Warren Buffett says his views on parenting, risk-taking, and politics are shaped by long-term thinking and restraint. His reflections, shared in a recent interview, echo principles that increasingly resonate in today’s startup and technology ecosyste

Warren Buffett rarely speaks in the language of startups or technology. Yet his latest reflections—touching on parenting, horse betting, and his decision to stop talking about politics—read like a quiet manifesto for an era defined by volatility, attention economics, and short-term thinking.

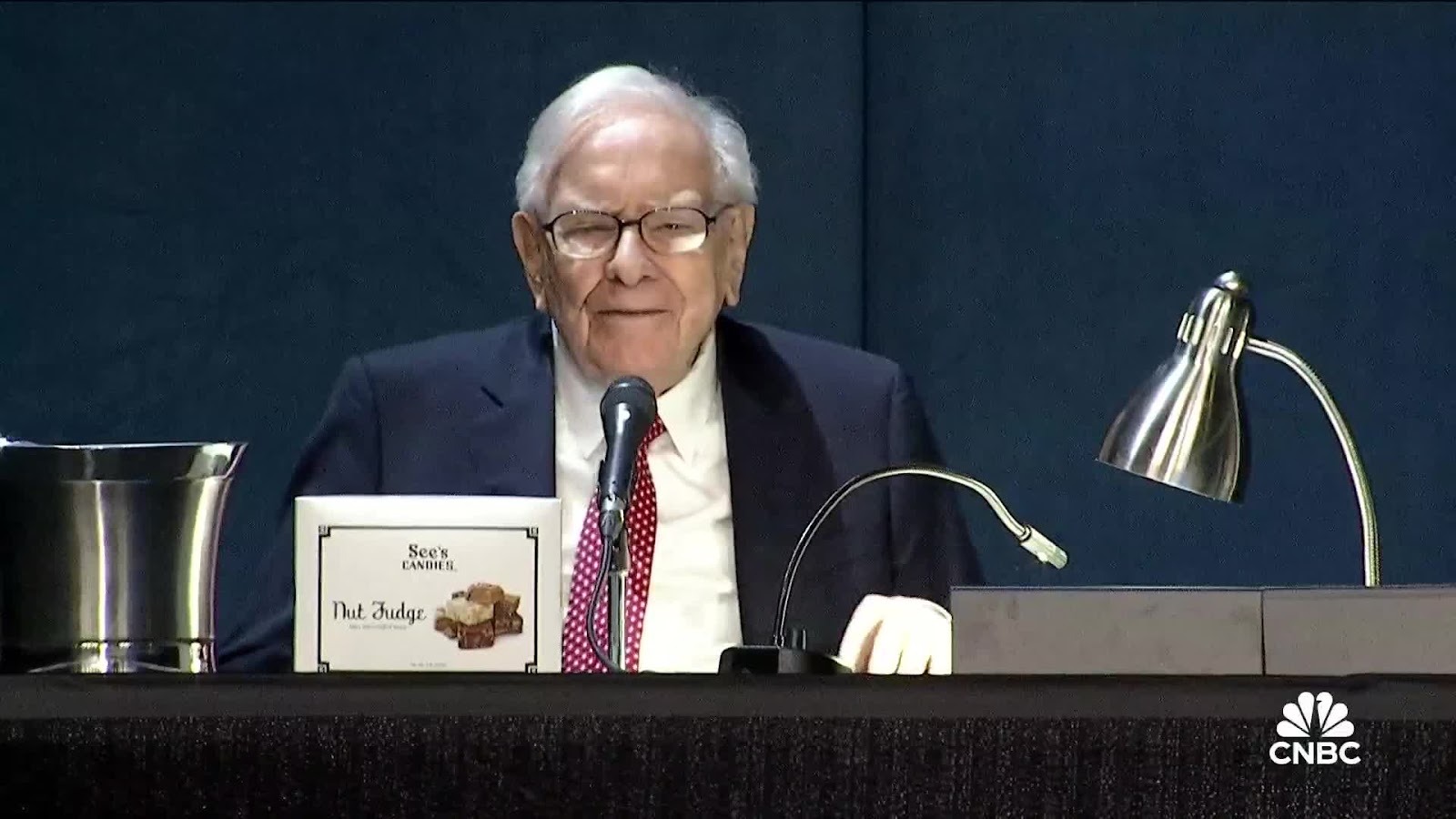

In a recent CNBC interview, Buffett, now in his 90s, revisited the personal philosophies that have guided him for decades. While the conversation was not about artificial intelligence or venture capital, the subtext was unmistakable: discipline, patience, and focus still matter, even as markets and technologies accelerate.

For founders and investors navigating today’s fast-moving tech economy, Buffett’s remarks land with renewed relevance.

Parenting as long-term capital allocation

Warren Buffett framed parenting not as control, but as creating conditions for independence and responsibility. He has long argued that children should be given enough support to do anything, but not so much that they do nothing—a principle he has also applied to wealth transfer.

That mindset mirrors how experienced startup investors think about capital allocation. Too little support can stall progress; too much can erode discipline. In both cases, outcomes depend less on micromanagement and more on incentives and values.

Buffett’s approach stands in contrast to the “growth at all costs” mentality that has periodically dominated tech culture.

What horse betting taught Buffett about risk

Buffett also reflected on horse betting, a topic he has used before to illustrate the difference between speculation and informed risk-taking. Betting, he noted, can be entertaining, but it is not investing—because the odds are stacked against you.

The analogy resonates strongly in today’s tech markets, where hype cycles, meme stocks, and speculative crypto or AI plays often blur the line between calculated risk and pure chance.

Buffett’s core lesson is not to avoid risk, but to understand it deeply. For startups, that means building on fundamentals rather than momentum. For investors, it means distinguishing durable value from temporary excitement.

Why Buffett stepped away from politics

One of the more striking parts of the CNBC interview was Buffett’s explanation for why he stopped talking publicly about politics. He said doing so often created division without improving outcomes.

Instead, he chose to focus on areas where his actions could have tangible impact, such as philanthropy, corporate governance, and long-term investment stewardship.

In an era where tech leaders are increasingly vocal on political and social issues, Buffett’s restraint offers a counterpoint. Silence, in his view, is not disengagement—it is prioritization.

For startup founders, the takeaway is pragmatic: public positions carry tradeoffs, and not every issue requires a platform response.

Lessons for the technology ecosystem

Buffett’s philosophy has often been described as old-fashioned, but many of its principles align with what today’s tech sector is rediscovering after years of excess.

As capital tightens and scrutiny increases, startups are being pushed to demonstrate real value, sustainable economics, and disciplined leadership. Those demands echo Buffett’s long-standing emphasis on cash flow, competitive moats, and rational decision-making.

Even in technology, where change is constant, the underlying economics have not been repealed.

A contrast to founder culture

Modern founder culture often celebrates visibility, bold predictions, and rapid iteration in public. Buffett represents the opposite: quiet consistency, limited commentary, and a focus on outcomes rather than narratives.

That contrast does not make one approach universally better, but it does highlight an imbalance that many in tech are now questioning—especially as the costs of overexposure and overpromising become clearer.

For global startups operating in uncertain regulatory and economic environments, Buffett’s selective engagement offers a form of risk management rarely discussed in pitch decks.

Timeless ideas in a fast-moving world

Buffett is not positioning himself as a guide for the AI age. Yet his reflections on parenting, betting, and politics all point to the same core idea: long-term success depends on resisting unnecessary noise.

In technology, where cycles move faster and stakes feel higher, that lesson may be more valuable than ever.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)