Talos, a leading provider of institutional digital asset infrastructure, has extended its Series B funding with a $45 million strategic raise that brings its total to $150 million and values the firm at approximately $1.5 billion. New investors including Robinhood Markets — alongside Sony Innovation Fund and trading firms IMC and QCP — are backing the expansion as demand grows for unified institutional crypto technology.

Institutional Crypto Infrastructure at a Tipping Point

New York–headquartered Talos announced on January 29, 2026 that it has raised an additional $45 million as an extension of its Series B funding round, bringing the total raise to roughly $150 million and positioning the company at a $1.5 billion post-money valuation. This strategic round attracted a mix of new and returning institutional partners, signaling broad confidence in Talos’s approach to building front-to-back digital asset infrastructure for large financial institutions, asset managers, and trading organisations.

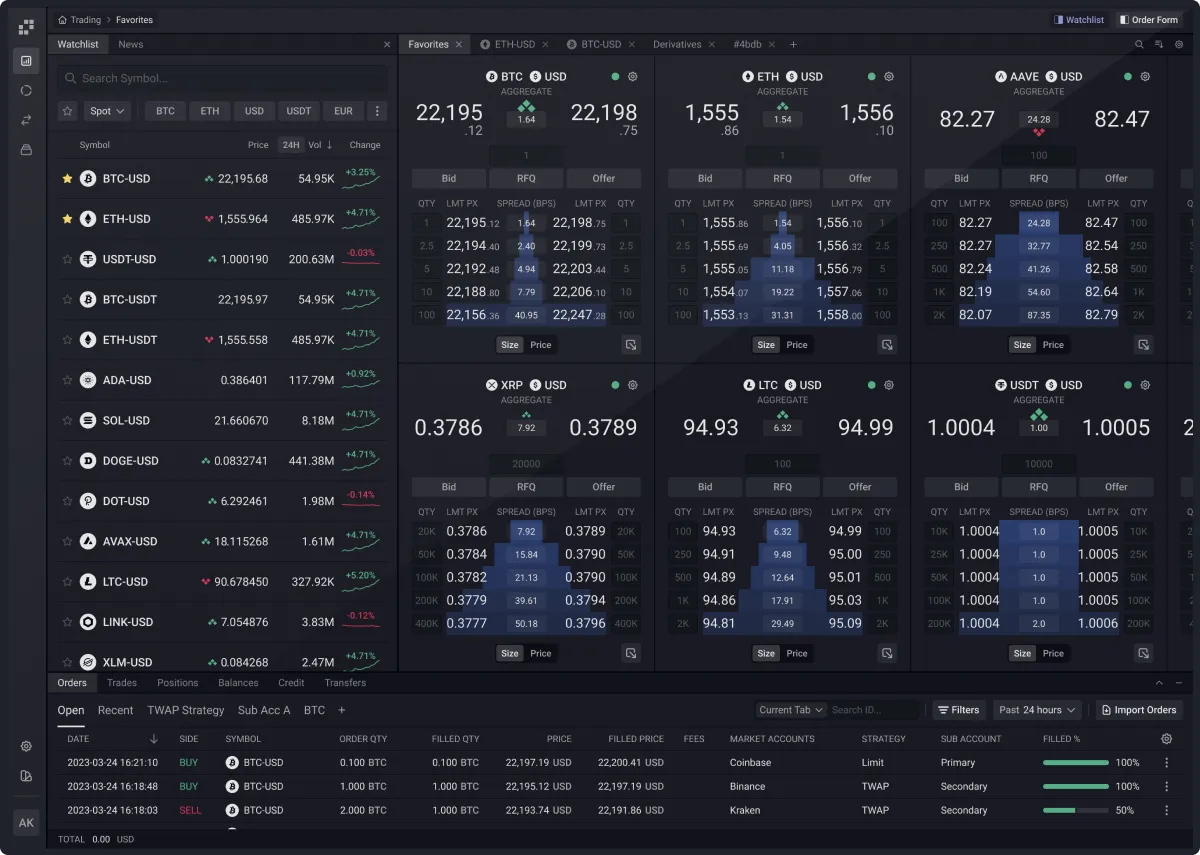

Talos specialises in software and data infrastructure that supports the full lifecycle of institutional digital asset operations — from trading and portfolio management to risk, settlement and treasury tools — meeting a growing need as traditional asset classes increasingly adopt blockchain rails.

