Amazon shares moved higher after the company announced an expansion of a self-driving vehicle partnership through Amazon Web Services (AWS). The deal reinforces AWS’s position as a critical cloud and AI infrastructure provider for autonomous vehicle development. Investors reacted positively, viewing the move as a sign of growing long-term demand for AWS services beyond traditional cloud computing.

Shares of Amazon rose in trading after its cloud unit, Amazon Web Services, expanded a major deal linked to self-driving vehicle technology.

The development highlights AWS’s increasing involvement in powering next-generation mobility solutions, as autonomous vehicle companies rely heavily on cloud computing, artificial intelligence, and large-scale data processing.

What Drove the Amazon Stock Move

The stock reaction followed reports that AWS has broadened its collaboration with a self-driving vehicle company, extending cloud, data, and AI support for autonomous driving systems.

Key elements of the expanded deal include:

- Increased use of AWS cloud infrastructure

- Support for large-scale data storage and processing

- Advanced AI and machine learning tools for autonomous systems

- Long-term collaboration rather than a short-term contract

Investors interpreted the expansion as a validation of AWS’s role in mission-critical technologies beyond retail and enterprise IT.

Why AWS Matters in Autonomous Vehicles

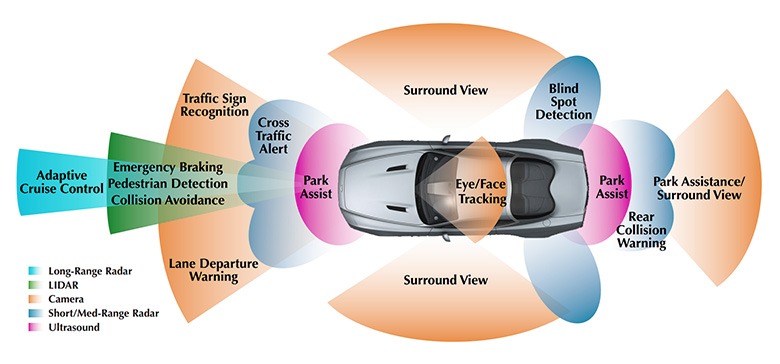

Autonomous vehicles generate massive amounts of data from sensors, cameras, and onboard systems.

AWS provides essential capabilities such as:

- High-performance computing for simulation and model training

- Real-time data analytics for vehicle testing

- Scalable cloud storage for sensor data

- AI and machine learning platforms for decision-making models

As self-driving technology evolves, cloud providers like AWS become deeply embedded in the development lifecycle.

Strategic Importance for Amazon

AWS remains Amazon’s most profitable business segment and a major driver of investor confidence.

The expanded autonomous vehicle deal supports several strategic goals:

- Diversifying AWS revenue streams

- Strengthening its presence in AI-driven industries

- Building long-term, high-value enterprise relationships

- Positioning AWS as foundational infrastructure for future mobility

This aligns with Amazon’s broader push into artificial intelligence and advanced computing services.

Market Reaction and Investor Sentiment

Following the news, Amazon shares posted gains as markets responded to the growth signal from AWS.

Investor sentiment has been influenced by:

- Renewed focus on AI and automation-related spending

- Expectations of sustained cloud demand despite macro uncertainty

- AWS’s ability to secure large, multi-year technology partnerships

The move underscores how AWS announcements can significantly impact Amazon’s stock performance.

Broader Autonomous Vehicle Landscape

The autonomous vehicle sector continues to face regulatory, technical, and cost challenges. However, investment in core technology infrastructure remains strong.

Key trends include:

- Increased reliance on simulation over physical testing

- Greater demand for scalable cloud and AI platforms

- Partnerships between tech firms and mobility companies

Cloud providers are seen as enablers rather than direct competitors in the autonomous vehicle space.

Competitive Context

AWS competes with other major cloud platforms in providing infrastructure for autonomous driving development.

Competition centers around:

- AI and machine learning toolkits

- Global data center availability

- Cost efficiency at scale

- Security and reliability

AWS’s expanded deal suggests it continues to win confidence in high-stakes, compute-intensive applications.

Why This Matters to Investors

For investors, the development reinforces the narrative that AWS is central to emerging technology ecosystems.

Key takeaways include:

- Autonomous driving is a long-term growth area for cloud services

- AWS continues to secure complex, high-value contracts

- Amazon’s growth story extends beyond e-commerce

These factors contribute to sustained optimism around Amazon’s long-term valuation.

Conclusion

Amazon’s share price rise following AWS’s expanded self-driving vehicle deal reflects growing investor confidence in the cloud unit’s strategic importance.

As autonomous vehicle developers increasingly rely on cloud-based AI and data infrastructure, AWS is positioning itself as a critical partner in the future of mobility. The expanded partnership highlights how emerging technologies continue to create new growth avenues for Amazon.

Key Highlights

- Amazon shares rise after AWS expands a self-driving vehicle deal

- AWS strengthens its role in autonomous mobility infrastructure

- Autonomous vehicles drive demand for cloud and AI services

- Investors view the deal as a long-term growth signal

- Reinforces AWS’s strategic importance within Amazon

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)