Google and Axis Bank today joined forces to launch the Google Pay Flex Axis Bank Credit Card, a UPI-powered co-branded credit card designed to simplify and elevate the entire card experience for India’s financial needs. Built on the RuPay network, the card aims to make the credit experience as ubiquitous as the UPI payments people make every day, powered by Google Pay’s convenient, secure experience and Axis Bank’s trusted banking expertise.

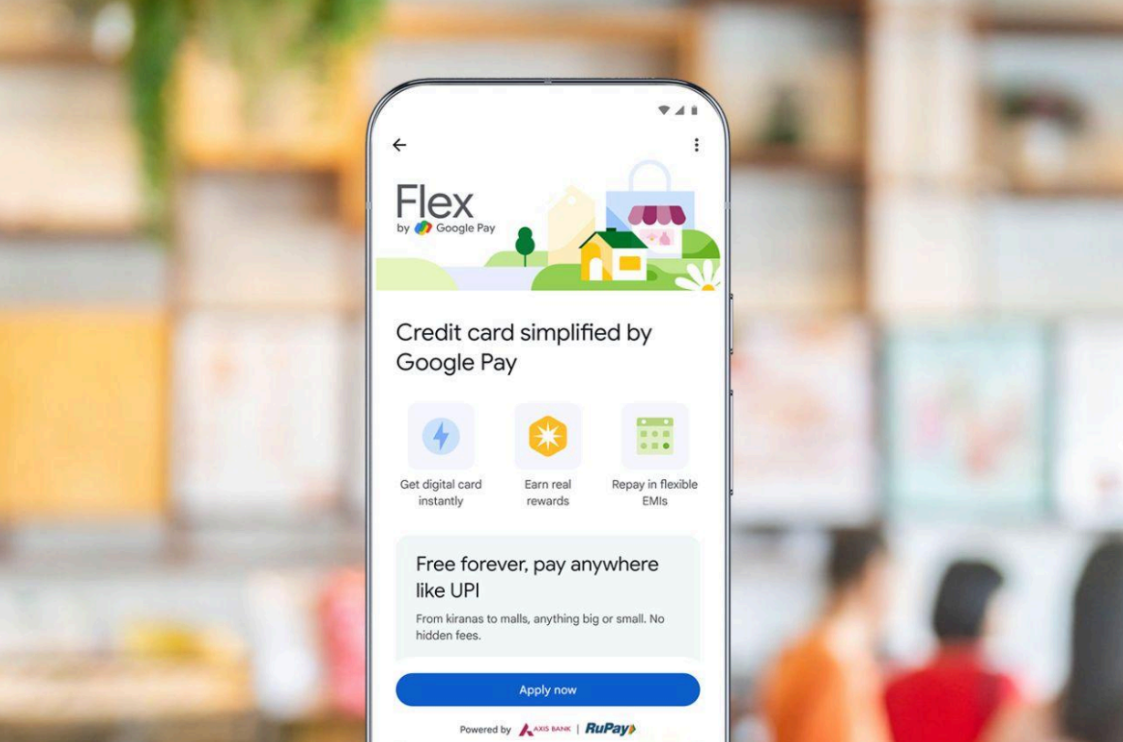

The Google Pay Flex Axis Bank Credit Card is the first launch as part of Flex by Google Pay, Google’s latest offering aimed at making credit more simple and accessible for everyone, marking its foray into the co-branded credit card space. With Flex by Google Pay, users will be able to apply and receive the card within minutes and pay across millions of offline merchants or apps.

With every Flex transaction, users can earn and redeem reward points instantly, turning everyday spends into tangible benefits. Additionally, the card offers flexible repayment options via the Google Pay app, allowing users to convert credit card bills into EMIs effortlessly, ensuring convenience, control and financial flexibility.

Sharath Bulusu, Senior Director – Product Management, Google Pay, said:

“At Google Pay, our goal has always been to use technology to make financial products simple and accessible for everyone. While digital payments have become ubiquitous in India, transactional credit remains underpenetrated. We built Flex to bridge this gap, simplifying and reimagining the card experience for the next generation of users.

We’re thrilled to launch this first with Axis Bank and look forward to announcing more issuer partners very soon. By combining the widespread acceptance of the RuPay network and Axis Bank’s financial expertise with the trusted experience of Google Pay, we’re introducing a digital solution aiming to give users in India genuine confidence and control in their daily lives.”

Arnika Dixit, President & Head – Cards, Payments and Wealth Management, Axis Bank, said:

“We are delighted to continue partnering with Google to jointly redefine the digital payments experience for our customers. With UPI emerging as the preferred mode of payment, we identified a clear opportunity to co-create a credit offering tailored for the digital-first consumer.

This brings together Axis Bank’s leadership in financial solutions and Google Pay’s cutting-edge technology to simplify everyday transactions with instant rewards, flexible repayments options, and more. Seamlessly integrated into the Google Pay app, this card delivers a secure, convenient and rewarding experience that perfectly complements the modern Indian lifestyle.”

Sohini Rajola, Executive Director Growth, NPCI, said:

“We remain committed to delivering trusted and seamless digital payment experiences for consumers, and Google Pay Flex Axis Bank Credit Card furthers this mission by making everyday payments smarter. Users can enjoy enhanced convenience and instant rewards, all within a frictionless journey.

Key Features of Google Pay Flex Axis Bank Credit Card

● Simple Digital Application: Users will be able to apply at zero cost from anywhere and start transacting within minutes, with no physical paperwork required. The card lives entirely on the phone, giving users access to it anytime they need it.

● Pay anywhere, everywhere: Powered by the RuPay network, it gives users the freedom to scan and pay at millions of offline merchants or checkout on their favourite apps, for small or big payments.

● Instant Rewards: Stars earned on transactions are instantly redeemable on any Flex transaction, with a value of 1 Star = ₹1. Users don’t have to wait till month end to use their rewards.

● Flexible Repayment controls: Spends and bills can be tracked directly in the Google Pay app, with the option to pay in full or convert the credit card bill into EMIs.

● In-App Control: The Google Pay app allows users to easily manage their card usage, block/unblock the card, or reset their PIN instantly.

Google and Axis Bank are starting to roll this out today and look forward to bringing this to all users in the coming months. Interested users can join the waitlist directly within the Google Pay app.

To know more about the feature: Click here

About Google

Google’s mission is to organize the world’s information and make it universally accessible and useful. Through products and platforms like Search, Maps, Gemini, Gmail, Android, Google Pay, Google Play, Google Cloud, Chrome and YouTube, Google plays a meaningful role in the daily lives of billions of people and has become one of the most widely-known companies in the world. Google is a subsidiary of Alphabet Inc.

About Axis Bank

Axis Bank is one of the largest private sector banks in India. Axis Bank offers the entire spectrum of services to customer segments covering Large and Mid-Corporates, SME, Agriculture, and Retail Businesses.

It has 5,976 domestic branches (including extension counters) and 13,177 ATMs and cash recyclers spread across the country as on 30th September 2025. The Bank’s Axis Virtual Centre is present across eight centres with over ~1,786 Virtual Relationship Managers as on 30th September 2025.

The Axis Group includes Axis Mutual Fund, Axis Securities Ltd., Axis Finance, Axis Trustee, Axis Capital, A.TReDS Ltd., Freecharge, Axis Pension Fund and Axis Bank Foundation.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)