Microsoft CEO Satya Nadella says customers are actively using Copilot across work and consumer products, countering skepticism around enterprise AI adoption. His remarks come as Microsoft faces growing pressure to justify massive AI investment with sustained usage and revenue.

Microsoft Defends Copilot’s Momentum

As questions mount around whether enterprise AI tools are delivering real, everyday value, Satya Nadella is making Microsoft’s position clear: Copilot is being used — and heavily.

Speaking amid renewed scrutiny of generative AI adoption, Nadella insisted that Microsoft’s Copilot products are seeing strong engagement across both consumer and enterprise contexts. His comments, reported by TechCrunch, come at a moment when investors and analysts are increasingly demanding proof that AI assistants are more than experimental add-ons layered onto existing software.

For Microsoft, the stakes are high. Copilot is not just another feature — it is the company’s primary interface for monetising its multi-billion-dollar investment in AI infrastructure, models, and partnerships.

A Utilisation Question Hanging Over AI

While generative AI captured global attention in 2023 and 2024, 2025 brought a more sobering phase: deployment reality. Enterprises rolled out copilots, assistants, and internal agents — but many struggled to translate pilots into habitual use.

That context explains why Nadella’s comments matter. “People are using Copilot a lot,” he said, pushing back on narratives that suggest AI assistants remain underutilised or gimmicky. Microsoft has not disclosed detailed daily or monthly active usage figures, but Nadella pointed to signals such as repeat usage, integration depth, and expansion across workflows as indicators of traction.

