Sony has revealed the January 2026 game lineup for PlayStation Plus Extra and Premium tiers. The update illustrates how rotating libraries, legacy content, and premium access are shaping the future of subscription gaming.

Sony has unveiled the January 2026 lineup for its PlayStation Plus Extra and Premium tiers, offering a snapshot of how subscription-based gaming continues to evolve. According to GameSpot, the update brings a mix of modern titles, returning franchises, and classic games—while reinforcing the reality that access, not ownership, now defines much of the console experience.

The announcement comes as subscription services across gaming face increasing scrutiny from players and publishers alike. Growth remains strong, but expectations around value, consistency, and transparency are rising just as quickly.

For Sony, January’s refresh is less about individual games and more about maintaining momentum in an increasingly competitive subscription landscape.

What Sony has revealed for January 2026

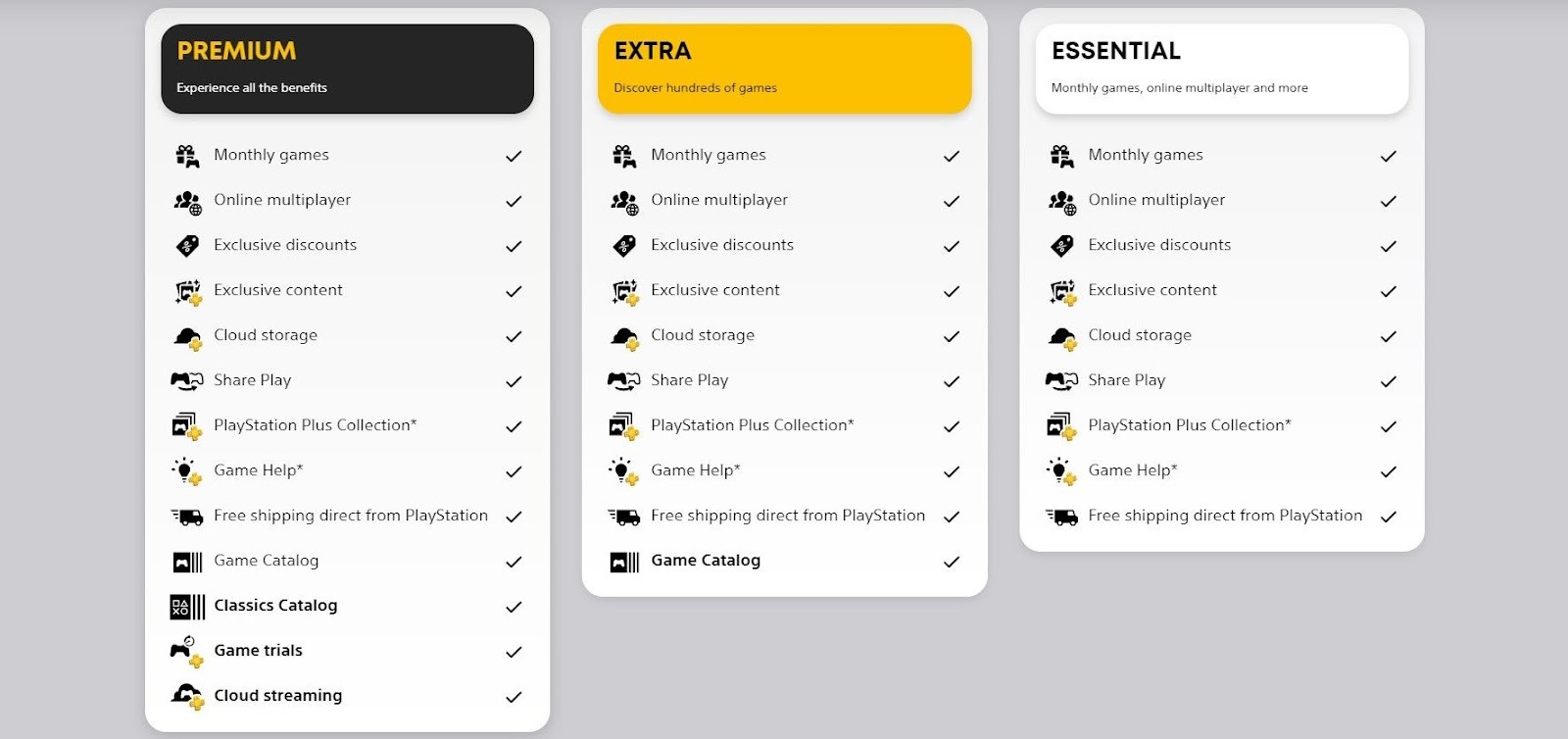

Sony confirmed the January additions across both PlayStation Plus Extra and Premium, with Extra focusing on downloadable PS4 and PS5 titles, and Premium continuing to differentiate itself through classic games and cloud streaming options.

The exact list, as detailed by GameSpot, includes a combination of well-known franchises and smaller titles designed to broaden the appeal of the catalog. Sony has not disclosed how long individual games will remain available, a standard practice that reflects the flexible licensing model underpinning the service.

As with previous months, no major first-party day-one releases were announced for Extra or Premium, reinforcing Sony’s strategy of keeping new blockbuster titles primarily within traditional sales channels.

Extra versus Premium: two strategies under one brand

PlayStation Plus Extra and Premium serve distinct roles within Sony’s ecosystem. Extra is designed to compete directly with other “game library” subscriptions, emphasizing volume and variety. Premium, by contrast, leans on nostalgia and exclusivity through access to older console titles and experimental features like streaming.

This tiered approach allows Sony to segment its audience: casual players gravitate toward Extra, while long-time PlayStation fans and collectors are nudged toward Premium.

However, it also introduces complexity. Subscribers must continuously evaluate whether the incremental value of Premium justifies its higher price—a question that becomes more pointed when monthly updates feel incremental rather than transformative.

Why rotating lineups are central to the model

