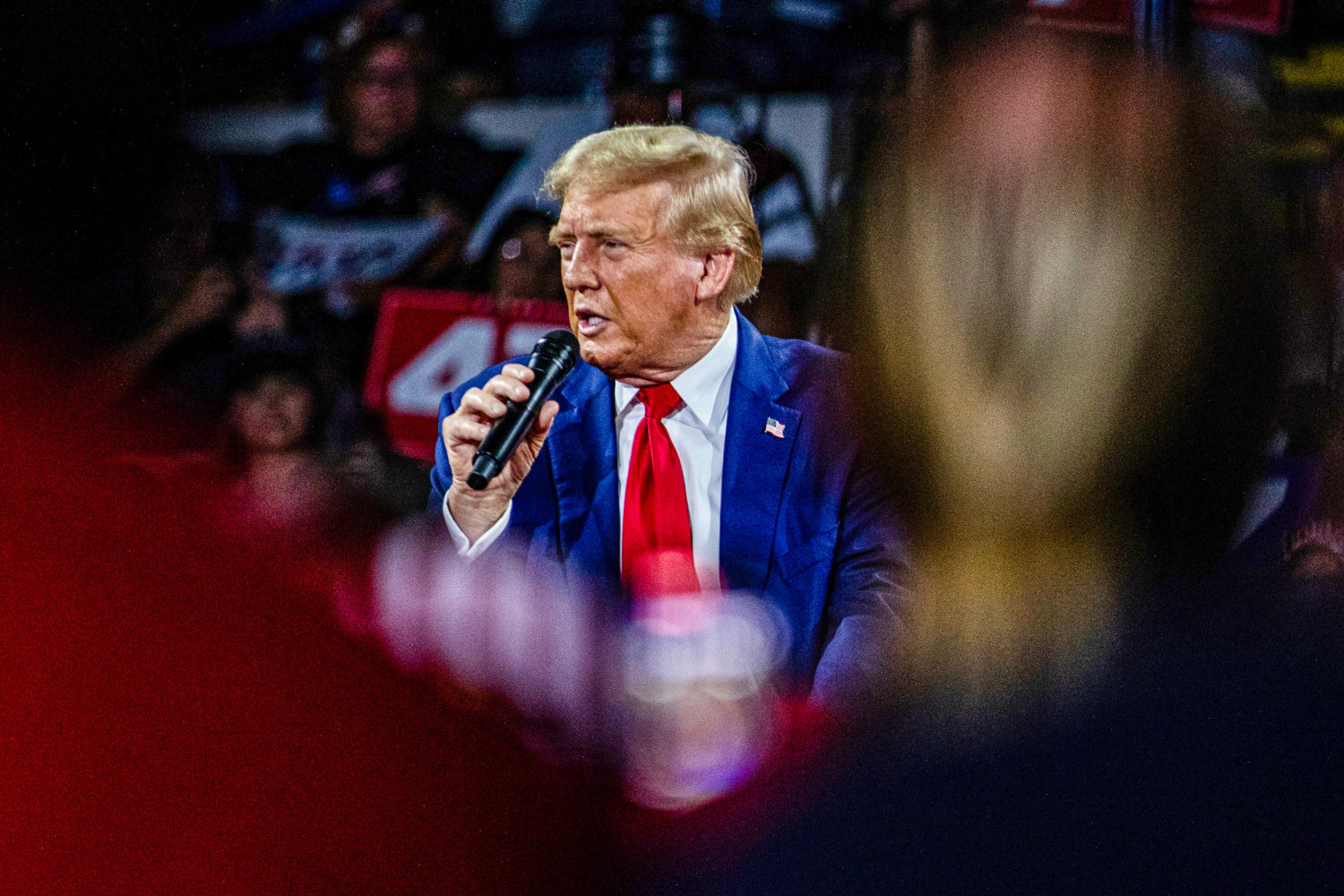

President Donald Trump has called for a one-year cap on credit card interest rates at 10 percent, positioning the move as consumer relief. The proposal follows his administration’s rollback of other fee limits, raising questions about feasibility, legality, and impact on borrowers and banks.

