PayNearby, India’s leading branchless banking and digital network, has received Third-Party Application Provider (TPAP) approval from the National Payments Corporation of India (NPCI). The company has introduced PayNearby Saathi – an innovative platform that will seamlessly ensure onboarding of citizens on UPI in an assisted mode through PayNearby’s retail network.

UPI is one of the most preferred payment modes in India, with over 504 million active users and the potential to reach a significantly wider population. As digital payments continue to expand, a large segment of India’s adult population is actively beginning its digital adoption journey, creating strong opportunities to build trust, awareness and digital literacy. Addressing this opportunity, PayNearby, through its 15 lakh retail partners and Digital Naaris, is enabling citizens across Bharat to transact digitally with ease and confidence.

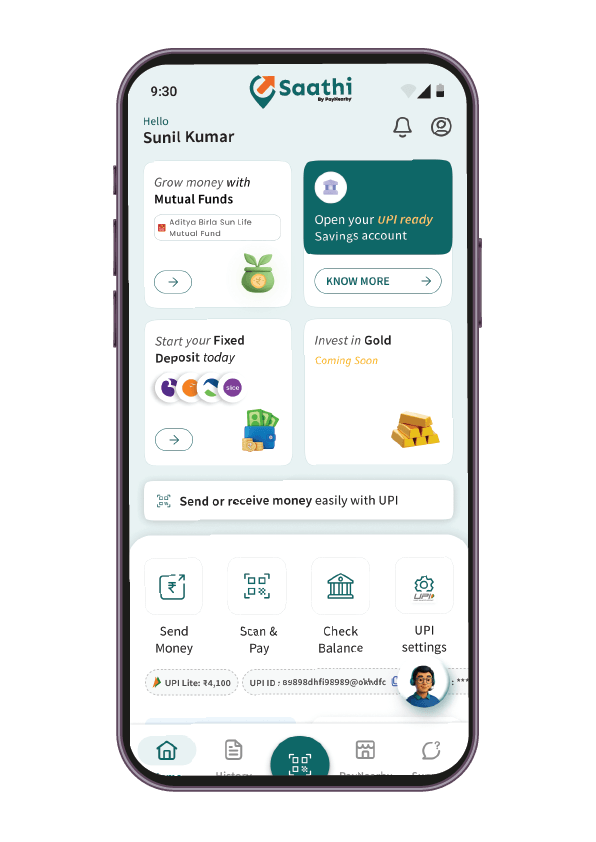

PayNearby Saathi is available in multiple Indian languages, offering a simple and comfortable onboarding experience for existing and first-time users. Besides UPI payments, it also integrates key financial services into one unified platform. These services include opening UPI-linked bank accounts, making and receiving payments, paying bills, and more.

The app is supported by a personal AI assistant that helps users to navigate the digital ecosystem with confidence. Designed for those new or need help with digital services, it provides education, awareness, and real-time guidance across offerings such as UPI, mutual funds, insurance, and savings. With integrated voice assistance, users can learn and transact easily in their local language.

Strengthening accessibility further, PayNearby Saathi also integrates Bhashini, the Government of India’s AI-driven speech technology, allowing users to speak in their preferred language, raise queries, and receive instant responses — ensuring every citizen can confidently adopt digital and financial services without barriers.

Anand Kumar Bajaj, Founder, MD & CEO of PayNearby said, “UPI has gone global and a reflection of India’s strong digital payment ecosystem. Yet, for millions in India this digital revolution is still waiting to unfold fully. Our Distribution-as-a-Service model solves for accessibility challenges, especially in semi-urban and rural areas. Building on this foundation, with PayNearby Saathi we have simplified technology, localised it, and brought it to their trusted retail stores. The TPAP recognition will further strengthen our commitment of connecting Bharat to India. Our next step is to strengthen our network extensively and ensure that every citizen becomes a part of India’s digital financial revolution.”

Over time, the PayNearby Saathi app will further add other essential financial services including micro-insurance, lending, credit etc., ensuring long-term financial empowerment for audiences in Bharat.

About PayNearby

Incepted in April 2016, PayNearby is a DPIIT-certified company and India’s leading branchless banking and digital network. PayNearby operates on a B2B2C model, where it partners with neighbourhood retail stores and enables them with the tools to provide digital and financial services to local communities.

PayNearby’s mission is to make financial and digital services available to everyone, everywhere. The company aims to simplify high-end technology so that it can be easily assimilated at the last mile while transforming the lives of its retail partners and customers.

Today, through its tech-led DaaS (Distribution as a Service) network, PayNearby enables services like cash deposits, withdrawals, ecommerce, credit, insurance, travel, utility payments, and more. Currently, PayNearby’s 12+ lakh retail partners & 1.5 lakh Digital Naaris spread across 20,000+ PIN codes assist over 5+ crore customers across the country, facilitating 25 crores yearly transactions.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)