The January refresh highlights a defining feature of subscription gaming: constant rotation. Games arrive, gain attention, and eventually depart as licensing agreements expire or strategic priorities shift.

For Sony, rotation serves multiple purposes. It keeps the catalog feeling fresh, limits long-term licensing costs, and provides leverage in negotiations with publishers. For publishers, time-limited inclusion offers marketing exposure without permanently undercutting direct sales.

The downside is uncertainty. Players must adapt to a mindset closer to streaming media, where timing matters and backlog management becomes a skill rather than an afterthought.

Market implications beyond PlayStation

Sony’s approach reflects broader trends across the gaming industry. Subscription services are no longer experimental add-ons; they are core distribution channels that influence development timelines, pricing strategies, and even game design.

Studios increasingly consider whether a title is “subscription-friendly,” favoring engagement-driven or replayable experiences. Meanwhile, smaller developers may see short-term subscription deals as a way to gain visibility in a crowded market.

For startups operating in analytics, discovery, or game lifecycle management, these dynamics create opportunities to help players and publishers navigate increasingly fluid libraries.

A global strategy with local impact

PlayStation Plus operates across major markets in North America, Europe, and parts of Asia, making lineup decisions globally consequential. A single addition or removal can affect millions of players simultaneously.

This scale amplifies both goodwill and criticism. Strong months reinforce the value proposition; weaker ones fuel subscription fatigue. January’s lineup, while solid, underscores how difficult it is to satisfy a diverse global audience with a single rotating catalog.

What January’s update ultimately signals

Sony’s January 2026 PlayStation Plus update is not a dramatic pivot—but it is revealing. The company continues to refine a subscription model that prioritizes flexibility, cost control, and long-term engagement over permanence.

For players, the message is pragmatic: PlayStation Plus remains a strong value, but only if treated as a dynamic service rather than a static library. For the industry, the signal is clearer still—subscription gaming has settled into its next phase, where sustainability matters as much as scale.

This article is based on publicly available reporting and official announcements. Sony has not disclosed detailed licensing terms or the duration of availability for individual titles, and details may evolve.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)