ASML’s fourth-quarter 2025 earnings showed resilient revenue and profits, supported by long-term demand for advanced chipmaking tools, while new orders reflected continued caution across the semiconductor industry.

The world’s most critical supplier of advanced chipmaking equipment is navigating a familiar tension: strong structural demand versus near-term uncertainty. In its latest earnings report, ASML delivered solid fourth-quarter results for 2025, even as order trends underscored how uneven the semiconductor recovery remains.

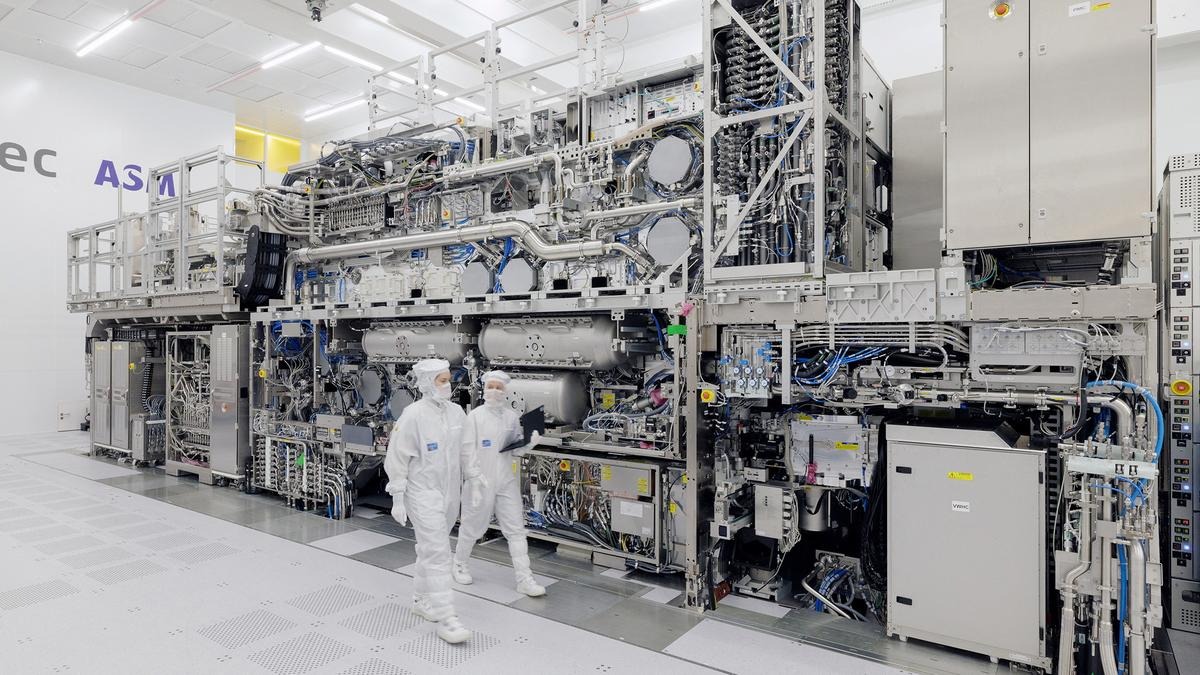

ASML’s performance matters well beyond its own balance sheet. As the sole producer of extreme ultraviolet (EUV) lithography systems, the company sits at the center of the global semiconductor supply chain. Its results are often read as a proxy for where the industry is heading next.

Earnings reflect stability, not acceleration

For the December quarter, ASML reported results that largely aligned with market expectations, reinforcing a picture of stability rather than rapid growth. Revenue and margins remained supported by previously booked orders and long-term contracts with leading chipmakers.

What stood out was not a collapse in demand, but a lack of acceleration. Customers continue to take delivery of high-end tools ordered during earlier investment cycles, while showing restraint on committing to new capacity at the same pace.

This pattern reflects a semiconductor industry still digesting excess capacity in some segments, particularly in memory and consumer-oriented chips, even as advanced logic remains strategically important.

Orders signal caution from chipmakers

Order intake drew particular attention from investors. While ASML maintained a strong backlog, new bookings suggested customers are being more selective about timing and scale of future investments.

Chipmakers are balancing competing pressures: preparing for long-term growth in artificial intelligence and advanced computing, while managing near-term softness in end markets such as smartphones, PCs, and certain industrial applications.

For ASML, this means visibility remains solid, but momentum depends on when customers decide to unlock the next wave of capital spending.

AI demand supports long-term confidence

One reason ASML has avoided sharper swings is the role of AI-driven demand. Advanced AI chips require cutting-edge manufacturing processes, and those processes depend on ASML’s most sophisticated machines.

Leading foundries and logic manufacturers continue to invest in nodes that rely heavily on EUV technology. That dynamic provides ASML with a level of insulation that other equipment makers lack, particularly those more exposed to mature-node production.

However, AI alone is not enough to drive immediate order growth across the entire industry. Many customers are sequencing investments carefully, prioritizing critical upgrades while deferring less urgent expansions.

Supply chain and geopolitical context

ASML’s results also sit against a backdrop of geopolitical complexity. Export controls, particularly around advanced chipmaking technology, remain a key consideration for the company and its customers.

While ASML has adjusted its business to comply with regulations, restrictions influence where and how quickly certain systems can be deployed. That adds another layer of uncertainty to order timing, even when underlying demand exists.

From a supply chain perspective, ASML has largely worked through the bottlenecks that plagued manufacturing in earlier years, allowing it to deliver systems more predictably. This operational stability has helped support margins despite softer order growth.

How investors are reading the signal

Markets generally interpreted the Q4 report as confirmation that the semiconductor downturn has bottomed, but that a robust upswing is not yet underway. ASML’s shares tend to react less to quarterly fluctuations and more to changes in forward guidance and order momentum.

For long-term investors, the company’s strategic position remains unchanged. ASML continues to occupy an irreplaceable role in advanced semiconductor manufacturing, with demand driven by technology roadmaps measured in decades.

Shorter-term, however, the earnings reinforce expectations of a gradual, uneven recovery rather than a sharp rebound.

A bellwether still worth watching

ASML’s Q4 2025 earnings do not point to crisis, nor do they signal a boom. Instead, they capture the industry’s current reality: cautious optimism constrained by macroeconomic uncertainty and cyclical adjustment.

For the broader tech ecosystem, that message matters. When ASML’s customers regain confidence to invest aggressively again, it will likely mark a more decisive turn for the semiconductor cycle. Until then, ASML’s results suggest the industry is steady—but still waiting for its next clear catalyst.1

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)