Global payments provider Stripe has partnered with Crypto.com to expand cryptocurrency payment acceptance across Stripe’s merchant network.

The integration allows businesses using Stripe to accept payments via Crypto.com Pay, enabling customers to transact with cryptocurrencies while merchants avoid exposure to price volatility through automatic fiat conversion.

This collaboration reflects growing demand for crypto-enabled commerce and positions Stripe as a key infrastructure provider in the evolving digital payments ecosystem.

How the Stripe–Crypto.com Integration Works

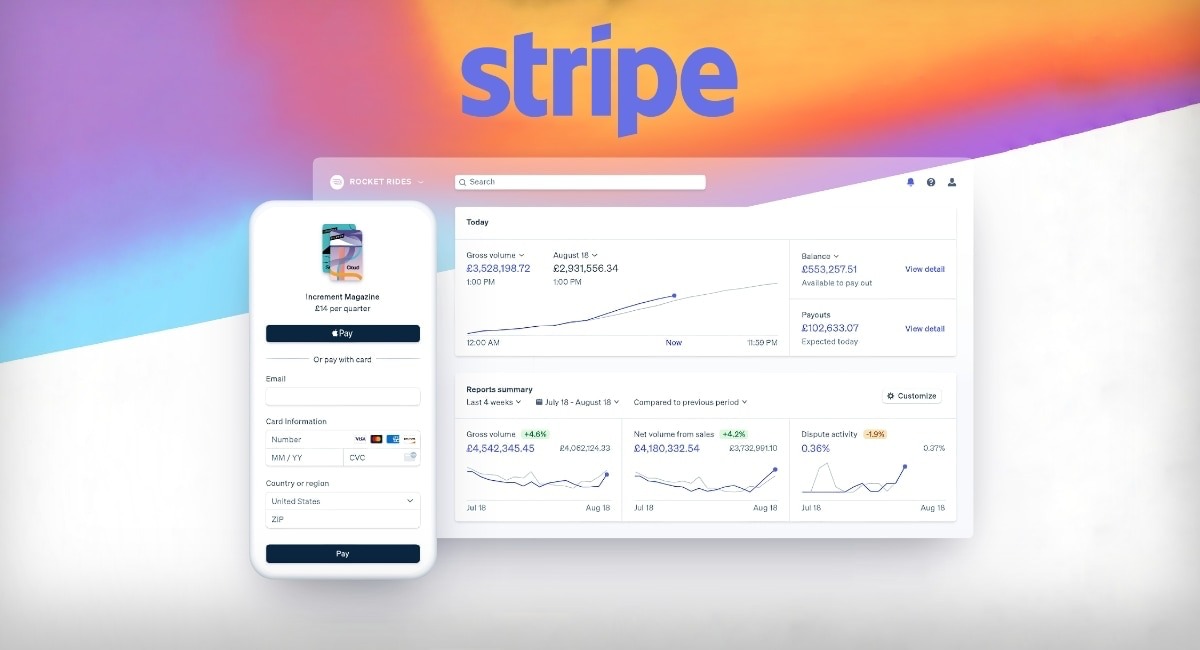

The integration embeds Crypto.com Pay directly into Stripe’s existing checkout experience.

Key functionality includes:

- Merchants can enable Crypto.com Pay without building custom crypto infrastructure

- Customers pay using supported cryptocurrencies from their Crypto.com wallets

- Stripe automatically converts crypto payments into the merchant’s local currency

- Funds are settled to merchant bank accounts like standard card transactions

By handling conversion and settlement, Stripe removes operational and accounting complexity for businesses interested in offering crypto payments.

What It Means for Merchants

For merchants, the integration provides access to a fast-growing segment of crypto-native consumers without introducing balance-sheet risk.

Merchant benefits include:

- Expanded payment options for global customers

- No need to custody or manage digital assets

- Reduced friction compared to standalone crypto payment tools

- Seamless integration with existing Stripe billing and checkout systems

This approach mirrors Stripe’s broader strategy of abstracting complexity while offering advanced payment capabilities to businesses of all sizes.

Consumer Experience and Use Cases

From the customer perspective, the checkout flow remains familiar.

Users selecting Crypto.com Pay can:

- Authorize payments directly from the Crypto.com app

- Pay with supported cryptocurrencies and stablecoins

- Complete transactions without converting assets manually

The process is designed to make crypto payments feel comparable to digital wallets or card-based checkouts, improving usability and trust.

Strategic Context: Stripe’s Expanding Crypto Strategy

Stripe has steadily re-entered the crypto space after previously scaling back its early Bitcoin support.