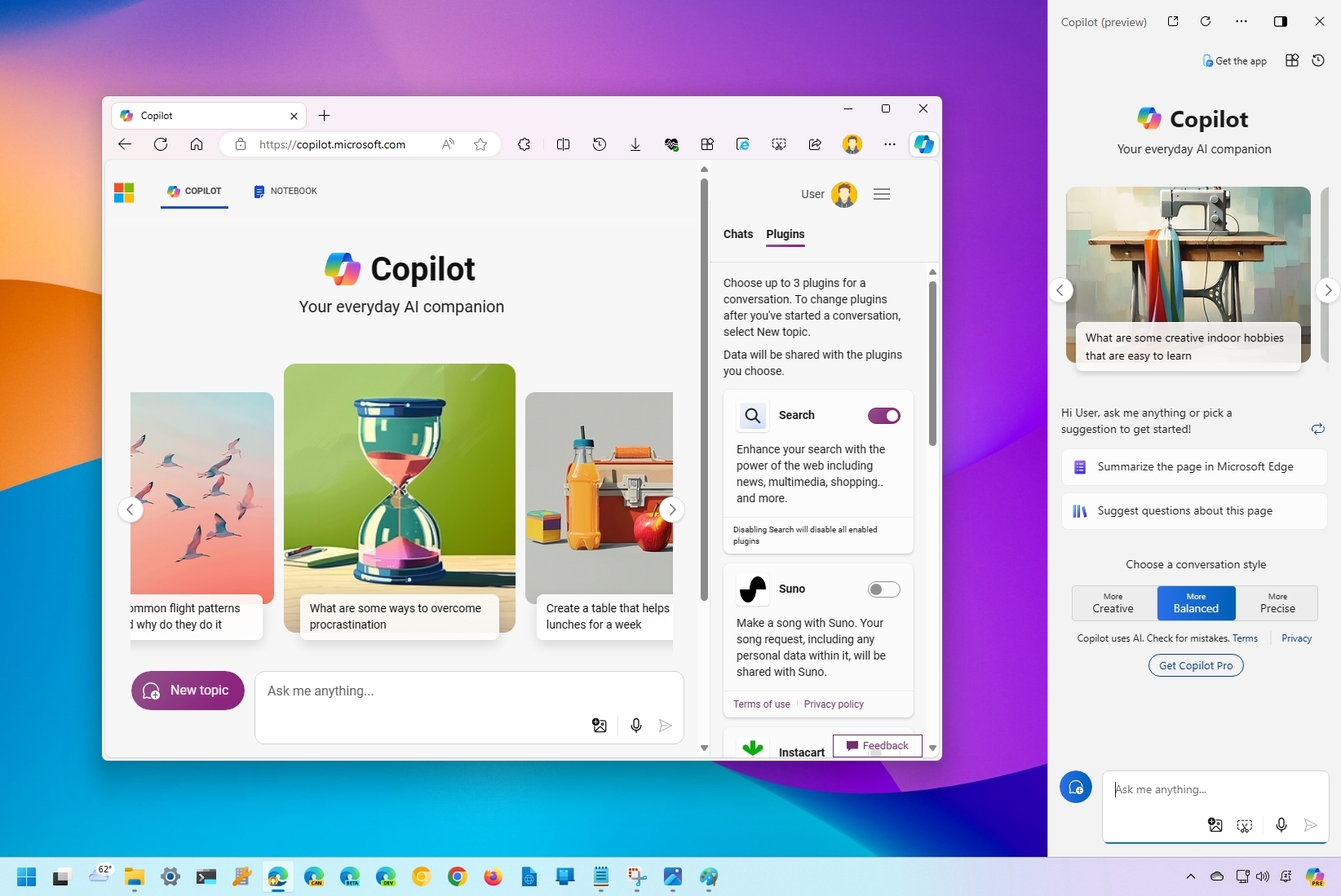

Unlike standalone chatbots, Copilot is embedded across Microsoft’s ecosystem — from Word, Excel, and Outlook to GitHub, Windows, and Dynamics — making usage harder to measure, but also harder to avoid.

Copilot as Interface, Not App

One of Microsoft’s core arguments is that Copilot should not be evaluated like a traditional SaaS product. Rather than being a destination app, it functions as an ambient layer inside tools people already use daily.

In Word, it drafts. In Excel, it models. In Outlook, it summarises. In Teams, it recaps meetings. In GitHub, it writes code. The company believes this “everywhere, all at once” approach is what differentiates Copilot from competing AI offerings that rely on explicit prompts and separate workflows.

This framing also helps explain why adoption can look uneven externally, even if internal telemetry suggests growing reliance. Copilot usage may show up as incremental productivity gains rather than obvious spikes in standalone sessions.

Pressure From the Market and Competitors

Microsoft’s insistence on strong Copilot usage comes as competitors face their own challenges. Enterprise buyers are increasingly cautious, asking whether AI assistants justify per-seat pricing premiums — particularly when budgets are tight and ROI remains hard to quantify.

At the same time, rivals including Google, Salesforce, and a growing field of startups are offering their own copilots, agents, and vertical AI tools. Many promise more autonomy, deeper specialisation, or lower costs, forcing Microsoft to defend both Copilot’s breadth and its value proposition.

Nadella’s response has been consistent: scale matters. Microsoft’s advantage, he argues, lies in distribution and integration, not novelty. By embedding Copilot across hundreds of millions of users and devices, the company believes adoption will compound over time rather than peak early.

The Economics Behind the Confidence

There is also a financial subtext. Microsoft continues to spend aggressively on AI compute, data centres, and model development, largely through its partnership with OpenAI. Those investments require sustained demand to justify margins over the long term.

Copilot subscriptions, usage-based pricing, and enterprise renewals are expected to play a central role in offsetting those costs. Nadella’s public confidence signals that Microsoft believes it is seeing the early signs of that flywheel — even if the company is not yet ready to share granular metrics.

From Hype to Habit

Ultimately, Microsoft’s challenge is not convincing early adopters, but turning AI into habit. Nadella’s remarks suggest the company sees Copilot crossing that threshold, at least for a meaningful subset of users.

Whether that usage scales broadly enough — and profitably enough — remains an open question. But Microsoft’s message is unambiguous: Copilot is not a future bet waiting to pay off. In Nadella’s telling, it is already embedded in how work gets done.

As the AI industry moves from experimentation to execution, Microsoft is staking its claim on one core belief: the winning AI products will not be the loudest or flashiest, but the ones people quietly use every day.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)