Introduction

President Donald Trump has reignited debate over consumer finance by calling for a 10 percent cap on credit card interest rates, even as his administration previously rolled back limits on other credit card fees. The proposal, announced publicly in early January, is framed as a temporary measure to protect Americans from high borrowing costs amid rising household debt.

The announcement has drawn attention not only for its potential impact on consumers but also for its timing and political context. Credit card interest rates in the United States remain near record highs, while outstanding consumer debt continues to climb. At the same time, critics point out that Trump’s administration had earlier weakened or eliminated several fee restrictions designed to protect cardholders.

This contrast has sparked debate over whether the proposal represents a genuine policy shift or a political signal with limited prospects for implementation.

Trump’s Proposal: A 10 Percent Credit Card Interest Cap

Trump has called on credit card companies to limit interest rates to 10 percent for one year, starting January 20, 2026. He described the move as necessary to stop financial institutions from “ripping off” American consumers through excessive interest charges.

The proposal does not currently include draft legislation or regulatory guidance. Instead, it is a public call to action directed at Congress and the financial industry.

If implemented, a 10 percent credit card interest cap would represent a dramatic reduction from current rates. Most U.S. credit cards today charge interest rates ranging from the high teens to well above 25 percent, depending on creditworthiness and market conditions.

The Trump credit card interest cap proposal has therefore been positioned as a form of immediate consumer relief, particularly for households carrying revolving balances.

Why Credit Card Interest Rates Are Under Scrutiny

Rising Consumer Debt

U.S. credit card debt has surpassed $1 trillion, driven by higher living costs, inflationary pressures, and elevated interest rates. Many households rely on credit cards to cover everyday expenses, making interest costs a significant financial burden.

Even small balances can grow quickly when interest rates exceed 20 percent. For lower-income households, this dynamic can lead to prolonged debt cycles.

High Interest Rate Environment

Credit card interest rates are closely linked to broader monetary policy. As benchmark interest rates rose over recent years, card issuers passed those costs on to consumers. Unlike mortgages or auto loans, credit card rates are variable and adjust quickly.

The result is an environment where consumers face some of the highest borrowing costs in decades, intensifying calls for regulatory intervention.

The Policy Context: Fee Limits Rolled Back

The Trump credit card interest cap proposal stands in contrast to earlier actions taken during his administration that reduced or eliminated certain fee restrictions.

Changes to Late Fee Rules

Under Trump’s leadership, federal agencies scaled back enforcement and oversight related to credit card late fees and penalty charges. These changes allowed card issuers greater flexibility in setting fees, which critics argue increased costs for consumers.

Supporters of the rollbacks said they reduced regulatory burdens on banks and preserved market efficiency. Opponents countered that the changes disproportionately harmed lower-income borrowers who are more likely to incur late fees.

Consumer Protection Debate

The rollback of fee limits has remained controversial. Consumer advocacy groups argue that late fees and penalty charges often exceed the administrative cost incurred by issuers, effectively functioning as profit centers rather than deterrents.

Against this backdrop, Trump’s call for a 10 percent interest cap has been viewed by some analysts as inconsistent with prior deregulatory actions.

Legal and Regulatory Challenges

Presidential Authority Limits

One of the central questions surrounding the Trump credit card interest cap is whether it can be implemented without congressional approval.

Legal experts widely agree that the president does not have unilateral authority to impose a nationwide interest rate cap on private financial products. Such a measure would require legislation passed by Congress.

Federal regulators currently lack explicit statutory authority to enforce a blanket credit card interest ceiling at the national level.

