuous updates on economic policy, inflation trends, and financial insights, visit StartupNews.fyi.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)