Robinhood’s Strategic Entry and Industry Validation

One of the most notable developments in the Series B extension is the participation of Robinhood Markets, the U.S.-based brokerage known for commission-free trading and an expanding footprint in digital assets. Johann Kerbrat, Senior Vice President and General Manager of Crypto at Robinhood, said Talos’s flexible platform and robust infrastructure will help deepen liquidity and support more advanced digital asset features for Robinhood Crypto customers, aligning both companies’ interests in scaling institutional-grade services.

Robinhood’s momentum in the crypto space — particularly around tokenised assets and on-chain settlement — reflects wider strategic shifts among retail brokers toward more sophisticated backend systems. Its backing of Talos underscores how infrastructure layers are increasingly viewed as critical differentiators in a market where execution, compliance, and connectivity span legacy finance and blockchain networks.

A Broader Strategic Investor Syndicate

Beyond Robinhood, the extension round attracted other notable strategic investors: the Sony Innovation Fund, trading firms IMC and QCP, and digital asset specialist Karatage. Returning investors such as Andreessen Horowitz Crypto (a16z crypto), BNY Mellon, and Fidelity Investments also participated, illustrating both continuity and growth in support.

Sony’s involvement through its venture arm highlights a broader interest among global technology conglomerates in institutional crypto infrastructure. According to Talos leadership, the platform’s evolution from basic order execution to a comprehensive suite of front, middle and back-office capabilities — enriched with premium analytics and data services — was a key factor in attracting these partners.

Capital Use: Product Expansion and Institutional Readiness

Talos plans to deploy the $45 million extension to accelerate product development across its platform, particularly in areas that serve institutional demands: risk management modules, execution and trading interfaces, portfolio construction tools, and treasury and settlement systems. The company also intends to enhance support for traditional asset classes as they transition to digital formats or become tokenised — a growing priority for banks, asset managers, and global financial institutions.

A portion of the latest investment was reportedly settled using stablecoins, illustrating the increasing comfort among institutional players with blockchain-native settlement mechanisms and modern payment rails in venture transactions.

Momentum, Acquisitions and Market Signal

Talos’s fundraising follows a period of significant business momentum. Over the past two years, the company has roughly doubled both its revenue and its institutional client base, a growth trajectory that reflects rising institutional adoption of crypto markets and demand for unified infrastructure layers that mirror legacy finance infrastructure’s reliability and performance.

Strategic acquisitions completed by Talos — including analytics, risk and DeFi-oriented firms such as Coin Metrics, Cloudwall, Skolem and D3X Systems — have further strengthened its technology stack, expanding capabilities in market data, risk frameworks and portfolio engineering. These moves position Talos as not just a trading interface provider, but a full-service platform supporting institutional digital asset workflows.

The Big Picture: Infrastructure as the New Frontier

The Series B extension and Robinhood’s participation illustrate a broader maturation in the digital asset ecosystem. Early crypto infrastructure efforts focused on retail interfaces and decentralised exchanges; today, sophisticated institutional adoption requires platforms that can integrate seamlessly with existing financial systems, comply with evolving regulations and support deep liquidity across tokenised and traditional markets.

By attracting heavyweight strategic partners and expanding its technological footprint, Talos aims to be at the centre of this shift — building the rails that connect institutional finance to the next generation of digital markets. For investors and institutions alike, the message is clear: the era of standalone retail products is evolving into one where institutional infrastructure and interoperability define competitive advantage in digital finance.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)