Role of Congress

For the proposal to become law, lawmakers would need to draft and pass legislation specifying:

- The scope of the interest cap

- Duration of the cap

- Enforcement mechanisms

- Penalties for non-compliance

Given divided political views on financial regulation, the path to passage remains uncertain.

Industry Reaction and Economic Concerns

Banking Industry Response

Financial institutions and industry groups have expressed skepticism about the proposal. Banks argue that interest rates reflect credit risk and operational costs, particularly for borrowers with weaker credit profiles.

According to industry representatives, a strict 10 percent cap could lead to:

- Reduced availability of credit

- Stricter lending standards

- Elimination of cards for higher-risk borrowers

Some banks warn that consumers who lose access to traditional credit cards may turn to unregulated or higher-cost alternatives.

Investor and Economist Views

Economists are divided on the likely impact. Supporters argue that lower interest rates would increase household disposable income and reduce defaults. Critics warn that price controls can distort credit markets and limit financial inclusion.

The debate highlights a broader tension between affordability and access in consumer finance.

Political Reactions Across Party Lines

Democratic Lawmakers

Several Democratic lawmakers have criticized Trump’s proposal as lacking substance without legislative backing. Some have also pointed to the contradiction between the interest cap proposal and earlier deregulatory actions affecting consumer protections.

Others have noted that similar interest rate cap proposals have stalled in Congress for years due to industry opposition.

Bipartisan Interest in Rate Caps

Despite criticism, interest rate caps are not exclusively partisan. In recent years, lawmakers from both parties have introduced bills proposing limits on credit card interest rates, though none have passed.

This bipartisan history suggests that while the issue resonates with voters, achieving consensus on implementation remains difficult.

Potential Impact on Consumers

Possible Benefits

If enacted, a 10 percent credit card interest cap could:

- Reduce interest payments for millions of borrowers

- Help consumers pay down balances faster

- Lower overall household debt stress

For borrowers with large revolving balances, the savings could be substantial.

Potential Risks

However, consumers could also face unintended consequences:

- Reduced access to credit for lower-score borrowers

- Fewer credit card options

- Increased reliance on alternative lenders

The overall impact would depend heavily on how banks adjust their lending practices.

Political Strategy and Timing

The timing of Trump’s announcement has drawn attention. With economic affordability a central voter concern, the proposal aligns with broader populist messaging focused on reducing household costs.

By targeting credit card interest rates, the Trump credit card interest cap proposal addresses a pain point experienced by a wide range of voters. At the same time, the lack of a detailed policy framework suggests the move may be more symbolic than immediately actionable.

Comparison With Past Efforts

Interest rate caps have a long history in U.S. financial regulation. Many states once enforced usury laws limiting interest rates, but federal preemption and changes in banking law weakened those caps over time.

Modern credit card markets operate largely without federal interest ceilings, relying instead on disclosure requirements and competition. Trump’s proposal would mark a significant departure from that approach.

What Happens Next

As of now, the proposal remains a statement rather than a policy.

Key next steps would include:

- Drafting formal legislation

- Building congressional support

- Defining enforcement authority

- Addressing industry concerns

Without these elements, the 10 percent cap is unlikely to take effect.

Conclusion

Trump’s call for a 10 percent credit card interest cap, following the rollback of other fee limits, has reignited debate over consumer protection and financial regulation. While the proposal speaks to widespread frustration over high borrowing costs, it faces significant legal, political, and economic hurdles.

The contrast between the interest cap proposal and earlier deregulatory actions underscores the complexity of balancing affordability with market access. Whether the idea evolves into concrete legislation or remains a political signal will depend on congressional action and broader economic conditions.

For now, the Trump credit card interest cap stands as a high-profile proposal that reflects growing concern over consumer debt, even as its future remains uncertain.

Key Highlights

- Trump calls for a one-year 10 percent credit card interest cap

- Proposal follows rollback of other credit card fee limits

- Implementation would require congressional approval

- Banks warn of reduced credit access

- Consumers could see both benefits and risks

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)