Recent initiatives include:

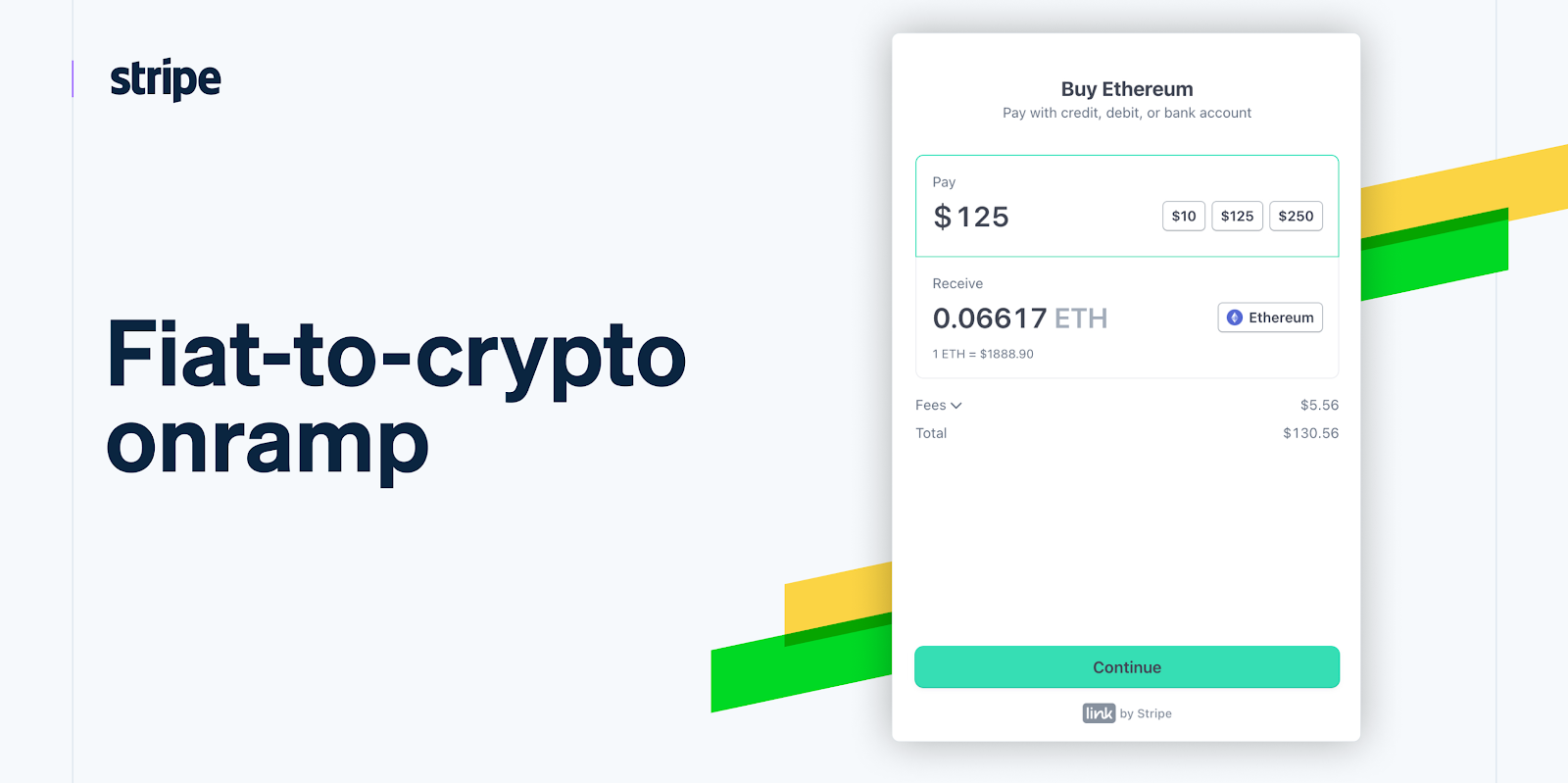

- Support for stablecoin-based payments

- Tools for crypto on-ramps and off-ramps

- Infrastructure for blockchain-based financial services

The Crypto.com partnership fits into Stripe’s broader push to support programmable money while maintaining compliance and risk controls.

For Crypto.com, the integration extends its payment utility beyond trading and custody, positioning Crypto.com Pay as a viable consumer payment method in real-world commerce.

Market Implications

The partnership highlights a broader industry trend where traditional payment platforms are converging with digital asset ecosystems.

Key implications include:

- Increased normalization of crypto as a payment method

- Reduced barriers for merchants experimenting with digital assets

- Greater emphasis on stablecoins for transactional use cases

As regulatory clarity improves in major markets, integrations like this could accelerate crypto adoption beyond investment and into everyday spending.

Competitive Landscape

Stripe’s move follows similar efforts across the payments industry:

- Major e-commerce platforms are piloting crypto checkout options

- Fintech firms are integrating blockchain-based settlement layers

- Payment providers are prioritizing interoperability between fiat and crypto

By partnering rather than building in-house wallets, Stripe leverages Crypto.com’s consumer base while maintaining its infrastructure-first model.

Conclusion

The Stripe–Crypto.com integration marks a meaningful step toward making cryptocurrency payments practical for mainstream businesses.

By combining Stripe’s global merchant reach with Crypto.com’s digital asset capabilities, the partnership removes key friction points that have historically limited crypto’s use in commerce.

As adoption grows, this collaboration could serve as a blueprint for how crypto payments integrate into established financial infrastructure without disrupting existing workflows.

Key Highlights

- Stripe integrates Crypto.com Pay for crypto checkout

- Merchants receive automatic fiat settlement

- Customers can pay directly from Crypto.com wallets

- No crypto custody or volatility exposure for businesses

- Strengthens Stripe’s long-term crypto payments strategy

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)