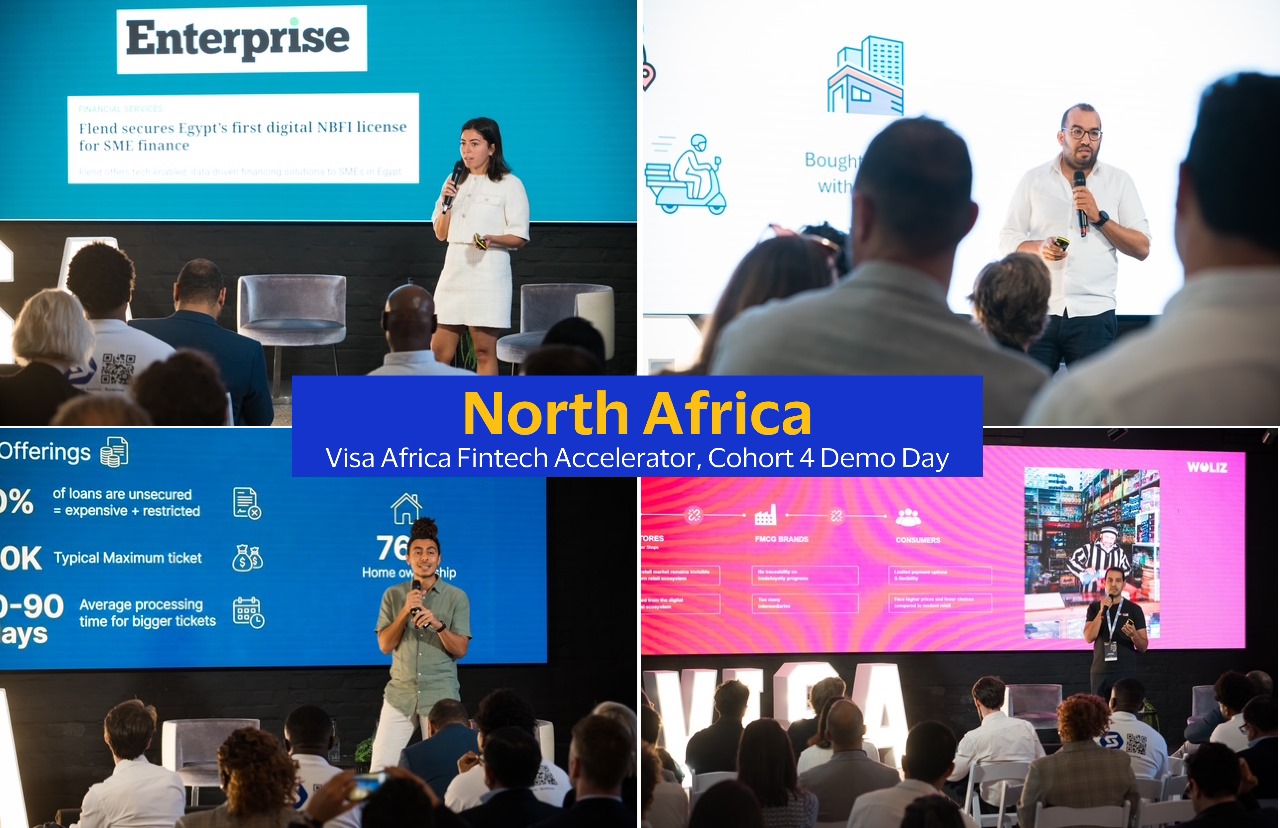

Visa, a global leader in digital payments, convened founders, investors, corporate partners, and industry leaders in Cape Town for the Visa Africa Fintech Accelerator program Cohort 4 Demo Day. The event spotlighted 22 high-growth fintech startups from across the continent, marking the culmination of an intensive three-month journey to develop and scale innovative digital commerce solutions.

Cohort 4 reflects the continued momentum of Africa’s fintech landscape and demonstrates the strength, diversity, and ambition of the region’s innovators. This year’s group includes startups headquartered in 12 African countries and operating across 31 markets. Women-led innovation stands out as a defining feature of this cohort, with eight female founders and 90 percent of participating startups having a women part of their leadership team.

With Cohort 4, Visa has now accelerated 86 African fintech startups, which collectively hold a cumulative valuation of USD 1.3 billion. Alumni continue to scale into new markets, secure follow-on investment, and develop deeper commercial engagements with Visa.

Leila Serhan, Senior Vice President and Group Country Manager for North Africa, Levant and Pakistan at Visa said: “Africa’s fintech landscape continues to expand at extraordinary speed, powered by founders solving real-world challenges and reshaping the future of digital commerce. The startups in Cohort 4, including four standout fintechs from North Africa, Flend and Mnzl from Egypt, and Hsabati and Woliz from Morocco, truly capture the energy and ingenuity driving Africa’s fintech transformation. We are proud to stand behind their journey and eager to see the new possibilities they unlock as they scale across the continent.”

Structured pathways to investment and global partnerships

The Visa Africa Fintech Accelerator program offers startups a pathway to scale through hands-on, specialized support. Participating companies receive guidance across product design, marketing, finance, and sales, as well as one-to-one mentorship from experienced founders and industry specialists. The program also helps startups build strategic partnerships and access investment opportunities through Visa’s extensive global network.

This year’s program also deepened collaboration with three strategic corporate partners – Bank of Africa, Onafriq, and First Bank of Nigeria Ltd. Each partner played a pivotal role by sharing industry expertise, market insights, and access to their broad operational capabilities. Their involvement not only enriched the cohort experience but also opened pathways for potential commercial partnerships, investment opportunities, and proof-concept engagements. Together, this expanded strategic community is helping to unlock new business opportunities and drive collaborative growth across Africa’s financial ecosystem.

A Sector on the Rise

Fintech continues to be the engine of Africa’s venture ecosystem. McKinsey estimates that Africa’s fintech revenues could reach US$47 billion by 2028, rising from approximately US$10 billion in 2023—a trajectory that highlights the sector’s significant commercial potential. The broader ecosystem is expanding at pace as well: the number of active fintech companies nearly tripled between 2020 and early 2024, increasing from 450 to 1,263 firms, according to the European Investment Bank. Together, these indicators reinforce the strong investor confidence and growing consumer demand driving the adoption of digital‑first financial services across the continent.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)