Shares of several video game companies declined after Google unveiled an AI tool designed to generate interactive game worlds. The reaction reflects investor uncertainty about how generative AI could reshape game development economics.

Video game company stocks edged lower following Google’s introduction of a new AI tool capable of generating virtual worlds, highlighting growing investor unease over how generative AI may disrupt traditional game development.

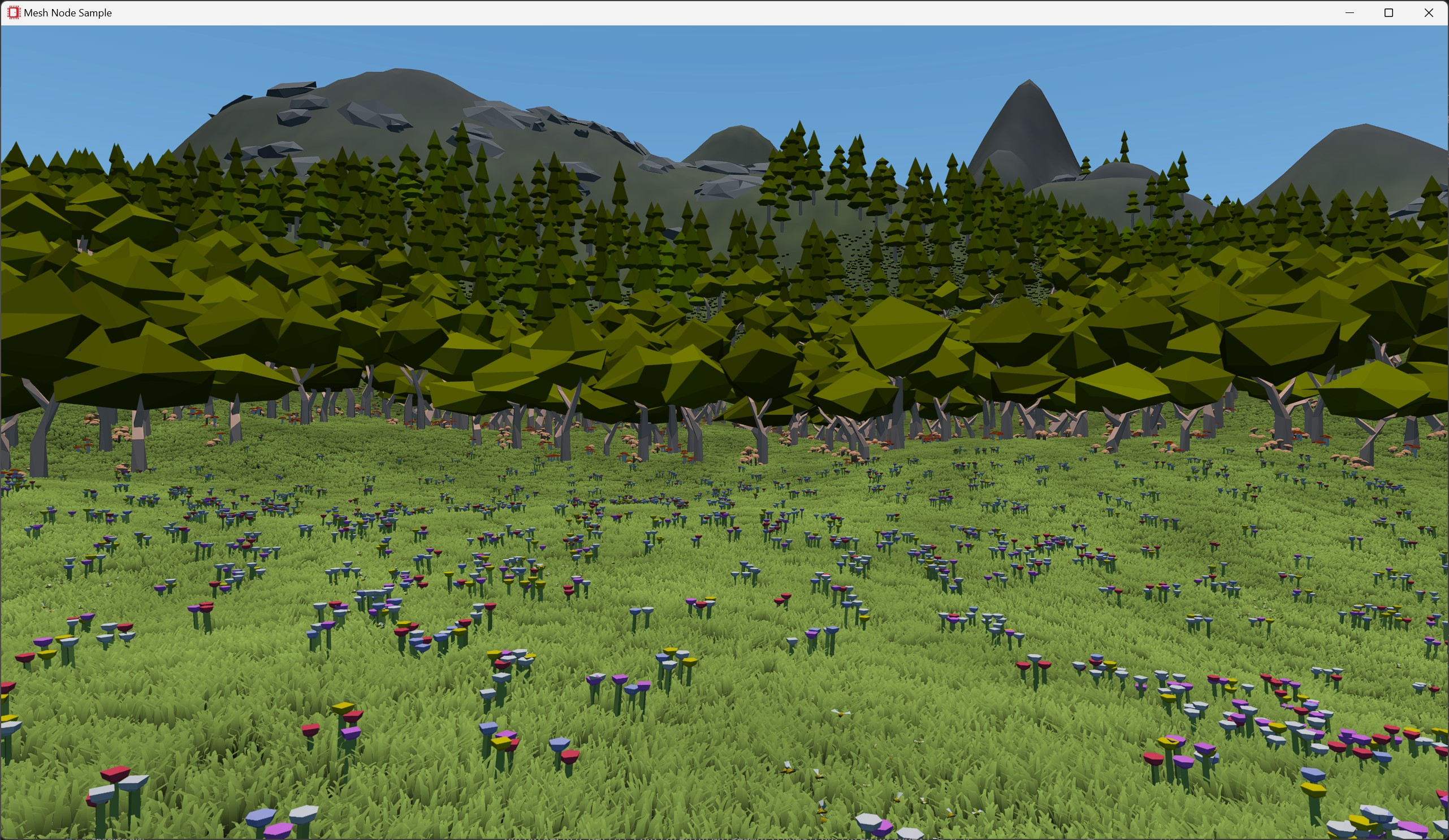

The tool, demonstrated as a way to rapidly create environments, landscapes, and interactive elements, is positioned as a productivity accelerator for developers. But in financial markets, the announcement landed differently — raising questions about cost structures, competitive moats, and the long-term value of human-intensive game production.

Why markets reacted negatively

Game development is labor-intensive, time-consuming, and expensive — particularly for large open-world titles. Any technology that threatens to compress that process inevitably triggers concern about:

- Margin pressure

- Talent displacement

- Reduced barriers to entry

For investors, the worry is not that AI will replace game studios overnight, but that it could weaken the differentiation of mid-tier publishers whose value depends on scale, polish, and production depth.

Google’s role as an external disruptor

Unlike game engines such as Unity or Unreal, Google is entering the space from outside the traditional gaming toolchain. That matters.

When Google introduces foundational tools, markets often assume they will be:

- Widely accessible

- Aggressively priced

- Integrated with cloud and AI infrastructure

That combination can shift bargaining power away from established studios and toward platforms and tooling providers.

What developers see — versus what investors see

Developers have generally viewed AI world generation as assistive rather than replacement technology. Procedural generation has existed for decades, and human design, narrative, and testing remain critical.

Investors, however, tend to price in second-order effects early. If AI tools reduce production timelines or allow smaller teams to build competitive experiences, revenue concentration in the industry could shift.

That uncertainty alone is often enough to pressure valuations in the short term.

A familiar pattern in AI-driven markets

The stock reaction mirrors what has happened in other creative industries — from media to software — where AI announcements initially trigger sell-offs before the market recalibrates.

For now, Google’s tool is a signal, not a verdict. But it reinforces a growing reality for the games industry: generative AI is no longer an abstract future risk. It is becoming part of the production stack — and investors are adjusting expectations accordingly.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)